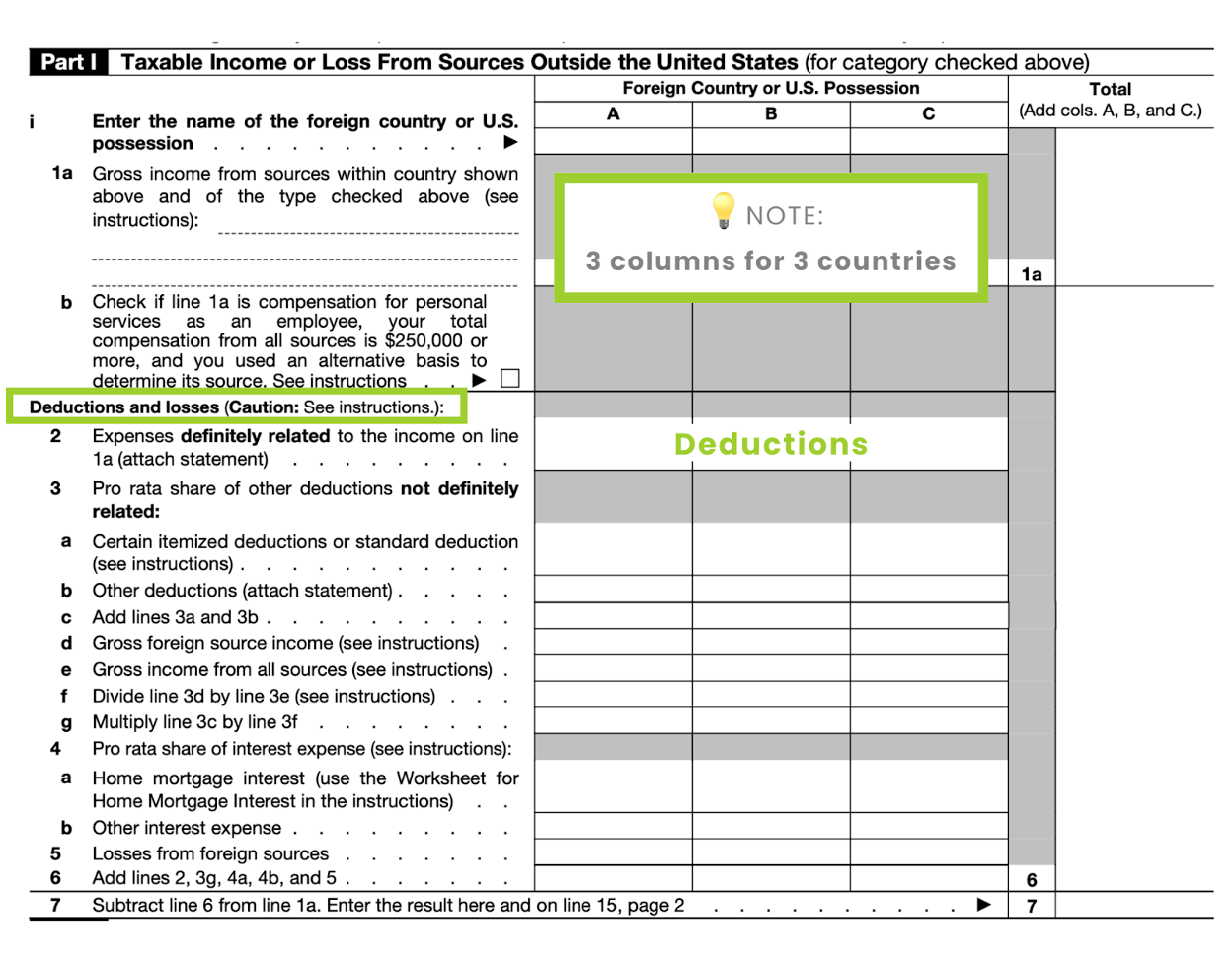

How Do I Claim Foreign Tax Credit On Tax Return To choose the foreign tax credit you generally must complete Form 1116 Foreign Tax Credit and attach it to your U S tax return However you may qualify for an exception

If you re an American who lived or worked outside the United States you almost certainly have to file a tax return with the IRS and Deduct their foreign taxes on Schedule A like other common deductions Use Form 1116 to claim the Foreign Tax Credit FTC and subtract the taxes they paid to another country from whatever they

How Do I Claim Foreign Tax Credit On Tax Return

How Do I Claim Foreign Tax Credit On Tax Return

https://brighttax.com/wp-content/uploads/2022/06/foreign-tax-credit-form-1116.png

What If You Paid Foreign Taxes As An American

https://cdn.dockwalk.com/convert/files/2022/01/267a64d0-7a3a-11ec-92f7-71680378d645-foreign-tax-credit-receipt-iStock.jpg/r[width]=1280/267a64d0-7a3a-11ec-92f7-71680378d645-foreign-tax-credit-receipt-iStock.jpg

Expat Guide To Understand Foreign Tax Credit Form 1116 TaxActions

https://expat.taxactions.com/wp-content/uploads/2021/02/6-scaled.jpg

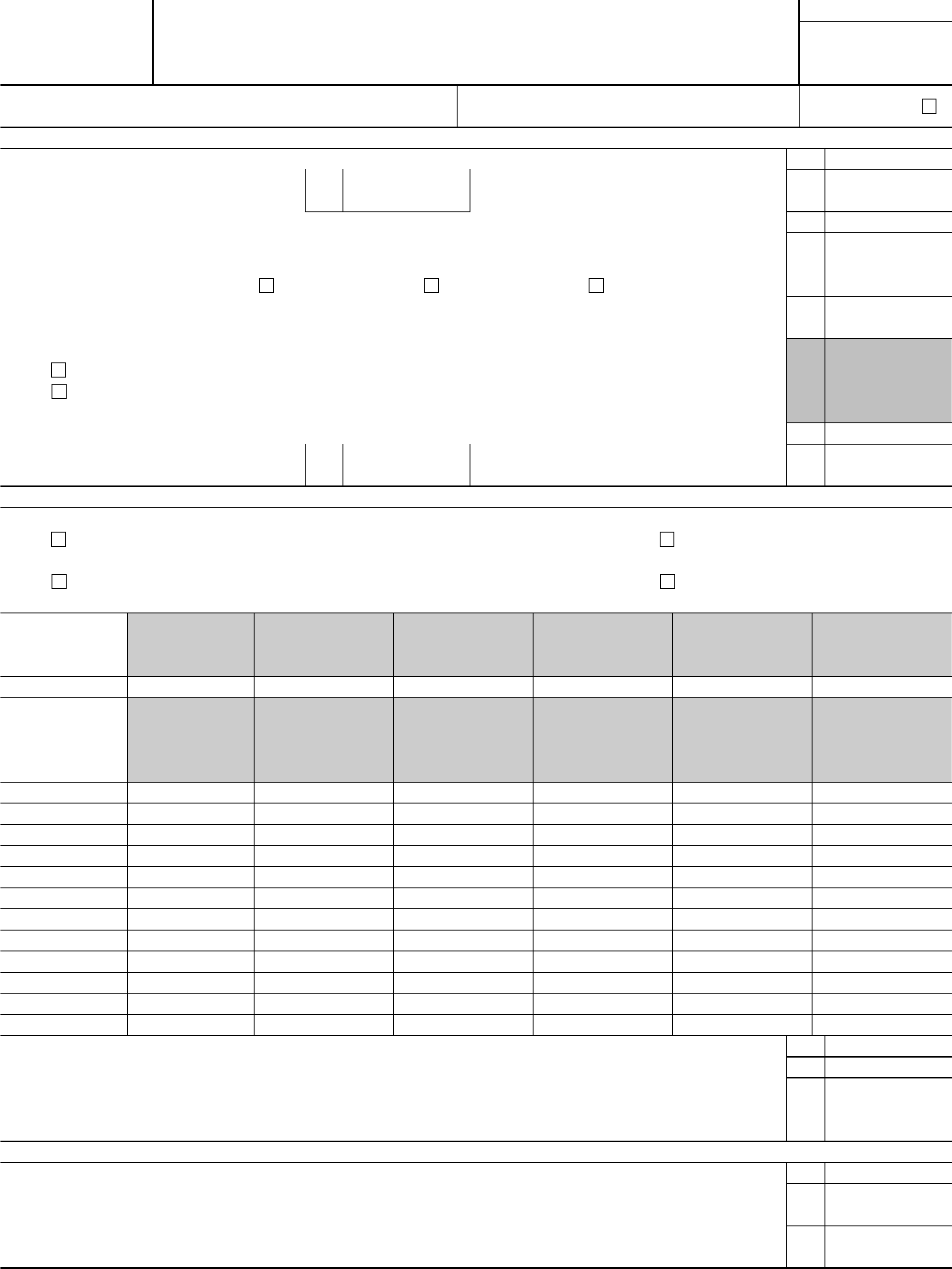

This lesson will show you how to help taxpayers claim the foreign tax credit This credit applies to those who have paid or accrued taxes to a foreign country on foreign sourced If you opt for the tax credit you must complete Form 1116 and attach it to your U S tax return You must take a credit or a deduction for all qualified foreign taxes You can t take

You can usually claim Foreign Tax Credit Relief when you report your overseas income in your tax return How much relief you get depends on the UK s double taxation Guidance Relief for Foreign Tax Paid 2021 HS263 Updated 6 April 2024 If you ve paid foreign tax on income received or capital gains made that are also taxable

Download How Do I Claim Foreign Tax Credit On Tax Return

More picture related to How Do I Claim Foreign Tax Credit On Tax Return

The U S Foreign Tax Credit Guide For Expats Expat US Tax

https://www.expatustax.com/wp-content/uploads/2021/06/Foreign-Tax-Credit.jpg

VERIFY Should You Claim Child Tax Credit On Tax Return Wthr

https://media.tegna-media.com/assets/WTHR/images/084f7642-fd2d-4c72-a6f4-9b8ef97e5e2d/084f7642-fd2d-4c72-a6f4-9b8ef97e5e2d_1920x1080.jpg

A Step by Step Guide To Claim Foreign Tax Credit

https://www.vramaratnam.com/wp-content/uploads/2022/01/Understanding-the-procedure-to-claim-foreign-tax-credit-1024x512.jpg

How to claim the foreign tax credit The IRS limits the foreign tax credit you can claim to the lesser of the amount of foreign taxes paid or the U S tax liability on the foreign income For example if you Any foreign tax paid in the current year must be first used to claim the foreign tax credit You can then use credits from past years starting with the year with unused tax credits furthers in the past which

The FTC on the other hand allows you to claim a credit on your U S tax return for foreign income taxes paid to a foreign government This credit can offset your This form allows you to claim the Foreign Tax Credit reducing your U S tax liability by the amount of foreign income taxes paid By filing Form 1116 you ensure

How To Fill Form 1116 Foreign Tax Credit For Individuals Explained

https://mars-images.imgix.net/seobot/vintti.com/658a4b0a896bdc25cc34e845-fec865164e0fb3ab977ace37c46c3d23.png?auto=compressimage.png

Foreign Tax Credit How To Claim Tax Credit On Foreign Income

https://ebizfiling.com/wp-content/uploads/2022/08/tax-credit.png

https://www.irs.gov/individuals/international...

To choose the foreign tax credit you generally must complete Form 1116 Foreign Tax Credit and attach it to your U S tax return However you may qualify for an exception

https://www.nerdwallet.com/article/tax…

If you re an American who lived or worked outside the United States you almost certainly have to file a tax return with the IRS and

Local Taxes Paid In USA Which Isn t Eligible For Foreign Tax Credit To

How To Fill Form 1116 Foreign Tax Credit For Individuals Explained

How To Claim Foreign Tax Credit Claim In India India Financial

Form 1116 Instructions For Expats Claiming The Foreign Tax Credit

Foreign Tax Credit PDF Taxation In The United States Income Tax

Foreign Tax Credit Processing Of Tax Returns HLS 2234 Harvard

Foreign Tax Credit Processing Of Tax Returns HLS 2234 Harvard

Foreign Tax Credit Limitations 4 Rules Every Expat Should Meet

Premium Tax Credit Form Edit Fill Sign Online Handypdf

Foreign Tax Credit Form 1116

How Do I Claim Foreign Tax Credit On Tax Return - You can usually claim Foreign Tax Credit Relief when you report your overseas income in your tax return How much relief you get depends on the UK s double taxation