How To Claim Fuel Reimbursement Flexible Benefit Plans allow organisations to include fuel costs in the salary structure of their employees Employees can claim a reimbursement of their petrol or diesel bills by submitting the bills to their employers

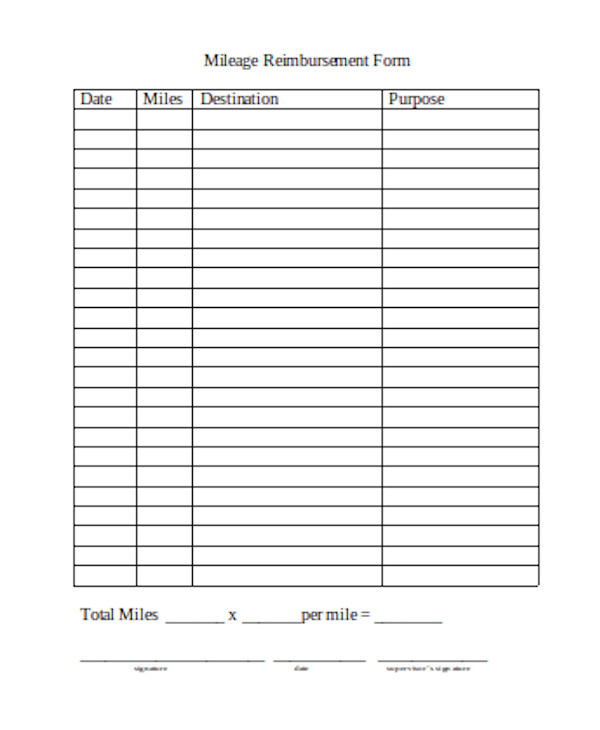

Mileage reimbursement is when employers offer employees reimbursement for expenses associated with driving on behalf of the business These expenses can include fuel costs maintenance and Learn about mileage reimbursement and how some employers use it to offset employees costs for using personal vehicle for work purposes IRS standard mileage rates and how to record mileage

How To Claim Fuel Reimbursement

How To Claim Fuel Reimbursement

https://www.staffnews.in/wp-content/uploads/2022/05/gds-gramin-dak-sevak.jpg

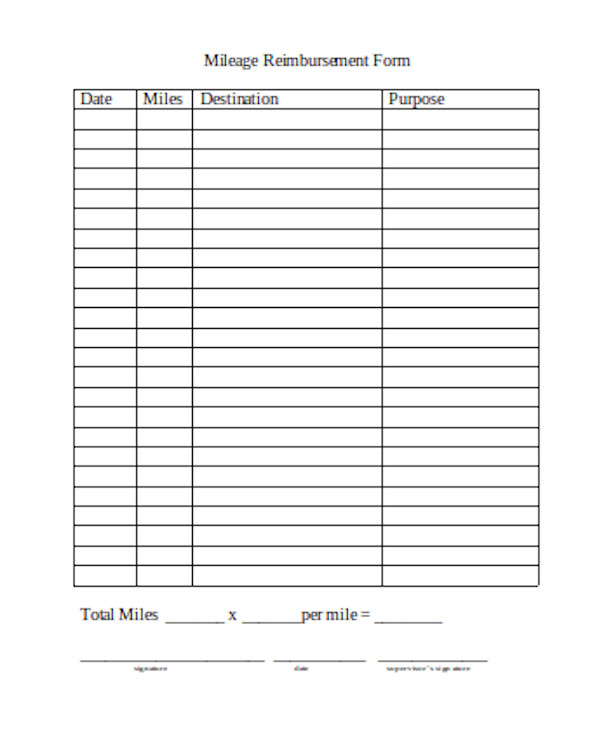

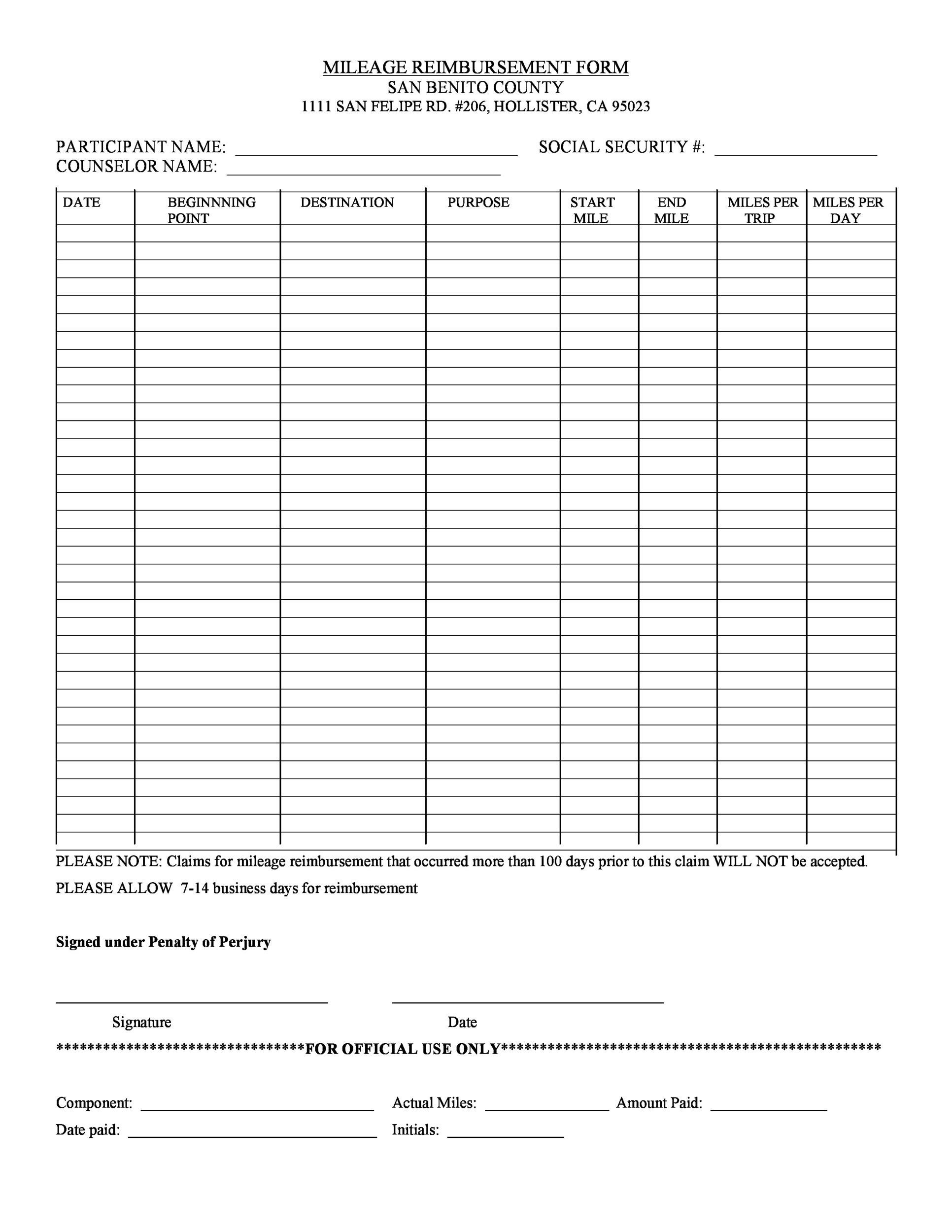

Mileage Reimbursement Form Excel Excel Templates

https://images.sampleforms.com/wp-content/uploads/2016/08/Basic-Mileage-Reimbursement-Form.jpg

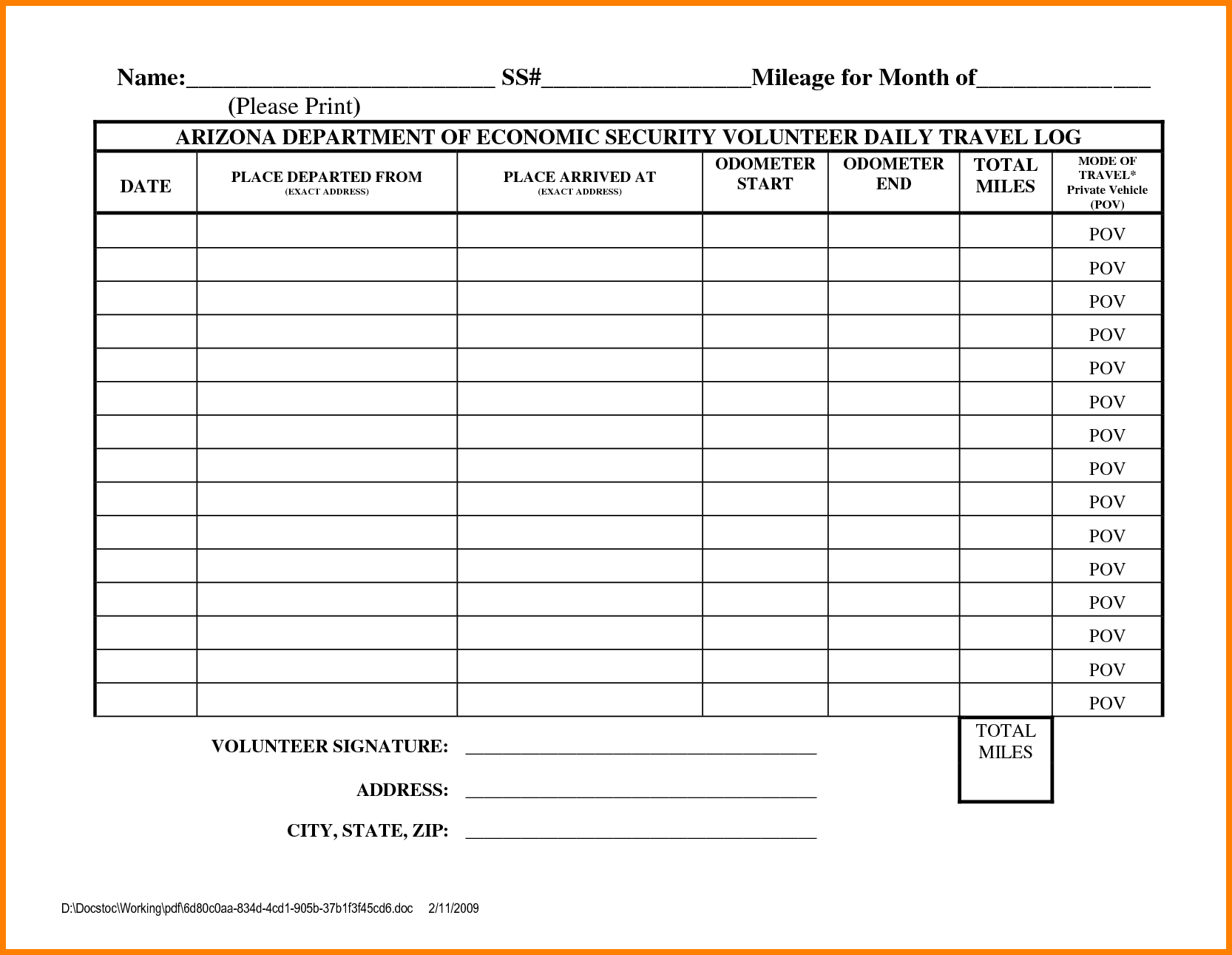

How To Calculate Mileage Claim In Malaysia Karen Rutherford

https://www2.deloitte.com/content/dam/Deloitte/nz/Images/infographics/tax alert/tax-alert-infographics-June-2021.JPG

Per the Internal Revenue Service IRS companies can choose to reimburse the actual amount an employee incurred on the trip or use a specific rate for each mile the employee drove usually less than 1 per mile The IRS further provides a standard mileage rate but businesses are free to choose a different one if they wish A best practice is to use the IRS mileage reimbursement rate but you re free to choose a higher or lower rate When you reimburse employees at a higher rate the extra amount is counted

You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel How to Claim Mileage on Your Tax Returns Step by Step Process What Is a Mileage Log and How Does It Affect Your Taxes Mileage Rates The Current IRS Mileage Rates 2024 Historical mileage rates year by year from 2018 to 2024 Tax Deduction

Download How To Claim Fuel Reimbursement

More picture related to How To Claim Fuel Reimbursement

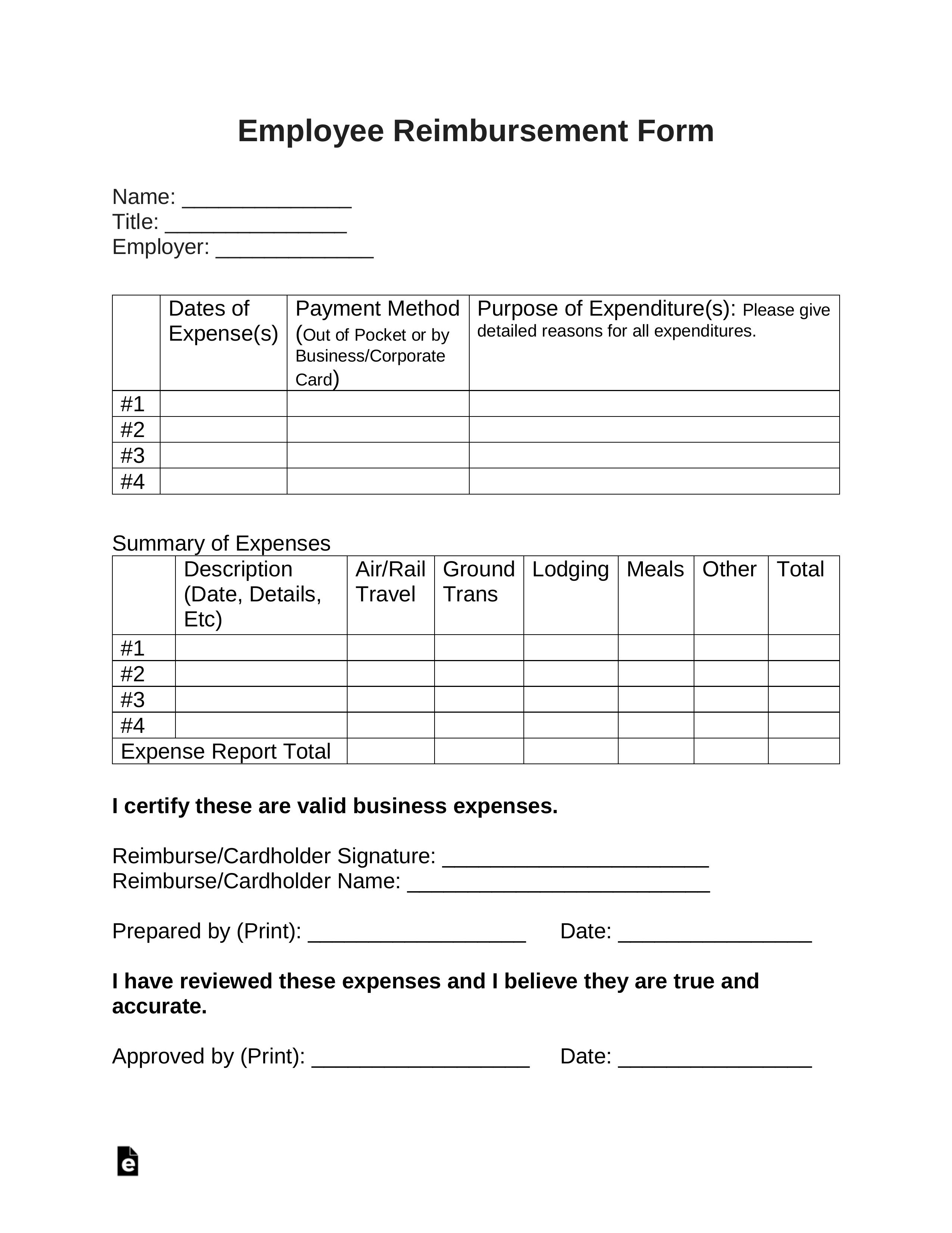

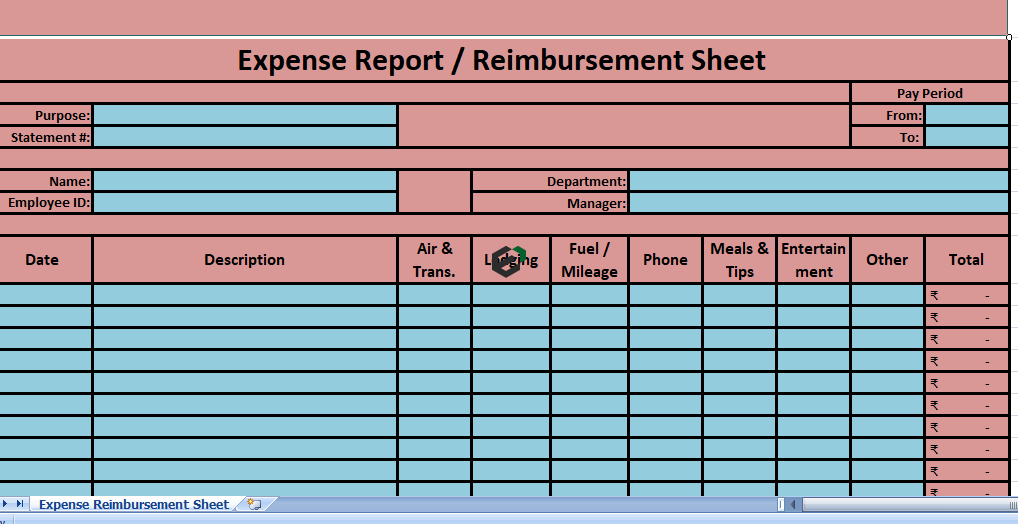

Reimbursement Sheet Template Spreadsheet Templates For Busines Easy

https://db-excel.com/wp-content/uploads/2018/02/simple-expense-reimbursement-form-1.png

Reimbursement Sheet Template TUTORE ORG Master Of Documents

https://eforms.com/images/2016/12/employee-reimbursement-form.png

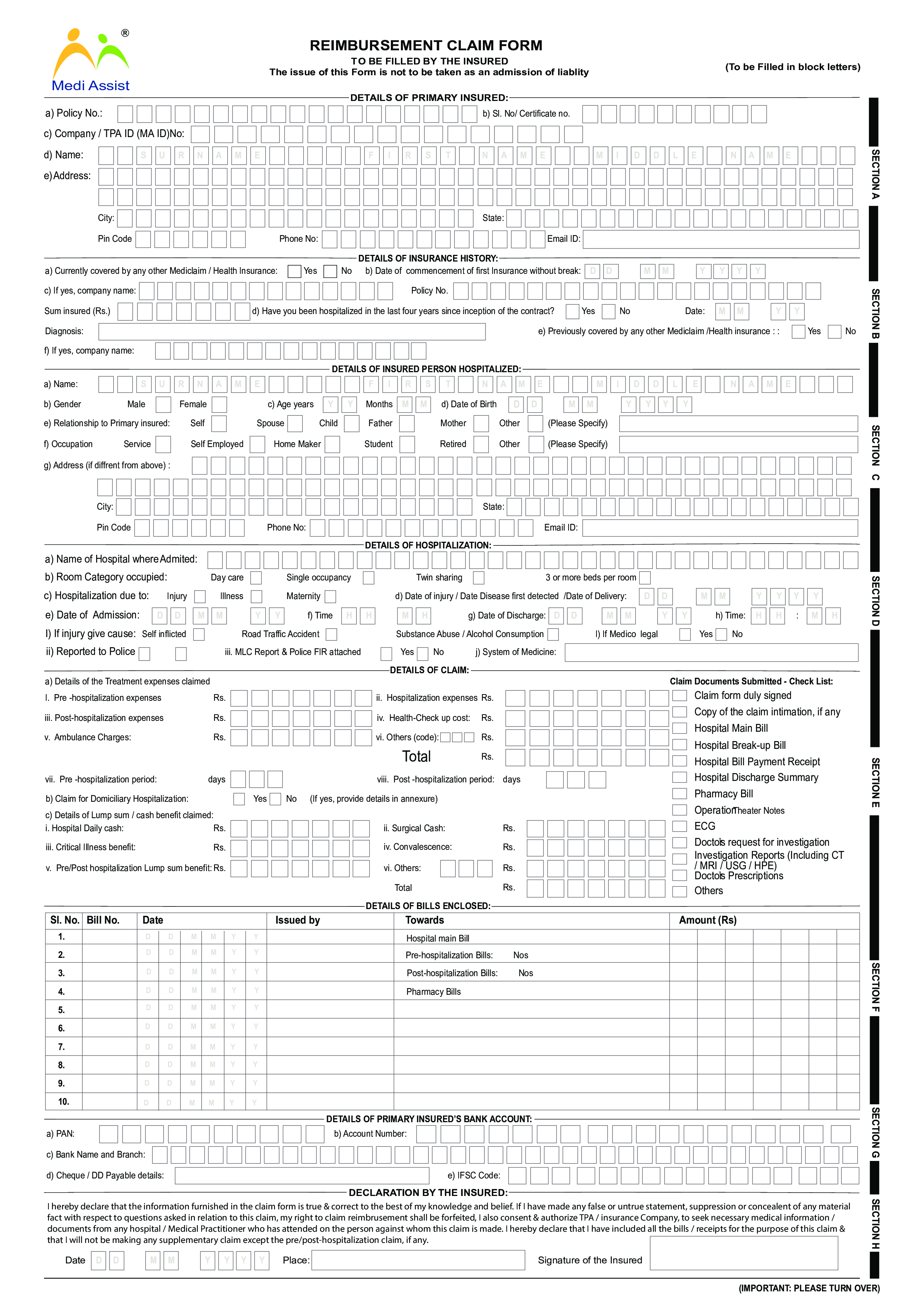

Reimbursement Claim Form Templates At Allbusinesstemplates

https://www.allbusinesstemplates.com/thumbs/07e1762e-9c95-4235-ab70-00c5296b853d_1.png

What s the Best Way to Reimburse Employees for Mileage Expenses Using an Allowance vs Reimbursement By Jean Murray Updated on September 17 2019 In This Article Taxes and Business Driving Systems Paying Employees The Two Options for Employee Driving Allowance or Reimbursement Payment Options for Tax 1 Make Sure You Qualify for Mileage Deduction The most common reason for claiming the mileage deduction is travel from the office to a worksite or from the office to a second business related

[desc-10] [desc-11]

Example Mileage Reimbursement Form Printable Form Templates And Letter

https://i2.wp.com/eforms.com/images/2020/01/IRS-Mileage-Reimbursement-Form.png?fit=1600%2C2070&ssl=1

EXCEL Of Travel Expenses Reimbursement Form xlsx WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20191105/f94f81de029f435783578ac3f6fc7198.jpg

https://cleartax.in/s/flexible-benefit-plan-fbp

Flexible Benefit Plans allow organisations to include fuel costs in the salary structure of their employees Employees can claim a reimbursement of their petrol or diesel bills by submitting the bills to their employers

https://www.businessnewsdaily.com/15891-mileage...

Mileage reimbursement is when employers offer employees reimbursement for expenses associated with driving on behalf of the business These expenses can include fuel costs maintenance and

EXCEL Of Expense Claim Form xlsx WPS Free Templates

Example Mileage Reimbursement Form Printable Form Templates And Letter

Stipend Policy Template

free Download Travel Expenses Reimbursement Format In Excel

2024 Irs Mileage Rate Medical Nana Talyah

Mileage Reimbursement 2023 Form Printable Forms Free Online

Mileage Reimbursement 2023 Form Printable Forms Free Online

47 Reimbursement Form Templates Mileage Expense VSP

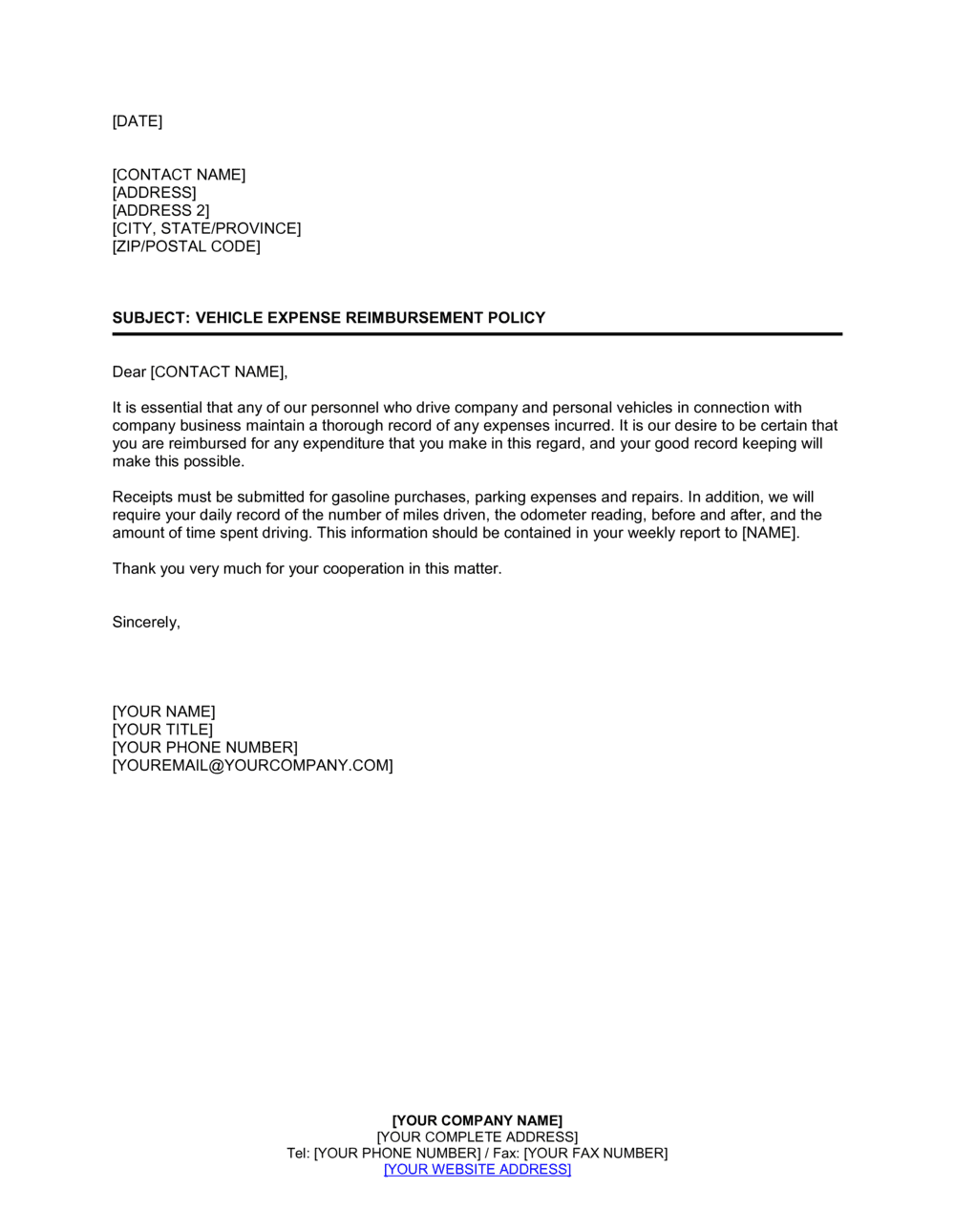

Policy Letter On Vehicle Expense Reimbursement Template By Business

FREE 49 Claim Forms In PDF

How To Claim Fuel Reimbursement - You can claim tax relief on the money you ve spent on fuel and electricity for business trips in your company car Keep records to show the actual cost of the fuel