How To Claim Tax Back On Medical Expenses Ireland Relief for your health expenses is granted by way of a tax refund To benefit you must have paid tax in the relevant year If you have private health insurance you can claim tax relief on the portion of those qualifying expenses not covered by your insurer

You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 This section will explain the types of expenses that qualify Medical insurance premiums If you pay medical insurance directly to an approved insurer tax relief is available Qualifying medical insurance policies can be for health insurance dental insurance health and dental insurance combined You do not need to claim the tax relief from Revenue

How To Claim Tax Back On Medical Expenses Ireland

How To Claim Tax Back On Medical Expenses Ireland

https://i.ytimg.com/vi/PvO2a73LCTo/maxresdefault.jpg

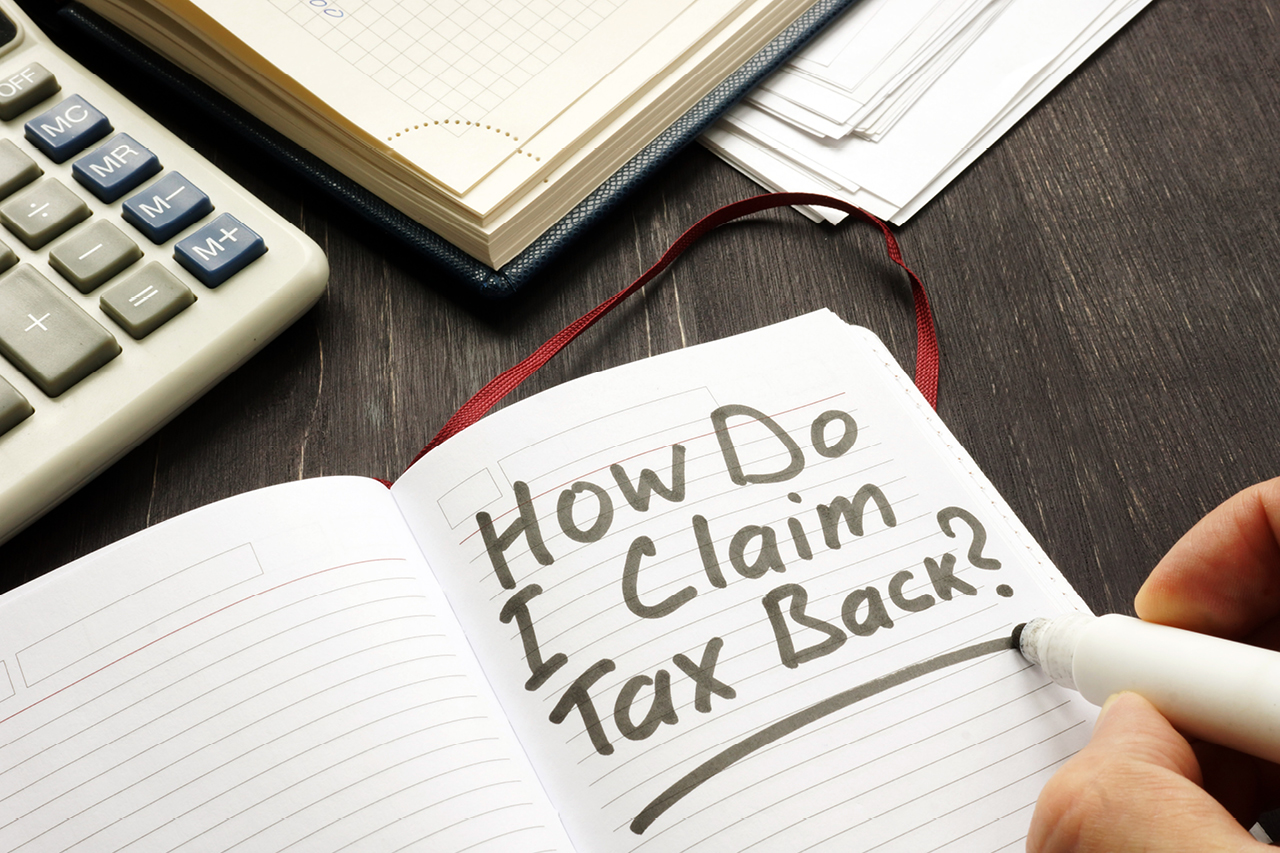

Tax Back On Medical And Dental Expenses My Tax Rebate

https://www.mytaxrebate.ie/wp-content/uploads/2020/09/Medical-Expenses-Blog-Image-e1602500412593.png

How To Lodge Tax Return In Australia Yourself 2023 Step By Step

https://i.ytimg.com/vi/PsK2cK0G5EM/maxresdefault.jpg

Claim 20 back on the cost of GP Doctor and Consultant fees or treatment in a hospital Example GP visits for a family of 5 throughout the year can add up to 500 resulting in a tax rebate up to 100 Required Receipt from your Doctor and or hospital You can claim tax relief on medical expenses that you pay for yourself or for someone else

Understand the process of claiming back medical expenses on your Irish taxes with MyTaxRefunds ie s straightforward guide Discover how to claim tax relief on medical and dental expenses in Ireland Learn about eligible expenses procedures and benefits Don t miss out on potential tax refunds

Download How To Claim Tax Back On Medical Expenses Ireland

More picture related to How To Claim Tax Back On Medical Expenses Ireland

Irish Tax FAQ s The Complete Guide Irish Tax Rebates

http://blog.irishtaxrebates.ie/wp-content/uploads/2018/03/currency-3077900.jpg

Tax Refund Claim Your Tax Refund On Medical Expenses Today

https://yourmoneyback.ie/wp-content/uploads/2017/11/Medical.jpg

How To Claim Tax Back For Dental Expenses Irish Tax Rebates

http://blog.irishtaxrebates.ie/wp-content/uploads/2017/12/pexels-photo-305568.jpeg

Did you know you can claim 20 back on A LOT of your medical expenses In this video I answer the most frequently asked questions and how to get your tax bac You may also be able to claim tax back on tuition fees dental or medical expenses paid over the last 4 years If you have changed personal circumstances and got married or divorced in the last 4 years it is also important to check if you are due tax back

How do I claim Medical Insurance Tax Relief To claim Medical Insurance Relief just fill in our Full Review Form This form will provide us with the details necessary to claim Medical Insurance Relief along with any additional tax credits you might be due for the last 4 years The quickest easiest and most convenient way to submit your claim for tax back is online using PAYE Services in myAccount which is accessible on all mobile devices If you are not

How To Claim Tax Back In Ireland

https://blog.irishtaxrebates.ie/wp-content/uploads/2022/01/Blog-Image-how-do-i-claim-tax-back.jpg

How To Claim Tax Relief On Medical Expenses In Ireland

https://www.taxback.com/resources/blogimages/20190626121526.1561540526516.ce5b8ddfbb069175ee3a5a8ed6b.jpg

https://www.revenue.ie/en/personal-tax-credits...

Relief for your health expenses is granted by way of a tax refund To benefit you must have paid tax in the relevant year If you have private health insurance you can claim tax relief on the portion of those qualifying expenses not covered by your insurer

https://www.revenue.ie/.../health-expenses/index.aspx

You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 This section will explain the types of expenses that qualify

3 Ways To Claim Tax Back WikiHow

How To Claim Tax Back In Ireland

Uniform Allowance Claim Tax Back Now

Find Out How To Claim Tax Back From Covid 19 Tests

How To Claim Tax Back Ireland Tax Returns Submitted In 3 Easy Steps

3 Ways To Claim Tax Back When You Work In Construction Irish Tax Rebates

3 Ways To Claim Tax Back When You Work In Construction Irish Tax Rebates

Maximizing Your Tax Return Easy Guide On What Expenses You Can Claim

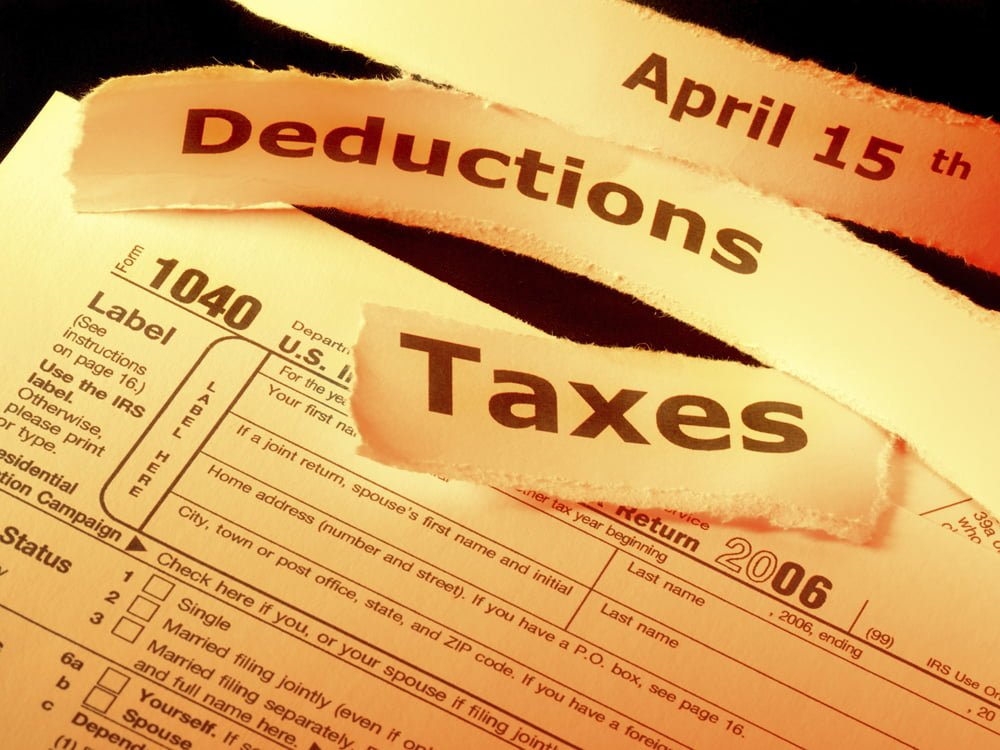

Tax Deductions For Small Business How To Claim Tax Deductions

Register For Tax Preparation Services To Claim Tax Back YourMoneyBack

How To Claim Tax Back On Medical Expenses Ireland - Understand the process of claiming back medical expenses on your Irish taxes with MyTaxRefunds ie s straightforward guide