How Do I Claim Tax Back On My Medical Expenses You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 This section will explain the

You can claim income tax back on some types of healthcare expenses Tax relief for most expenses is at the standard rate of tax Relief on nursing home expenses is available How To Claim Medical Expenses on Your Taxes To claim qualifying medical expenses on your tax return you ll need to complete Schedule A and file it with your Form 1040

How Do I Claim Tax Back On My Medical Expenses

How Do I Claim Tax Back On My Medical Expenses

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/04xx.jpeg

What Is The Home Carer Tax Credit Am I Owed A Tax Rebate And How Do I

https://www.thesun.ie/wp-content/uploads/sites/3/2018/10/NINTCHDBPICT0004403735981.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

How To Claim Tax Back In Ireland Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2022/01/Blog-Image-how-do-i-claim-tax-back.jpg

Taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their adjusted gross income The 7 5 threshold used to be 10 but legislative changes at the end of Hi I m sometimes being reimbursed for project related expenses by my clients That is I m paying for something and then getting the amount back from my client What would

How do I claim tax back on my medical expenses You can claim tax relief after the year in which the claim was made by applying with Taxback For example you can claim for expenses you paid for in 2017 in 2018 Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance exchange or directly from an insurance company the

Download How Do I Claim Tax Back On My Medical Expenses

More picture related to How Do I Claim Tax Back On My Medical Expenses

3 Ways To Claim Tax Back WikiHow

https://www.wikihow.com/images/c/ca/Claim-Tax-Back-Step-15-Version-2.jpg

Claiming Tax Relief On Expenses Moorgates

https://moorgates.co.uk/wp-content/uploads/2023/02/Tax-Relief-on-Expenses.png

Hecht Group Does Pennymac Pay Property Taxes

https://img.hechtgroup.com/1663215364372.jpg

Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must itemize your deductions We ll answer the top 10 frequently asked questions about medical expense tax deductions From prescriptions to medical devices we ll cover what expenses can be

To claim medical expenses beyond 7 5 percent of your AGI you must itemize your expenses That means keeping an accurate records of what you spend and proof of See the Instructions for Form 7206 If you don t claim 100 of your paid premiums you can include the remainder with your other medical expenses as an itemized deduction on

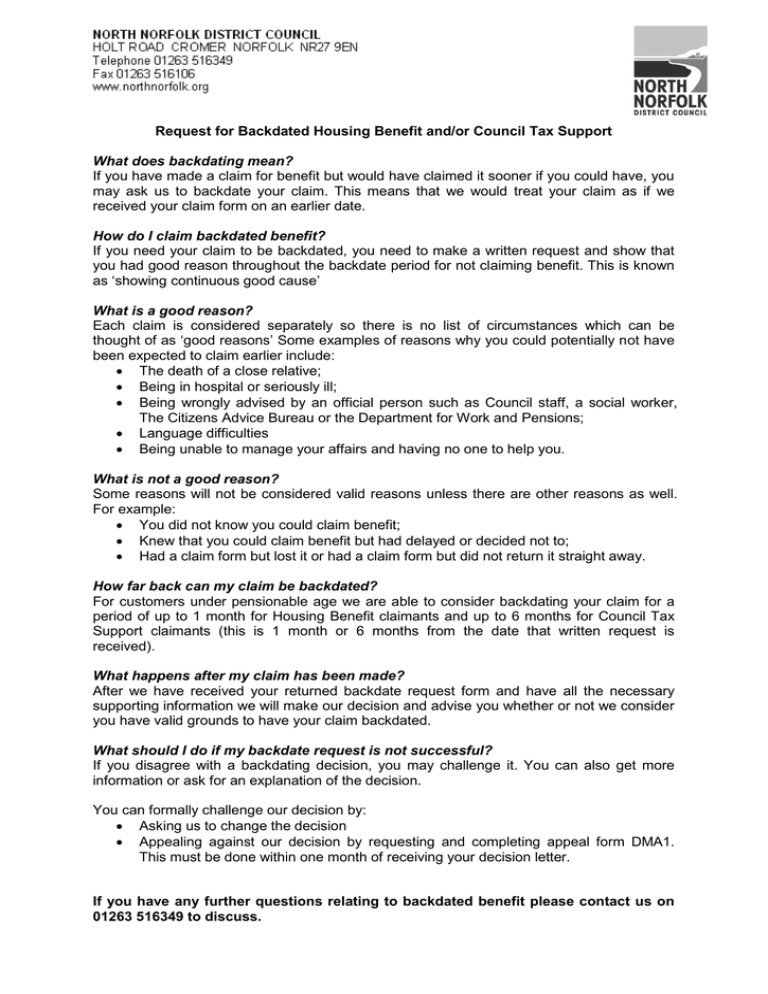

Document 12927281

https://s2.studylib.net/store/data/012927281_1-bb2f843a32d7c5fbc00b0ec65690255f-768x994.png

Can I Claim Back Tax Paid In The US

https://static.wixstatic.com/media/2c594f_b812a2711a8b485fa22aed6239949d4e~mv2.jpg/v1/fill/w_1000,h_667,al_c,q_90,usm_0.66_1.00_0.01/2c594f_b812a2711a8b485fa22aed6239949d4e~mv2.jpg

https://www.revenue.ie › ... › health-expenses › index.aspx

You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 This section will explain the

https://www.citizensinformation.ie › ... › taxation-and-medical-expenses

You can claim income tax back on some types of healthcare expenses Tax relief for most expenses is at the standard rate of tax Relief on nursing home expenses is available

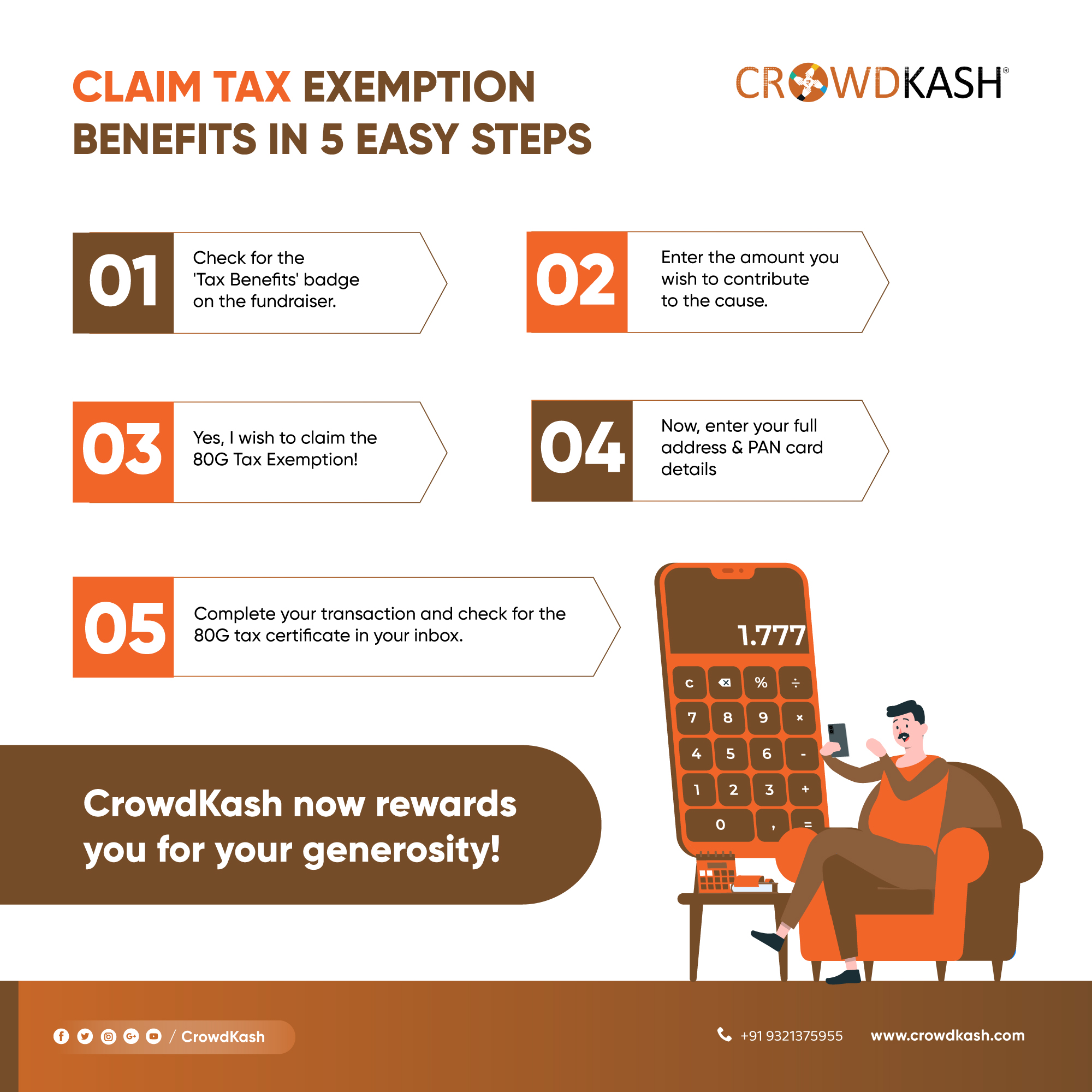

Now You Can Claim Tax Exemptions On CrowdKash Fundraisers CrowdKash Blog

Document 12927281

Here S Who Can Claim The Home Office Tax Deduction This Year

Medical Expenses You Can Claim Back From Tax Momentum Multiply Blog

Can I Claim Tax Back On Health Insurance Bloom

Image Result For Hair Salon Expenses Printable Business Tax

Image Result For Hair Salon Expenses Printable Business Tax

Can I Claim Medical Expenses On My Taxes TMD Accounting

How To Claim Tax Back Ireland Tax Returns Submitted In 3 Easy Steps

Register For Tax Preparation Services To Claim Tax Back YourMoneyBack

How Do I Claim Tax Back On My Medical Expenses - Can I claim medical expenses on my taxes If you re itemizing deductions the IRS generally allows you a medical expenses deduction if you have unreimbursed expenses that are more