How To Claim Vat Refund In France This article explained the few steps it takes to get your VAT refund upon exit from France From getting your tax exemption form to having it stamped to obtaining your refund the process is not overly

Simple Steps for Receiving VAT Tax Refund Go Shopping Spend over 100 01 in a Single Store or Department Store Request an Invoice Request a VAT Tax Refund Take advantage of getting money back on purchases over 100 by applying for the EU VAT refund in France Just know the rules and procedures

How To Claim Vat Refund In France

How To Claim Vat Refund In France

https://i0.wp.com/thefrenchadobo.com/wp-content/uploads/2020/03/becca-mchaffie-Fzde_6ITjkw-unsplash-scaled.jpg?fit=1024%2C683&ssl=1

How To Claim Your VAT Refund In UAE A Guide For Tourists UAE Expatriates

https://uaeexpatriates.com/wp-content/uploads/2023/06/how-to-claim-vat-refund-in-uae-for-tourist-1024x576.png

How To Claim Vat Refund In Dubai Airport The Right Answer 2022

https://www.travelizta.com/wp-content/uploads/2022/08/how-to-claim-vat-refund-in-dubai-airport.jpg

Firstly you must Ask the shop assistant if they provide a d taxe service although there will often be a sign reading tax free or VAT free if it is offered Ask what the value of the purchase needs to be in You must claim your VAT refund online via the authorities in the country where your business is based If you are eligible for a refund the authorities will pass on

Companies who wish to claim a refund of VAT paid in France that carry out no transactions liable for VAT in France To request a refund claimants must send an electronic refund claim to their own national tax authorities who will confirm the claimant s identity VAT identification number and

Download How To Claim Vat Refund In France

More picture related to How To Claim Vat Refund In France

How To Claim VAT Refund With Silver Stone It Is Easy To C Flickr

https://live.staticflickr.com/65535/49704491432_8711cedc3c_b.jpg

Value Added Tax VAT Refund

https://www.triptipedia.com/tip/img/bU3jmlExN.jpg

How To Claim VAT Back On Expenses Accounting Education Business

https://i.pinimg.com/originals/cd/cb/3e/cdcb3e969a7204deb4cf7a6386aff6d2.png

Since 1 July 2021 applications for refunds of French VAT by taxable persons established outside the European Union EU must be submitted electronically If you re a tourist shopping in France it s possible to get a VAT refund on your purchases This full guide will provide you with step by step instructions on how to navigate the process and claim your

How to file a VAT refund claim in France As of 1 July 2021 non EU businesses claiming a VAT refund from France must file a digital 13th Directive claim Am I Eligible for a VAT Refund Who can Claim the VAT Refund The primary criteria you should reside outside the European Union But there s more to the

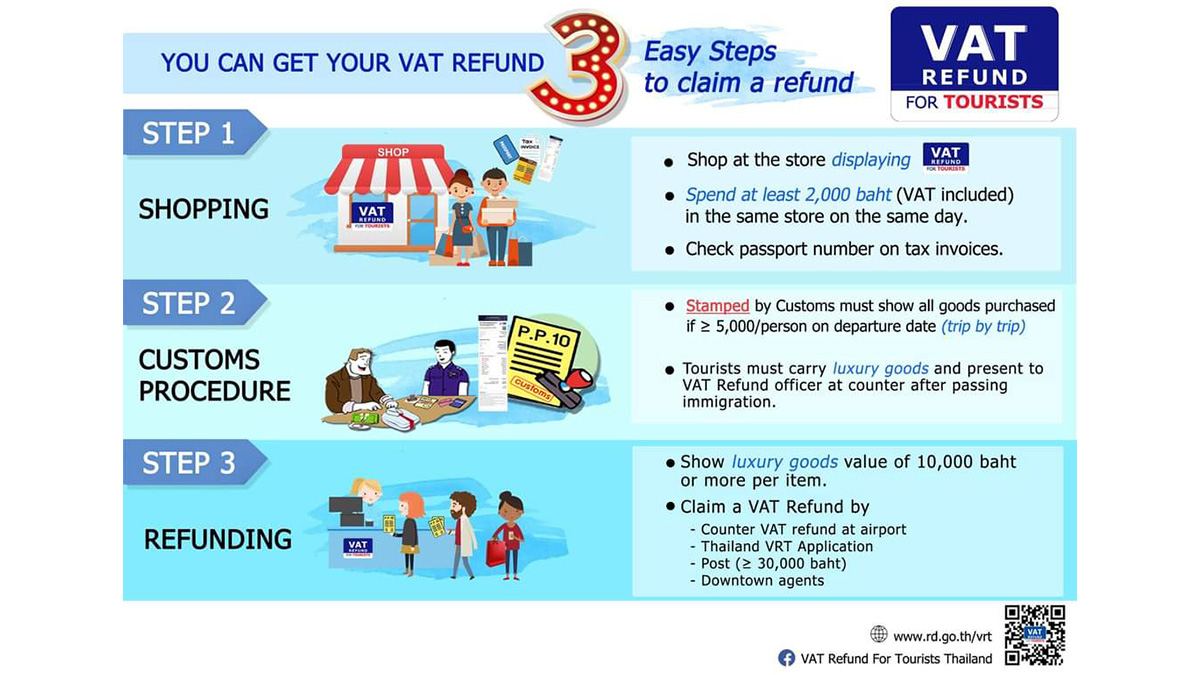

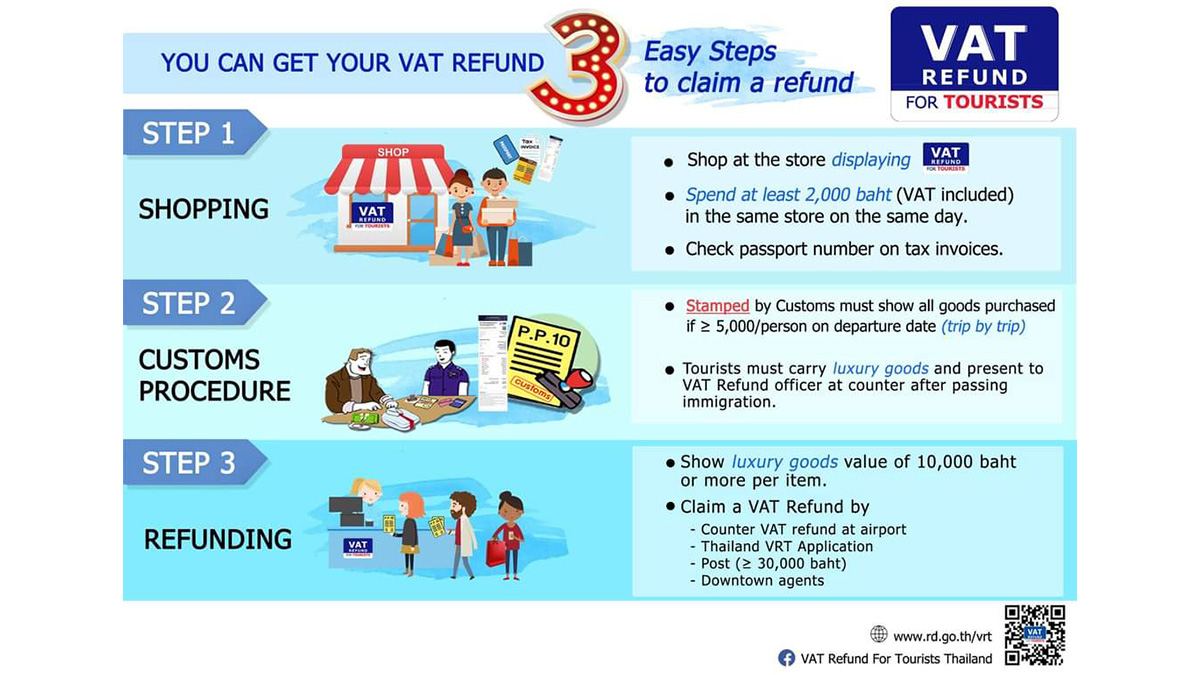

Thailand Offers VAT Refund For Tourists TAT Newsroom

https://www.tatnews.org/wp-content/uploads/2022/12/3-steps-to-claim-VAT-refund.jpg

How To Claim Vat Refund In Uk 2023 Updated

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/how-to-claim-vat-refund-in-uk_446838-1-768x432.jpg

https://wise.com/gb/blog/vat-refund-france

This article explained the few steps it takes to get your VAT refund upon exit from France From getting your tax exemption form to having it stamped to obtaining your refund the process is not overly

https://petiteinparis.com/vat-tax-refund-process-in-paris-france

Simple Steps for Receiving VAT Tax Refund Go Shopping Spend over 100 01 in a Single Store or Department Store Request an Invoice Request a VAT Tax Refund

How To Claim VAT Refund An EU Guide

Thailand Offers VAT Refund For Tourists TAT Newsroom

HOW TO CLAIM VAT REFUND IN UAE AccruonConsultants

How To Apply For The EU VAT Refund In France France Travel Tips

How To Claim VAT Refund In UAE 2023 UPDATED

How To Claim Vat Refund RefundProAdvice

How To Claim Vat Refund RefundProAdvice

Guide To VAT Refund In The Dubai UAE Psddubai

How To Claim VAT Refund In UAE VAT Refund Services

How To Claim Value Added Tax VAT Refunds By Rick Steves Ricksteves

How To Claim Vat Refund In France - Firstly you must Ask the shop assistant if they provide a d taxe service although there will often be a sign reading tax free or VAT free if it is offered Ask what the value of the purchase needs to be in