How To Clean Energy Tax Credits Work If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy

Investment Tax Credits ITC and Production Tax Credits PTC are some of the IRA s most powerful tools for the clean energy transition Here s how they work Get details on the Residential Clean Energy Credit Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may

How To Clean Energy Tax Credits Work

How To Clean Energy Tax Credits Work

https://epic.uchicago.edu/wp-content/uploads/2022/02/iStock-1060945826-scaled.jpg

Study Clean Energy Tax Credits Are Highly Effective

https://taxcreditpolicy.org/wp-content/uploads/2022/02/shutterstock_529456804-scaled.jpg

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we Use these steps for claiming a residential clean energy tax credits Step 1 Check eligibility Make sure the property on which you are installing the energy

Did you know your energy efficient home upgrades could save you money on your taxes Check out these credits and see if you qualify Q How do I know if my Home Energy Audit is eligible for a credit A Consumers can visit this IRS page on the Energy Efficient Home Improvement Credit Q What products are

Download How To Clean Energy Tax Credits Work

More picture related to How To Clean Energy Tax Credits Work

Energy Tax Credits Armanino

https://www.armanino.com/-/media/images/hero/energy-tax-credits.jpg

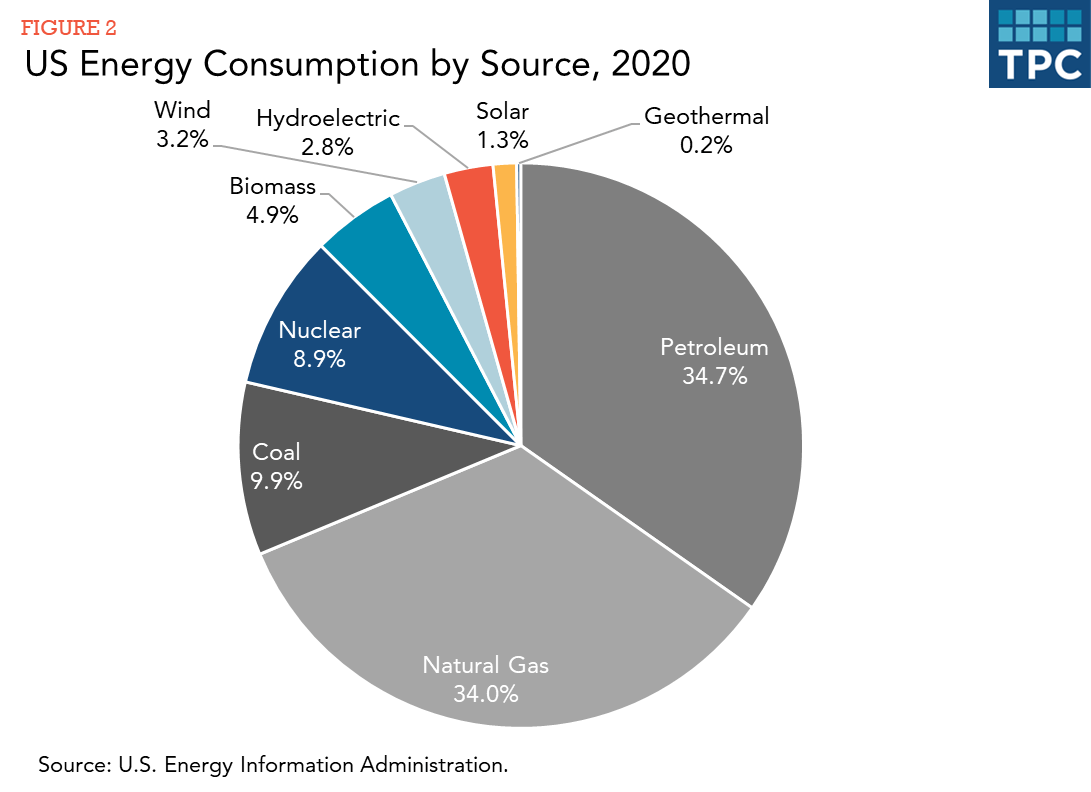

Clean Energy Tax Credits Can t Do The Work Of A Carbon Tax Tax Policy

https://www.taxpolicycenter.org/sites/default/files/styles/original_optimized/public/us_energy_consumption_by_source.png?itok=2rdJNT4H

Renewable Energy Tax Credits Iowa Utilities Board

https://iub.iowa.gov/sites/default/files/banner/renewable_tax_credits.jpg

A significant portion of the Inflation Reduction Act s clean energy investment is delivered through tax incentives which will help catalyze historic levels of The IRS and Treasury finalized proposed rules issued last June over how eligible taxpayers can effectively buy or sell certain energy tax credits and clarify who

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating Discover how these sustainable energy tax credits can drive the clean energy transition Unlock the power of clean energy tax credits and explore how the

Is Your Manufacturing Company Eligible For Clean Energy Tax Credits

https://hwco.cpa/wp-content/uploads/2023/05/CleanEnergyCredits_article.png

Pathways To Build Back Better Maximizing Clean Energy Tax Credits

https://rhg.com/wp-content/uploads/2021/07/clean-energy-tax-credits.png

https://www.irs.gov/credits-deductions/residential-clean-energy-credit

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy

https://evergreenaction.com/blog/what-are-…

Investment Tax Credits ITC and Production Tax Credits PTC are some of the IRA s most powerful tools for the clean energy transition Here s how they work

Critical Clean Energy Tax Incentives Extended Iowa Environmental Council

Is Your Manufacturing Company Eligible For Clean Energy Tax Credits

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

Homeowner Clean Energy Tax Credits

What Are Clean Energy Tax Credits And How Do They Work Evergreen Action

Refundability And Transferability Of The Clean Energy Tax Credits In

Refundability And Transferability Of The Clean Energy Tax Credits In

The Inflation Reduction Act Solar And Clean Energy Tax Credits Enphase

Nearly 8 Billion To Help NSW Transition To Clean Energy

Electricity CEOs Tout Biden Clean Energy Tax Credits Despite Stalled

How To Clean Energy Tax Credits Work - Use these steps for claiming a residential clean energy tax credits Step 1 Check eligibility Make sure the property on which you are installing the energy