How To Download My Income Tax Return Online ITR 1 ITR 2 ITR 3 ITR 4 ITR 5 ITR 6 ITR 7 for AY 2024 25 are enabled for filing in offline as well as Online mode at e filing portal Excel Utilities of ITR 1 ITR 2 ITR 3 ITR 4 ITR 5 ITR 6 and ITR 7 for AY 2024 25 are also live now

You can access your personal tax records online or by mail including transcripts of past tax returns tax account information wage and income statements and verification of non filing letters Download offline utilities related to Income tax returns forms DSC Management Software and Mobile App

How To Download My Income Tax Return Online

How To Download My Income Tax Return Online

https://carajput.com/blog/wp-content/uploads/2018/08/Filing-Income-Tax-Return-FY19.jpg

The Biggest Problem With Income Tax Return Filing And Due Date How You

https://www.avcindia.co.in/wp-content/uploads/2021/03/Income-Tax-Return-Filing.png

2023 Canada Tax Checklist What Documents Do I Need To File My Taxes

https://turbotax.intuit.ca/tips/images/turbotax-canada-tax-checklist.png

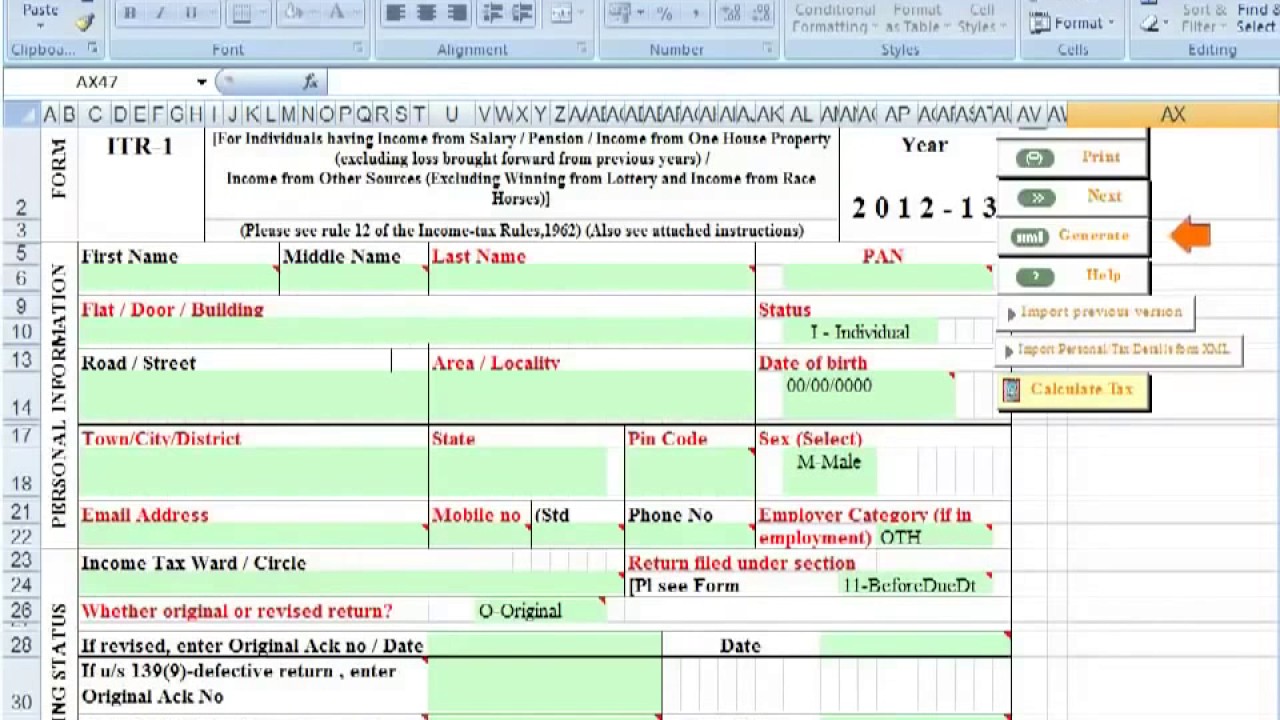

How to Download ITR V Acknowledgement Step 1 Go to the income tax India website at www incometax gov in and log in Step 2 Select the e File Income Tax Returns View Filed Returns option to see e filed tax returns Step 3 To download ITR V click on the Download Form button of the relevant assessment year You will be able to download the ITR V Acknowledgement uploaded JSON from the offline utility complete ITR form in PDF and intimation order by using the options on the right hand side

If you need to complete a return for a previous year you can do this in myIR or download and print the form Make sure we have your correct contact bank account and income information You can update these any time during the tax year The easiest way is in myIR or you can call us You can download the pdf version of filed ITR from the income tax e filing portal www incometax gov in under e File Income Tax Returns View Filed Returns A step by step guide with screenshots on how to check if you have e

Download How To Download My Income Tax Return Online

More picture related to How To Download My Income Tax Return Online

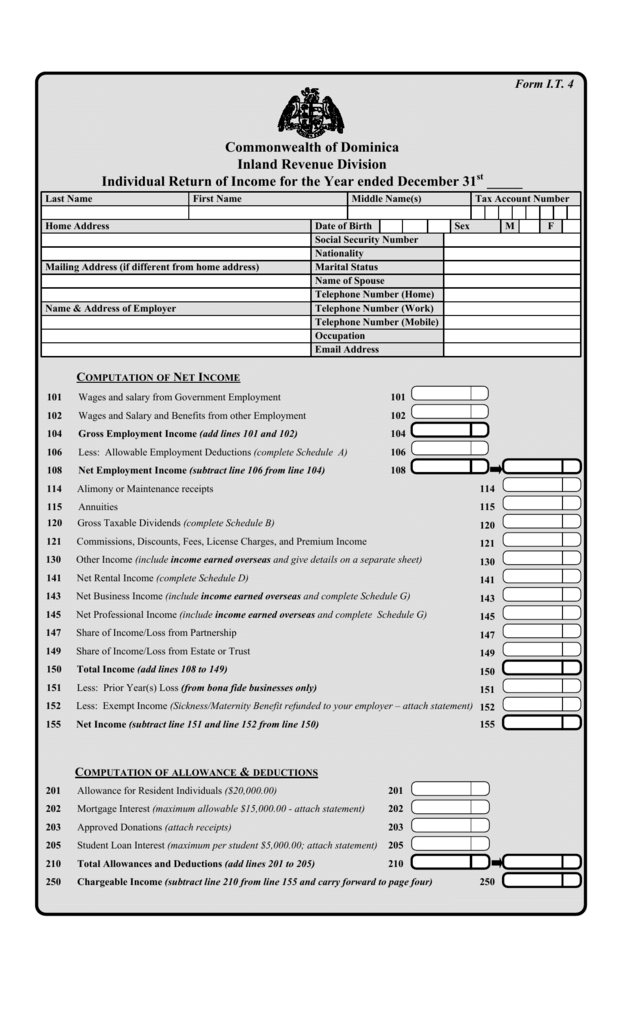

Final Senator Domeniu Annual Tax Return Form ndeaproape Porter Secol

https://s3.studylib.net/store/data/008685966_1-80a463639e972147f162eec574eb39af.png

Benefits Of E filing Income Tax Returns

https://www.kanakkupillai.com/learn/wp-content/uploads/2023/06/Benefits-of-E-filing-Income-Tax-Returns.jpg

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Printable Tax Declaration Form Printable Form Templates And Letter

https://www.investopedia.com/thmb/FOlL30LB0IoWAychszapZiHlUVk=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg

Prepare and lodge your own tax return online It is the quick safe and secure way to lodge most process in 2 weeks Last updated 20 June 2024 Print or You can electronically file your 2017 2018 2019 2020 2021 2022 and 2023 initial T1 personal income tax and benefit return using NETFILE and you can file your amended T1 return for 2020 2021 2022 and 2023 using ReFILE

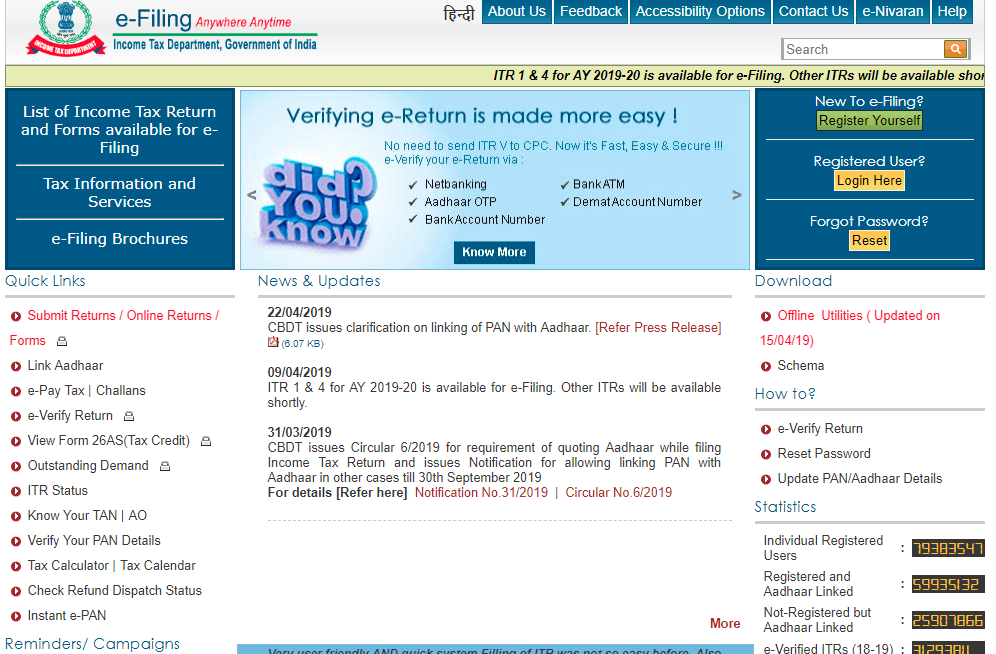

Step 1 Login Visit the official Income Tax e filing website and click on Login Enter your PAN in the User ID section Click on Continue Check the security message in the tickbox Enter your password Continue Step 2 Go To File Income Tax Return Click on the e File tab Income Tax Returns File Income Tax Return Get your SA302 tax calculation You can get evidence of your earnings SA302 for the last 4 years once you ve sent your Self Assessment tax return You can also get a tax

Difference Between Sa302 And Tax Year Overview What You Provide Your

https://www.spondoo.co.uk/wp-content/uploads/2022/04/How-to-view-download-and-print-SA032-Tax-Calculation-and-Tax-overview-3.png

Penalties On Late Filing Of Income Tax Returns ITR After Due Date

https://wp-asset.groww.in/wp-content/uploads/2019/07/27141759/How-to-Link-Aadhaar-with-PAN-to-File-Income-Tax-Returns-01-scaled.jpg

https://www.incometax.gov.in

ITR 1 ITR 2 ITR 3 ITR 4 ITR 5 ITR 6 ITR 7 for AY 2024 25 are enabled for filing in offline as well as Online mode at e filing portal Excel Utilities of ITR 1 ITR 2 ITR 3 ITR 4 ITR 5 ITR 6 and ITR 7 for AY 2024 25 are also live now

https://www.irs.gov/individuals/get-transcript

You can access your personal tax records online or by mail including transcripts of past tax returns tax account information wage and income statements and verification of non filing letters

6 Errors To AVOID While Filing Income Tax Return Online Check Details

Difference Between Sa302 And Tax Year Overview What You Provide Your

How To Claim Income Tax Refund Online Check Refund Status

Is It Mandatory To Online Income Tax Filing 09891200793 By

File Income Tax Return Online Income Tax E Filing Return 2023 2024

File Income Tax Return How To E File Your Income Tax Vrogue co

File Income Tax Return How To E File Your Income Tax Vrogue co

Jar Main Website

Income Tax Return

Free Step By Step Guide For E Filing Income Tax Return ITR Online

How To Download My Income Tax Return Online - You need to verify your Income Tax Returns to complete the return filing process Without verification within the stipulated time an ITR is treated as invalid e Verification is the most convenient and instant way to verify your ITR You can also e Verify other requests responses services to complete the respective processes successfully