How To File Income Tax Return For Senior Citizens In India You can efile income tax return on your income from salary house property capital gains business profession and income from other sources Further you can also file TDS returns generate Form 16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing

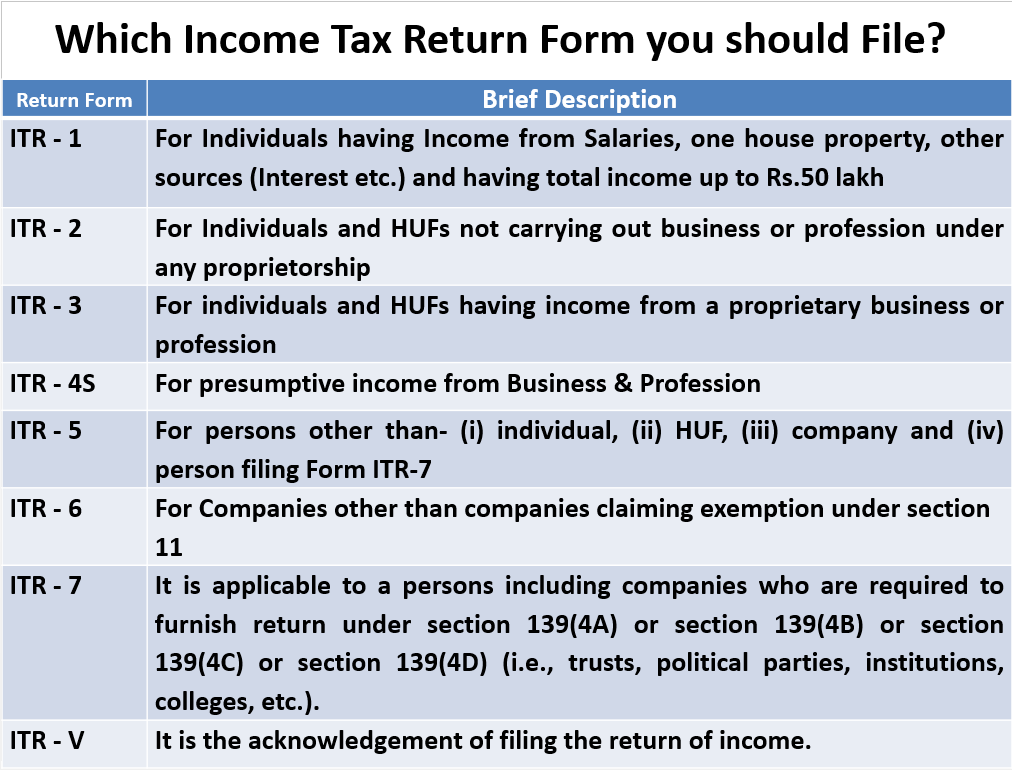

Updated on May 3rd 2023 8 min read According to the IT Act pensions come under the head Income from Salaries Thus if a person s pension income falls above the exemption level filing the ITR for pensioners is necessary In this regard individuals can submit the ITR 1 Sahaj form To file an income tax return senior citizens super senior citizens would have to use the following income tax forms depending on the nature of their income There is also a section in TDs 194P that is applicable to specified senior citizens whose age is 75 years or more and who have only pension income and no other income

How To File Income Tax Return For Senior Citizens In India

How To File Income Tax Return For Senior Citizens In India

https://resize.indiatv.in/resize/newbucket/715_-/2022/12/6-dec-image-9-1670333556.jpg

What Are The Income Tax Slabs For Senior Citizens In India

https://thefindstory.com/wp-content/uploads/2021/12/Income-Tax-Slabs-for-Senior-Citizens-In-India.jpg

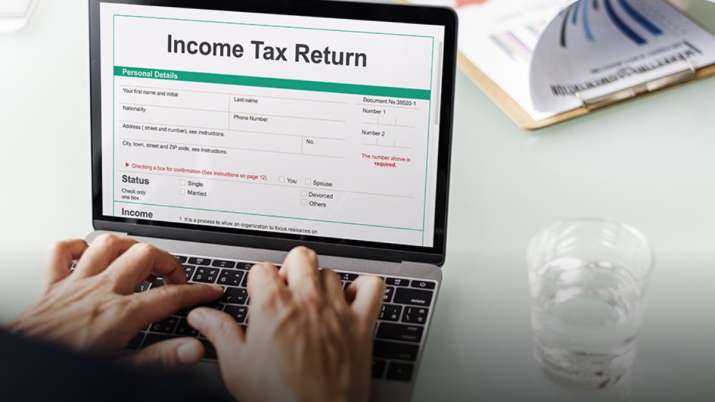

How To File Income Tax Return Online For Salaried Employees 2022 2023

https://www.businessinsider.in/photo/93055356/how-to-file-income-tax-return-online-for-salaried-employees-2022-2023.jpg?imgsize=88484

A senior citizen must submit a declaration using Form No 12BBA Once the older citizen has filed the declaration the bank will compute the gross total income pension plus interest income To calculate net taxable income the bank will also consider the deductions tax exemptions and rebates available to elderly citizens under Completely free of cost e Filing for Senior Citizens ClearTax is always free for Senior Citizens over the age of 60 Simply start e Filing and if your age is over 60 you automatically e File for free Start e Filing Now

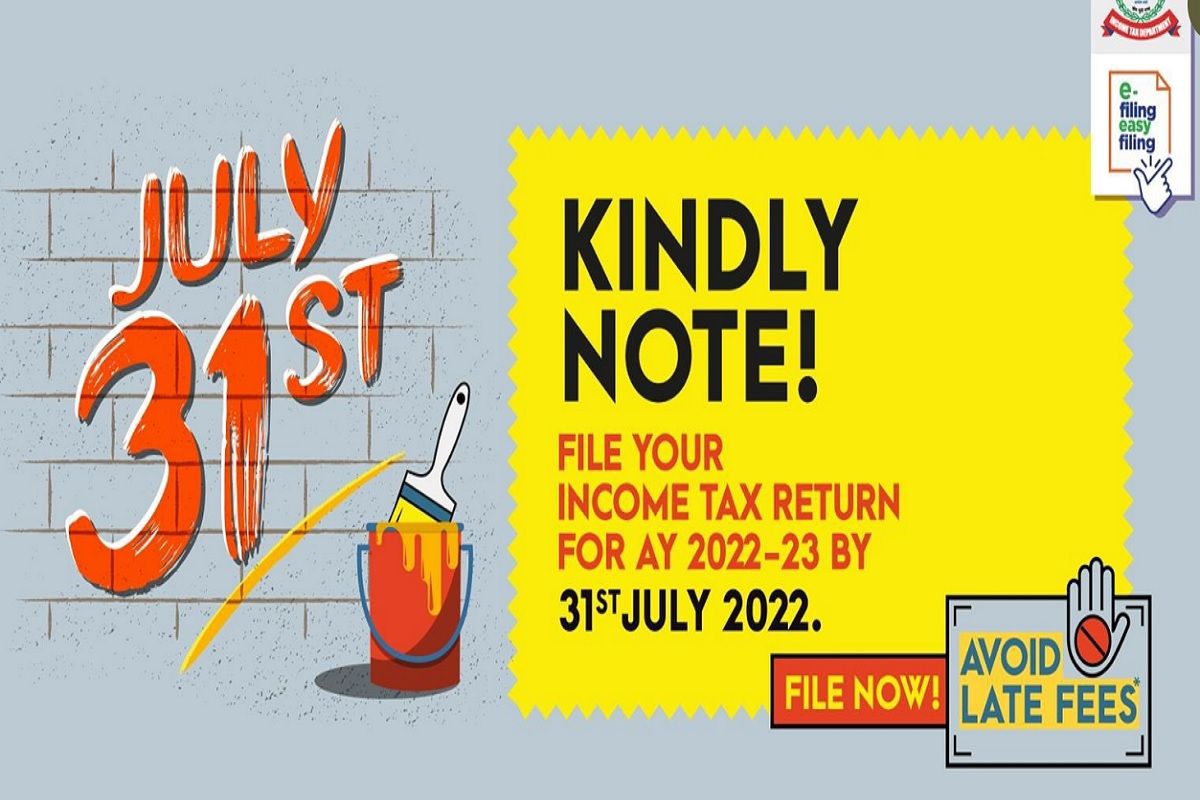

Income Tax Department Senior Citizen Who should file return of Income How to file return of income view more Refund View Refund Demand Status CBDT Department of Revenue Ministry of Finance Government of India India Code INDIA STQC Visitor counter 0 1 5 5 2 1 6 7 6 7 Itr filing income tax return senior citizen income tax Senior Citizen tax benefits income tax it act Income Tax Department The deadline to file income tax returns ITRs for the financial year 2022 23 assessment year 2023 24 is July 21 Senior citizens however get several tax benefits under the Income Tax IT Act 1961

Download How To File Income Tax Return For Senior Citizens In India

More picture related to How To File Income Tax Return For Senior Citizens In India

ITR How To File Income Tax Return In Just 30 Minutes

https://static.india.com/wp-content/uploads/2022/07/ITR-1.jpg

Which Is The Best Return Form For You To File Income Tax Return

https://www.itrtoday.com/wp-content/uploads/2021/06/Which-is-the-Best-return-form-for-you-to-File-Income-Tax-return.png

A Complete Guide On How To File Income Tax Return Online For Salaried

https://investorgyan.in/wp-content/uploads/2022/12/ITR-for-employees-1024x512.jpg

Author Rajiv Dogra Tags The income tax I T department notifies specific income tax return ITR forms for availing the tax filing and seeking eligible tax exemption benefits In the case of seniors there are various ITR forms they are required to be aware of when filing income tax Exemption from Filing ITR Home Explainers Income tax slabs for senior and super senior citizens new and old tax regimes for 2023 24 Understanding income tax slabs for senior and super senior citizens

E Filing not mandatory Any super senior citizen filing income tax return in Form ITR 1 or ITR 4 may file the income tax return in paper form They can file their return either electronically or by paper mode Income tax filing for senior citizens in India The Indian Income Tax Act gives certain tax benefits to Senior Citizens and also tries to ensure that income tax e filing is a hassle free process The complete list of all the tax benefits available to senior citizens is compiled in this article Who is a Senior Citizen for Income Tax purpose

Income Tax Return Filing Know How To File Income Tax Return Online For

https://www.jagranimages.com/images/newimg/04072020/04_07_2020-income_tax_20472981.jpg

If You re A Surviving Spouse Or Estate Executor For Someone Who Died In

https://i.pinimg.com/originals/70/58/18/70581874c62e4fe0bd4a8ed60e5daa6a.jpg

https:// cleartax.in /s/income-tax-slab-for-senior-citizen

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources Further you can also file TDS returns generate Form 16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing

https:// cleartax.in /s/how-to-file-itr-for-pensioners

Updated on May 3rd 2023 8 min read According to the IT Act pensions come under the head Income from Salaries Thus if a person s pension income falls above the exemption level filing the ITR for pensioners is necessary In this regard individuals can submit the ITR 1 Sahaj form

How To File Income Tax Return Online For Salaried Employee

Income Tax Return Filing Know How To File Income Tax Return Online For

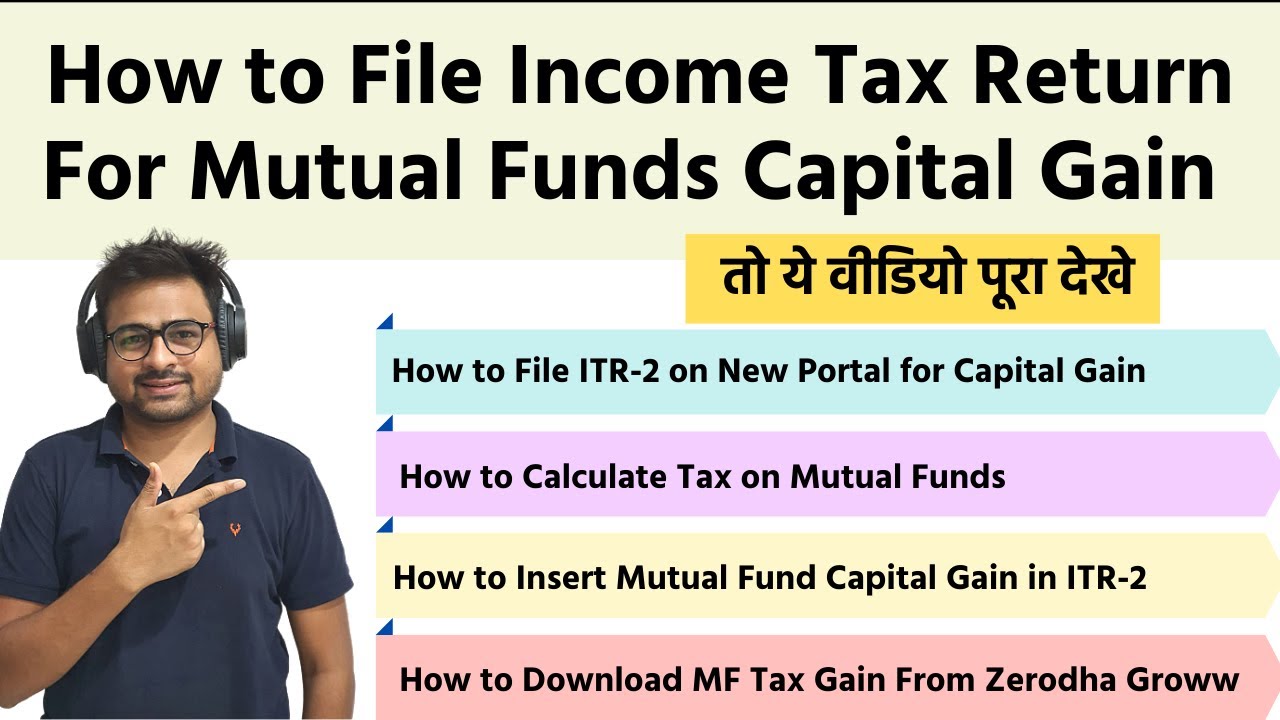

How To File Income Tax Return For Mutual Funds On New Income Tax Portal

Best Mattress For Senior Citizens In India

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Astrid Merrill

HOW TO FILE INCOME TAX RETURN FOR A Y 2020 21 HOW TO FILE ITR 1 A Y

HOW TO FILE INCOME TAX RETURN FOR A Y 2020 21 HOW TO FILE ITR 1 A Y

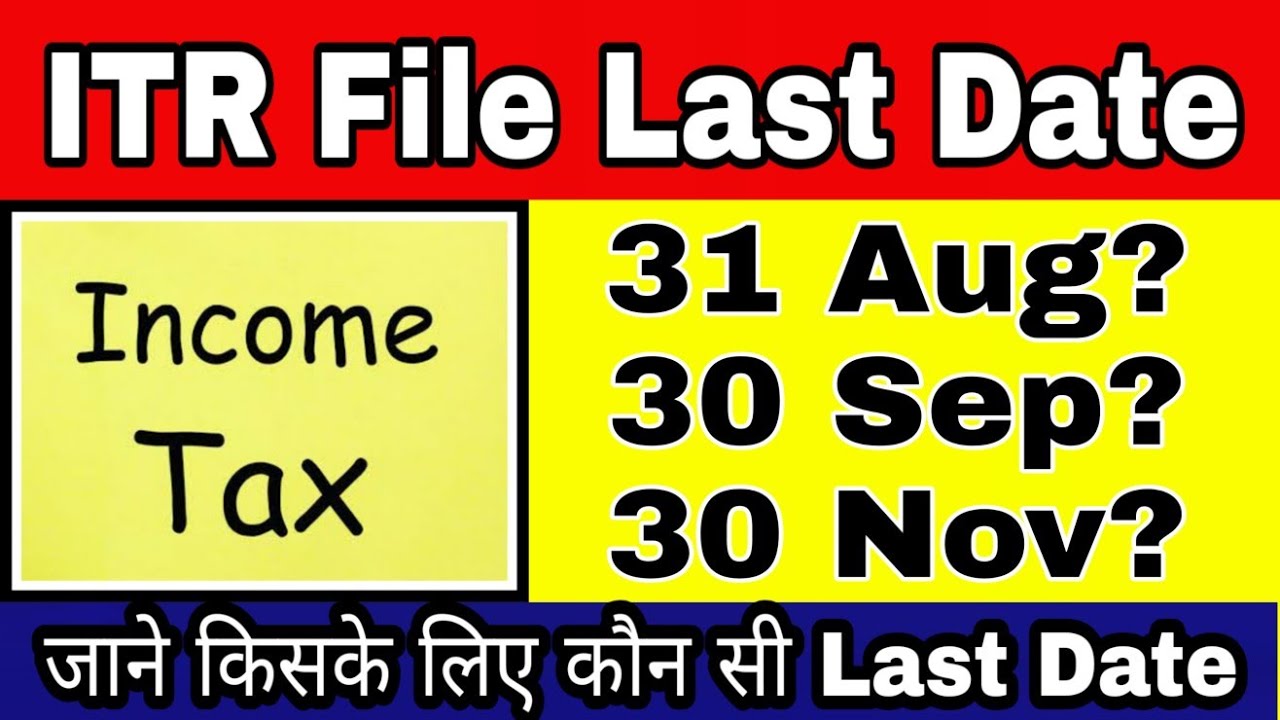

ITR Filing Online 2019 20 Last Date How To File Income Tax Return For

How To File Income Tax Return Live Tutorial In Hindi INCOME TAX

Income Tax Return Last Date Direct Link To File Itr Other Details Riset

How To File Income Tax Return For Senior Citizens In India - Income Tax Department Senior Citizen Who should file return of Income How to file return of income view more Refund View Refund Demand Status CBDT Department of Revenue Ministry of Finance Government of India India Code INDIA STQC Visitor counter 0 1 5 5 2 1 6 7 6 7