How To Qualify For Property Tax Relief Housing Selling your home Selling residential property Additional prepayment You can supplement your 2023 pre collected tax amount with an additional prepayment How to request and make an additional prepayment You may sell your permanent home exempt from tax provided that both of the following conditions are met

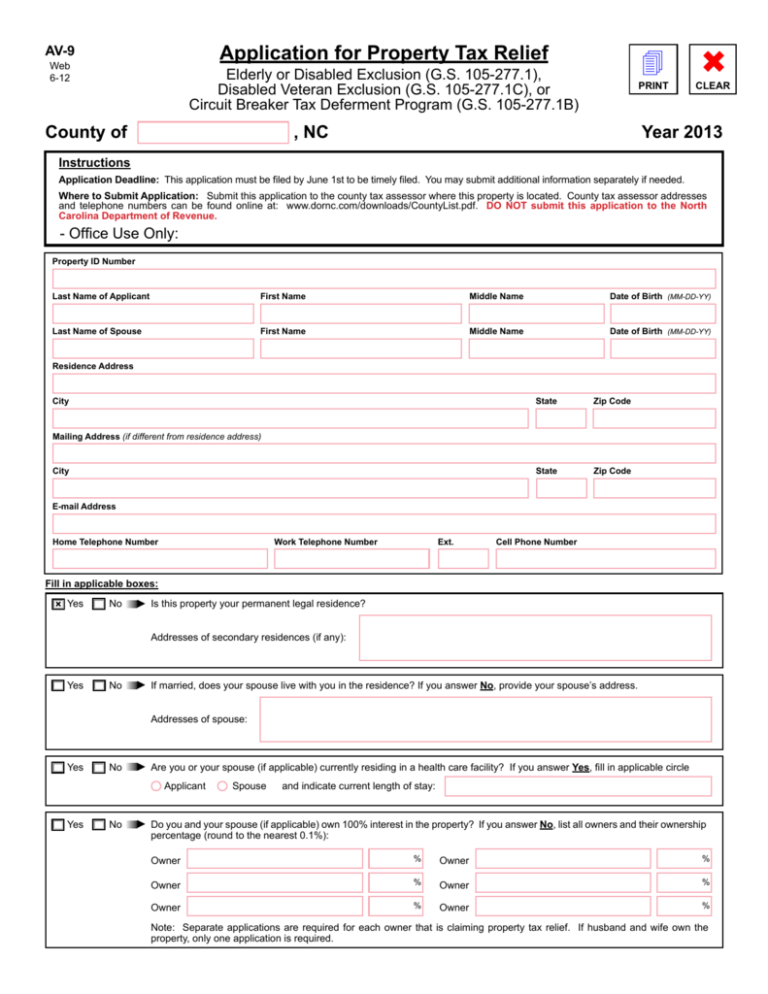

An applicant must meet all qualifications in the assessment year to receive property tax relief in the tax year Qualifications The exemption program qualifications are based of of age or disability ownership occupancy and income Details of each qualification follows Age or disability Tax on property You have to pay tax to the Finnish Tax Administration on inheritance valuable gifts rent income sales profits investment income and real estate for instance Rent income investment income sales profits and

How To Qualify For Property Tax Relief

How To Qualify For Property Tax Relief

https://swanwealth.com/wp-content/uploads/2020/02/State-Tax-Loss-dplic-207264826.jpg

Tax Rules On International Money Transfers To Canada Loans Canada

https://loanscanada.ca/wp-content/uploads/2022/04/Tax-Rules-On-International-Money-Transfers-To-Canada-1.png

Real Estate Tax Relief Program Official Website Of Arlington County

https://www.arlingtonva.us/files/sharedassets/public/housing/images/homeownership/realestaterelief-thumb.jpg?w=1200

Homeowners can find out what homeowner assistance covers how it works and who s eligible on the interagency housing portal hosted by the Consumer Financial Protection Bureau CFPB Homeowner Assistance Fund You can get up to 1 000 each tax year in tax free allowances for property or trading income from 6 April 2017 If you have both types of income you ll get a 1 000 allowance for

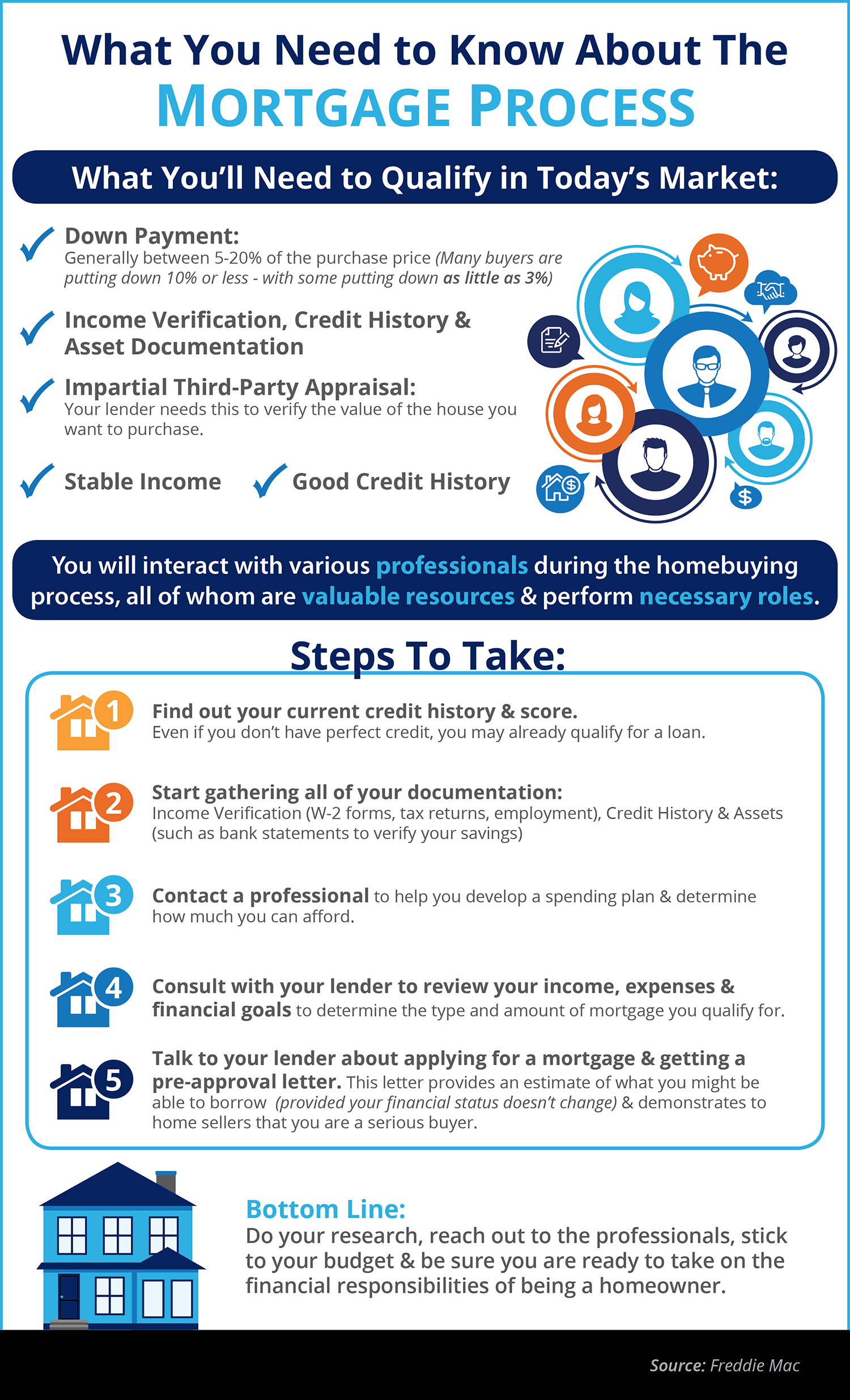

Since 2019 we ve empowered individuals to access over 10 million in property tax relief Here s what our free program offers National resource for state based property tax relief information An easy to use online eligibility screener to check your eligibility and get guidance on applying for relief programs in your area In addition to age requirements to qualify for the Property Tax Rent Rebate your household income must be 45 000 or less annually How to Apply There are a few ways to apply for the program online by mail or in person Learn more about your application options Application Deadline

Download How To Qualify For Property Tax Relief

More picture related to How To Qualify For Property Tax Relief

Property Tax Relief Available To Texas Homeowners Through Homestead

https://thumbnails.texastribune.org/-_FqXRIfyACjXuzikpLCHglvKy0=/1200x804/smart/filters:quality(95)/static.texastribune.org/media/images/2017/08/12/UP9A0022.JPG

Application For Property Tax Relief

https://s3.studylib.net/store/data/008248122_1-6c47f7a2d4cd083e68f0176661e61138-768x994.png

What You Need To Know About Qualifying For A Mortgage INFOGRAPHIC

https://files.keepingcurrentmatters.com/wp-content/uploads/2017/04/Mortgage-Process-STM.jpg

To qualify for a deferral of a property tax increase you must have a combined household income of 57 112 or less be 65 years of age or older OR 11 rowsProperty owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year

You May be Eligible for Real Estate Tax Relief if you Qualify Tax Relief for Seniors and People with Disabilities Fairfax County provides real estate tax relief and car tax relief to citizens who are either 65 or older or permanently and totally disabled and meet the income and asset eligibility requirements Property Tax Assistance Program Application Form PTAP Montana Department of Revenue Click here for more info You may use this form to apply for the Property Tax Assistance Program PTAP If you are already approved for the Property Tax Assistance Program you will not need to apply again

Income Tax Act Malaysia Samuel Gutierrez

https://soyacincau.com/wp-content/uploads/2022/03/220324-efiling-tax-relief-scaled.jpeg

Senior Citizens Can Learn How To Qualify For Property Tax Relief With

https://ucnj.org/wp-content/uploads/2020/10/senior-council.jpg

https://www.vero.fi/en/individuals/housing/selling_your_home

Housing Selling your home Selling residential property Additional prepayment You can supplement your 2023 pre collected tax amount with an additional prepayment How to request and make an additional prepayment You may sell your permanent home exempt from tax provided that both of the following conditions are met

https://dor.wa.gov/.../2022-02/PTExemption_Senior.pdf

An applicant must meet all qualifications in the assessment year to receive property tax relief in the tax year Qualifications The exemption program qualifications are based of of age or disability ownership occupancy and income Details of each qualification follows Age or disability

Property Tax Relief 5 Ways To Reduce Tax Load In 2022 SuperMoney

Income Tax Act Malaysia Samuel Gutierrez

What Credit Score Do I Need To Get A Credit Card Loans Canada

Taxes Taxpayers Protection Alliance

Taxes Taxpayers Protection Alliance

Tax Exemption Form For Veterans ExemptForm

Tax Exemption Form For Veterans ExemptForm

State Offering Property tax Relief For Some Homeowners New Hampshire

Best Credit Cards For Low Income Earners 2024 Loans Canada

How To Qualify For An FHA Home Loan Eligibility Down Payments And

How To Qualify For Property Tax Relief - In a Nutshell Property taxes can contribute significantly to the cost of homeownership Depending on where you live your property tax bill can run anywhere from 200 to more than 10 000 according to the Tax Foundation If you re struggling to pay yours property tax relief could help ease your burden if you qualify

/static.texastribune.org/media/images/2017/08/12/UP9A0022.JPG)