How To Reduce Tax In Hong Kong Web 22 Feb 2023 nbsp 0183 32 This article provides an overview of the obligations taxable earnings on established companies tax allowances and various exemptions your business can benefit from if you start your business in Hong Kong

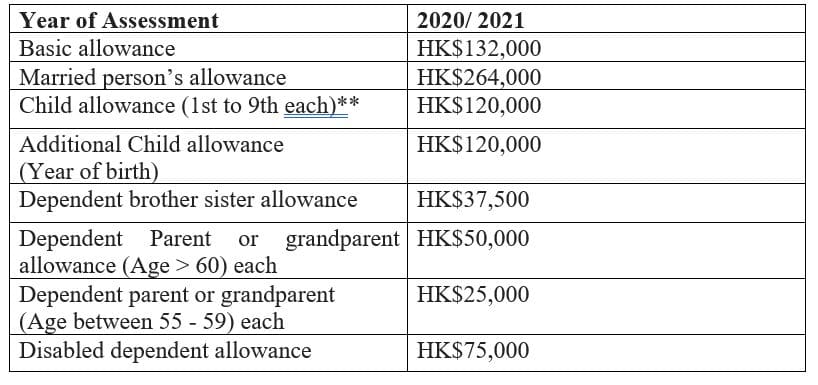

Web 1 Apr 2022 nbsp 0183 32 Salaries tax Levied on net chargeable income assessable income less personal deductions and allowances at progressive rates ranging from 2 to 17 or at a flat rate maximum rate of 15 on assessable income less personal deductions whichever calculation produces the lower tax liability Web This article explains who is eligible for personal assessment how election may reduce your overall tax liability how married couples are treated under it online help in computing your tax payable under personal assessment and where to go if you want to know more

How To Reduce Tax In Hong Kong

How To Reduce Tax In Hong Kong

https://hongkong.acclime.com/wp-content/uploads/HK-guide-PIT.png

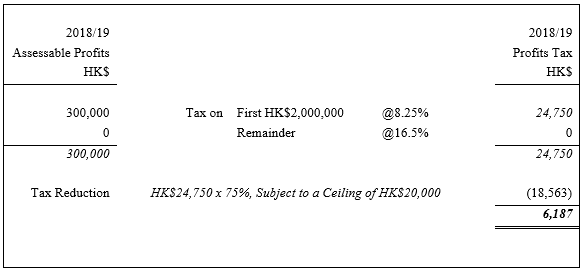

The HKSAR Government Proposes To Reduce The Profits Tax For The Year Of

https://www.kaizencpa.com/Upload/detail/2019-04-18/5cb7f28dc4316.png

Hong Kong Personal Income Tax Hong Kong Tax

https://www.paulhypepage.co.id/wp-content/uploads/2020/04/Personal_Income_Tax_in_Hong_Kong.svg

Web Vor einem Tag nbsp 0183 32 A pro business political party in Hong Kong has suggested imposing a departure tax on residents who travel out of the city to increase government revenue amid a protracted deficit Asked by Web GovHK Can Personal Assessment Reduce Your Tax Liability Feature article by the Hong Kong Government about deductions and allowances under personal assessment and whether or not it will be advantageous to elect personal assessment if you own a business or receive rental income Skip to main content MyGovHK LoginRegister Text Size

Web Businesses subject to Profits Tax will enjoy a reduction of 75 of the final tax for the years of assessment 2015 16 to 2017 18 subject to the ceiling of 20 000 per case for 2015 16 and 2016 17 and 30 000 per case for 2017 18 For the years of assessment 2018 19 to 2020 21 the final Profits Tax will be reduced by 100 subject to the ceiling of 20 000 Web Tax Reduction Annual Income Levels at Which Salaries Tax Payers Approach the Standard Rate Zone Including Two Dependent Parents or Grandparents Aged 60 or Above Including Two Dependent Parents or Grandparents Both Aged 60

Download How To Reduce Tax In Hong Kong

More picture related to How To Reduce Tax In Hong Kong

Your Complete Guide To Hong Kong Tax

https://www.cwhkcpa.com/wp-content/uploads/2023/02/Profits-Tax-Rates-Table-1024x1024.png

Currenxie An Easy Guide To Understanding Hong Kong s Tax System

https://www.currenxie.com/static/1a48c355297dd9ba2e385840d3cf1a9d/20435/tax1.png

Tax Planning Compliance Corporate Hub Hong Kong

http://corporatehub.hk/wp-content/uploads/2015/06/hong-kong-revenue-tower.jpg

Web Vor 3 Tagen nbsp 0183 32 Hong Kong may take a year or two longer than expected to return to a budget surplus according to the finance chief who attributed the delay to a sluggish city economy and reduced land Web 11 Okt 2022 nbsp 0183 32 1 What Items are Regarded as Taxable Income for Hong Kong Startups and SMEs 2 What is the Tax Rate for Startups and SMEs in Hong Kong 3 What are the Tax Benefits for startups and SME Owners 4 How to Reduce your Business Taxable Income 5 What are the Tax Deductible and Non Tax Deductible Expenses 6

Web Vor 2 Tagen nbsp 0183 32 Joby Aviation Inc NYSE JOBY a company developing electric air taxis for commercial passenger service today announced it has signed a definitive Web 24 Juli 2020 nbsp 0183 32 Hong Kong is of course a magnet for international investment with among other things its low and simple tax structures This simplicity of taxation also extends to individuals with personal tax rates starting as low as 2 percent and capping out at 17 Add to that no capital gains tax no tax on overseas income and no tax on

How To Reduce Your Tax Bill Help Your Business Pay Less In Taxes

https://www.patriotsoftware.com/wp-content/uploads/2023/01/how-to-reduce-tax-bill-1024x576.jpg

Certificate Of Tax Resident Status HKWJ Tax Law

https://www.hkwj-taxlaw.hk/wp-content/uploads/2020/01/Untitled-design-42.png

https://company-hongkong.com/business-in-hong-kong-find-out-ho…

Web 22 Feb 2023 nbsp 0183 32 This article provides an overview of the obligations taxable earnings on established companies tax allowances and various exemptions your business can benefit from if you start your business in Hong Kong

https://www.expat.hsbc.com/expat-explorer/expat-guides/hong-kon…

Web 1 Apr 2022 nbsp 0183 32 Salaries tax Levied on net chargeable income assessable income less personal deductions and allowances at progressive rates ranging from 2 to 17 or at a flat rate maximum rate of 15 on assessable income less personal deductions whichever calculation produces the lower tax liability

HongKong Tax Notes YouTube

How To Reduce Your Tax Bill Help Your Business Pay Less In Taxes

Corporate Tax Rate Benefits In Hong Kong Get Started HK

Withholding Tax In Hong Kong YouTube

6 Strategies To Reduce Taxable Income For High Earners

Share Option Award Gains Tax In Hong Kong HKWJ Tax Law

Share Option Award Gains Tax In Hong Kong HKWJ Tax Law

A Complete Guide To Hong Kong Profit Tax

Charities And Tax Exemption S88 In Hong Kong Foundation For Shared

Hong Kong Tax Haven What Can Be Revealed

How To Reduce Tax In Hong Kong - Web GovHK Can Personal Assessment Reduce Your Tax Liability Feature article by the Hong Kong Government about deductions and allowances under personal assessment and whether or not it will be advantageous to elect personal assessment if you own a business or receive rental income Skip to main content MyGovHK LoginRegister Text Size