How To Save Tax In Hong Kong After a year of hard work you may wish to reduce the tax payment amount as much as possible The HKSAR Government introduced 3 tax deductions in the year of

Personal Income Tax Planning in Hong Kong Start with an estimation of your taxable income for the year know your effective tax rate and plan for your tax payable for the year The purpose of this guide is The calculations of this tax savings calculator are based on the information provided by the Inland Revenue Department of the Hong Kong Special Administrative Region IRD for

How To Save Tax In Hong Kong

How To Save Tax In Hong Kong

https://hksar.org/images/20/02/v-2evmrbnrnzm.jpg

20 Easy Ways To Save Income Tax In 2023

https://images.ctfassets.net/uwf0n1j71a7j/6aXcWvn1di8jboAaKr1b47/502202cb634cb6ee8e369f16ea79c7e5/easy-ways-to-save-income-tax.png

Hong Kong Income Tax For Non local Employees Jenny

https://user-images.githubusercontent.com/30020736/132364098-cd6eab2b-baca-410e-918b-84482b44d41f.jpeg

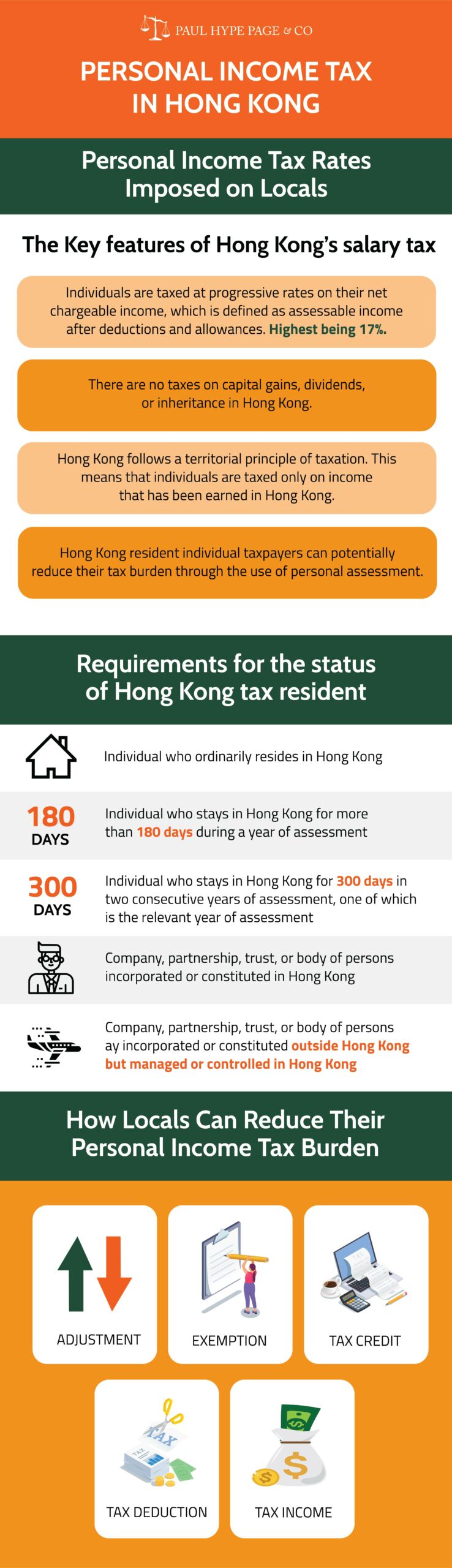

The one off tax reduction The tax reduction for the year of assessment 2022 23 is not applicable to property tax Individuals earning rental income if eligible may elect for Salaries tax Levied on net chargeable income assessable income less personal deductions and allowances at progressive rates ranging from 2 to

Individual Taxes on personal income Last reviewed 29 December 2023 Hong Kong SAR does not impose income tax based on an individual s total income Paying overseas taxes Save money when you send money with CurrencyFair s low margin FX rates Expats make up roughly 10 of Hong Kong s 7 5

Download How To Save Tax In Hong Kong

More picture related to How To Save Tax In Hong Kong

Hong Kong Guide Withholding Tax In Hong Kong Asia Briefing Country

https://www.asiabriefing.com/userfiles/country-guides/topics_images/withholding-tax-in-hong-kong.jpg

Tips For Freelancers To Save Tax In The UK 123Financials

https://www.123financials.com/insights/wp-content/uploads/2020/09/save-tax-tips.png

The Second 66 1 Bn Stimulus Package What You Need To Know Advisory Corp

https://www.advisorycorp.com.au/wp-content/uploads/2020/03/Copy-of-How-to-save-Tax-2-1.png

TAXATION IN HONG KONG The Inland Revenue Ordinance Chapter 112 IRO provides for the levying of three separate direct taxes for a year of assessment which ends on 31 Hang Seng offers products eligible for tax savings QDAP VHIS and TVC helping you achieve financial goals and satisfy your protection needs with potential tax deductions

This means that individuals earning income from a Hong Kong office Hong Kong employment or services rendered in Hong Kong for more than 60 days in any PPS Pay your tax bill through the PPS hotline at 18031 online or PPS on Mobile The merchant code for IRD is 10 ATM Pay at any ATM with the Bill Payment signage or

Hong Kong Personal Income Tax Hong Kong Tax

https://www.paulhypepage.co.id/wp-content/uploads/2020/04/Personal-Income-Tax-in-Hong-Kong.png

How To Save Income Tax In India TheFinFact

https://www.thefinfact.com/wp-content/uploads/2020/10/tax-saving.png

https://www.hangseng.com/en-hk/moments/building-wealth/save-tax

After a year of hard work you may wish to reduce the tax payment amount as much as possible The HKSAR Government introduced 3 tax deductions in the year of

https://www.3ecpa.com.hk/resources/hong-k…

Personal Income Tax Planning in Hong Kong Start with an estimation of your taxable income for the year know your effective tax rate and plan for your tax payable for the year The purpose of this guide is

FBR Online Tax Return FAQs Your Right Decision Blog

Hong Kong Personal Income Tax Hong Kong Tax

8 Exclusive Ways To Save Tax In India Legodesk

Tax Avoidance In Hong Kong

Hong Kong Personal Income Tax Hong Kong Tax

Profits Tax In Hong Kong Complete Guide Startupr Startupr hk

Profits Tax In Hong Kong Complete Guide Startupr Startupr hk

/GettyImages-153205900-5b08cb708e1b6e003ed4e7d6.jpg)

Understanding Hong Kong Tax And How It Works

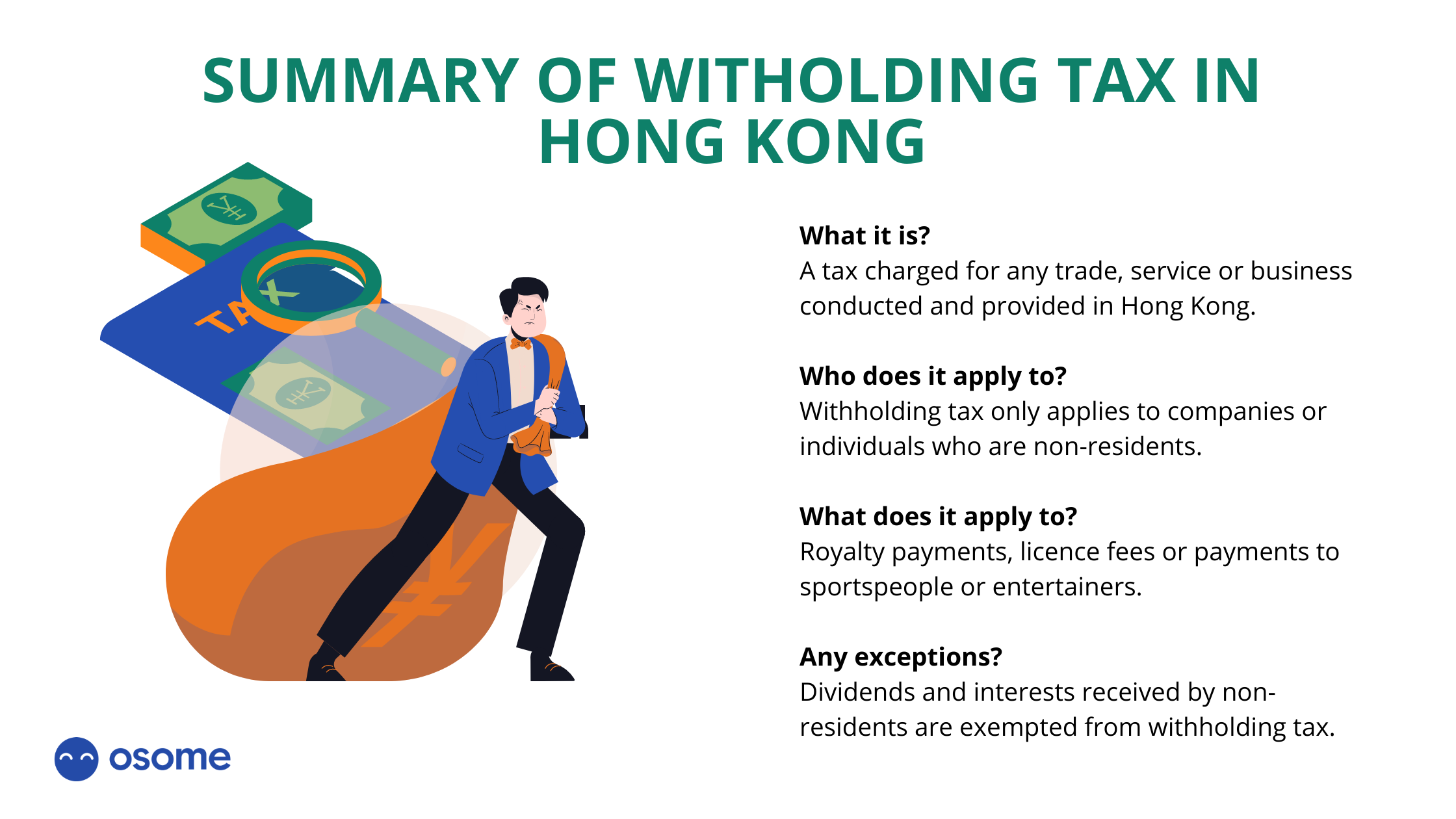

All You Need To Know About Withholding Tax In Hong Kong

How To Save Income Tax In India 6 Tax Saving Options FinCalC Blog

How To Save Tax In Hong Kong - Noble Group a big Asian commodities trader is teetering A new code aims to clean up the foreign exchange market How becoming a Hong Kong pensioner can