How To Show Medical Expenses In Itr Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if

Medical Reimbursement allows tax exemption of up to Rs 15 000 on expenses incurred by the employee Conditions and process for claiming 80D Tax Benefits How to Fill Schedule 80d in ITR Health Insurance and Preventive Checkup 80D Ft WealthDekho 80d tax benefits preventive health checkup

How To Show Medical Expenses In Itr

How To Show Medical Expenses In Itr

http://www.reluctantlandlord.net/wp-content/uploads/2015/05/Medical-Expenses1.jpg

Claim Medical Expenses On Your Taxes Health For CA

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

EXCEL Of Staff Medical Expenses Table xls WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20191105/82fb0fcf9b354e3cafac7a757a2b0c47.jpg

The food coupons and internet expenses reimbursement are included in my salary in Form 16 under section 17 1 While filling in the ITR form should we deduct the Under Section 80DDB the maximum deduction is Rs 1 lakh per dependent Explore Section 80D of the Income Tax Act to understand deductions available for medical and health insurance premiums Learn

Section 80DDB of Income Tax Act Deductions Under Section 80DDB can be claimed with respect to the expenses incurred in medical expenses Know more on 12 November 2013 at 11 27 You would need to open that return and click on the medical expenses question on the wizard a form will open up for you to enter the correct

Download How To Show Medical Expenses In Itr

More picture related to How To Show Medical Expenses In Itr

All You Need To Know About Claiming Medical Expenses On Your Personal

https://www.dmtax.ca/wp-content/uploads/2022/12/medical-expenses.jpg

How To Get The Most Out Of Your Medical Expenses Elite Tax

http://elitetax.ca/wp-content/uploads/2016/12/AdobeStock_117273938.jpeg

List Of Daily Expenses JsOlfe

https://db-excel.com/wp-content/uploads/2018/11/monthly-budget-list-for-bills-template-business-expenses-to-business-expense-list-template.jpg

Filling out the ITR V Income Tax Return Verification Form Where the Return Form is furnished in the manner mentioned at 3 iv the assessee should print out Form How do I show medical reimbursement in ITR Medical Reimbursement is tax free perquisites under Section 17 2 till INR 15000 However the employee can

Medical insurance paid to an insurance company is allowed under section 80D While medical allowance received from the employer is exempted up to Rs In this video we guide you through the process of claiming medical expenses in your Income Tax Return ITR filing Learn about the eligible deductions req

All And Everything About Bodily Injury Liability Insurance Your Guide

https://healthnewsreporting.com/wp-content/uploads/2018/12/Medical-expenses.jpeg

EXCEL Of Daily Expenses Report xls WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20190830/cfb8a944d48f426c8ee793f48130f526.jpg

https://economictimes.indiatimes.com/wealth/tax/...

Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if

https://cleartax.in/s/income-tax-benefit-employee...

Medical Reimbursement allows tax exemption of up to Rs 15 000 on expenses incurred by the employee Conditions and process for claiming

How To Categorize Business Expenses In My Home Budget The Mumpreneur

All And Everything About Bodily Injury Liability Insurance Your Guide

What Does Maryland s Updated Law On Extraordinary Medical Expenses

Medical Bill Invoice Template Excel PDF Word XLStemplates

3 Metrics That Are Closely Related To Your Chart Of Accounts

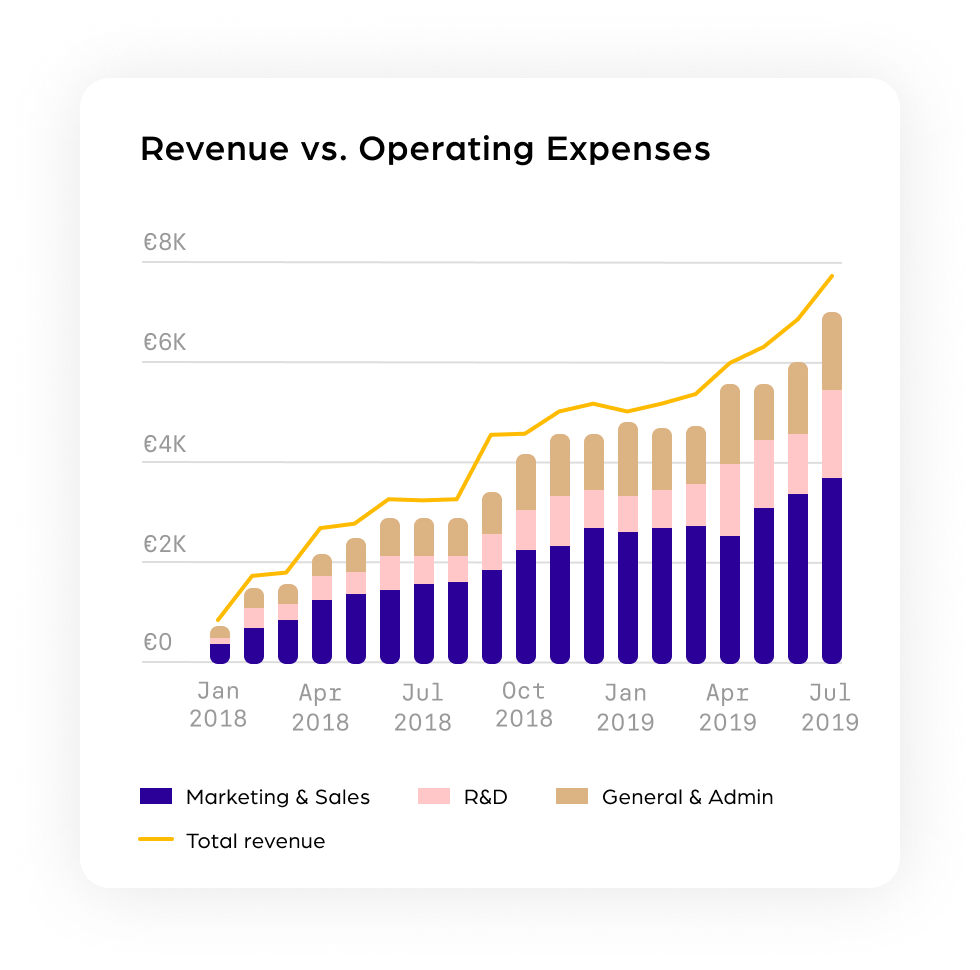

Operating Expenses OpEx Formula And Calculator

Operating Expenses OpEx Formula And Calculator

Medical expenses embed Mighty Casey Media Comedy Health Analyst

What Are Expenses Its Types And Examples Tutor s Tips

List Of Daily Expenses JsOlfe

How To Show Medical Expenses In Itr - Section 80DDB of Income Tax Act Deductions Under Section 80DDB can be claimed with respect to the expenses incurred in medical expenses Know more on