Hra Deduction Rules HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance the allowance will be fully taxable HRA tax exemption rules The HRA tax exemption reduces the total salary before calculating taxable income helping employees save on taxes It s important to note that if an employee lives in their own house or does not pay any rent the HRA received from the employer is fully taxable

Hra Deduction Rules

Hra Deduction Rules

http://im.rediff.com/getahead/2011/jun/21table3.gif

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

https://assets-news.housing.com/news/wp-content/uploads/2021/03/15192811/All-you-need-to-know-about-HRA-exemptions-792x400.jpg

CA Sumit Jain House Rent Allowance HRA Calculation Exemption

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEioI03OTdkdbScKwVOOo5_ZZvUTdtvWPFM204YxDyL8u0E7recSr_b3n2ixcTFszYyKmW2UV6oFCU7U3f3iqdzs-s7KdkxYQqKam1JtHguYuEVAU6PNl8y-y1v0zx46I6nOXD9o3s7KTpglmm3kMI7xYUOgK3wLBRw6ImnGQGXa5xkJuB0_c897IaBpRg/s696/hra-tax-exemption-calculate-in-hindi-696x392.jpg

Salaried individuals who live in a rented house can claim House Rent Allowance or HRA to lower taxes This can be partially or completely exempt from taxes The allowance is for expenses related to rented accommodation If you don t live in a rented accommodation this allowance is fully taxable Do you know you can claim an exemption for your house rent allowance Read Tax2win s guide to know who can claim HRA exemptions conditions limits process to claim deduction for House rent allowance

What is House Rent Allowance HRA House Rent Allowance HRA is paid by an employer to employees as a part of their salary to meet the accommodation expenses Salaried individuals who live in rental premises can claim exemption of House Rent Allowance u s 10 13A Know the HRA Exemption Rules how to calculate HRA on your salary Check out the eligibility criteria understand how HRA helps you to utilise Section 80C

Download Hra Deduction Rules

More picture related to Hra Deduction Rules

House Rent Allowance

https://i1.wp.com/www.hrknowledgecorner.com/wp-content/uploads/2017/04/HRA-1-1.jpg?fit=1233%2C536

PF Deduction Rules 2020 YouTube

https://i.ytimg.com/vi/Dk7-bLPBraw/maxresdefault.jpg

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

Calculate your HRA Exemption with Tax2win s House Rent Allowance HRA Calculator easily and maximize your tax benefits Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961 Amount of HRA tax exemption is deductible from the total salary income before arriving at a gross taxable

HRA full form stands for House Rent Allowance HRA It is a component of most workers pay packages It is one of the crucial salary components for which deductions are fully partially taxable under Section 10 13A of the Income Tax Act Let s understand more about the HRA component here HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a house You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable

Salaried Person Here s All You Need To Know About HRA Tax Deduction

https://akm-img-a-in.tosshub.com/sites/btmt/images/stories/Newstaffpics/mt-24n25_2_071217100028.jpg

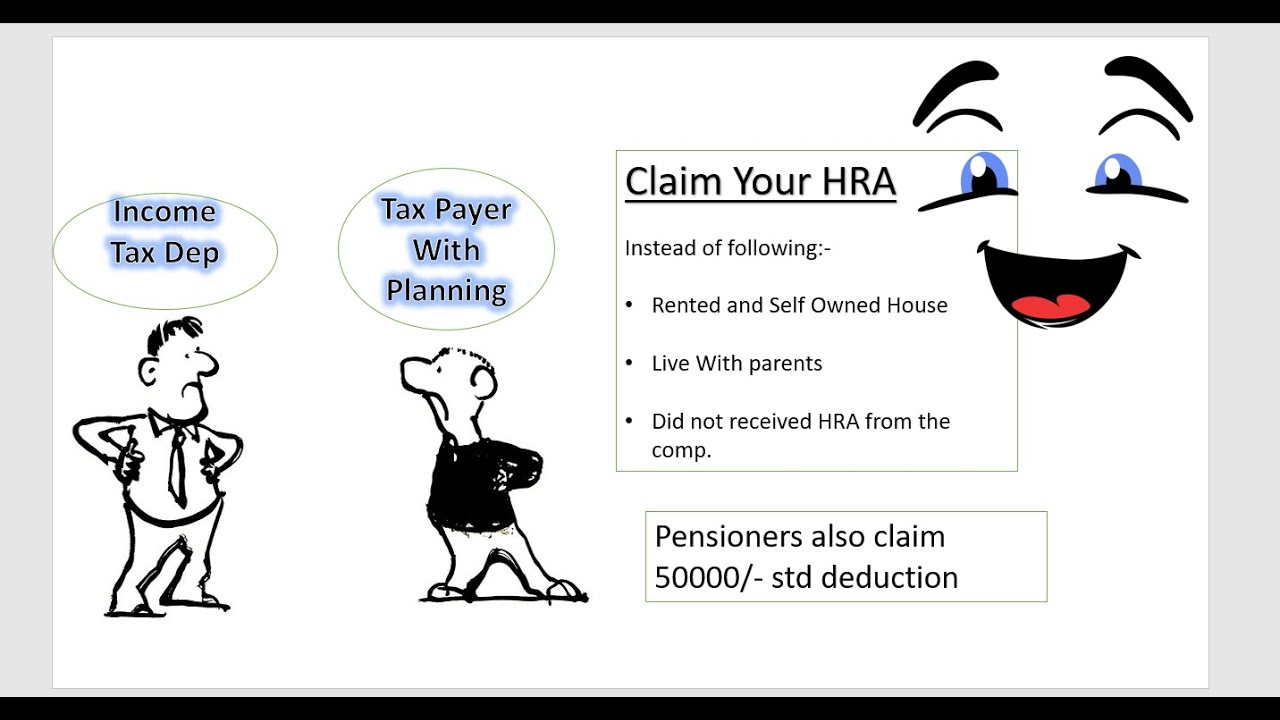

HRA Deductions In Different Situations YouTube

https://i.ytimg.com/vi/FaUzZsMS8Vs/maxresdefault.jpg

https://taxguru.in/income-tax/house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

https://cleartax.in/paytax/hracalculator

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance the allowance will be fully taxable

How To Show HRA Not Accounted By The Employer In ITR

Salaried Person Here s All You Need To Know About HRA Tax Deduction

HRA House Rent Allowances Claim HRA Benefits Without Landlord s PAN

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

HRA House Rent Allowance Exemption Rules Tax Deductions

Budget 2016 Govt Raises HRA Deduction Limit Times Of India

Budget 2016 Govt Raises HRA Deduction Limit Times Of India

House Rent Allowance HRA Receipt Format For Income Tax Teacher

HRA Or House Rent Allowance Deduction Calculation

HRA Exemption Calculator In Excel House Rent Allowance Calculation

Hra Deduction Rules - Know the HRA Exemption Rules how to calculate HRA on your salary Check out the eligibility criteria understand how HRA helps you to utilise Section 80C