Hra Exemption Rules 10 13a A deduction is permissible under Section 10 13A of the Income Tax Act in accordance with Rule 2A of the Income Tax Rules You can claim exemption on your HRA

House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the Therefore the amount exempted u s 10 13A shall be Rs 1 56 000 and taxable income will be the balance amount of Rs 12 000 i e total HRA exempted HRA 1 68 000 1 56 000 Tax2win s HRA calculator can be

Hra Exemption Rules 10 13a

Hra Exemption Rules 10 13a

https://i0.wp.com/taxationplanning.net/wp-content/uploads/2023/06/Read-These-Rules-Before-Claiming-HRA-Exemption.jpg

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

HRA Exemption Rules How To Save Tax On House Rent Allowance

https://img.etimg.com/thumb/msid-93791760,width-1070,height-580,imgsize-382255,overlay-etwealth/photo.jpg

Section 10 13A of the Act grants exemption in respect of any house rent allowance received by an employee from his employer subject to the satisfaction of certain A portion of HRA is excluded from taxation under Section 10 13A of the Income Tax Act of 1961 subject to some provisions Until calculating taxable income the sum of HRA exemption is

Subject to specific conditions a portion of the HRA is exempted from taxation under Section 10 13A of the Income tax Act 1961 The amount of HRA tax exemption is deducted from the total salary before calculating the Under Section 10 13A of the Income Tax Act an employee can claim an exemption on the HRA received from their employer subject to certain conditions The exemption is calculated based on the least of the following

Download Hra Exemption Rules 10 13a

More picture related to Hra Exemption Rules 10 13a

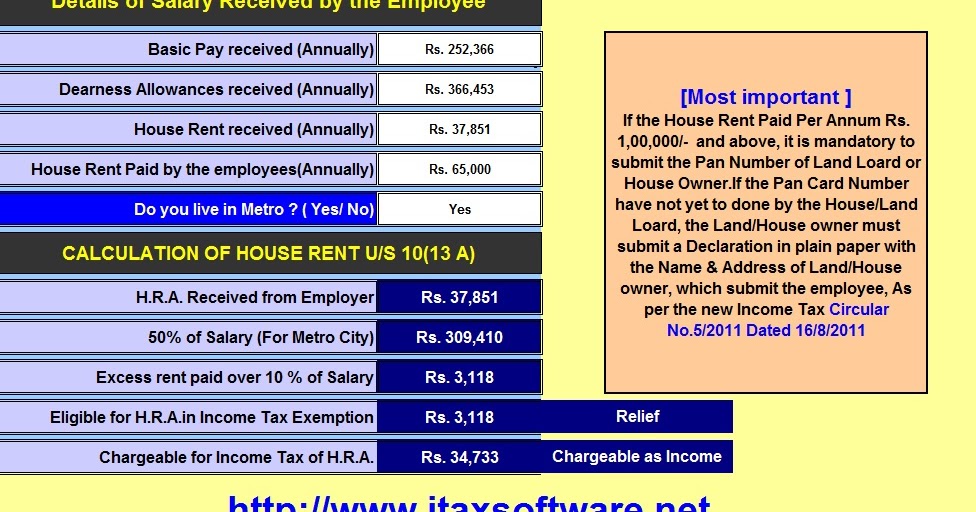

Download Automated H R A Calculator U s 10 13A With How To Calculate

https://3.bp.blogspot.com/-L79Odg1Uk6k/W7bAAIQwkGI/AAAAAAAAHn0/GJhZGuVqiu4roqQI0JNYTgfCogCHYJyHACLcBGAs/w1200-h630-p-k-no-nu/HRA%2BCalculator.jpg

Be Aware Before Submit Fake Rent Receipts At Your Office To Claim HRA

https://4.bp.blogspot.com/-8OthH2RBWqQ/WfQj6x_bZfI/AAAAAAAAFsk/eAYaok4XSiU0MbR5qoPDsyV-hFlHryTfACLcBGAs/s1600/HRA%2BRENT%2BRECEIPT.jpg

How HRA Exemption Is Calculated Excel Examples FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/03/hra-exemption-calculation-house-rent-allowance-excel-examples-video.webp

Section 10 13A rule number 2A specifically allows them to claim exemptions for House Rent Allowance How to claim an HRA exemption Follow these steps to claim HRA exemption in HRA exemption is covered u s 10 13A HRA granted to employee is exempted to the extent of least of the following HRA received from the employer Rent paid 10 of

HRA House Rent Allowance u s 10 13A exemption works only for scenario 2 Getting House Rent Allowance from your employer but you are living in a rented house If Understand the calculation of House Rent Allowance HRA exemption under section 10 13A of the Income Tax Act 1961 Learn the conditions maximum deduction limits

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

How To Save Tax On House Rent Section 10 13A HRA Exemption Tax

https://i.ytimg.com/vi/6iS4eeK_PUk/maxresdefault.jpg

https://taxguru.in › income-tax

A deduction is permissible under Section 10 13A of the Income Tax Act in accordance with Rule 2A of the Income Tax Rules You can claim exemption on your HRA

https://taxadda.com

House Rent Allowance HRA is an allowance paid by an employer to its employees for covering their house rent Such allowance is taxable in the hand of the

How To Calculate HRA With Example HRA Exemption Under Section 10 13A

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Error Exemption Of HRA U s 10 13a Shall Not Be More Than Minimum Of

Income Tax Savings HRA

House Rent Allowance Tax Deductions How To Claim HRA In ITR

HRA Exemption Calculator For Salaried Employees FinCalC Blog

HRA Exemption Calculator For Salaried Employees FinCalC Blog

HRA House Rent Allowance Exemption Rules Tax Deductions

Hra Calculation In Income Tax House Rent Allowance Calculator Hot Sex

House Rent Allowance HRA Calculation Exemption Rules Allowance

Hra Exemption Rules 10 13a - According to rule number 2A of Section 10 13A of the Income Tax Act salaried individuals have the opportunity to avail exemptions for their House Rent Allowance HRA