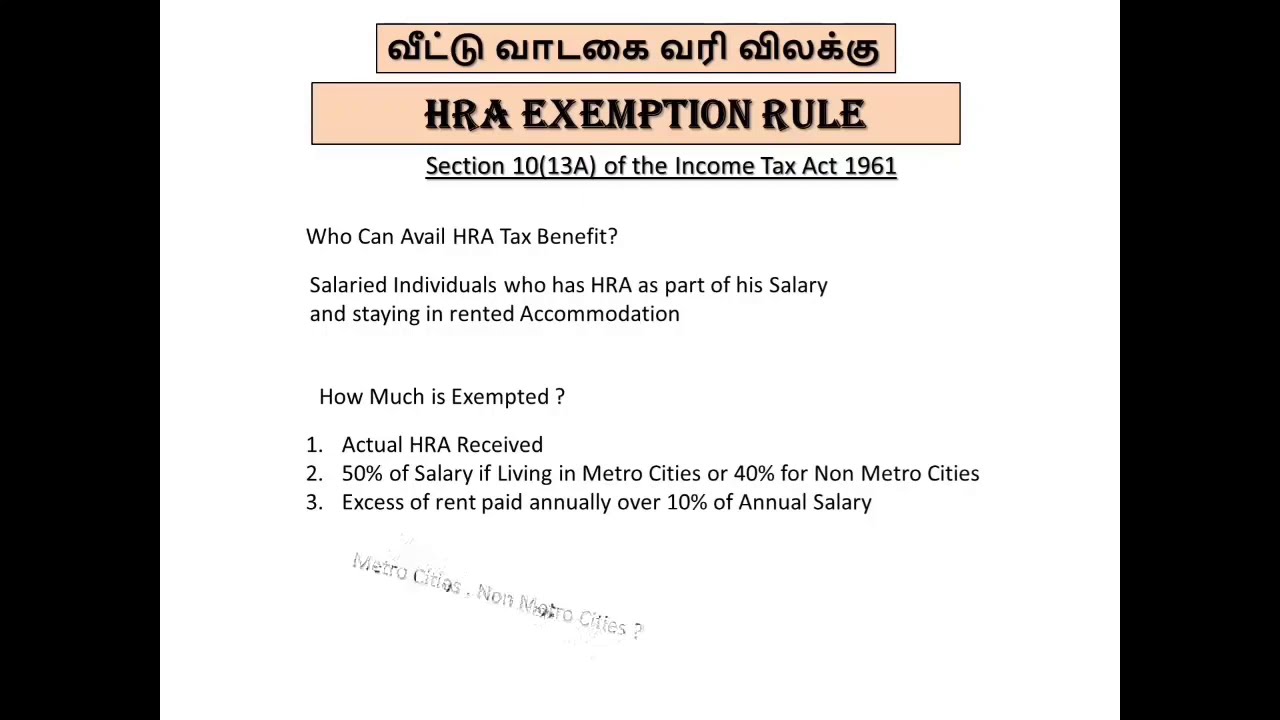

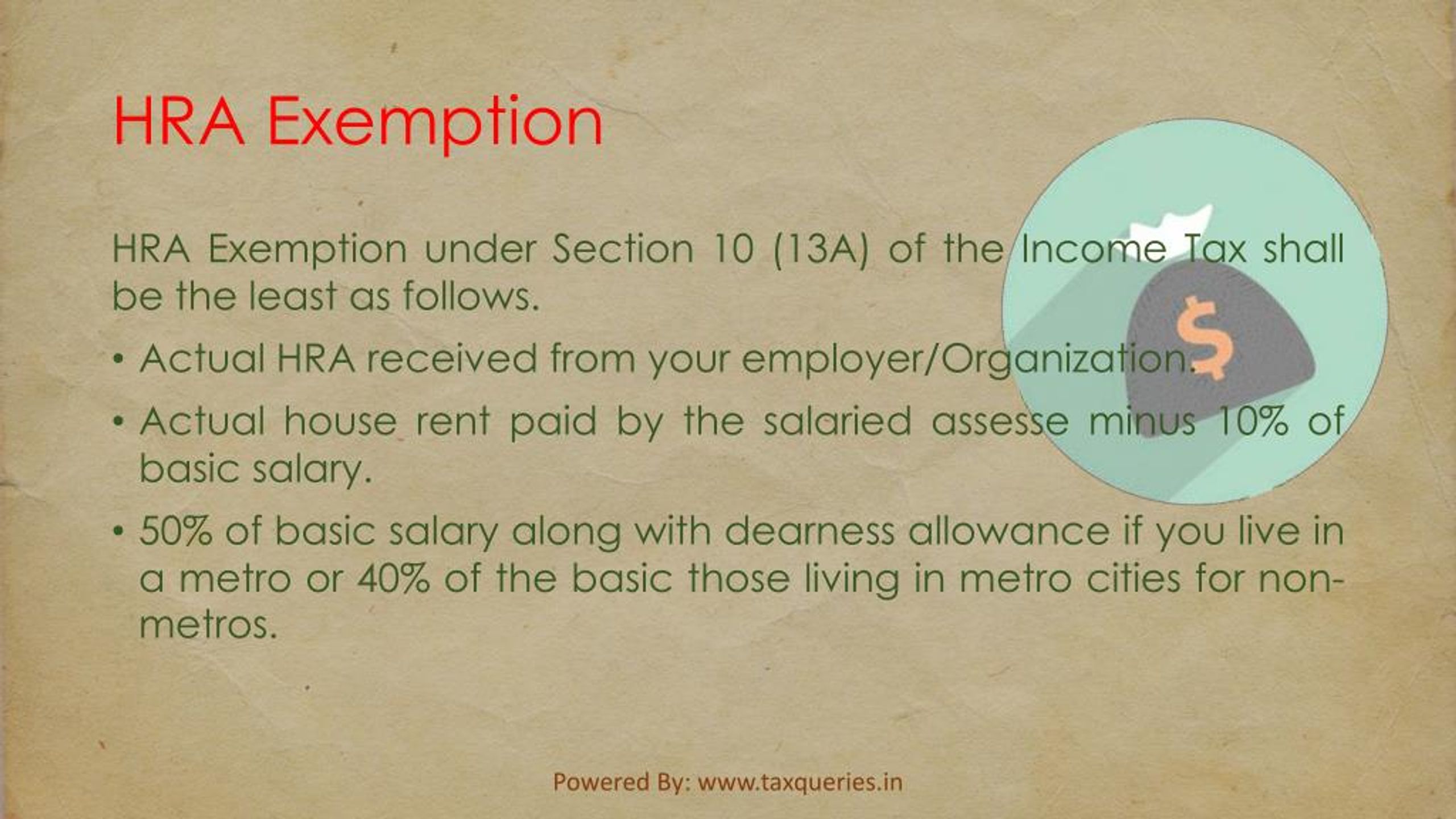

Hra Exemption Rules HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

Learn about House Rent Allowance in detail including what is HRA Tax Exemptions and benefits of availing HRA Also know How to Calculate and Claim HRA Do you know you can claim an exemption for your house rent allowance HRA is an allowance and is subject to income tax An employee can claim exemption on his House Rent Allowance HRA under the Income Tax Act if he stays in a rented house and is in receipt of HRA from his employer In order to claim the deduction an employee must actually pay rent for the house which he occupies

Hra Exemption Rules

Hra Exemption Rules

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-696x541.png

How To Get MORE Out Of Your HRA Rediff Getahead

http://im.rediff.com/getahead/2011/jun/21table2b.gif

House Rent Allowance HRA Exemption Rule YouTube

https://i.ytimg.com/vi/Wsog_GiBp0Q/maxresdefault.jpg

Learn about House Rent Allowance HRA exemptions and how they affect tax savings Understand the rules calculations and potential benefits for salaried employees HRA tax exemption rules offer benefits under specific conditions in the Income tax Act 1961 It provides tax saving opportunities for employees living in rented accommodation under the old tax regime subject to defined calculation factors

Those working in public sector companies get an HRA exemption based on the minimum or maximum HRA in different cities according to the recommendations of the 7th Pay Commission If you fail to submit rent receipts to your employer the employer will not factor in the HRA exemption and will deduct tax from the entire HRA amount Salaried individuals are eligible to claim exemptions for HRA under Section 10 13A rule number 2A of the Income Tax Act Self employed individuals are not eligible to claim HRA under the rules of the Income Tax Act However they are eligible to receive tax deductions under Section 80GG for rental housing

Download Hra Exemption Rules

More picture related to Hra Exemption Rules

HRA Exemption Rules V Secure Investments

https://vsecureinvestments.files.wordpress.com/2023/03/for-anand-1.jpeg?w=1200

HRA Exemption Rules

https://hindi.economictimes.com/thumb/msid-100802172,imgsize-1134391,width-700,height-525,resizemode-75/hra-exemption-rules-100802172.jpg

Salaried Person Here s All You Need To Know About HRA Tax Deduction

https://akm-img-a-in.tosshub.com/sites/btmt/images/stories/Newstaffpics/mt-24n25_2_071217100028.jpg

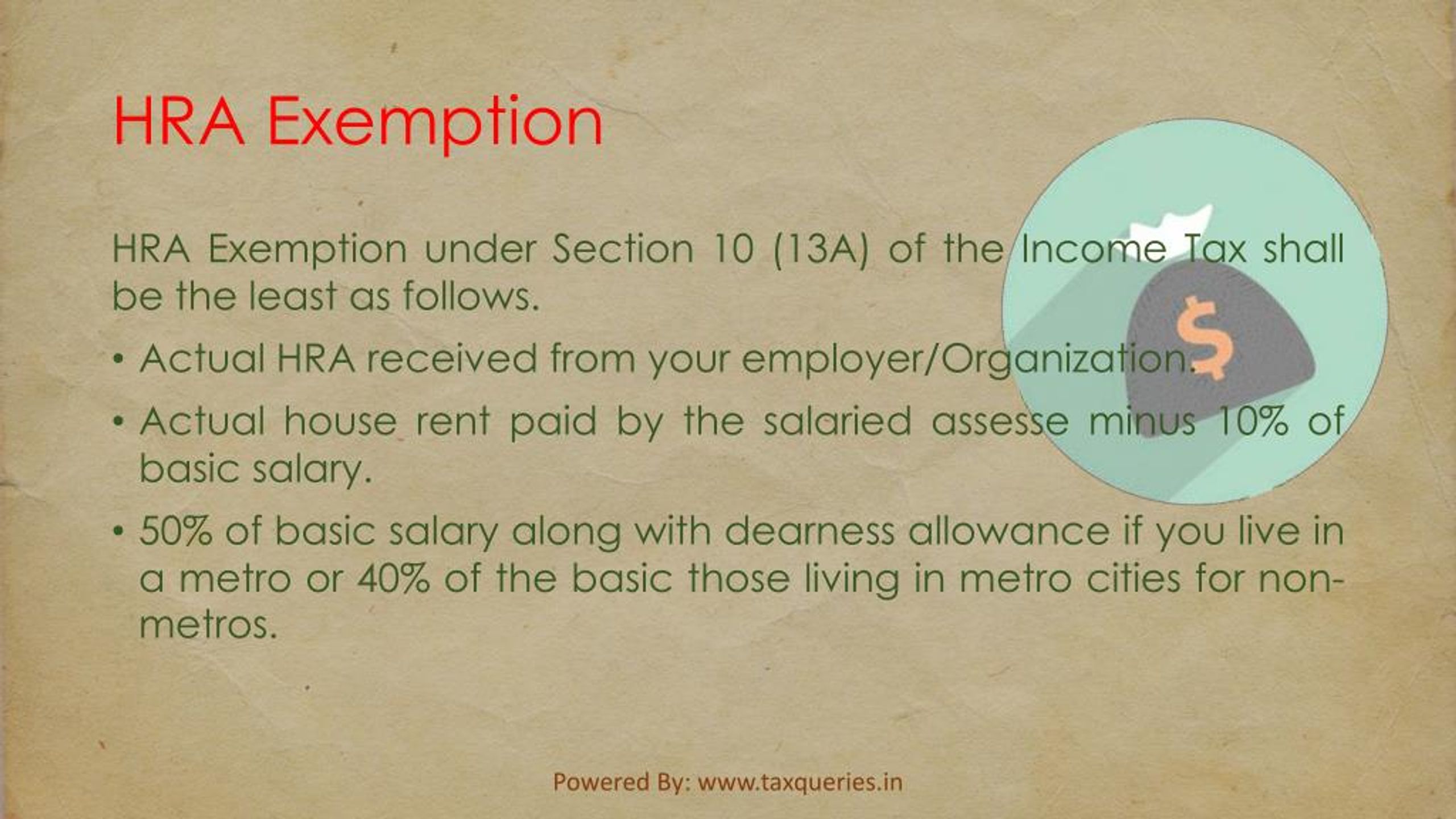

According to Section 10 13A rule number 2A of the Income Tax Act salaried individuals can claim exemptions for HRA How to Claim HRA Exemption For an individual to claim HRA exemption he she must meet the below listed conditions Live in rented housing Receive HRA as part of the CTC Cost To Company How Much Amount Can You Claim For HRA Exemption You can claim HRA exemption that is the minimum of Actual HRA received by your employer or Annual rent paid minus 10 of your salary or 50 of your salary if you live in a metro city i e Delhi Kolkata Mumbai and Chennai while 40 is for non metro cities The remaining amount of HRA will

[desc-10] [desc-11]

PPT HRA Exemption PowerPoint Presentation Free Download ID 7517998

https://image4.slideserve.com/7517998/hra-exemption1-l.jpg

House Rent Allowance HRA Exemption Rules Tax Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/House-Rent-Allowance.png

https://taxguru.in › income-tax › house-rent-allowance-hra-exemption...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

https://tax2win.in › guide › hra-house-rent-allowance

Learn about House Rent Allowance in detail including what is HRA Tax Exemptions and benefits of availing HRA Also know How to Calculate and Claim HRA Do you know you can claim an exemption for your house rent allowance

HRA Exemption Rules How To Save Tax On House Rent Allowance

PPT HRA Exemption PowerPoint Presentation Free Download ID 7517998

House Rent Allowance HRA Exemption Rules And Benefits YouTube

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

House Rent Allowance 101 HRA Exemption Rules Calculations 2018

House Rent Allowance HRA Calculation Exemption Rules

House Rent Allowance HRA Calculation Exemption Rules

HRA Exemption Rules HRA Will Get So Much Exemption In Income Tax You

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

House Rent Allowance HRA Exemption Rules With Detailed Analysis Tax

Hra Exemption Rules - Salaried individuals are eligible to claim exemptions for HRA under Section 10 13A rule number 2A of the Income Tax Act Self employed individuals are not eligible to claim HRA under the rules of the Income Tax Act However they are eligible to receive tax deductions under Section 80GG for rental housing