Hra Exemption In Income Tax Under Section However if you live in a rented accommodation you can claim a tax exemption either partially or wholly under Section 10 13A of the Income Tax Act This is popularly known as HRA exemption If you don t live in a rented accommodation this allowance is fully taxable

Subject to specific conditions a portion of the HRA is exempted from taxation under Section 10 13A of the Income tax Act 1961 The amount of HRA tax exemption is deducted from the total salary before calculating the What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section 80GG towards rent that you pay Learn more

Hra Exemption In Income Tax Under Section

Hra Exemption In Income Tax Under Section

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

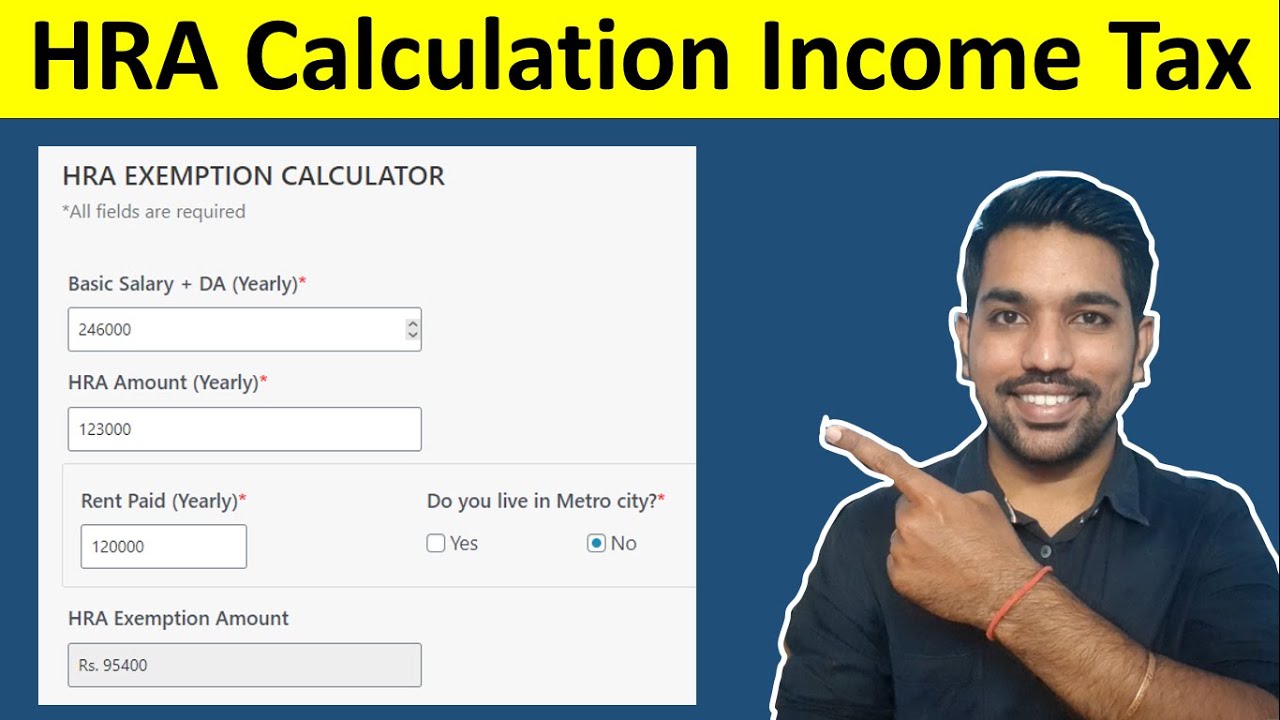

HRA Calculation Formula On Salary Change How HRA Exemption Is

https://i.ytimg.com/vi/O-wluM-mvG8/maxresdefault.jpg

HRA Calculation In Income Tax House Rent Allowance Calculator

https://i.ytimg.com/vi/J5KugtFfmJw/maxresdefault.jpg

Under Section 10 13A of the Income Tax Act the following types of expenses are covered under House Rent Allowance HRA for exemption from income tax Rent paid The actual rent paid by the taxpayer for Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals and self employed persons

According to Section 10 13A of the Income Tax Act 1961 salaried individuals in India can claim an exemption on their House Rent Allowance HRA This exemption is calculated by taking the Is House Rent Allowance deductible under section 80C No HRA is an allowance and is exempt from Salary Income u s 10 13A of the Income Tax Act

Download Hra Exemption In Income Tax Under Section

More picture related to Hra Exemption In Income Tax Under Section

HRA Exemption Calculator EXCEL House Rent Allowance Calculation To

https://i.ytimg.com/vi/J04no0lpYJA/maxresdefault.jpg

HRA Exemption In Income Tax Section 80GG Section 10 13A YouTube

https://i.ytimg.com/vi/wm3sYQlFzMk/maxresdefault.jpg

HRA Exemption In Income Tax 2023 Guide InstaFiling

https://instafiling.com/wp-content/uploads/2023/01/HRA-Exemption-In-Income-Tax-1080x675.png

You can claim exemption on your HRA under the Income Tax Act if you stay in a rented house and get a HRA from your employer The HRA deduction is based on salary HRA received the actual rent paid and place of residence A portion of HRA is excluded from taxation under Section 10 13A of the Income Tax Act of 1961 subject to some provisions Until calculating taxable income the sum of HRA exemption is deducted from the overall income which allows an individual to

Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961 Amount of HRA tax exemption is deductible from the total salary income before arriving at a gross taxable HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting a house You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

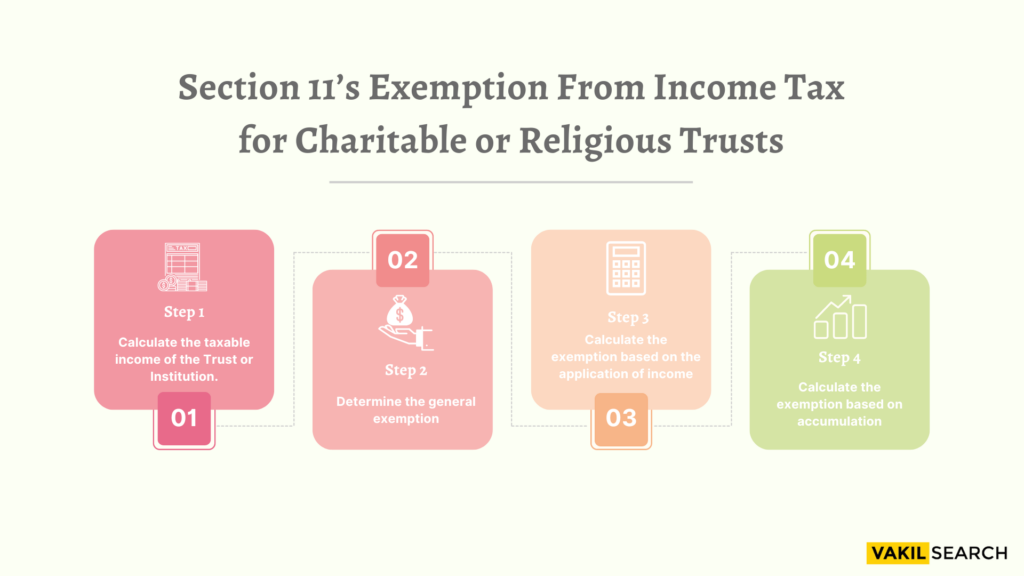

Section 11 Income Tax Act Exemptions For Charitable Trusts

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/08/SECTION-11S-INCOME-TAX-EXEMPTION-1024x576.png

https://cleartax.in/s/hra-house-rent-allowance

However if you live in a rented accommodation you can claim a tax exemption either partially or wholly under Section 10 13A of the Income Tax Act This is popularly known as HRA exemption If you don t live in a rented accommodation this allowance is fully taxable

https://economictimes.indiatimes.com/wealth/tax/...

Subject to specific conditions a portion of the HRA is exempted from taxation under Section 10 13A of the Income tax Act 1961 The amount of HRA tax exemption is deducted from the total salary before calculating the

What Is House Rent Allowance HRA Exemptions Calculation Tax2win

HRA Exemption Calculator In Excel House Rent Allowance Calculation

House Rent Receipt Format PDF Download

HRA Exemption Calculator For Income Tax Benefits Calculation And

Income Tax Savings HRA

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

ITR Filing 2023 How To Claim Exemption On HRA In Tax Return

Income Exempted U s 10 Lecture Notes INCOME EXEMPTED FROM TAX U S

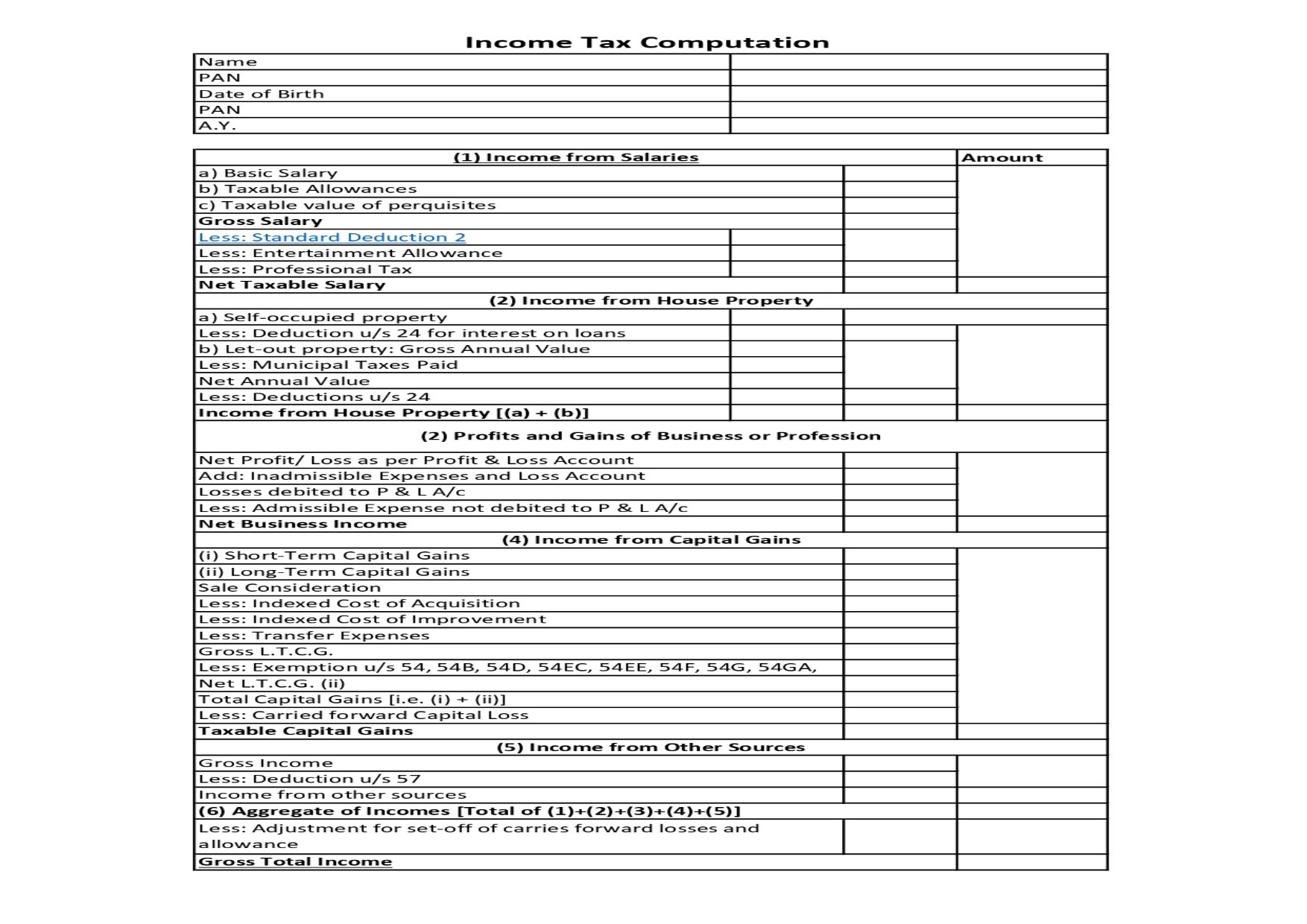

Income Tax Computation Format PDF A Comprehensive Guide

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

Hra Exemption In Income Tax Under Section - Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals and self employed persons