Iceland Tax Rate Tax assessment 2023 ISK 20 200 2 057 211 Tax assessment 2022 ISK 18 800 1 938 025 Tax assessment 2021 ISK 18 300 1 870 828 Tax assessment 2020 ISK 17 900 1 833 671 Tax assessment 2019 ISK 17 500 1 750 783 Tax assessment 2018 ISK 17 100 1 718 678 Tax assessment 2017 ISK 16 800 1 678 001 Tax

Tax rates and figures for the income year 2024 have been updated for the new year See the latest key figures amounts and percentages for the 2024 Key rates and amounts English Individuals Tax issues General tax information Tax liability Taxable income Allowances deductions and credits Non resident Limited tax liability All persons who are taxable in Iceland and have income above the tax free threshold pay taxes on their wages which go to the national common fund Tax on personal wages The tax free threshold takes account of the personal tax credit and the withholding rate which is the threshold used before tax is paid on the wages

Iceland Tax Rate

Iceland Tax Rate

https://img.take-profit.org/graphs/indicators/corporate-tax-rate/corporate-tax-rate-iceland.png

The Iceland Tax System Key Features And Lessons For Policy Makers

http://freedomandprosperity.org/wp-content/uploads/2010/11/fig7b-600x409.gif

The Iceland Tax System Key Features And Lessons For Policy Makers

http://freedomandprosperity.org/wp-content/uploads/2010/11/fig3b-600x409.gif

Individuals in Iceland pay 22 capital gains tax 2018 Corporate tax The corporate income tax rate in Iceland stands at 20 since 2011 1 one of the lowest in the world These 20 stand for limited liability companies and limited partnership companies Last reviewed 21 February 2024 In the Icelandic tax system individuals are subject to tax on all personal income and capital income Taxable income is divided into three main categories

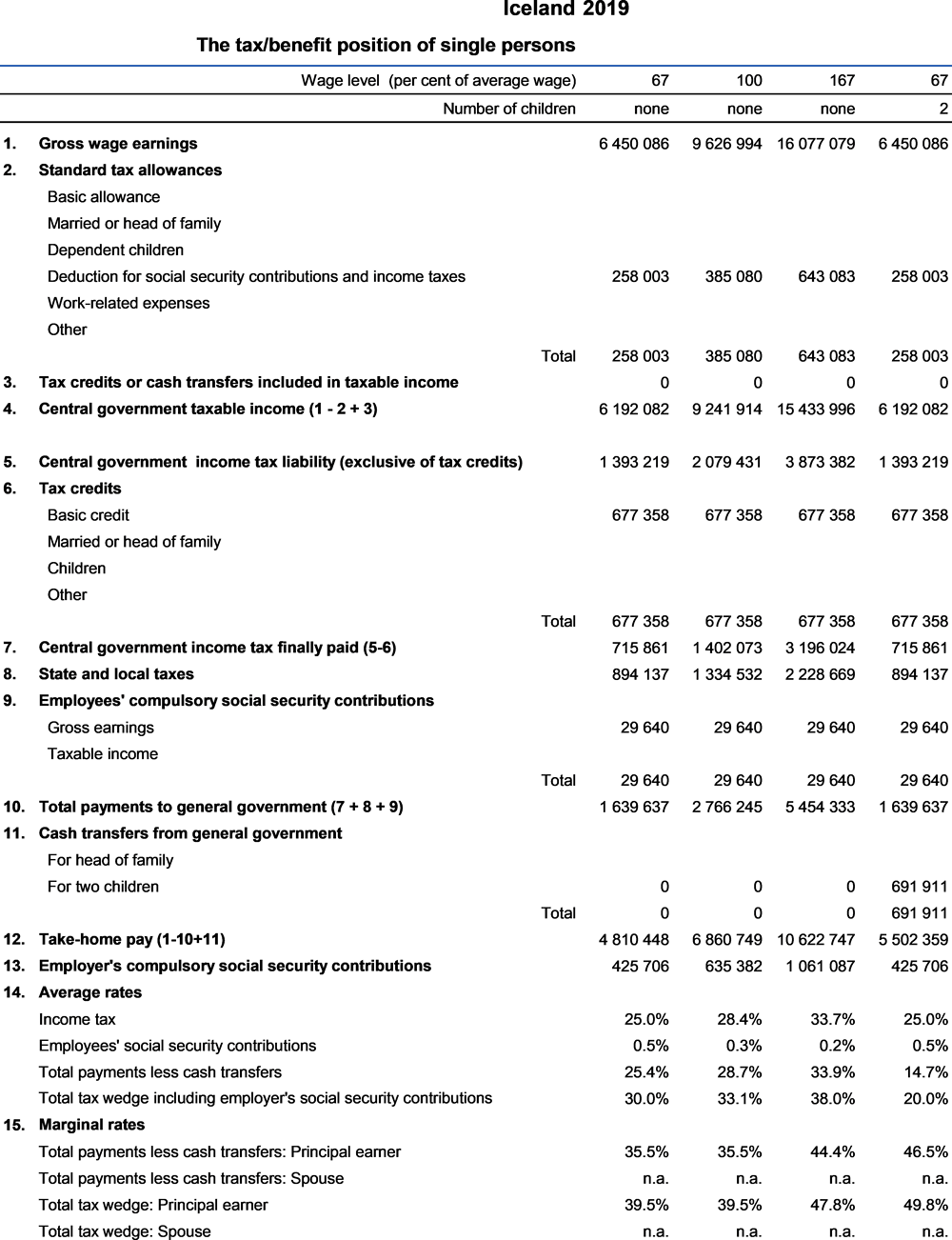

Table I 6 All in average personal income tax rates at average wage by family type Last reviewed 21 February 2024 Taxable period The tax year for individuals equals the calendar year Tax returns Individuals must file their tax returns before the end of 14 March in the consecutive year after the tax year Extensions may be granted for up to five days Payment of tax Individual income taxes are withheld at source each month

Download Iceland Tax Rate

More picture related to Iceland Tax Rate

Average Salary In Iceland 2023 The Complete Guide

http://www.salaryexplorer.com/charts/iceland/median-and-salary-distribution-monthly-iceland.jpg

Income Tax Rates 2023 To 2024 PELAJARAN

https://images.prismic.io/payfit/4a90d271-43c6-4dcf-834a-53fa79bb3a33_UK+tax+rates.png?auto=compress,format&rect=0,0,642,406&w=2429&h=1536

Tax Free Shopping In Iceland Claiming Your Tax Free Refund In Iceland

https://thoughtcard.com/wp-content/uploads/2017/12/Tax-Free-Shopping-Iceland-687x1030.jpg

The Personal Income Tax Rate in Iceland stands at 46 25 percent Personal Income Tax Rate in Iceland averaged 44 80 percent from 1995 until 2023 reaching an all time high of 46 90 percent in 1996 and a record low of 35 70 percent in 2007 source Directorate of Internal Revenue 15 4 1 National Income Tax Rates For the income years 2021 and 2022 assessment years 2022 and 2023 the income tax rate is 17 0 31 8 37 Capital income derived by individuals not engaged in a business is taxed sepa rately at a rate of 22 In the case of dividend and interest the tax is withheld at source

[desc-10] [desc-11]

Iceland GDP 2023 Iceland Taxes Iceland Income Tax Iceland Tax Rates

https://www.worldwide-tax.com/iceland/images/0004.jpg

The Iceland Tax System Key Features And Lessons For Policy Makers

https://freedomandprosperity.org/wp-content/uploads/2007/04/Iceland.jpg

https://www. skatturinn.is /english/individuals/key-rates-and-amounts/2023

Tax assessment 2023 ISK 20 200 2 057 211 Tax assessment 2022 ISK 18 800 1 938 025 Tax assessment 2021 ISK 18 300 1 870 828 Tax assessment 2020 ISK 17 900 1 833 671 Tax assessment 2019 ISK 17 500 1 750 783 Tax assessment 2018 ISK 17 100 1 718 678 Tax assessment 2017 ISK 16 800 1 678 001 Tax

https://www. skatturinn.is /english

Tax rates and figures for the income year 2024 have been updated for the new year See the latest key figures amounts and percentages for the 2024 Key rates and amounts English Individuals Tax issues General tax information Tax liability Taxable income Allowances deductions and credits Non resident Limited tax liability

Iceland s Tax On Faith Tiplr

Iceland GDP 2023 Iceland Taxes Iceland Income Tax Iceland Tax Rates

Iceland AtlasBig

PwC Iceland Tax And Legal

Iceland Taxing Wages 2020 OECD ILibrary

Iceland Sales Tax Rate 2024 Take profit

Iceland Sales Tax Rate 2024 Take profit

How To Obtain A Tax Card In Iceland Electricity Bill Calculator

Iceland 024c jpg

Our Performance About Iceland

Iceland Tax Rate - Table I 6 All in average personal income tax rates at average wage by family type