Income Limit For Electric Vehicle Rebate Web 31 mars 2023 nbsp 0183 32 Updated FAQs were released to the public in Fact Sheet 2023 08 PDF March 31 2023 The Inflation Reduction Act of 2022 IRA makes several changes to the

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks

Income Limit For Electric Vehicle Rebate

Income Limit For Electric Vehicle Rebate

https://i0.wp.com/www.electricrebate.net/wp-content/uploads/2022/09/california-income-based-electric-vehicle-rebate-program-expected-to-4.jpg

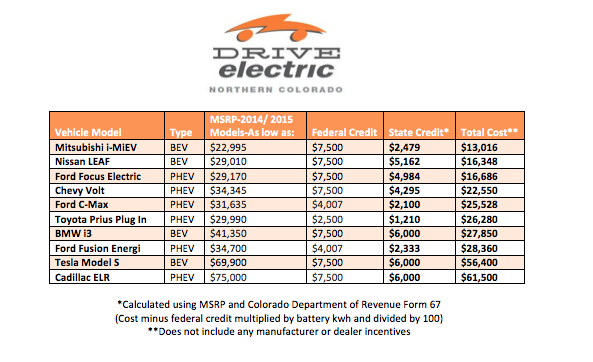

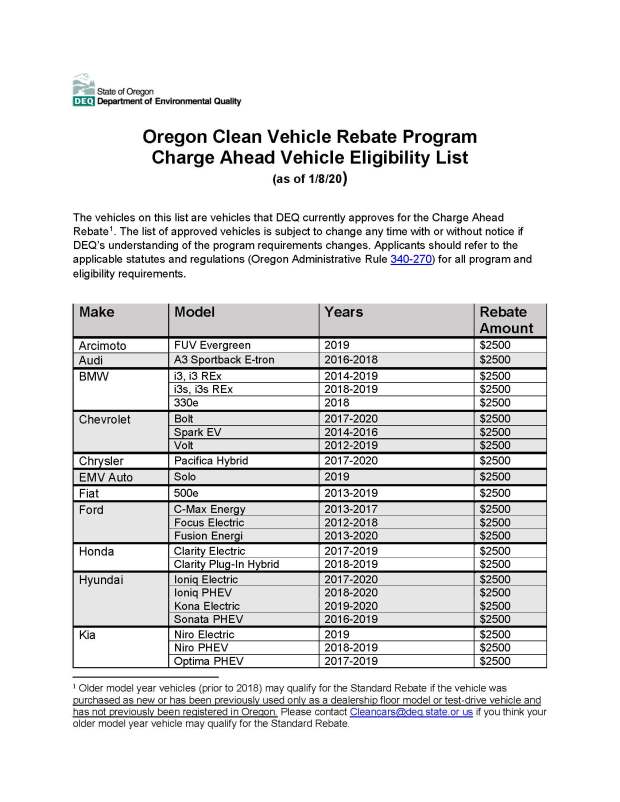

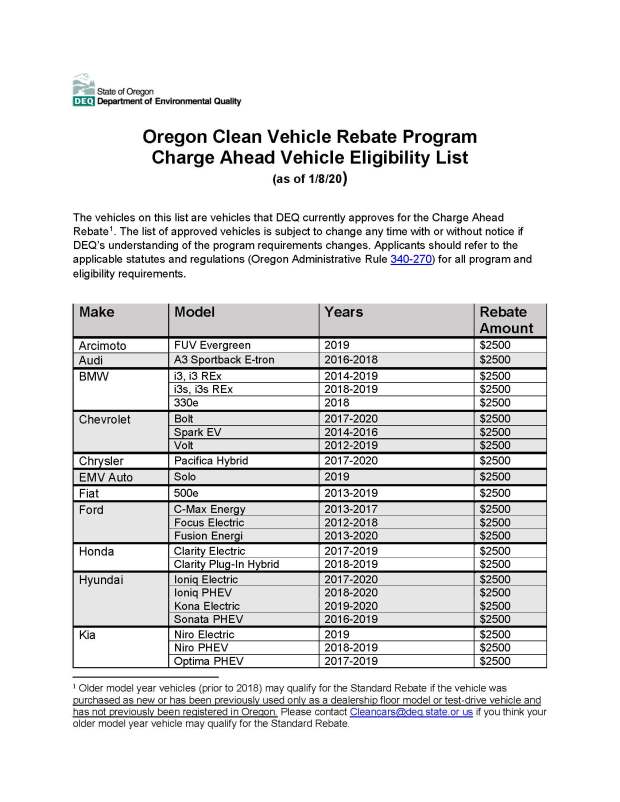

Electric Vehicle Rebates EClips Extra

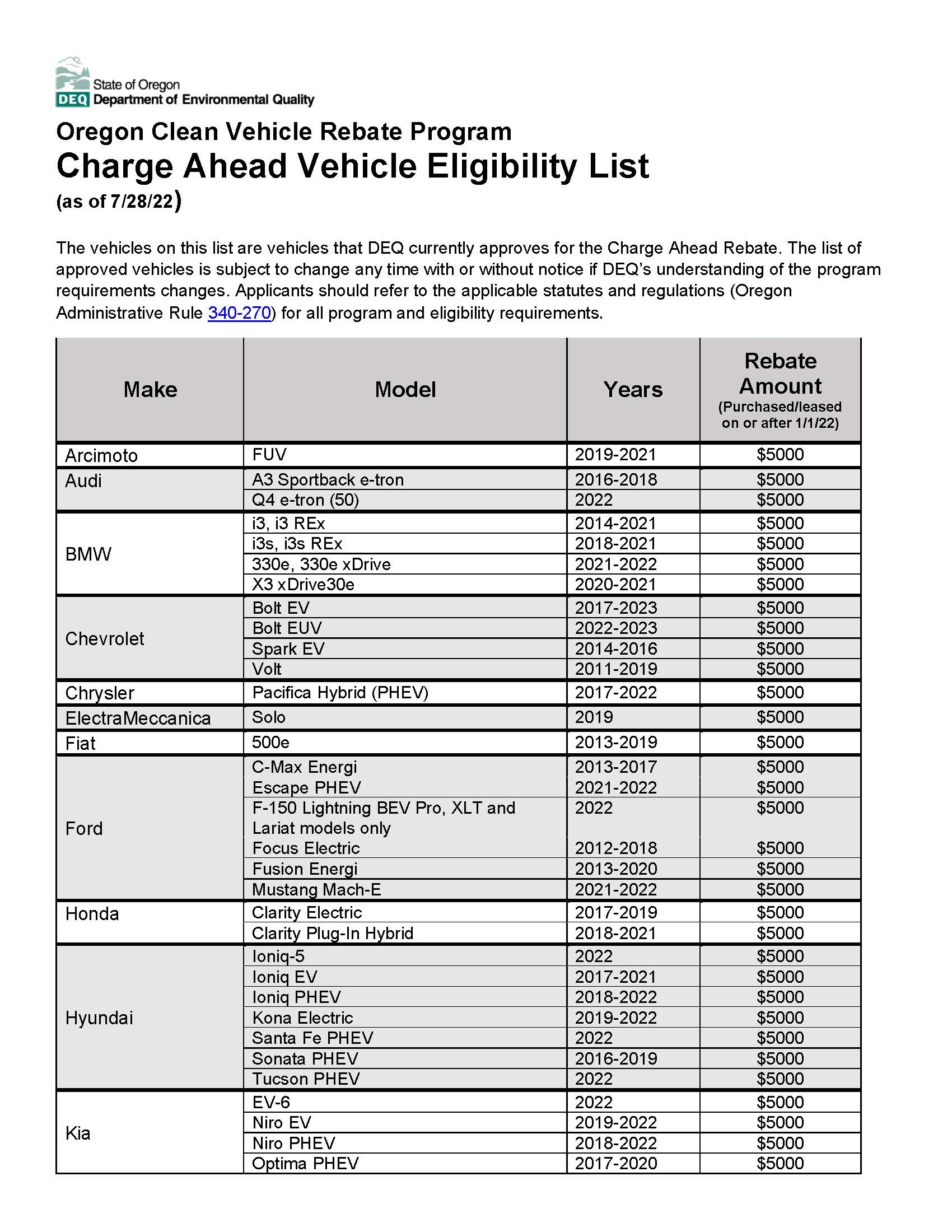

https://readallaboutitoregon.files.wordpress.com/2022/08/oregon-clean-vehicle-rebate-program-charge-ahead-vehicle-eligibility-list.jpg

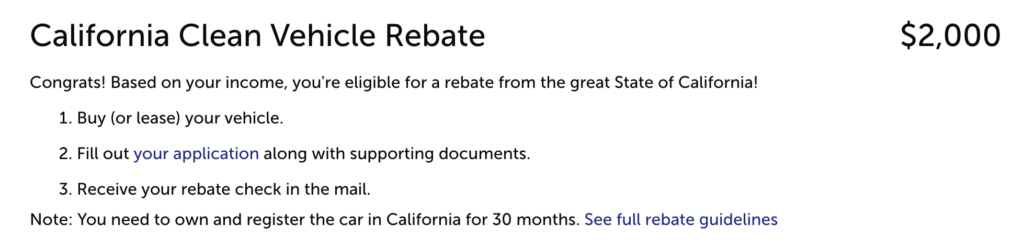

Ca Electric Car Rebate Income Limit ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/key-states-rethink-electric-car-subsidies-bestride-1.png

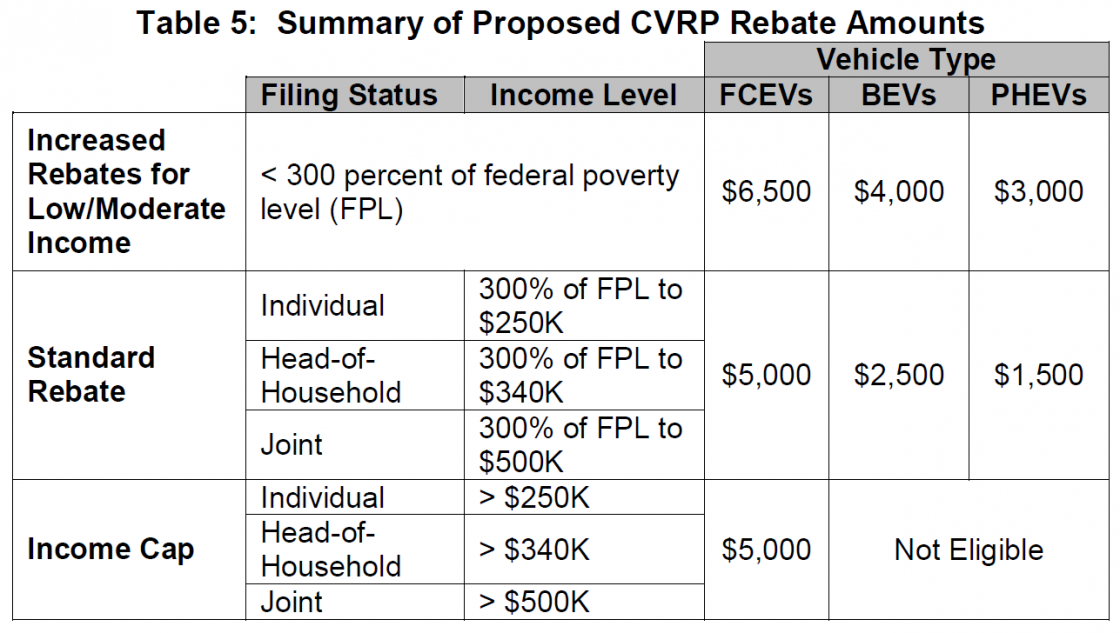

Web 5 sept 2023 nbsp 0183 32 EV NEWS AND UPDATES CLAIMING THE EV TAX CREDIT EV LEASES HOME EV CHARGERS OTHER IRA TAX CREDITS By Kelley R Taylor last updated 3 Web 22 ao 251 t 2022 nbsp 0183 32 Only singles with incomes up to 150 000 a year and couples who file taxes jointly who earn up to 300 000 will qualify This income cap requirement is meant to help less affluent people afford

Web The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s battery components are manufactured or assembled in Web 26 d 233 c 2022 nbsp 0183 32 GM says its eligible EVs should qualify for the 3 750 credit by March with the full credit available in 2025 Until Treasury issues its rules though the requirements

Download Income Limit For Electric Vehicle Rebate

More picture related to Income Limit For Electric Vehicle Rebate

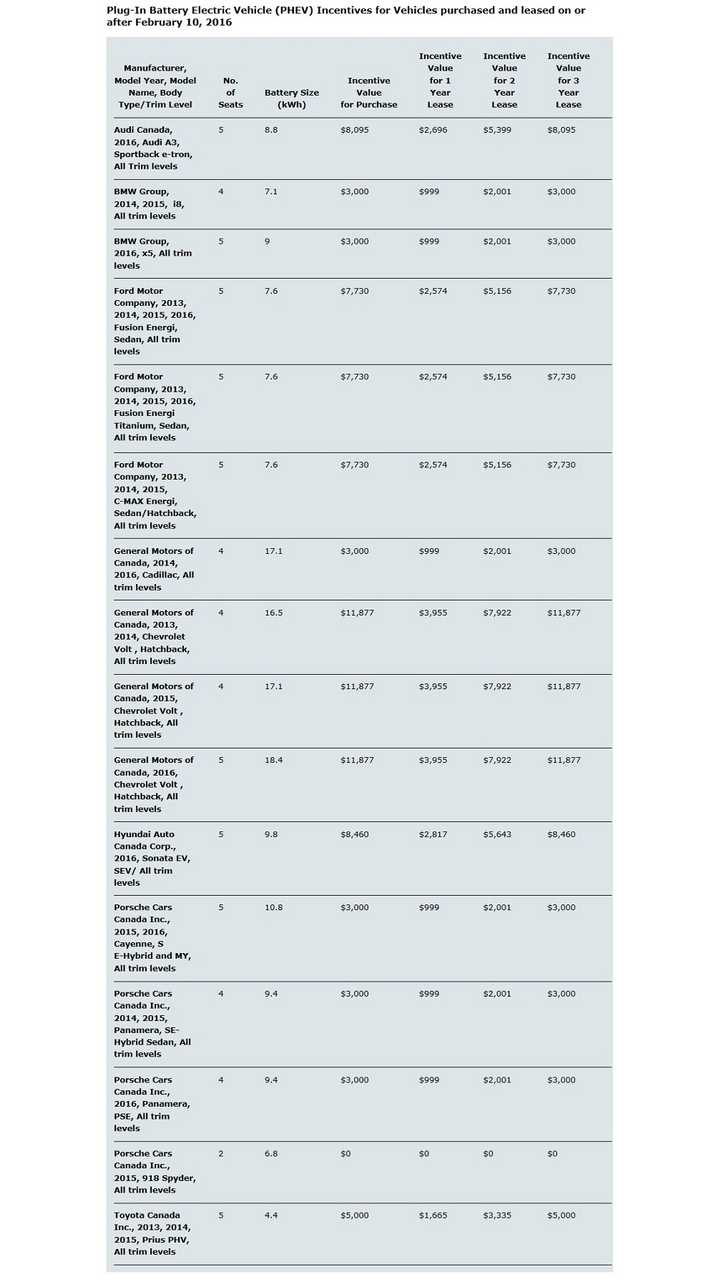

Ontario Electric Vehicle Rebate Eligibility ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/08/ontario-canada-boosts-electric-vehicle-incentive-program-up-to-14-000-16.jpg

Ontario Electric Vehicle Rebate Eligibility ElectricRebate

https://i0.wp.com/www.fordrebates.net/wp-content/uploads/2023/05/ontario-electric-vehicle-rebate-eligibility-electricrebate.jpg?fit=720%2C1280&ssl=1

Ca Electric Car Rebate Income Limit 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/california-electric-car-rebates-a-new-guide-to-saving-up-to-7-000-9.png

Web 5 janv 2023 nbsp 0183 32 Mesures antipollution Bonus 233 cologique voiture ou camionnette r 232 gles en 2022 V 233 rifi 233 le 05 janvier 2023 Direction de l information l 233 gale et administrative Web Il y a 2 jours nbsp 0183 32 California Times Sept 11 2023 2 14 PM PT California is eliminating its popular electric car rebate program which often runs out of money and has long

Web 21 avr 2023 nbsp 0183 32 Under the new Treasury rule eligible models can receive between EV tax credits of 3 750 to 7 500 depending on whether their battery minerals their battery Web 21 mars 2023 nbsp 0183 32 Qu est ce que le bonus 233 cologique Le bonus 233 cologique est une aide 224 l achat accord 233 e par l Etat qui souhaite favoriser l achat de v 233 hicules neufs ou

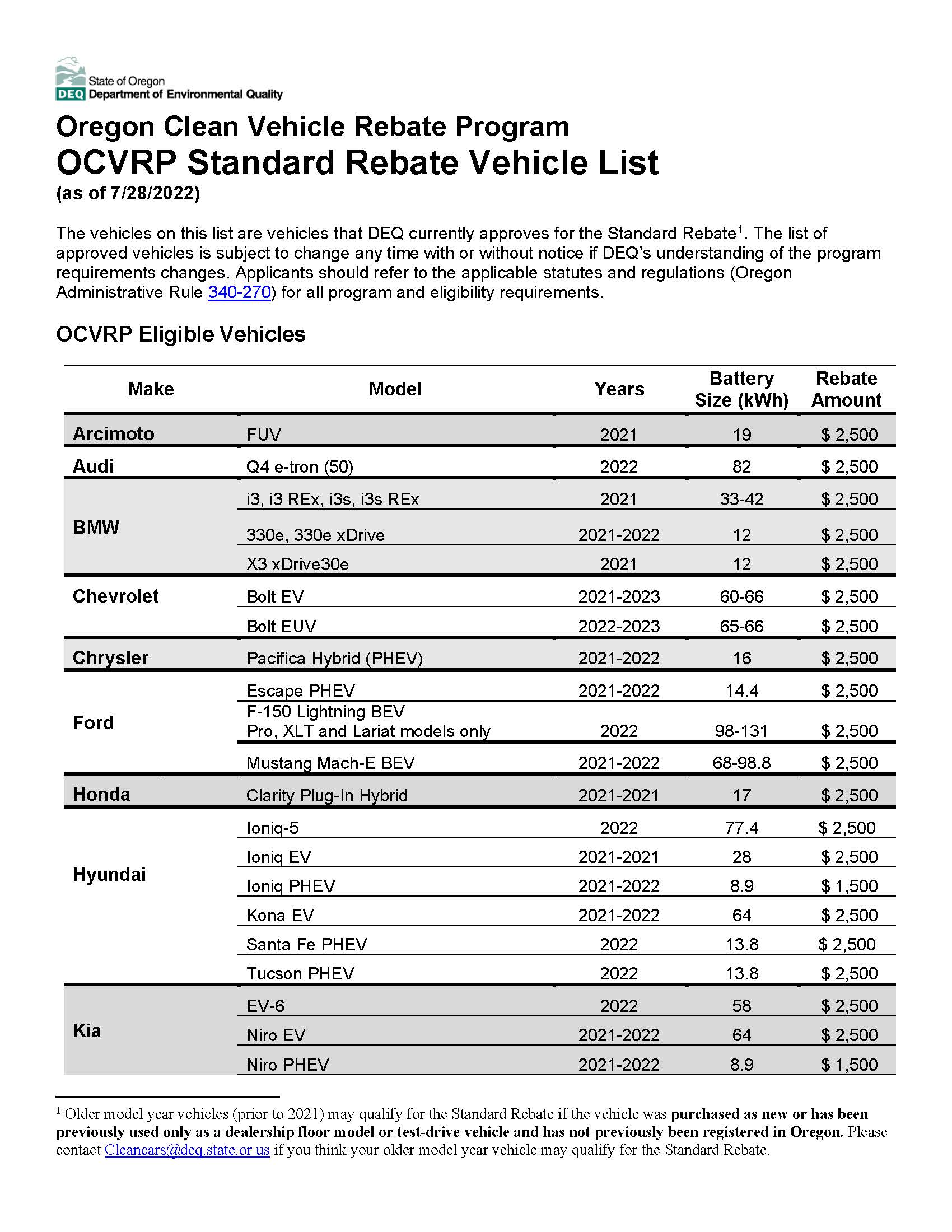

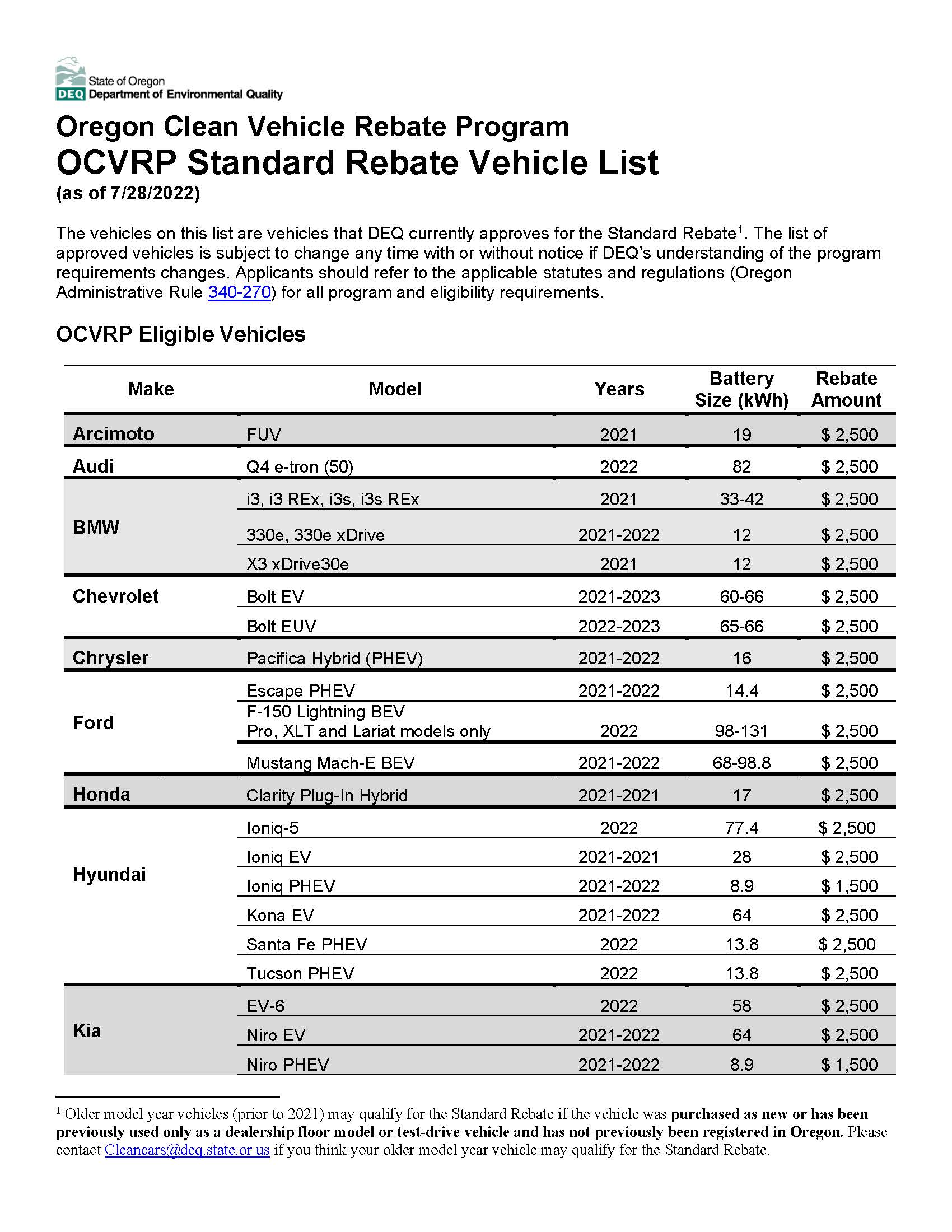

Electric Vehicle Rebates EClips Extra

https://readallaboutitoregon.files.wordpress.com/2022/08/oregon-clean-vehicle-rebate-program-ocvrp-standard-rebate-vehicle-eligibility-list.jpg

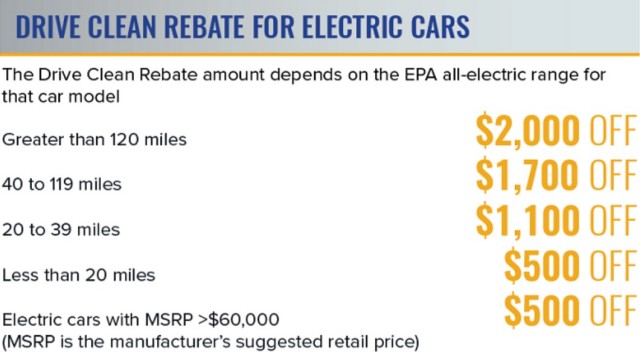

NY 2 000 Electric car Rebate Falls To 500 If It s Over 60K Sorry Tesla

https://images.hgmsites.net/med/new-york-state-drive-clean-electric-car-rebate-program-amounts-march-2017_100596542_m.jpg

https://www.irs.gov/newsroom/topic-b-frequently-asked-questions-about...

Web 31 mars 2023 nbsp 0183 32 Updated FAQs were released to the public in Fact Sheet 2023 08 PDF March 31 2023 The Inflation Reduction Act of 2022 IRA makes several changes to the

https://www.irs.gov/credits-deductions/credits-for-new-clean-vehicles...

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

Illinois Electric Vehicle Rebate Program LLC To Get Credit Funny

Electric Vehicle Rebates EClips Extra

Income Tax Rebate On Electric Car 2022 Carrebate

Electric Car Available Rebates 2023 Carrebate

Electric Vehicle Rebates For Lower income Buyers Go Virtually Unused In

Electric Vehicle Rebate Program EClips Extra

Electric Vehicle Rebate Program EClips Extra

Income Tax Rebate On Electric Car 2023 Carrebate

Illinois EV Purchase Rebate Share Deals Tips FORUM LEASEHACKR

Federal Tax Rebates Electric Vehicles ElectricRebate

Income Limit For Electric Vehicle Rebate - Web 22 ao 251 t 2022 nbsp 0183 32 Only singles with incomes up to 150 000 a year and couples who file taxes jointly who earn up to 300 000 will qualify This income cap requirement is meant to help less affluent people afford