Income Tax Act 2024 This amendment now effective from January 15 2024 broadens the scope of income tax exemptions to include terminal payouts received by both employees and pensioners applicable to retirement and certain early withdrawals The amendments aim to harmonize the Income Tax Act with the Retirement Funds Act of 2022

To Our Valued Client Botswana Parliament enacted the Income Tax Amendment Bill 2023 on December 20 2023 This amendment now effective from January 15 2024 broadens the scope of income tax exemptions to include terminal payouts received by both employees and pensioners applicable to retirement and certain early withdrawals The Botswana Unified Revenue Service March 22 issued guidance clarifying the latest amendments to the Income Tax Amendment Act 2024 which took effect Jan 15 Topics covered include 1 the increase in the tax free threshold to 50 percent from 33 33 percent for payments made on or after Jan 15 of pension fund commutable

Income Tax Act 2024

Income Tax Act 2024

https://sortingtax.com/wp-content/uploads/2022/06/Section-91-of-Income-Tax-Act-with-Example.png

Section 13 OF THE INCOME TAX ACT

https://www.legalmantra.net/admin/assets/upload_image/blog/INCOME_TAX2.jpg

Power Conferred By Section 254 2 Of Income Tax Act Does Not Extend

https://legiteye.com/media/uploads/legiteyeindian/Income-Tax-Act.jpg

The Income Tax Amendment Act 2024 was Gazetted and is effective 15 January 2024 This Amendment Act increases the tax exempt portion of specific lumpsums payable to an employee according to sections 32 7 32 10 32 11 32 12 32 14 and the Second Schedule to the Income Tax Act namely An Act to consolidate and amend the law relating to the imposition assessment and collection of tax on incomes Date of Commencement 1st July 1995 PART I Preliminary ss 1 2 1 Short title This Act may be cited as the Income Tax Act 2 Interpretation In this Act unless the context otherwise requires

Botswana Residents Income Tax Tables in 2024 Personal Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold 0 Income from P 0 000 00 to P 48 000 00 5 Income from P 48 000 01 to P 84 000 00 12 5 Income from P 84 000 01 to P 120 000 00 18 75 Income from P 120 000 01 to P 156 000 00 THE INCOME TAX ACT CHAPTER 470 Revised Edition 2022 1973 Published by the National Council for Law Reporting with the Authority of the Attorney General www kenyalaw Rev 2022 Income Tax CAP 470 CHAPTER 470 INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1 Short title and

Download Income Tax Act 2024

More picture related to Income Tax Act 2024

Master Income Tax ACT 2023 Inklogy

https://www.inklogy.com/wp-content/uploads/2020/06/Picture3.png

Income Tax Act 1961 Establishing Taxation Rules In The Country

https://getlegalindia.com/wp-content/uploads/2021/09/income-tax-act-1.jpg

Malaysia Income Tax Act 1967 LAWS OF MALAYSIA ONLINE VERSION OF

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/fb38da961814d2d70f0f34d95585bdb5/thumb_1200_1694.png

Income Tax Act Act Number Act Number 3 of 1997 An Act to provide for the taxation of incomes and matters connected therewith Volume Volume 19 Document Income Tax Act pdf Amendment of section 8 of the Income Tax Act Amendment of section 16 of the Income Tax Act Amendment of section 20 of the Income Tax Act Amendment of section 36 of the Income Tax Act Amendment of section 36A of the Income Tax Act Amendment of section 60 of the Income Tax Act Amendment of Schedule I to the Value Added Tax Act

[desc-10] [desc-11]

Section 24B Of Income Tax Act 2023 Guide InstaFiling

https://instafiling.com/wp-content/uploads/2023/01/Frame-135-1080x675.png

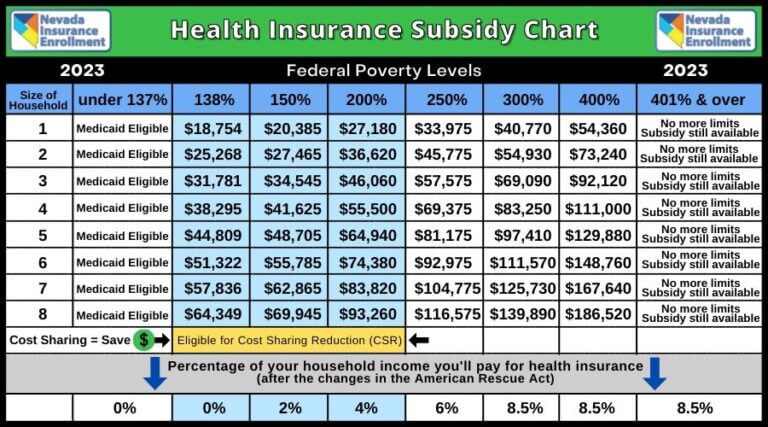

2023 Health Insurance Subsidy Chart Federal Poverty Levels

https://www.nevadainsuranceenrollment.com/wp-content/uploads/2022/10/2023-Health-Insurance-Subsidy-Chart-Federal-Poverty-Levels-768x427.jpg

https://www.rsm.global/botswana/news/income-tax...

This amendment now effective from January 15 2024 broadens the scope of income tax exemptions to include terminal payouts received by both employees and pensioners applicable to retirement and certain early withdrawals The amendments aim to harmonize the Income Tax Act with the Retirement Funds Act of 2022

https://www.rsm.global/botswana/sites/default/files...

To Our Valued Client Botswana Parliament enacted the Income Tax Amendment Bill 2023 on December 20 2023 This amendment now effective from January 15 2024 broadens the scope of income tax exemptions to include terminal payouts received by both employees and pensioners applicable to retirement and certain early withdrawals

Income Tax Act 1 3 Notes On Law Of Taxation PART THE INCOME

Section 24B Of Income Tax Act 2023 Guide InstaFiling

Income Tax Act 1973 Edition 2022 LAWS OF KENYA THE INCOME TAX ACT

44ae Of Income Tax Act Everything You Need To Know

Know About Section 43B In Income Tax Act 1961

Section 194M Of Income Tax Act 1961 Sorting Tax

Section 194M Of Income Tax Act 1961 Sorting Tax

Section 115BAC Of Income Tax Act IndiaFilings

Printable Tax Deduction Cheat Sheet

Income TAX ACT 1961 INCOME TAX ACT 1961 BASIC INTRODUCTION

Income Tax Act 2024 - THE INCOME TAX ACT CHAPTER 470 Revised Edition 2022 1973 Published by the National Council for Law Reporting with the Authority of the Attorney General www kenyalaw Rev 2022 Income Tax CAP 470 CHAPTER 470 INCOME TAX ACT ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1 Short title and