Income Tax Benefit On Electric Vehicles In India Tax deductions on loan for EVs When paying off an EV loan a total tax exemption of up to Rs 1 50 000 is available under section 80EEB This tax break is

You get a deduction of Rs 1 50 000 under section 80EEB on the interest paid on loan taken to buy Electric vehicles Low GST rate The government has reduced the In a bid to promote the adoption of electric vehicles EVs and combat climate change the Indian government introduced Section 80EEB in the 2019 budget This initiative incentivizes individuals by offering tax

Income Tax Benefit On Electric Vehicles In India

Income Tax Benefit On Electric Vehicles In India

https://img.money.com/2022/12/News-Save-buying-electric-car-using-tax-credits.jpg?quality=85

Tax Benefits On Electric Vehicles In India Bharat Times

https://c.ndtvimg.com/2021-12/qv1b35f8_car_625x300_22_December_21.jpg

Record Breaking Q1 FY 2022 23 Sales Of Electric Vehicles In India

https://inverted.in/wp-content/uploads/2022/09/EVs-Sale-4.JPG-768x549.jpg

EV buyers can claim up to 1 5 lakh income tax deduction on the interest paid for vehicle loans under section 80EEB of the IT Act As the current financial year is Under Section 80EEB of the Income Tax Act consumers can get an income tax benefit of up to INR 1 5 lakhs on the interest paid on loans taken for the purchase of electric

Buying an electric vehicle with a vehicle loan can make you eligible for income tax benefits under the 80EEB Also an EV purchase will bring you tax benefits Explore the benefits of Section 80EEB providing a deduction for interest paid on loans for Electric Vehicles EVs Understand the eligibility criteria quantum of

Download Income Tax Benefit On Electric Vehicles In India

More picture related to Income Tax Benefit On Electric Vehicles In India

Tax Benefit From Electric Vehicle

https://taxguru.in/wp-content/uploads/2022/05/Tax-Benefit-from-Electric-Vehicle.jpg

Section 80EEB Of Income Tax Act Deduction Tax Benefits

https://navi.com/blog/wp-content/uploads/2022/12/Section-80EEB.webp

Buying An Electric Vehicle Here s How Much TAX BENEFIT You Can Claim

https://english.cdn.zeenews.com/sites/default/files/styles/zm_700x400/public/2022/10/24/1107678-ev-tax-benefits.jpg

Check income tax benefits on electric vehicles in India Under Section 80EEB of the Income Tax Act individual taxpayers can claim a deduction of up to Rs Under Section 80EEB you can claim a tax deduction of up to Rs 1 50 000 for the interest repayment for a loan taken for the purchase of an electric vehicle To be eligible the loan should have been

Income tax benefit Provided as a deduction on the tax amount payable by an individual to the government Scrapping incentives Provided upon de registering old Petrol and To provide thrust to the electric vehicle revolution the government should consider a one time tax deduction while computing taxable income for buyers of new

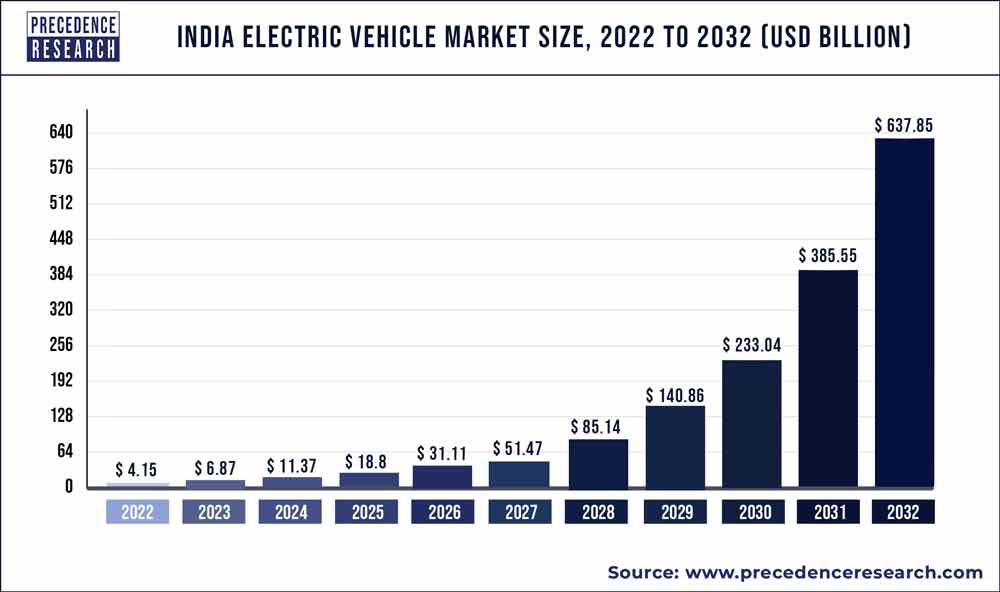

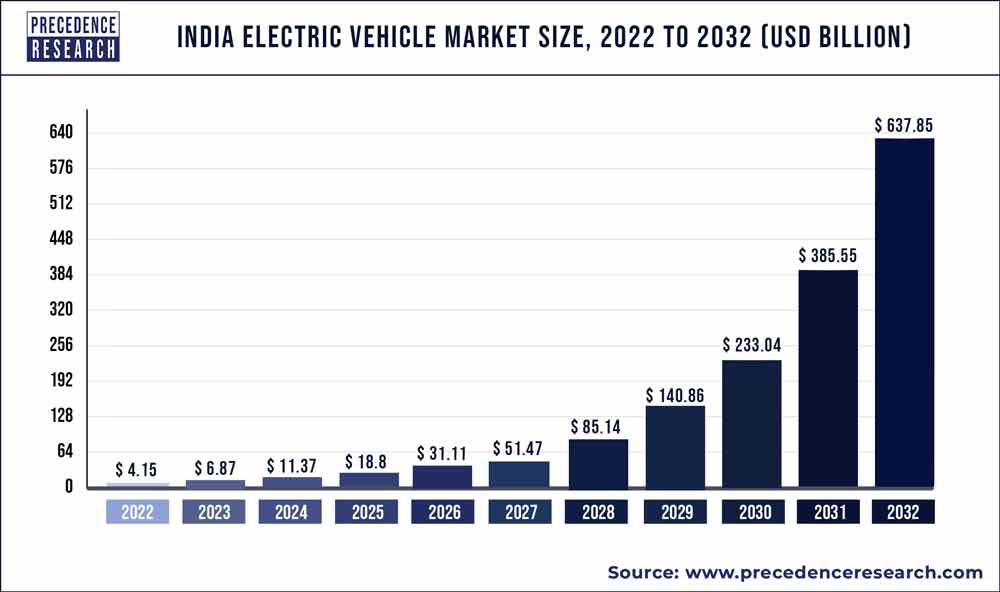

India Electric Vehicle Market Size To Hit USD 637 85 Bn By 2032

https://www.precedenceresearch.com/insightimg/india-electric-vehicle-market-size.jpg

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

https://economictimes.indiatimes.com/news/how-to/...

Tax deductions on loan for EVs When paying off an EV loan a total tax exemption of up to Rs 1 50 000 is available under section 80EEB This tax break is

https://taxguru.in/income-tax/purchase-electric...

You get a deduction of Rs 1 50 000 under section 80EEB on the interest paid on loan taken to buy Electric vehicles Low GST rate The government has reduced the

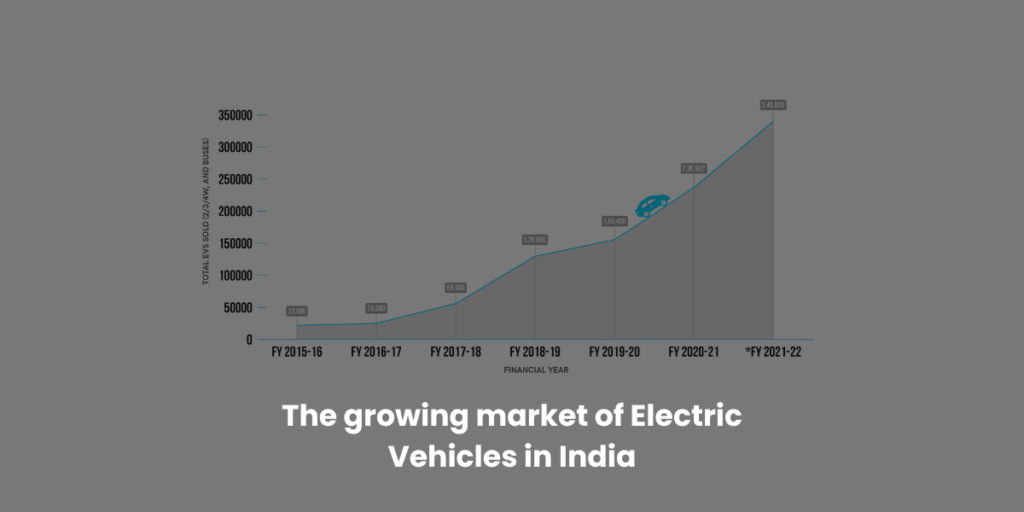

The Growing Market Of Electric Vehicles In India Ipower Batteries

India Electric Vehicle Market Size To Hit USD 637 85 Bn By 2032

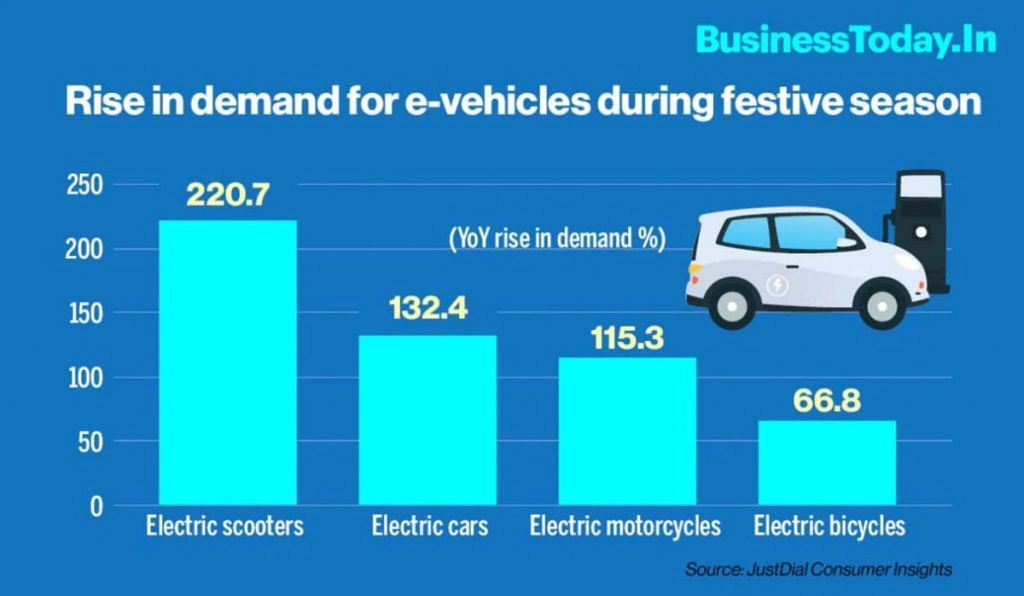

Demand For Electric Vehicles In India At A Rise Know More

EV Tax Credit Changes Mean Low income Buyers Can Soon Get Full 7 500

What Are The Tax Benefit On Home Loan FY 2020 2021

Top 10 Countries With Highest Electric Vehicle Sales Newswebpress

Top 10 Countries With Highest Electric Vehicle Sales Newswebpress

PDF Assessing Adoption Intention Of Electric Vehicles In India The

How To Maximize Battery Life Of Your Electric Vehicle EVEHICLESHOP

EV Options In India Clean Mobility Shift

Income Tax Benefit On Electric Vehicles In India - The government created a new section that includes tax benefits on Electric Vehicles in India The Tax Savings Calculator helps to calculate how much amount in tax would be