Income Tax Deductions Canada Learn how to reduce your tax owed by claiming various deductions credits and expenses on your tax return Find out what you can claim for family child care education

Your taxable income is your income after various deductions credits and exemptions have been applied There are also various tax credits deductions and benefits Tax deductions are amounts you subtract from your total income making your taxable income lower This means you d be charged taxes on a smaller amount of

Income Tax Deductions Canada

Income Tax Deductions Canada

https://i.pinimg.com/736x/3e/58/01/3e5801e1bdf5350d6be67f1cb159bff9--tax-deductions-income-tax.jpg

Are You Ready Greater Fool Authored By Garth Turner The Troubled

https://www.greaterfool.ca/wp-content/uploads/2017/08/RYAN-2.png?x64811

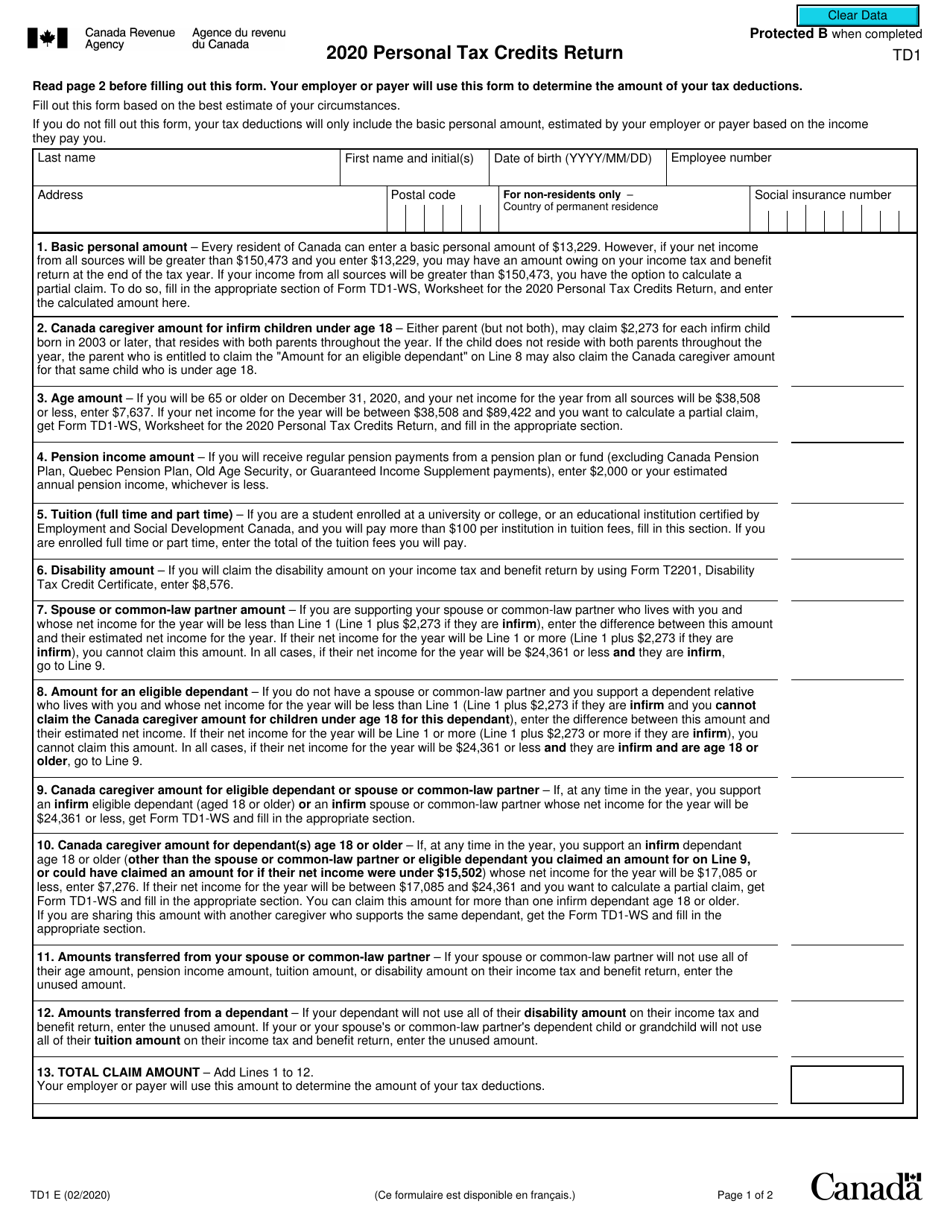

Form TD1 2020 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2066/20664/2066481/form-td1-personal-tax-credits-return-canada_print_big.png

The Canada Revenue Agency allows you to deduct amounts from the tax that you owe based on your taxable income These calculations are carried out in There are some tax deductions and credits you know you should claim on your income tax return every year It s unlikely you ll ever forget to deduct your RRSP

Estimate your income taxes with our free Canada income tax calculator See your tax bracket marginal and average tax rates payroll tax deductions tax refunds and taxes A tax deduction sometimes referred to as a tax write off is any legitimate expense that can be subtracted from your taxable income Lowering your taxable

Download Income Tax Deductions Canada

More picture related to Income Tax Deductions Canada

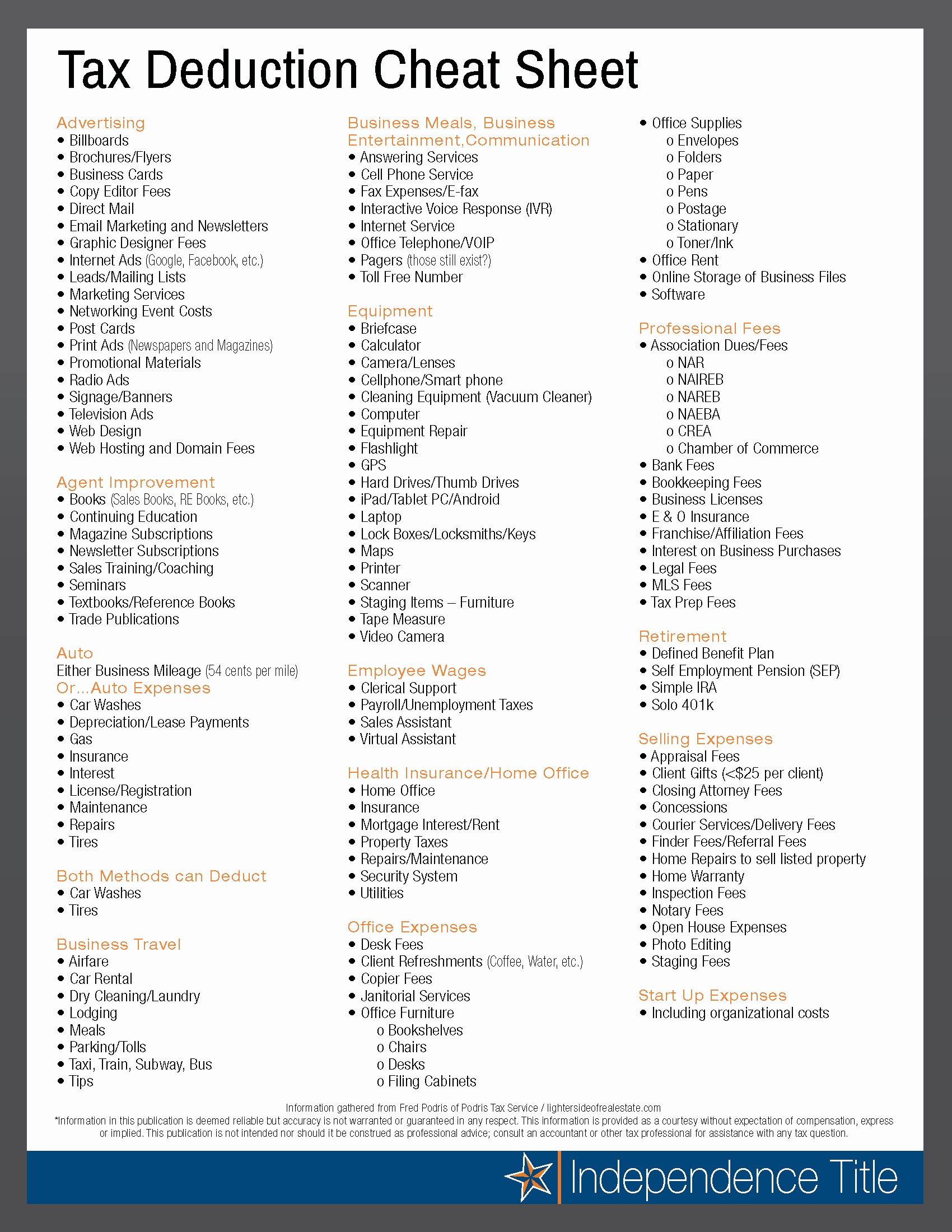

Business Tax List Of Business Tax Deductions

https://www.qtoffice.com/ckfinder/userfiles/images/1312/Tax Deductions.png

Filing Your Tax Return Don t Forget These Credits Deductions

https://globalnews.ca/wp-content/uploads/2015/03/tax-checklist-image.jpg?quality=85&strip=all

The Handy Income Tax Deductions Checklist To Help You Maximize Your

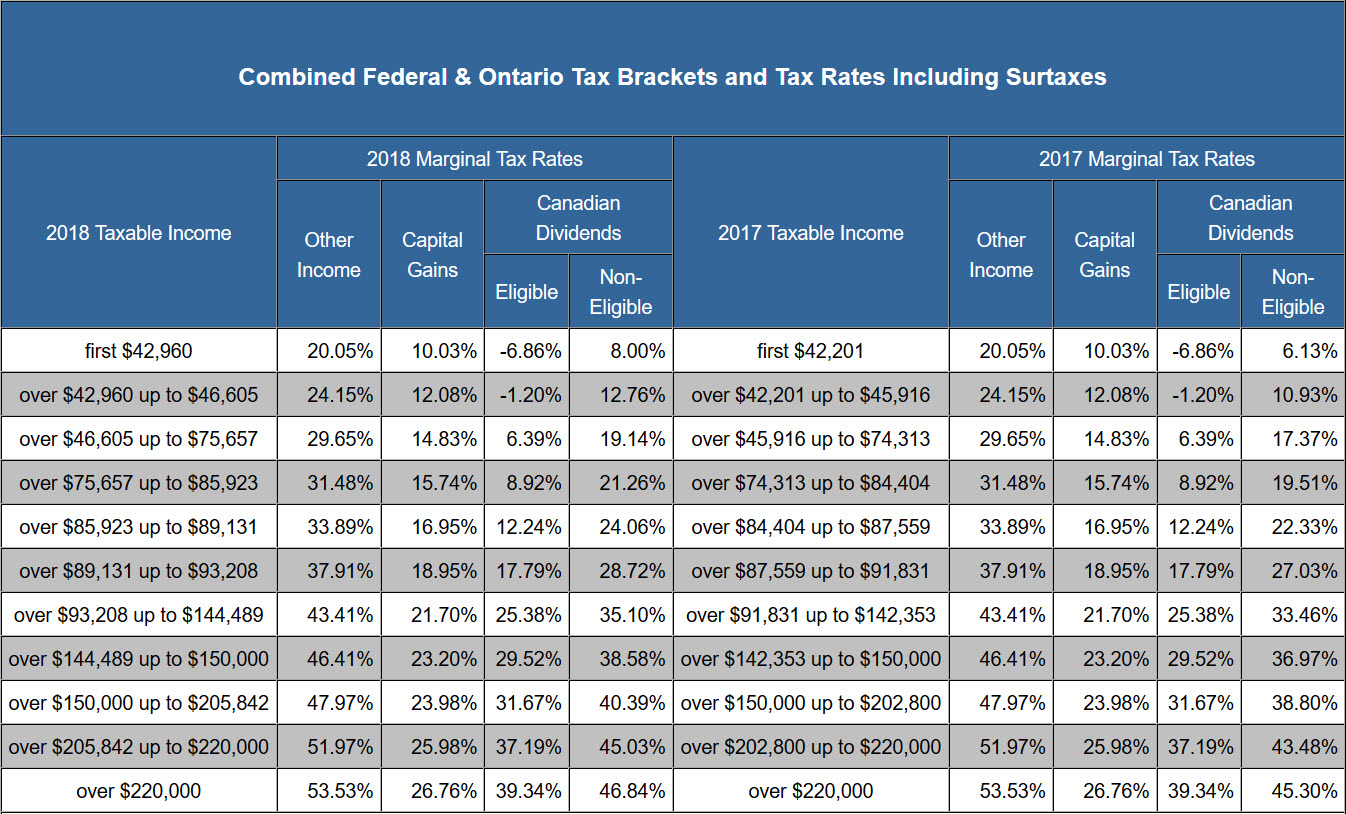

http://www.isaved5k.com/wp-content/uploads/2018/03/OntarioMarginalTaxRate.jpg

Personal deductions Deductible non business expenses include alimony and maintenance payments if taxable to the recipient certain child care expenses and Your tax bracket is based on taxable income which is your gross income from all sources minus any tax deductions you may qualify for In other words it s your net

Get a quick free estimate of your 2023 income tax refund or taxes owed using our income tax calculator Plus explore Canadian and provincial income tax FAQ and resources Individuals resident in Canada are subject to Canadian income tax on worldwide income Relief from double taxation is provided through Canada s

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-3-768x432.jpg

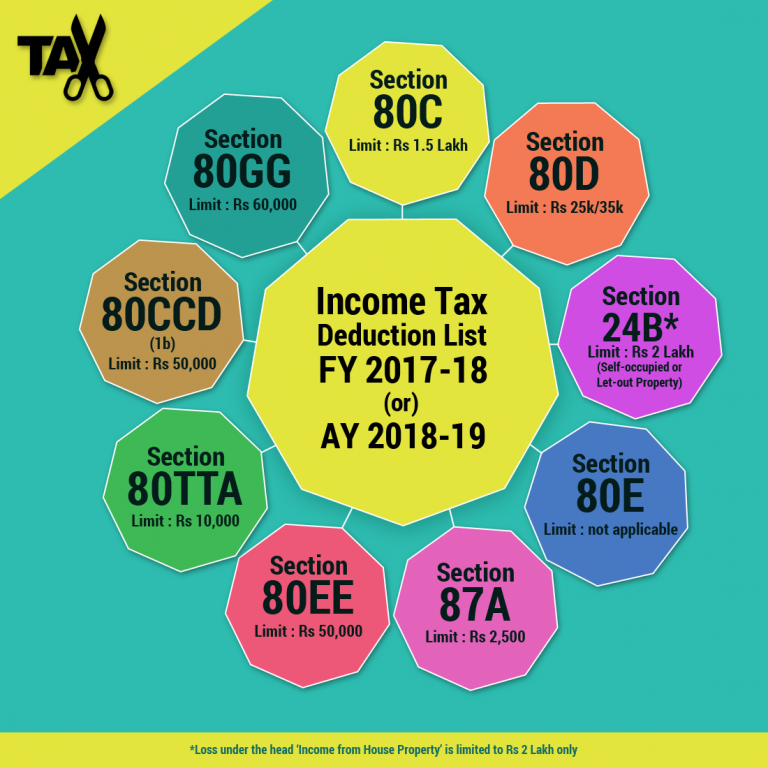

Income Tax Deduction List 2017 18 Comparepolicy

https://www.comparepolicy.com/blogs/wp-content/uploads/2017/12/income-tax-deduction-list-2017-18-768x768.png

https://www.canada.ca/en/revenue-agency/services...

Learn how to reduce your tax owed by claiming various deductions credits and expenses on your tax return Find out what you can claim for family child care education

https://www.canada.ca/en/revenue-agency/services...

Your taxable income is your income after various deductions credits and exemptions have been applied There are also various tax credits deductions and benefits

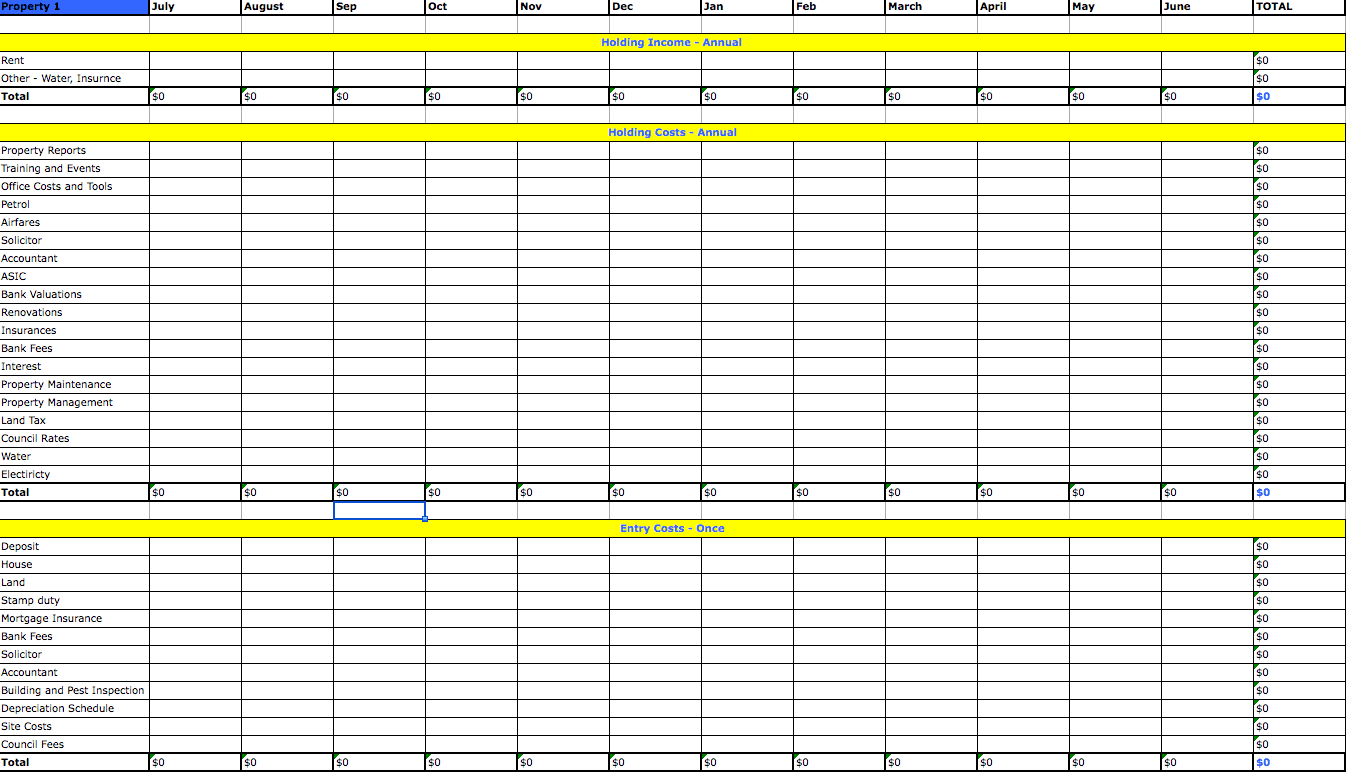

Itemized Deductions Spreadsheet Excelxo

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

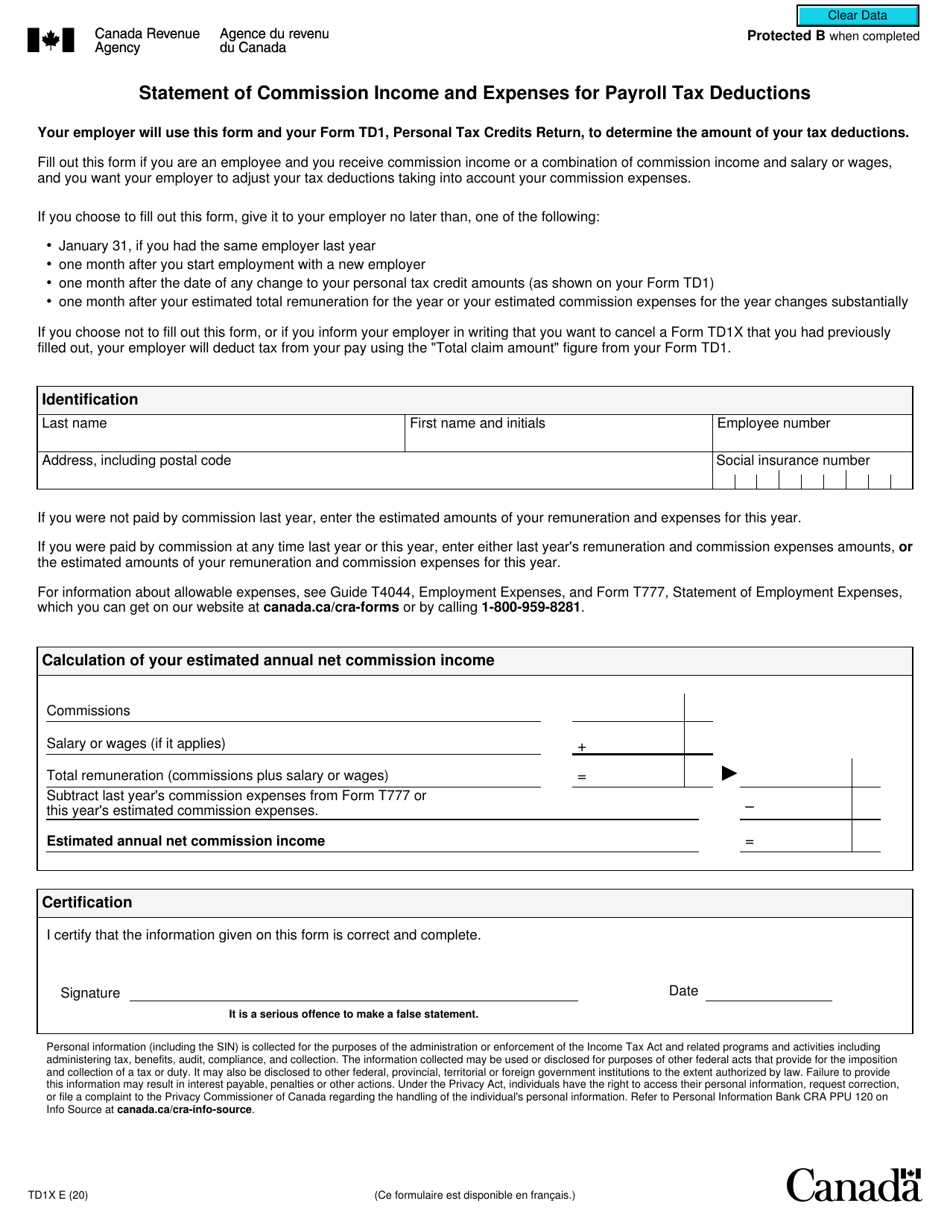

Form TD1X Download Fillable PDF Or Fill Online Statement Of Commission

Business Itemized Deductions Worksheet Beautiful Business Itemized For

Home Based Business Tax Deductions Canada Black Scholes Employee

List Of Tax Deductions Fill Online Printable Fillable Blank

List Of Tax Deductions Fill Online Printable Fillable Blank

Income Tax Rates For The Self Employed 2020 2021 TurboTax Canada Tips

13 Car Expenses Worksheet Worksheeto

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

Income Tax Deductions Canada - Free income tax calculator to estimate quickly your 2023 and 2024 income taxes for all Canadian provinces Find out your tax brackets and how much Federal and