Income Tax Exemption On Higher Education Fees Exempt Allowance for salaried people In addition to the two benefits explained above which are available for all the taxpayer whether one is salaried or self employed the tax laws also allow

How to Claim College Tuition and Fees on Your Taxes If you expect to qualify for education tax deductions or credits for yourself or your dependents you ll need to complete the correct For 2023 there are two tax credits available to help you offset the costs of higher education by reducing the amount of your income tax They are the American opportunity credit and the lifetime learning credit

Income Tax Exemption On Higher Education Fees

Income Tax Exemption On Higher Education Fees

http://4.bp.blogspot.com/-_bKZyHk-qz0/VVSX94s6h4I/AAAAAAABe-c/qZY8hsOrmXY/s1600/largest-real-in-state-tuition-increases-at-public-schools-1998-2014-change_chartbuilder.png

Revenue Dashboard For Higher Education Institutions Example Uses

https://www.solverglobal.com/wp-content/uploads/2021/05/PowerBi_HigherEd_01-scaled-1.jpg

Tax Exemption On Loan For Abroad Education U S 80E SAG Infotech Tax

https://saginfotech.files.wordpress.com/2022/03/income-tax-exemption-on-education-loan.jpeg

1 1 Income Tax charge and rate the government will introduce legislation in Finance Bill 2024 25 to remove the VAT exemption on private school fees 2 15 High Generally personal interest you pay other than certain mortgage interest is not deductible on your tax return However if your modified adjusted gross income MAGI is less

An individual can get tax deductions on the interest paid for educational laon taken for higher studies This tax benefits on education loan can be claimed under Section 80E of the Income Education loan interest is tax deductible under section 80E for individuals taking loans for higher studies limited to interest payments only Loan must be from recognized institutions No cap on deduction amount available

Download Income Tax Exemption On Higher Education Fees

More picture related to Income Tax Exemption On Higher Education Fees

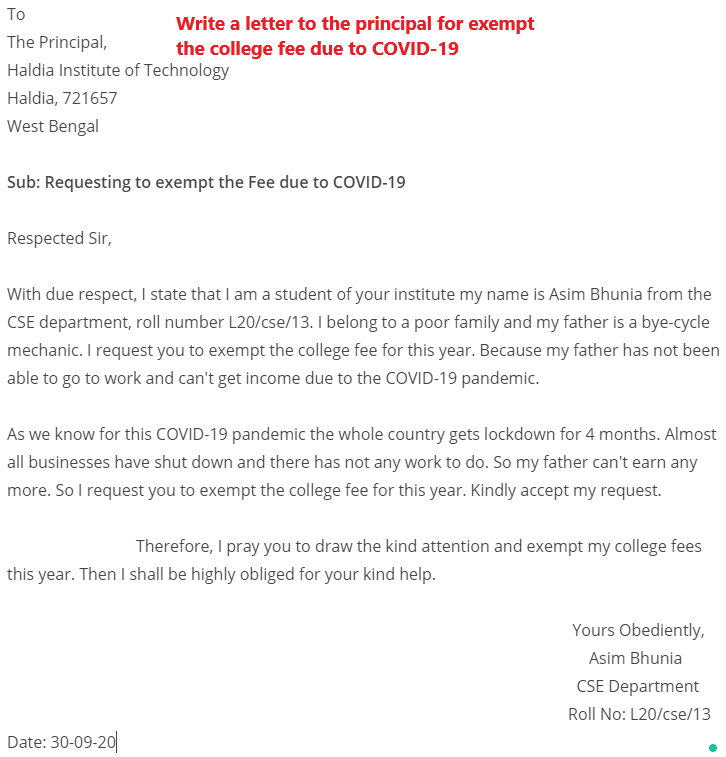

Write A Letter To The Principal For School College Fee Exemption

https://studyviewer.com/wp-content/uploads/2020/09/write_a_letter_to_principal_for_covid.png

Income Tax Exemption On Interest Of Education Loan YouTube

https://i.ytimg.com/vi/6NRHslwXCcM/maxresdefault.jpg

The Rising Unaffordability Of A College Education Political Calculations

https://2.bp.blogspot.com/-xMeoxzyMCMA/T0zlIasKCJI/AAAAAAAAFAQ/zor6LFFl_K8/s1600/c-inflation-higher-education-buble-average-tuition-vs-median-household-income-1976-2010.png

No education allowance is an exemption upto 100 per child maximum of two children under section 10 However tuition fee deduction can be claimed upto 1 5 lakh for The government has committed to not increase taxes on working people which is why it is not increasing the basic higher or additional rates of income tax National Insurance

In 2021 11 higher education related tax benefits are available The available tax benefits are a mixture of credits deductions exclusions and other incentives The Joint Committee on The increased pension benefits announced in this Budget for pensioners aged 61 and over as well as for widowed individuals will be tax exempt Increase in deduction relating to private

Income Tax Exemption On Gratuity Eligibility Maximum Limit

https://emailer.tax2win.in/assets/guides/all_guides/gratuity.jpg

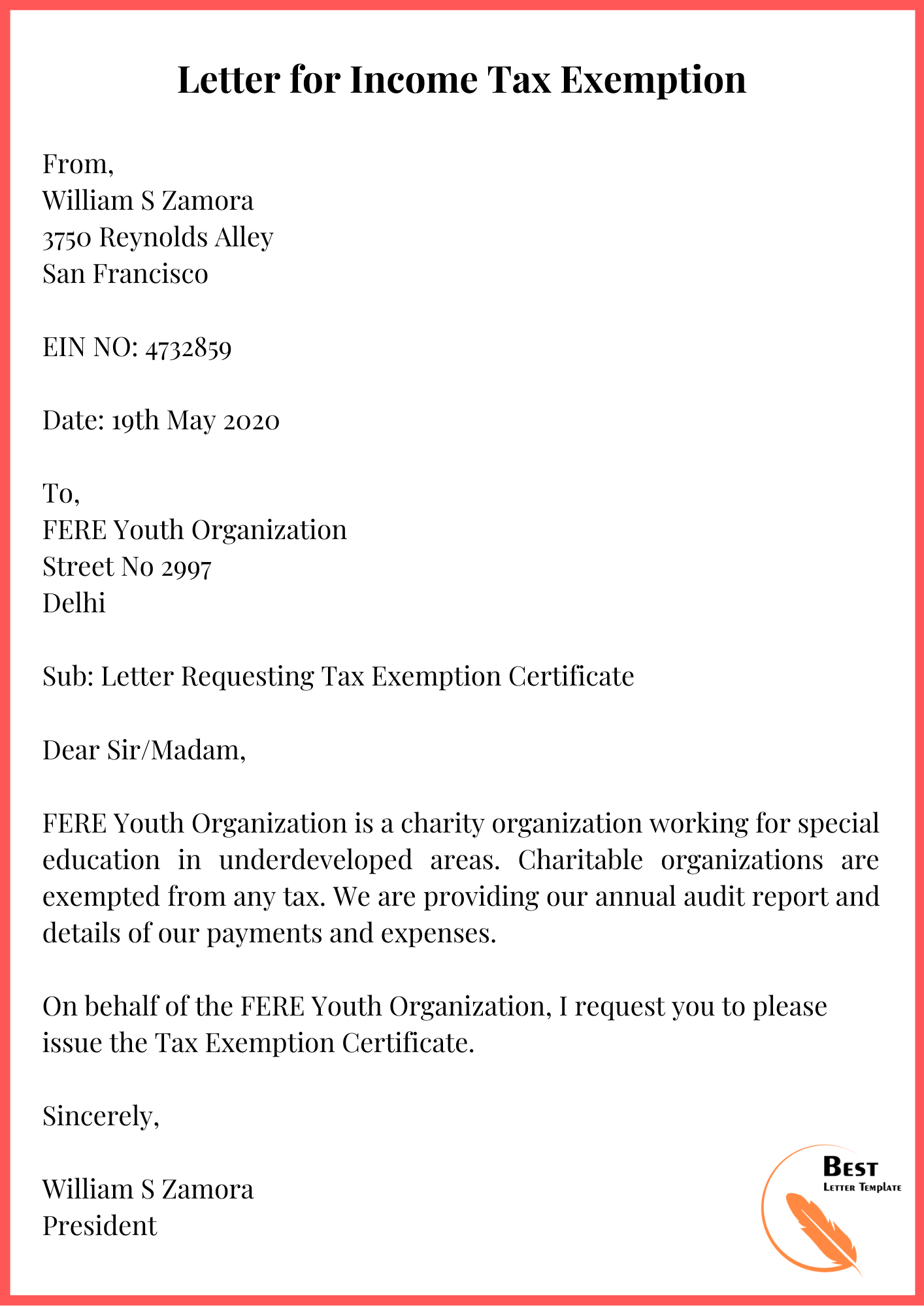

Tax Letter Template Format Sample And Example In PDF Word

https://bestlettertemplate.com/wp-content/uploads/2020/10/Letter-for-Income-Tax-Exemption.png

https://www.livemint.com › money › pers…

Exempt Allowance for salaried people In addition to the two benefits explained above which are available for all the taxpayer whether one is salaried or self employed the tax laws also allow

https://www.forbes.com › advisor › taxe…

How to Claim College Tuition and Fees on Your Taxes If you expect to qualify for education tax deductions or credits for yourself or your dependents you ll need to complete the correct

South Africa s Higher Education Fees Myths And Lies feesmustfall

Income Tax Exemption On Gratuity Eligibility Maximum Limit

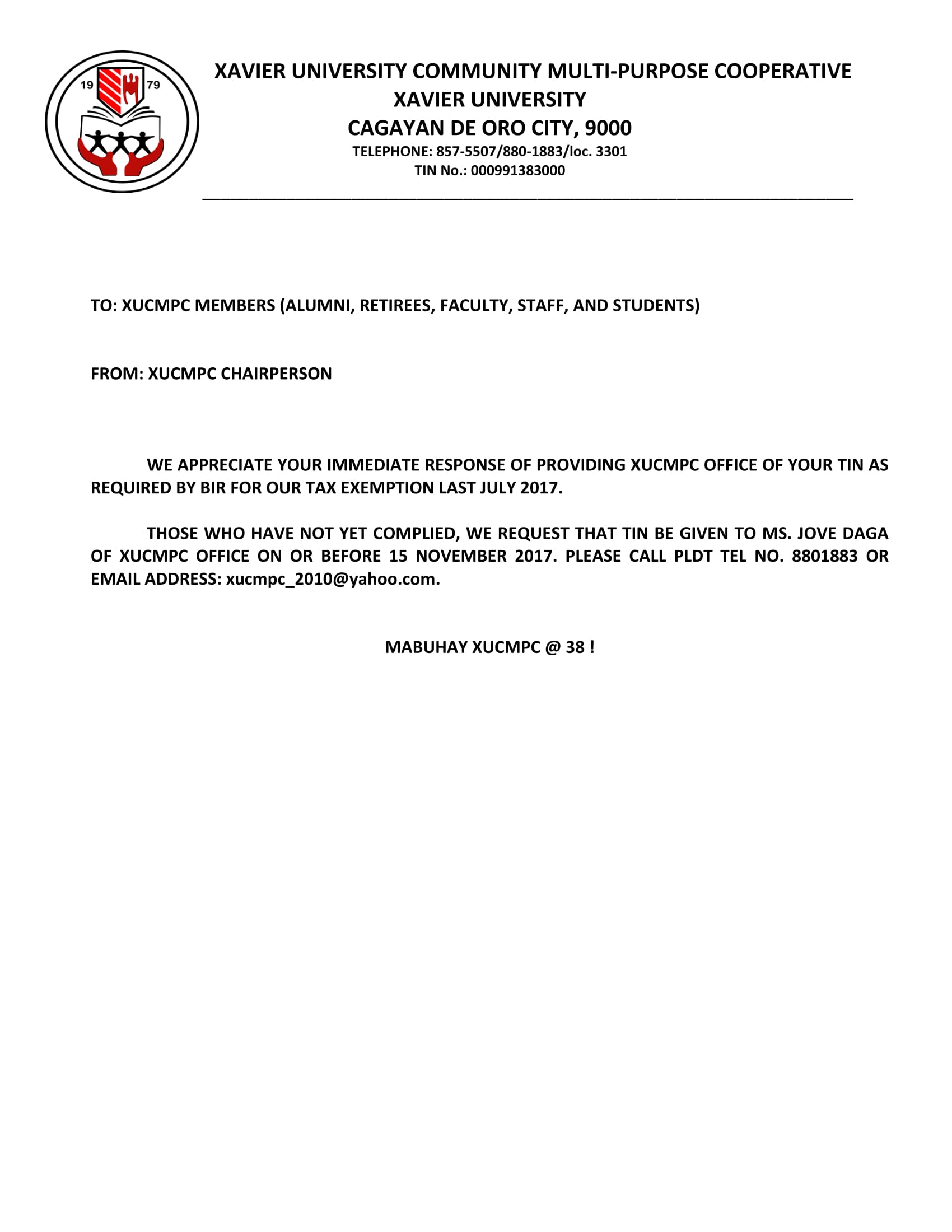

Xavier University Tax Exemption Letter

Income Tax Exemption And Calculation Process Of Gratuity

Letter Of Exemption From School Letter To Principal For Exemption Of

Gratuity Under Income Tax Act All You Need To Know

Gratuity Under Income Tax Act All You Need To Know

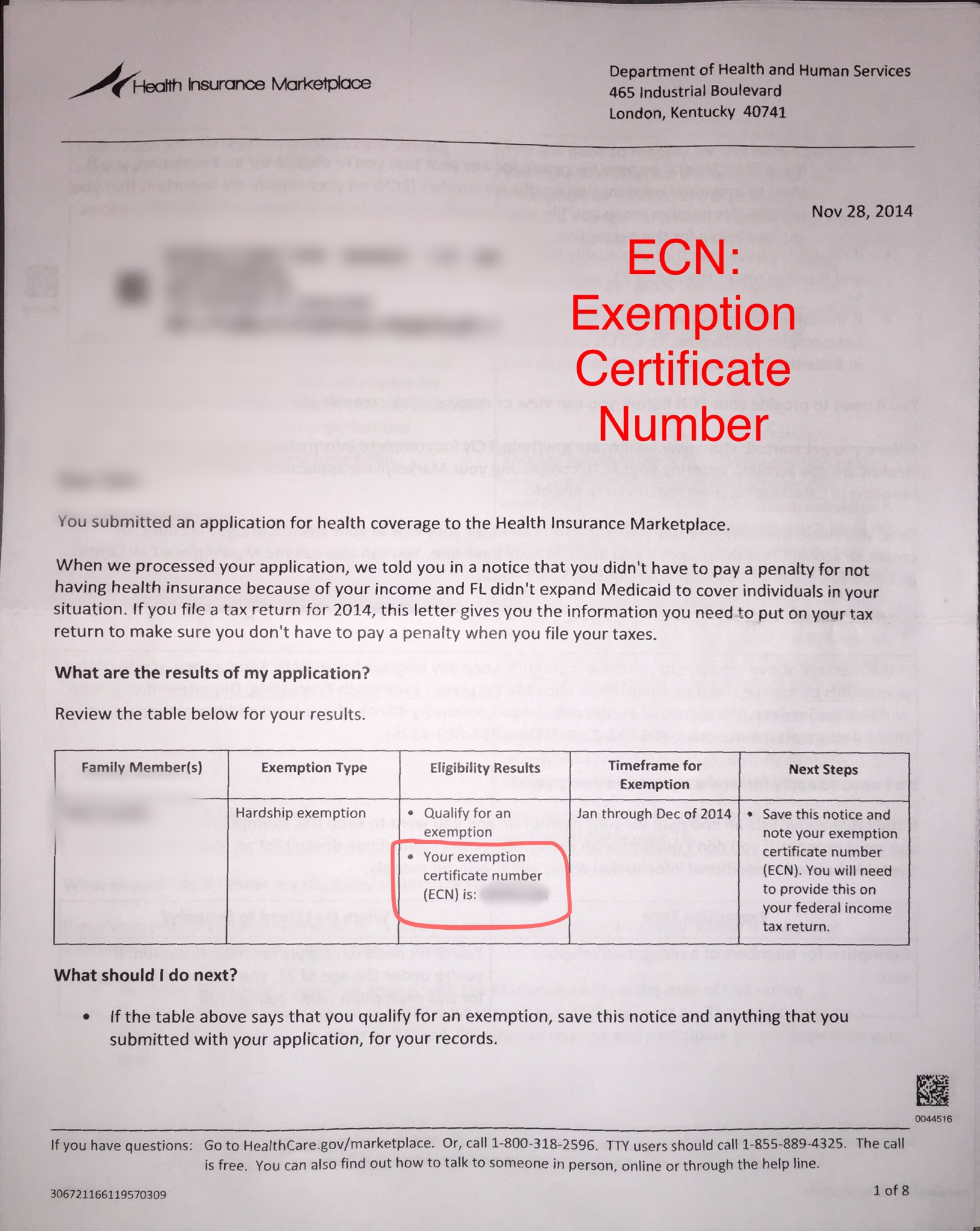

Exemption Certificate Number ECN

Sales Tax Exemption Extension Letter Presbytery Of Philadelphia

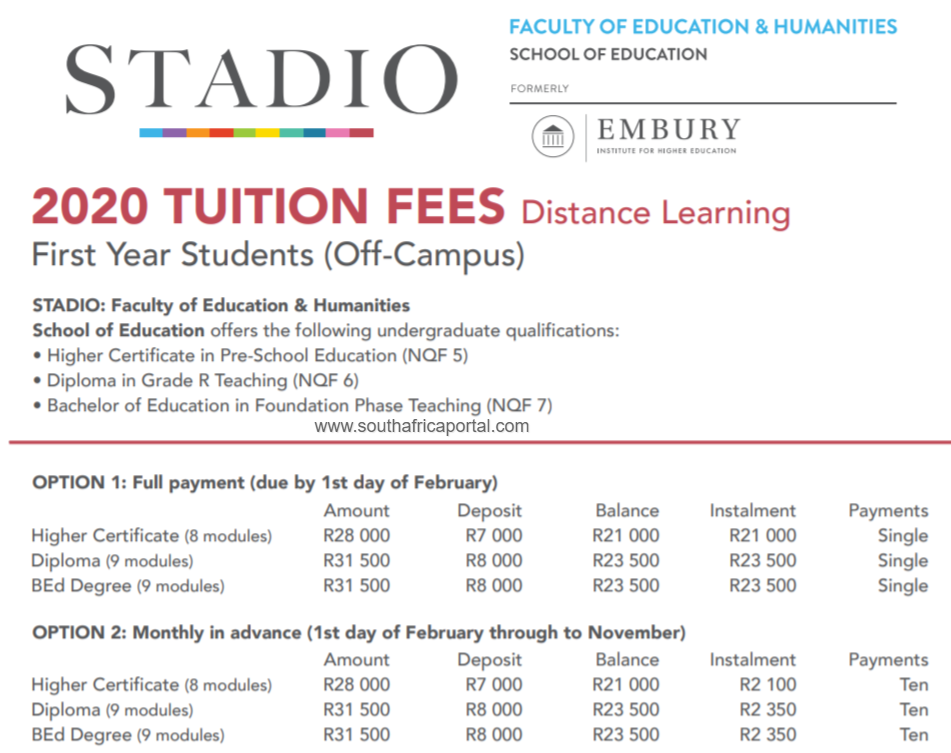

Embury College Tuition Fees Structure 2022 South Africa Portal

Income Tax Exemption On Higher Education Fees - The revenues or income of NSNP educational institutions not used actually directly and exclusively for educational purposes shall be subject to 25 regular corporate