Income Tax Hra Rebate Rules Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your

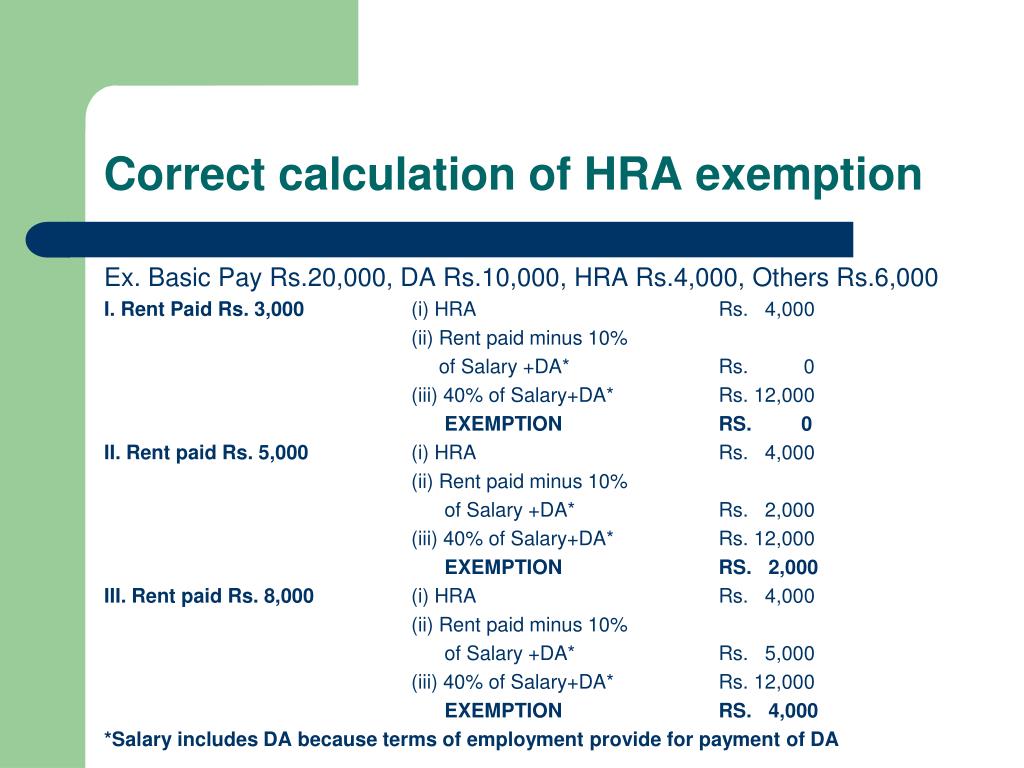

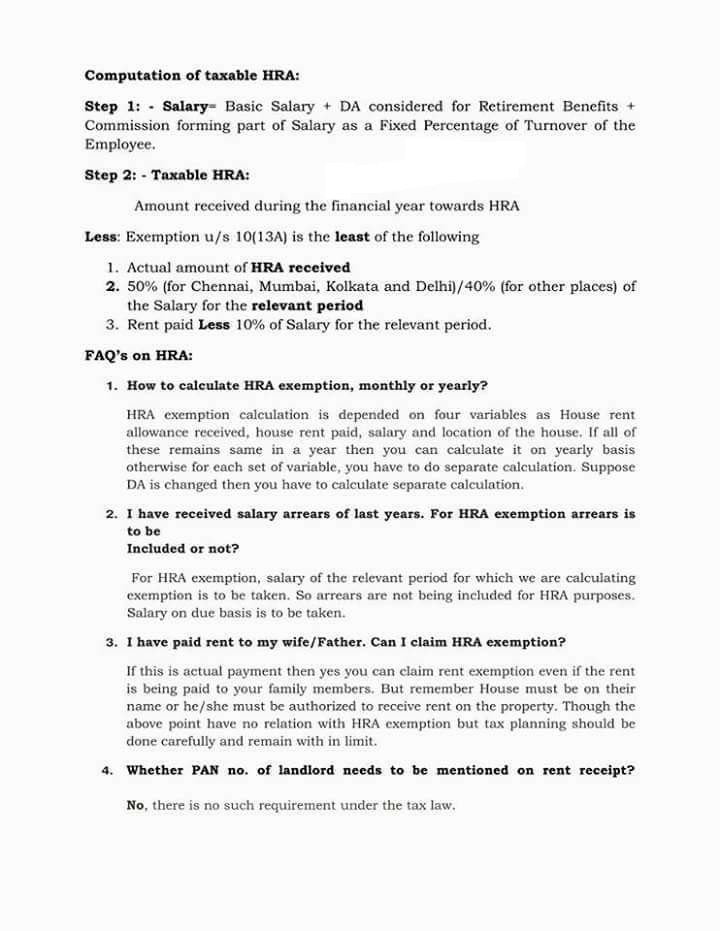

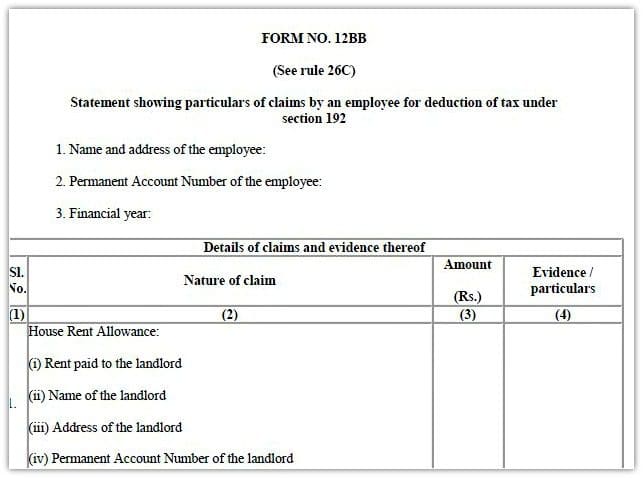

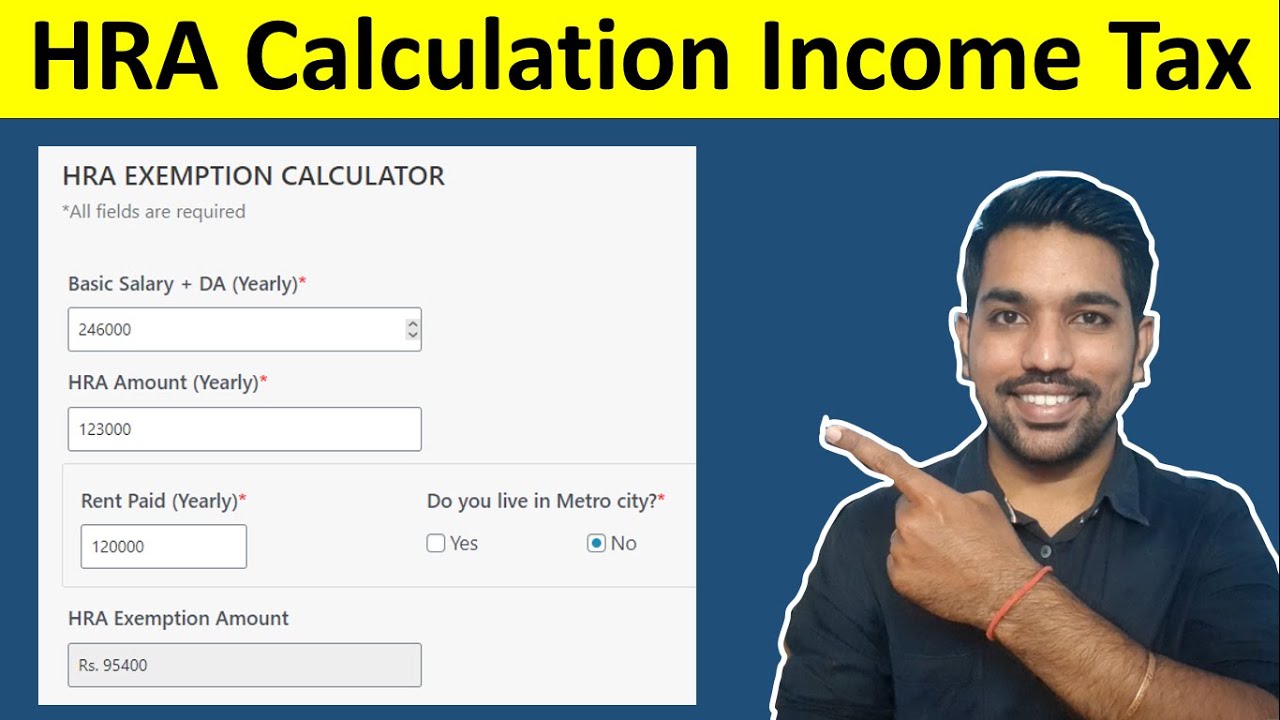

Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under Web HOUSE RENT ALLOWANCE Basic salary DA forming part of salary Commission as of turnover achieved by the employee HRA Received Rent Paid Tick if residing in metro

Income Tax Hra Rebate Rules

Income Tax Hra Rebate Rules

https://image2.slideserve.com/4632901/correct-calculation-of-hra-exemption-l.jpg

Income Tax HRA

https://cdn.zeebiz.com/hindi/sites/default/files/inline-images/HRA.jpg

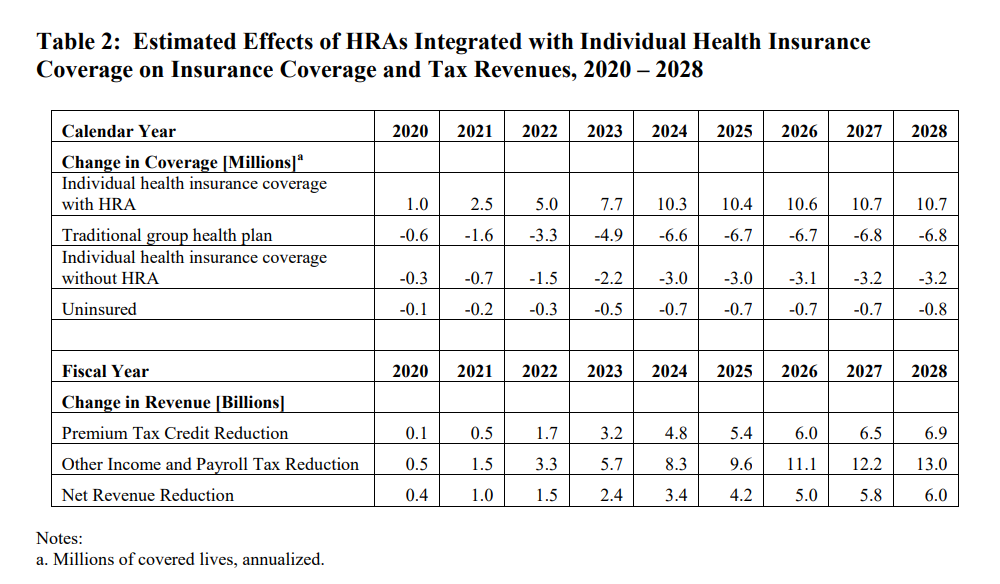

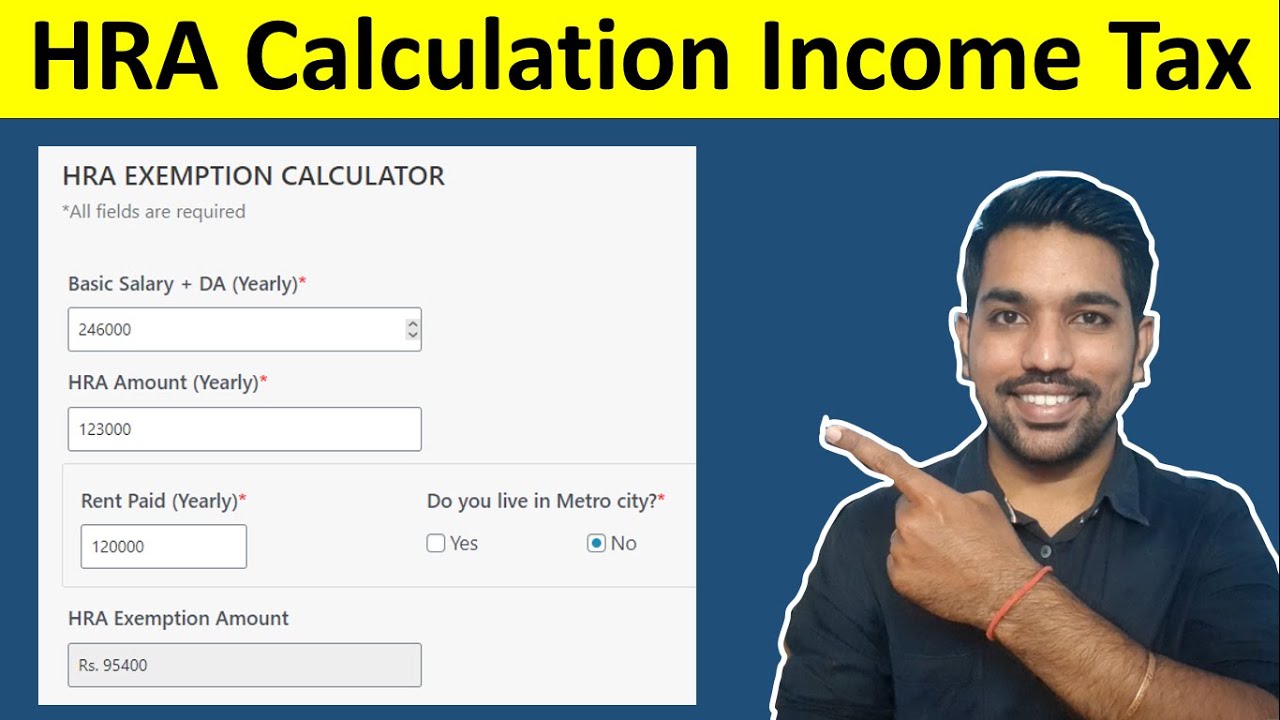

Sizing Up The Proposed HRA Rule AAF

https://www.americanactionforum.org/wp-content/uploads/2018/10/HRA.png

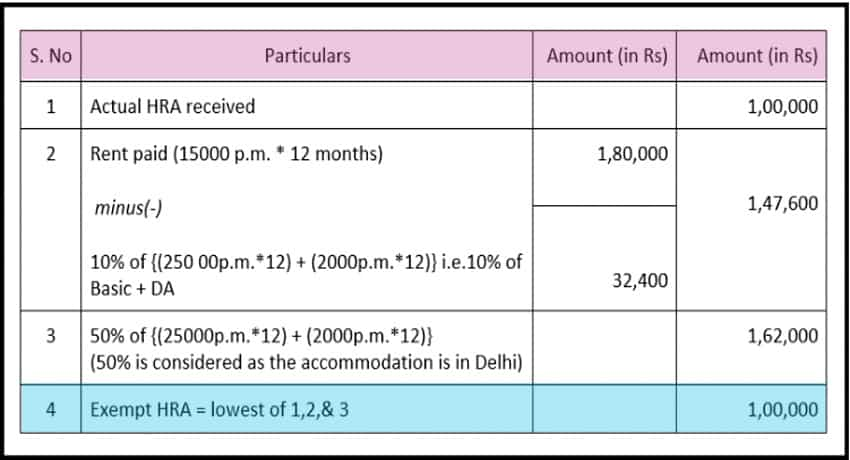

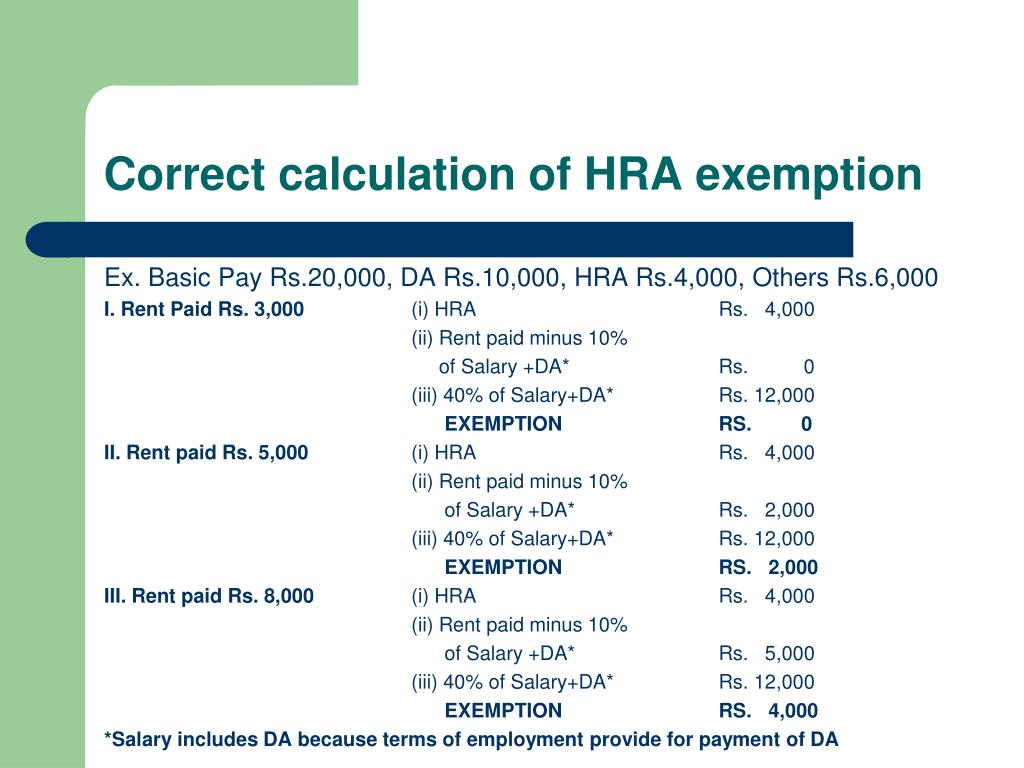

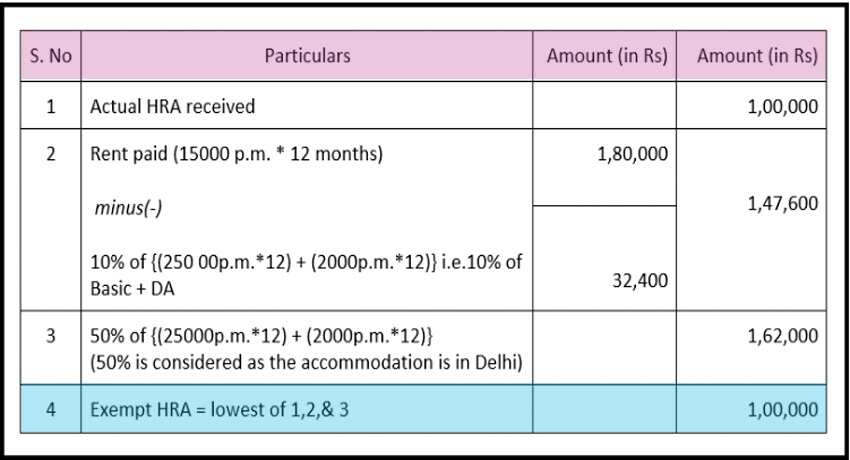

Web 28 juin 2018 nbsp 0183 32 1 Actual House Rent Allowance HRA received from your employer 2 Actual house rent paid by you minus 10 of your basic Web 22 avr 2022 nbsp 0183 32 Listed below are the conditions All you want to know about rent receipt amp its role in saving tax Conditions for claiming HRA rebate under Section 10 13A Key

Web 50 of basic salary Rs 40 000 X 12 X 50 Rs 2 40 000 In this example Rs 1 32 lakh is the least amount among all the options Therefore you will get Rs 1 32 lakh exemption Web 6 janv 2018 nbsp 0183 32 House rent allowance HRA tax benefit is available only to salaried individuals who are planning to opt for old tax regime Further this tax benefit can be

Download Income Tax Hra Rebate Rules

More picture related to Income Tax Hra Rebate Rules

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1068x830.png

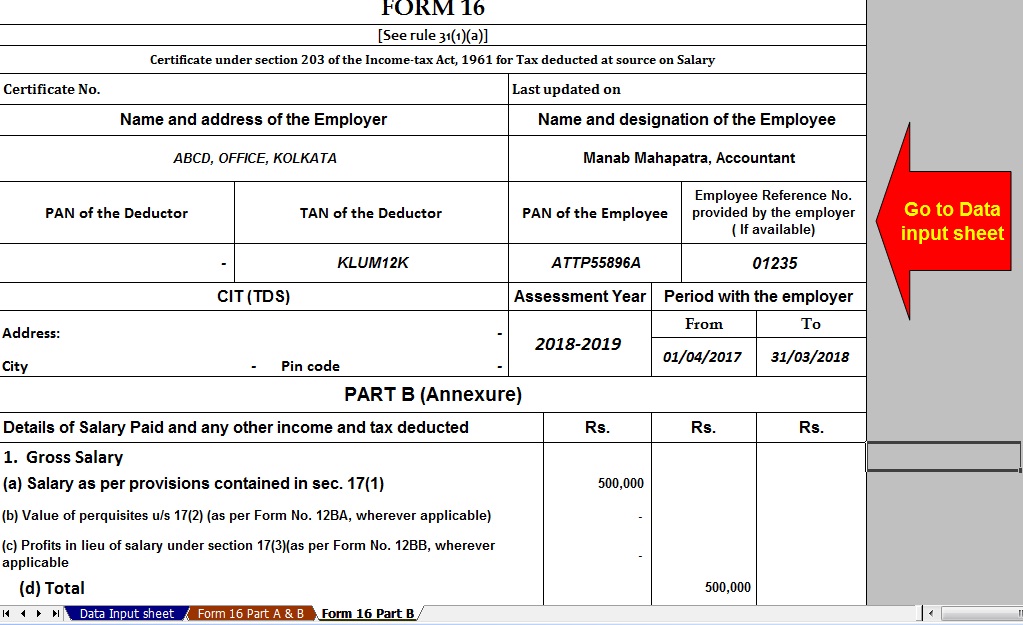

Download Automated Tax Computed Sheet HRA Calculation Arrears

https://4.bp.blogspot.com/-jcXR46JGbOw/WhOAD1L3J8I/AAAAAAAAF4A/ISuIxQnFWx4USLckHZYtmPvfE-NtuKIlwCLcBGAs/s1600/Form%2B16%2BPart%2BB.jpg

House Rent Allowance

https://i1.wp.com/www.hrknowledgecorner.com/wp-content/uploads/2017/04/HRA-1-1.jpg?fit=1233%2C536

Web 26 janv 2022 nbsp 0183 32 The income tax rules allow deduction of the salary component received as HRA from the taxable salary income However HRA is fully taxable for an employee not living in a rented house Web 10 mai 2021 nbsp 0183 32 The annual limitation on deductions under Sec 223 b 2 A for an HSA with self only coverage is 3 650 an increase of 50 over 2021 the corresponding

Web HRA Exemption Rules amp Tax Deductions The following rules are applicable for HRA claims HRA can t be more than 50 of your basic salary The full amount cannot be Web 19 avr 2021 nbsp 0183 32 April 19 2021 11 53 IST Tax benefits for home loans are available for interest payment as well as for repayment of the principal amount I get many questions

Rules Get Tighter For Claiming HRA LTA Standard News Rules Law

https://i.pinimg.com/originals/c6/c3/1c/c6c31c4d938d4e89d3e25b53a89e6a64.jpg

Income Tax Department Puts House Rental Allowance HRA Exemption Rules

https://i.pinimg.com/736x/4b/35/2c/4b352c55ac0959e4b980ff968f94f4f0--hra-income-tax.jpg

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

Web 22 sept 2022 nbsp 0183 32 Tax Benefits of HRA HRA deduction under Section 10 13A of the ITA has the following benefits The biggest advantage of the HRA rebate is that it reduces your

https://taxguru.in/income-tax/house-rent-all…

Web 5 mai 2020 nbsp 0183 32 1 CONDITIONS FOR CLAIMING HRA EXEMPTION Salaried Individual only can claim HRA Self employed cannot claim HRA However Self Employed can also claim deduction of Rent paid under

Salaried Person Here s All You Need To Know About HRA Tax Deduction

Rules Get Tighter For Claiming HRA LTA Standard News Rules Law

HRA Income Tax Deduction Rules Teacher Haryana Education News

Charity Income Tax Exemption Calculate HRA Exemption For Income Tax

Form 12BB New Form To Claim Income Tax Benefits Rebate

HRA Calculation In Income Tax House Rent Allowance Calculator

HRA Calculation In Income Tax House Rent Allowance Calculator

HRA Calculation Everything You Need To Know

A Timeline Of The Medicare Rebate Rule Budget Gimmick Foundation

How To Claim HRA Allowance House Rent Allowance Exemption

Income Tax Hra Rebate Rules - Web 50 of basic salary Rs 40 000 X 12 X 50 Rs 2 40 000 In this example Rs 1 32 lakh is the least amount among all the options Therefore you will get Rs 1 32 lakh exemption