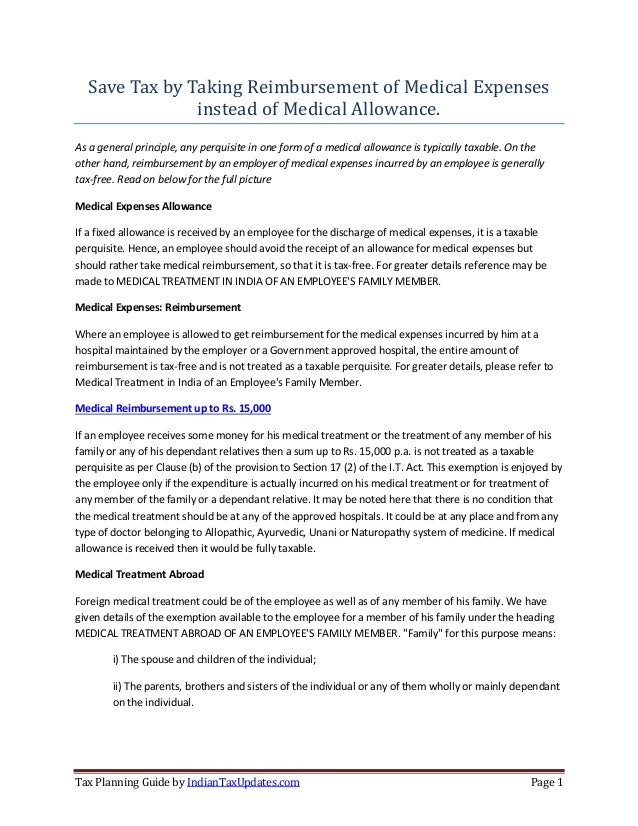

Income Tax Medical Bills Exemption Under Section 17 2 Web 12 Juni 2020 nbsp 0183 32 This is dealt in section 17 2 of the Income Tax Act as perquisite The whole amount of expenses incurred by the employer will be allowable expenditure to such employer under Income Tax Act In case

Web 20 Jan 2015 nbsp 0183 32 Brief facts of the case are that The assessee received a sum of Rs 90 090 towards reimbursement of medical expenses from the company M s Bajaj Consultants Web 15 M 228 rz 2016 nbsp 0183 32 Any amount exceeding the medical allowance is not exempt from tax and can be taxed at the appropriate rate according to the employee s tax bracket As far as taxation is concerned it must be

Income Tax Medical Bills Exemption Under Section 17 2

Income Tax Medical Bills Exemption Under Section 17 2

https://i.ytimg.com/vi/6FZkdampLz0/maxresdefault.jpg

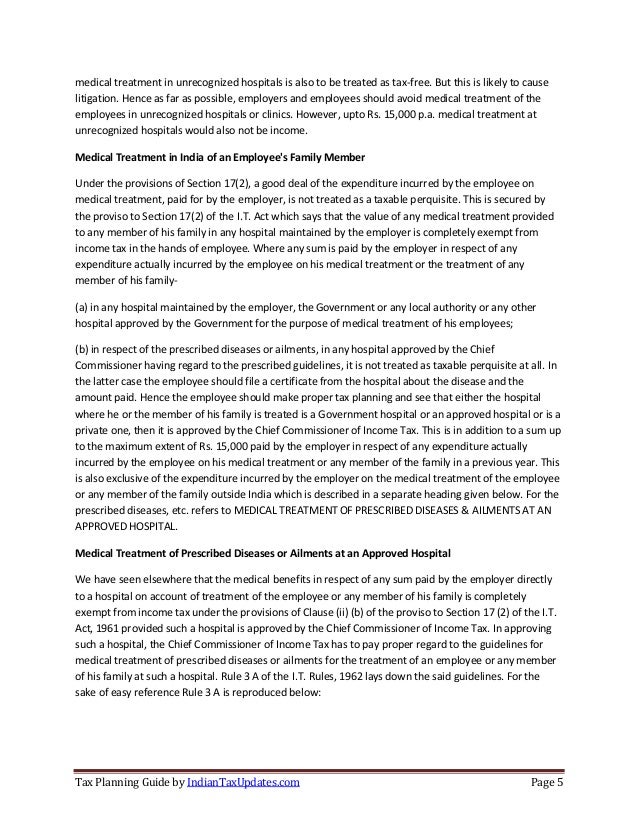

Medical Facilities Income Tax Act Proviso To Section 17 2

https://commerceachiever.com/wp-content/uploads/2022/07/2-2.png

Deductions For Medical Treatment Under Income Tax

https://www.consultease.com/wp-content/uploads/2020/11/Capture-100.png

Web 97 Zeilen nbsp 0183 32 Proviso to section 17 2 Medical facilities outside India Any expenditure incurred or reimbursed by the employer for medical treatment of the employee or his family Web Section 17 2 of the Income tax Act 1961 gives an inclusive definition of perquisite As per this section perquisite includes i the value of rent free accommodation provided

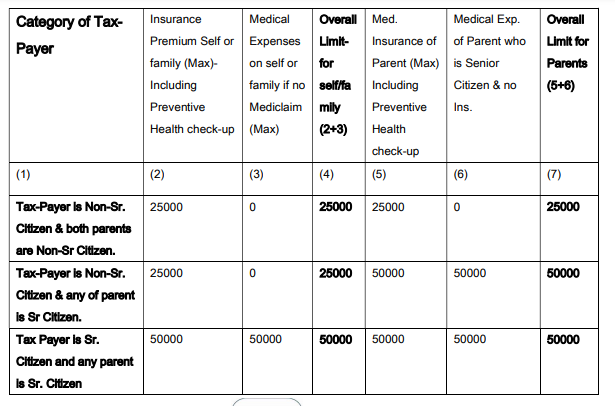

Web Apart from medical reimbursement worth Rs 15 000 being tax free the following prerequisites are considered tax free under Section 17 2 Bills incurred for medical Web 1 In granting approval to any hospital other than a hospital for Indian system of medicine and homoeopathic treatment for the purposes of sub clause b of clause ii of the

Download Income Tax Medical Bills Exemption Under Section 17 2

More picture related to Income Tax Medical Bills Exemption Under Section 17 2

Section 17 2 Of Income Tax Act Learn About Perquisites And Its

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/income-tax/Section.jpg

- Fully Exemped Perquisites - Category C.jpg)

Income From Salaries Section 15 To 17 Graphical Table Presentation

https://incometaxmanagement.com/Images/Graphical-ITAX/Salary/6-Section 17(2) - Fully Exemped Perquisites - Category C.jpg

Tax Saving On Medical Reibursement Under Section 17 2

https://image.slidesharecdn.com/taxsavingonmedicalreibursementundersection172-130417020502-phpapp02/95/tax-saving-on-medical-reibursement-under-section-172-1-638.jpg?cb=1366164444

Web 6 M 228 rz 2019 nbsp 0183 32 While Medical Reimbursement on any disease was tax free up to Rs 15 000 u s 17 2 of the Income Tax Act till last year Medical Allowance was fully taxable Web The second scenario is known as medical reimbursement Unlike allowance medical reimbursements are exempt from tax to a certain extent Currently reimbursements up

Web Perquisite is defined in the section 17 2 of the Income tax Act as including i Value of rent free accommodation provided by the employer ii Value of any concession in the Web Any other expenditure incurred or reimbursed by the employer for providing medical facility in India is chargeable to tax exemption of Rs 15 000 was available for such

Income Tax Act For Medical Bills Under Section 80D

https://www.legalwindow.in/wp-content/uploads/Deductions-available-under-Section-80D-of-the-Income-Tax-Act-for-Medical-Bills-of-Senior-Citizen-Parents-1-1024x538.png

Tax Saving On Medical Reibursement Under Section 17 2

https://image.slidesharecdn.com/taxsavingonmedicalreibursementundersection172-130417020502-phpapp02/95/tax-saving-on-medical-reibursement-under-section-172-5-638.jpg?cb=1366164444

https://taxguru.in/income-tax/taxability-…

Web 12 Juni 2020 nbsp 0183 32 This is dealt in section 17 2 of the Income Tax Act as perquisite The whole amount of expenses incurred by the employer will be allowable expenditure to such employer under Income Tax Act In case

https://taxguru.in/income-tax/reimbursement-medical-expense-perq…

Web 20 Jan 2015 nbsp 0183 32 Brief facts of the case are that The assessee received a sum of Rs 90 090 towards reimbursement of medical expenses from the company M s Bajaj Consultants

Income Tax Medical Bills Exemption Under Section 17 2 Compilance India

Income Tax Act For Medical Bills Under Section 80D

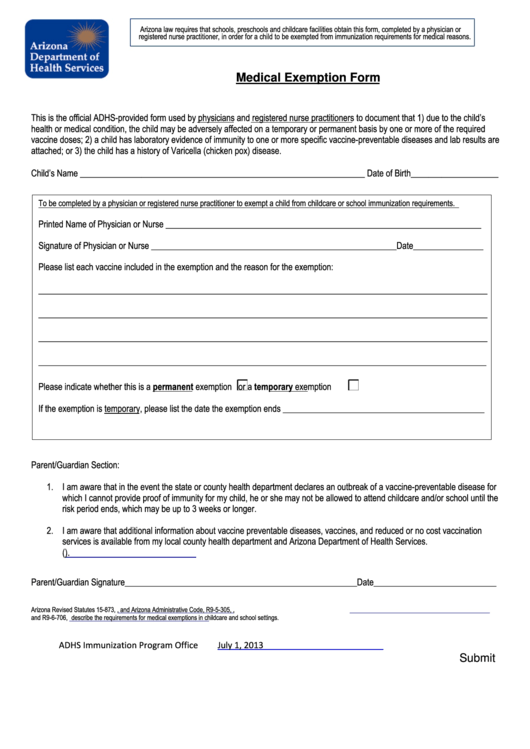

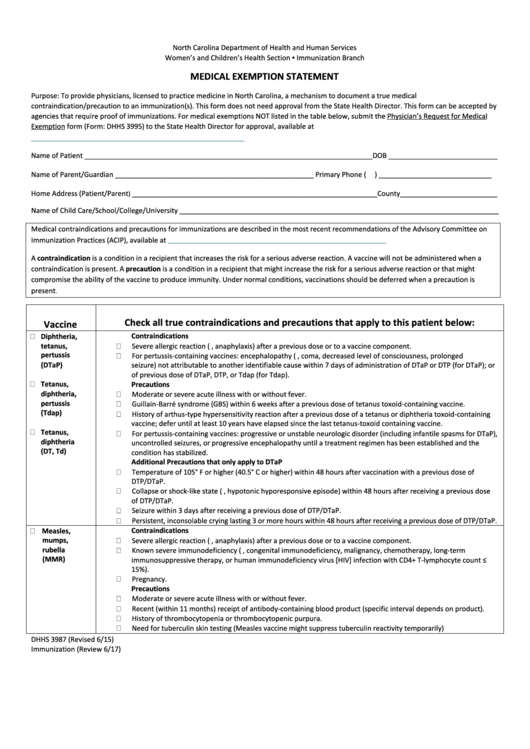

Fillable Medical Exemption Form Printable Pdf Download

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

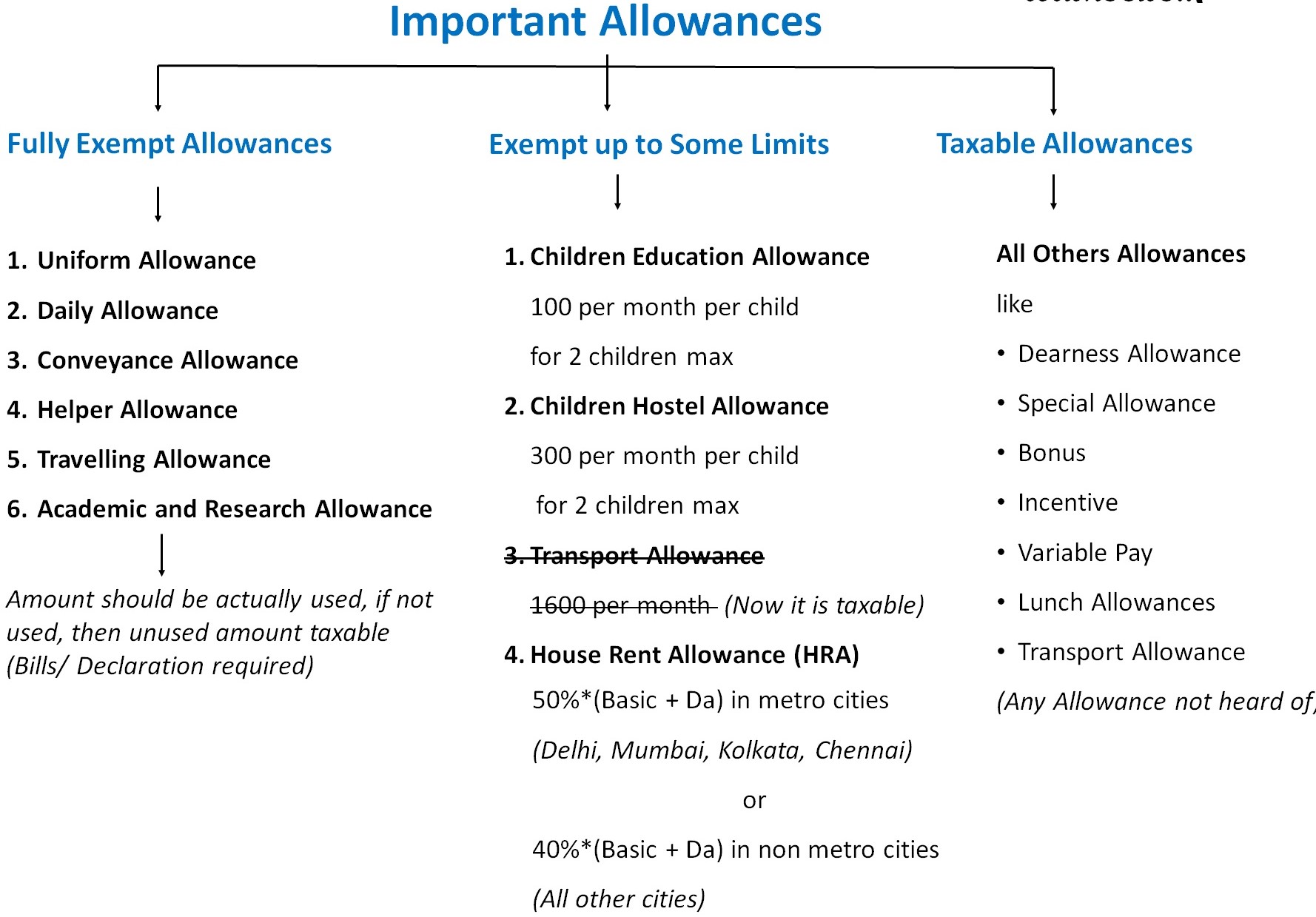

All About Allowances Income Tax Exemption CA Rajput Jain

Deduction 80D Upload Form 16

Deduction 80D Upload Form 16

Income Tax Exemption Under 80DDB With Diseases List SAG Infotech

Tax Exemption Of Health Insurance U s 80 D F Y 2020 21 With Automated

Medical Exemption Statement Printable Pdf Download

Income Tax Medical Bills Exemption Under Section 17 2 - Web Section 17 2 of the Income tax Act 1961 gives an inclusive definition of perquisite As per this section perquisite includes i the value of rent free accommodation provided