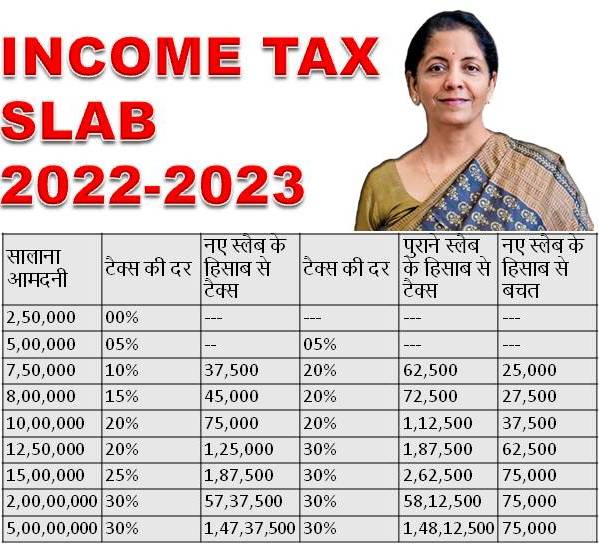

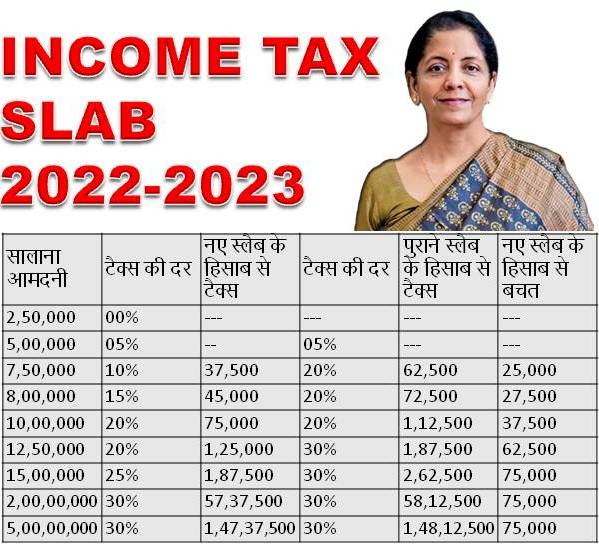

Income Tax Rate For Ay 2022 23 Stay up to date with the latest Income Tax Slab Rates for the financial year 2022 23 with this comprehensive guide from Tax2win Understand the new tax rates exemptions deductions and the impact

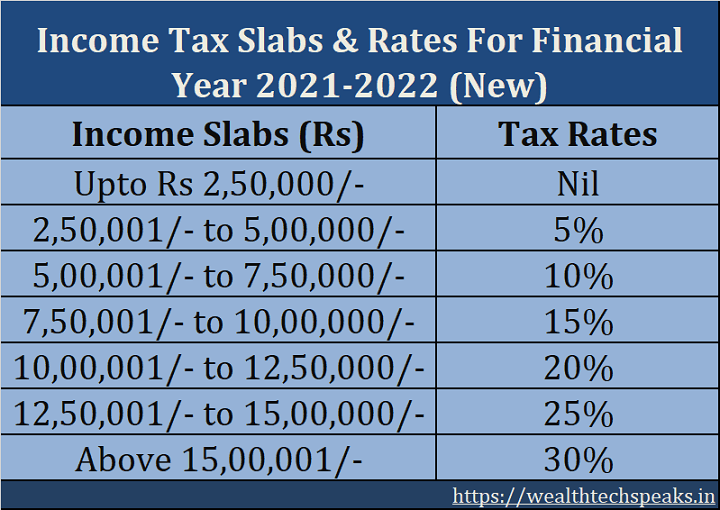

A new tax regime has been established by the insertion of section 115 BAC in the Income Tax Act 1961 vide the Finance Act 2020 Individuals and HUFs can choose between Latest Income Tax Slab Tax Rates in India for FY 2023 24 AY 2024 25 Check out the latest income tax slabs and rates as per the New tax regime and Old tax

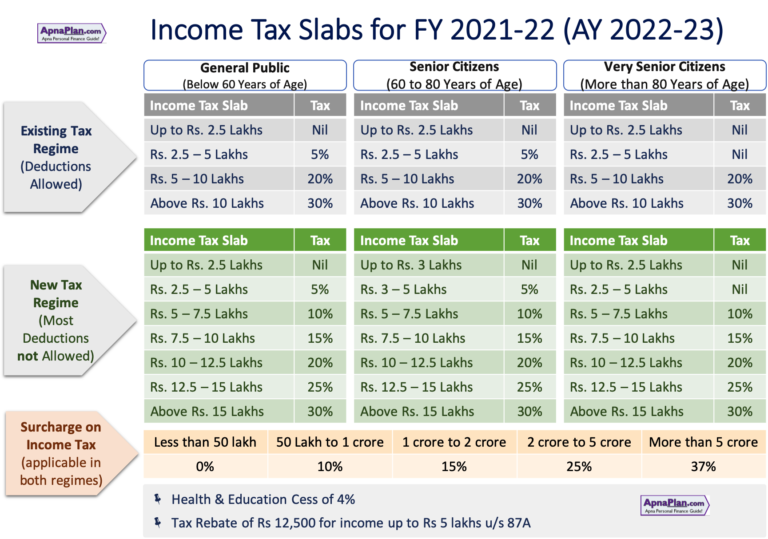

Income Tax Rate For Ay 2022 23

Income Tax Rate For Ay 2022 23

https://www.wecanspirit.com/wp-content/uploads/2022/02/Income-Tax-Slab-for-AY-2022-23.jpg

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

https://cacube.in/wp-content/uploads/2018/08/pexels-photo-6863259-1536x1024.jpeg

Income Tax Slabs For FY 2022 23 AY 2023 24 FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/income-tax-slabs-india-2022-23-1024x576.webp

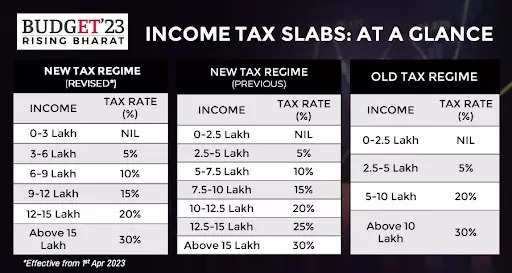

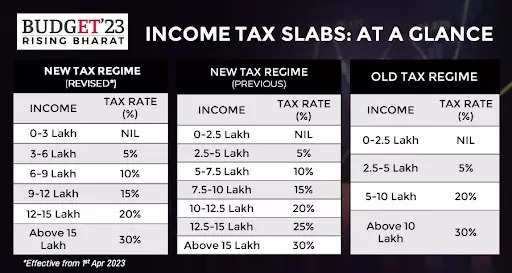

Advisory Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct position prevailing law before relying upon Tax Slabs for AY 2024 25 The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the

New tax regime also known as alternative tax regime is optional for the Assessment Year 2023 24 An individual or HUF has to exercise the option under Section 115BAC 5 to E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries

Download Income Tax Rate For Ay 2022 23

More picture related to Income Tax Rate For Ay 2022 23

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiuBLR2sr4zdq6frnOvYmY4TMuEbMynEFSiCiVO9-h9YlyZVcz20Rnk1V34S46-X5dWuSxwpF5eEVHb9f_Y-PWQSvT6D5tOGCeOjc5Ffmu9hxfpK9DcrJcDq3faqy3aR4w7eexxY8DMrm13bqa9-CohjejrV7vWzHLgplcUb6NtDbK0V_2k8wdyiQ9e/s1600/Income Tax FY 2022-23 AY 2023-24 Income Tax Act - IT Slab Rates Income Tax Official Circular.png

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax

https://i.ytimg.com/vi/Ib9IdrMgw84/maxresdefault.jpg

Income Tax Calculator Fy 2021 22 Ay 2022 23 Excel Download 2023

https://cdn.statically.io/img/i0.wp.com/res.cloudinary.com/jerrick/image/upload/q_auto,w_720/6037201906fa70001cdd3738.png?resize=160,120

The taxpayers can choose between the old regime which includes various deductions and exemptions and the new regime which offers lower tax rates for those who are willing to forgo exemptions and Understanding income tax rates is essential for financial planning be it for an individual a Hindu Undivided Family HUF a partnership firm or a company This

Income Tax Rates applicable for Individuals Hindu Undivided Family HUF Association of Persons AOP and Body of Individuals BOI in India is as under Learn about the income tax return filing process for the assessment year 2022 23 Understand the slab rates and due dates as well as the relevant ITR forms

Tax Rates For Assessment Year 2022 23 Tax Hot Sex Picture

https://wealthtechspeaks.in/wp-content/uploads/2022/03/Income-Tax-Calculation-Financial-Year-2022-23.png

Latest Income Tax Slab Rates For FY 2021 22 AY 2022 23 If You Are

https://1.bp.blogspot.com/-yM7MY4B2SMI/YBfAzHLhY8I/AAAAAAAADSw/D-Xb_4wwy9Ip7PuNNaBnb23mAT5xoVitQCLcBGAsYHQ/w640-h526/images%2B%252816%2529.jpeg

https://tax2win.in/guide/income-tax-slab-rate…

Stay up to date with the latest Income Tax Slab Rates for the financial year 2022 23 with this comprehensive guide from Tax2win Understand the new tax rates exemptions deductions and the impact

https://www.referencer.in/Income_Tax/Income_Tax...

A new tax regime has been established by the insertion of section 115 BAC in the Income Tax Act 1961 vide the Finance Act 2020 Individuals and HUFs can choose between

Current Income Tax Rates For Fy 2021 22 Ay 2022 23 Sag Infotech

Tax Rates For Assessment Year 2022 23 Tax Hot Sex Picture

Income Tax 2022 23 Slab Bed Frames Ideas

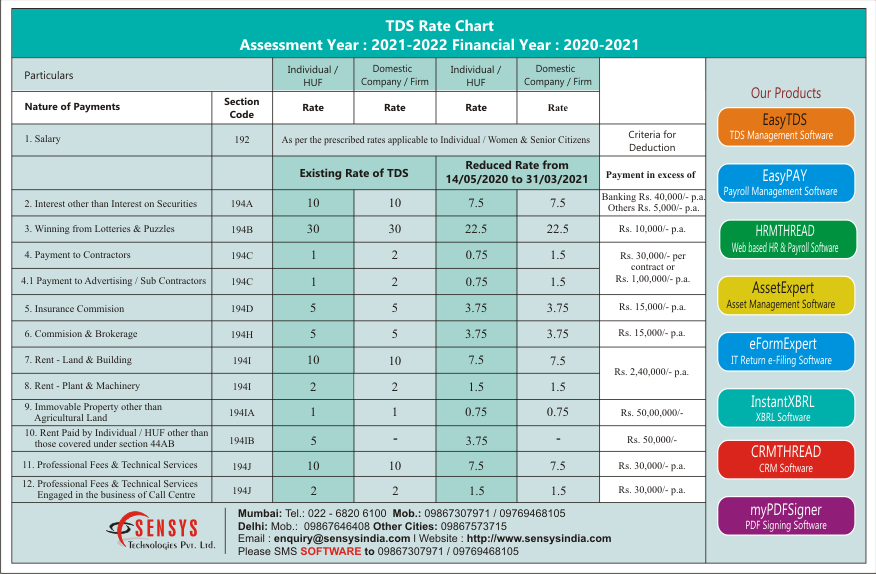

TDS Rate Chart FY 2020 2021 AY 2021 2022 Sensys Blog

Income Tax Slab Fy 2022 23 Ay 2023 24 Old New Regime Home Interior Design

Income Tax Slab 2023 New Income Tax Slab Rates For FY 2023 24 AY 2024

Income Tax Slab 2023 New Income Tax Slab Rates For FY 2023 24 AY 2024

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

Income Tax Rates Slab For FY 2023 24 AY 2024 25 Ebizfiling

Download Income Tax Calculator Fy 2021 22 Ay 2022 23 ZOHAL

Income Tax Rate For Ay 2022 23 - E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries