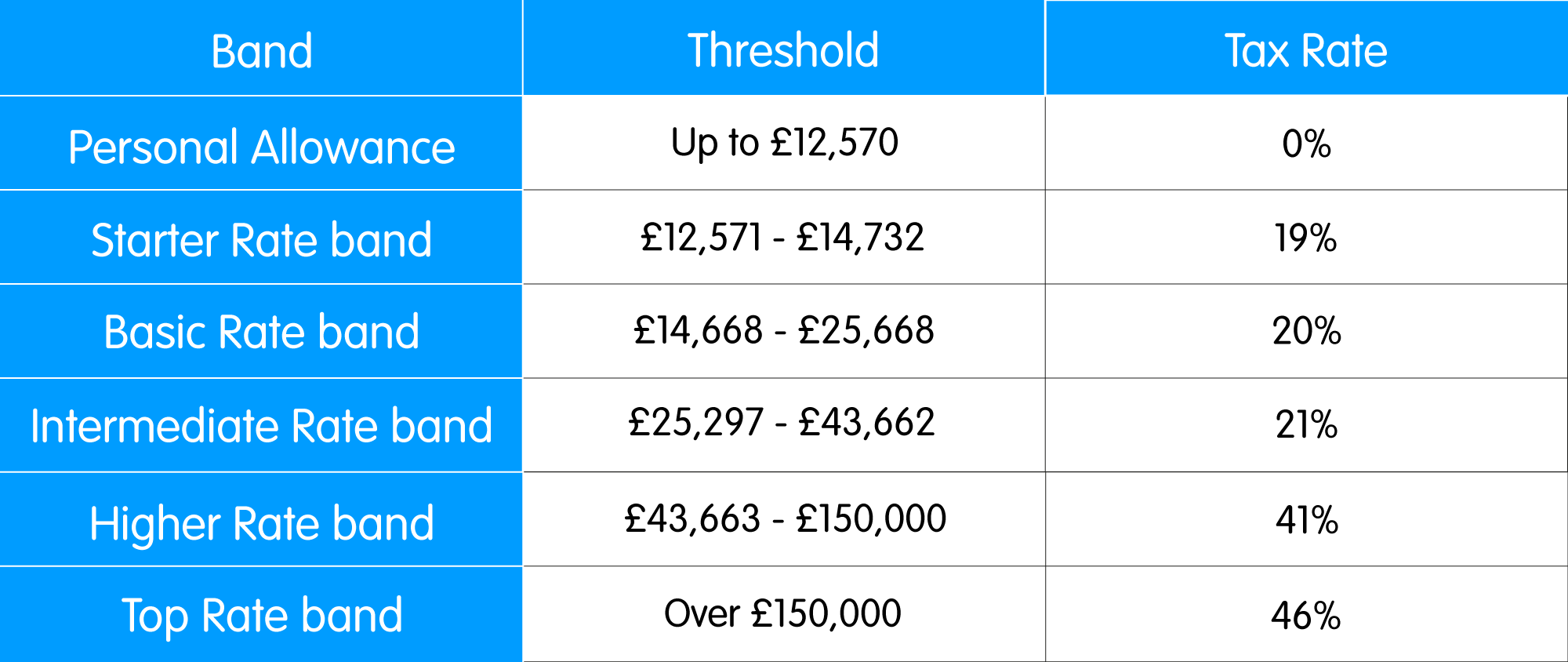

Income Tax Rates 2022 23 Tax rates and bands Tax is paid on the amount of taxable income remaining after the Personal Allowance has been deducted The following rates are for the 2024 to 2025

Tax thresholds rates and codes The amount of Income Tax you deduct from your employees depends on their tax code and how much of their taxable income is above their Income tax on earned income is charged at three rates the basic rate the higher rate and the additional rate For 2022 23 these three rates are 20 40 and 45 respectively Tax is charged on taxable income at the

Income Tax Rates 2022 23

Income Tax Rates 2022 23

https://1.bp.blogspot.com/-uPBCTtQ-r9Y/YJ4s67woahI/AAAAAAAAQeY/VxrmlcSHAUgOtrrRsCsPU0OmnPxbGUwCgCNcBGAsYHQ/w640-h310/Untitled.jpg

The Best Us Tax Rates 2022 References Finance News

https://i2.wp.com/static.twentyoverten.com/5c98ec659c4ce5673c7afaf6/OLwl1xx7miB/2020-Tax-Brackets.jpg

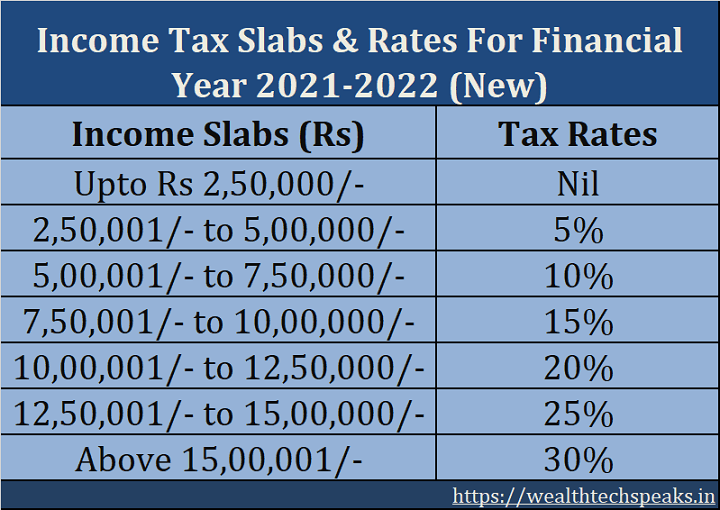

Income Tax Rates For Fy 2021 22 Ay 2022 23 Fy 2022 23 Ay 2023 24 Hot

https://wealthtechspeaks.in/wp-content/uploads/2020/07/New-Income-Tax-Slab-Rates-FY-2021-22.png

2022 2023 Tax Rates and Allowances Click to select a tax section Income Tax Use our Tax Calculator to Calculate Income Tax Tax Free Personal Allowance the amount of gross income you can earn before you are liable to paying The 2022 23 tax calculator provides a full payroll salary and tax calculations for the 2022 23 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more

Profits 1 500 000 or over normally payable in 7th 10th 13th and 16th months after start of the accounting period Profits 20 000 000 or over normally payable in 3rd 6th 9th and 12th For 2022 23 the Scottish Government has set five rates of income tax the starter rate of 19 the basic rate of 20 the intermediate rate of 21 the higher rate of 41 and the top rate of

Download Income Tax Rates 2022 23

More picture related to Income Tax Rates 2022 23

Income Tax Slabs For FY 2022 23 AY 2023 24 FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/income-tax-slabs-india-2022-23-1024x576.webp

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What s The Difference

https://www.investopedia.com/thmb/9xFmEb6FVlX0hIqe4MC_vVtlHLk=/1355x1142/filters:no_upscale():max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg

Income Tax Rates Slab For FY 2021 22 Or AY 2022 23 Ebizfiling

https://ebizfiling.com/wp-content/uploads/2021/04/Income-Tax-Rate-Slabs.png

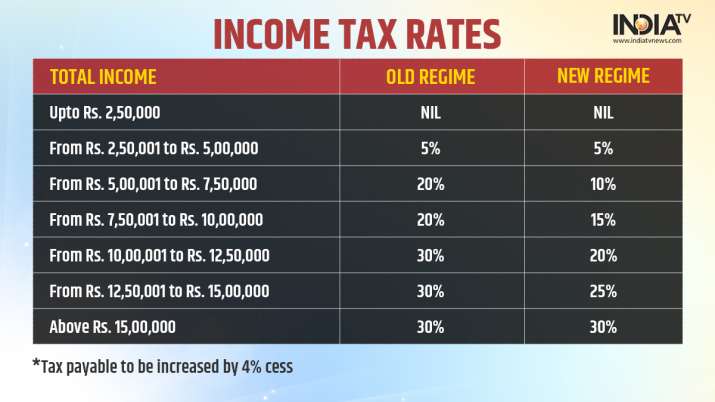

There are seven federal income tax rates in 2022 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent The top marginal income tax rate of 37 percent will hit taxpayers with taxable income Understanding income tax rates is essential for financial planning be it for an individual a Hindu Undivided Family HUF a partnership firm or a company This article aims to provide a comprehensive guide on the income

Rates of Income Tax for FY 2021 22 AY 2022 23 and FY 2022 23 AY 2023 24 applicable to various categories of persons viz Individuals Firms companies etc The rates of income tax for the tax year 2022 23 are therefore A starting rate of 0 applies to savings income where it falls within the first 5 000 of taxable income Personal allowance

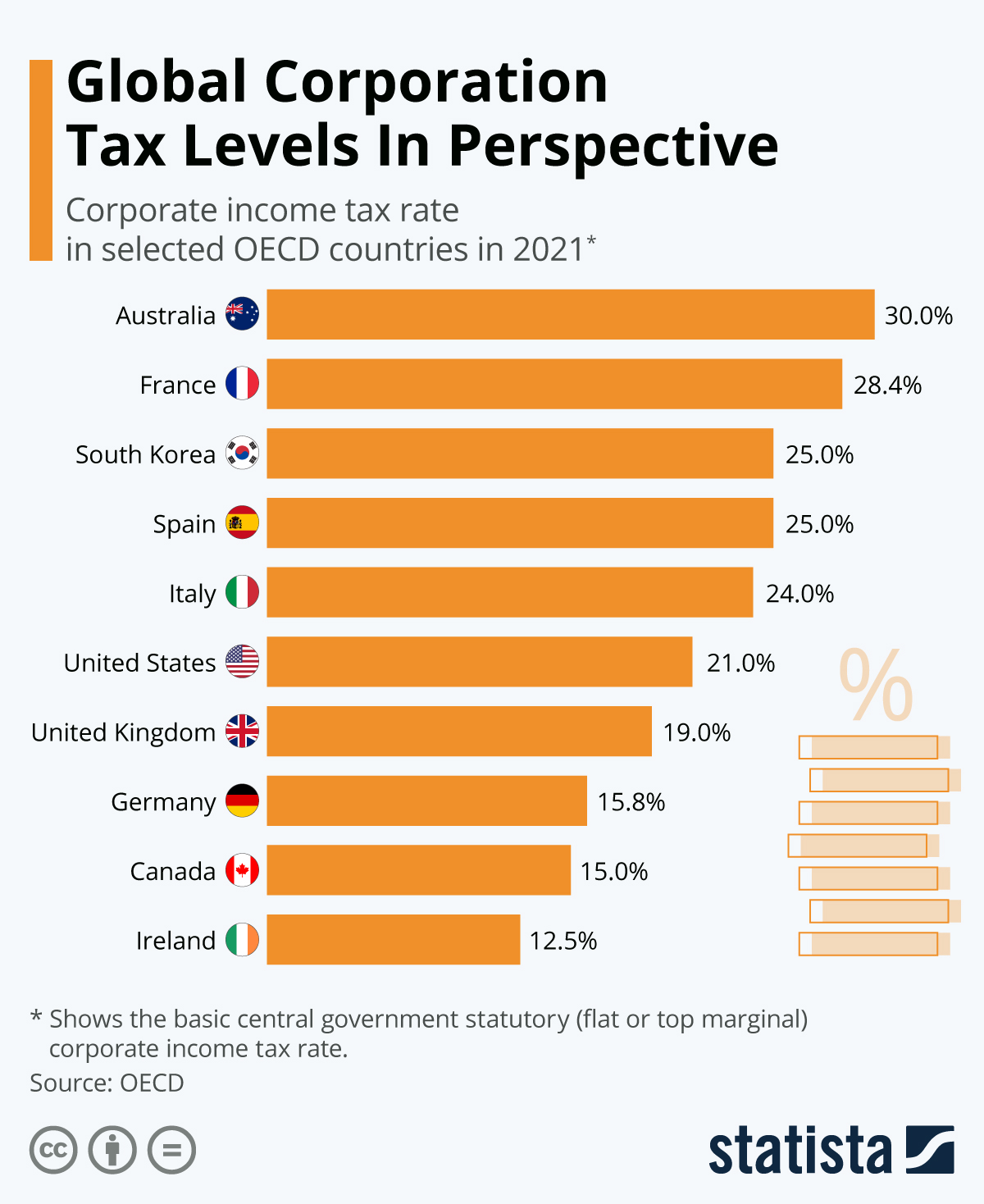

TaxTips ca Business 2022 Corporate Income Tax Rates

https://www.taxtips.ca/smallbusiness/corporatetax/corporate-tax-rates-2022.jpg

Preparing For The Tax Year 2022 23 PayStream

https://static.paystream.co.uk/media/3848/tax-rates-and-thresholds-for-scotland.png

https://www.gov.uk › government › publications › rates...

Tax rates and bands Tax is paid on the amount of taxable income remaining after the Personal Allowance has been deducted The following rates are for the 2024 to 2025

https://www.gov.uk › guidance

Tax thresholds rates and codes The amount of Income Tax you deduct from your employees depends on their tax code and how much of their taxable income is above their

2023 Federal Tax Rates Cra Printable Forms Free Online

TaxTips ca Business 2022 Corporate Income Tax Rates

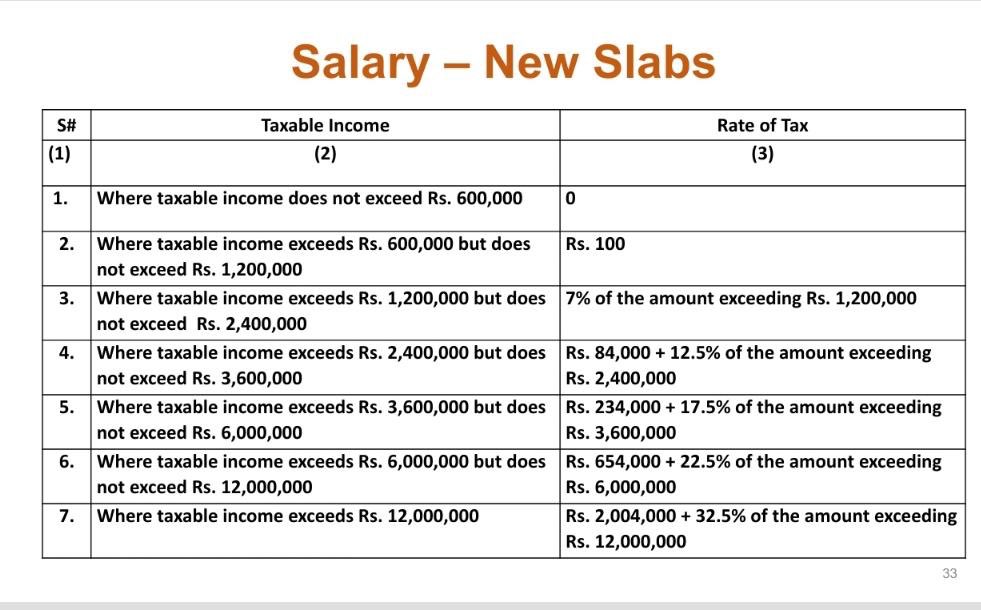

Pakistan Budget 2022 23 New Slabs For Taxable Income

Corporate Tax Revenues Are Irrelevant The Sounding Line

Federal Tax Brackets 2021 Newyorksilope

Income Tax 2022 23 Slab Bed Frames Ideas

Income Tax 2022 23 Slab Bed Frames Ideas

Estimated Business Tax Brackets 2022 Business Books 2022

2022 Us Tax Brackets Irs

Income Tax Rates For FY 2021 22 How To Choose Between Old Regime And

Income Tax Rates 2022 23 - For 2022 23 the Scottish Government has set five rates of income tax the starter rate of 19 the basic rate of 20 the intermediate rate of 21 the higher rate of 41 and the top rate of