Income Tax Rebate For Health Insurance Web New lower costs available 2022 health coverage amp your federal taxes If you had Marketplace coverage at any point during 2022 you must file your taxes and quot reconcile quot

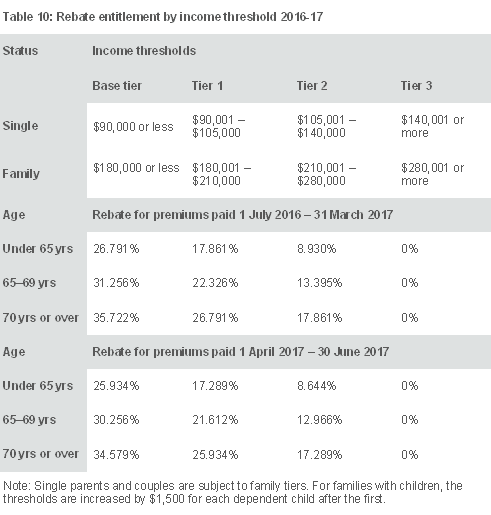

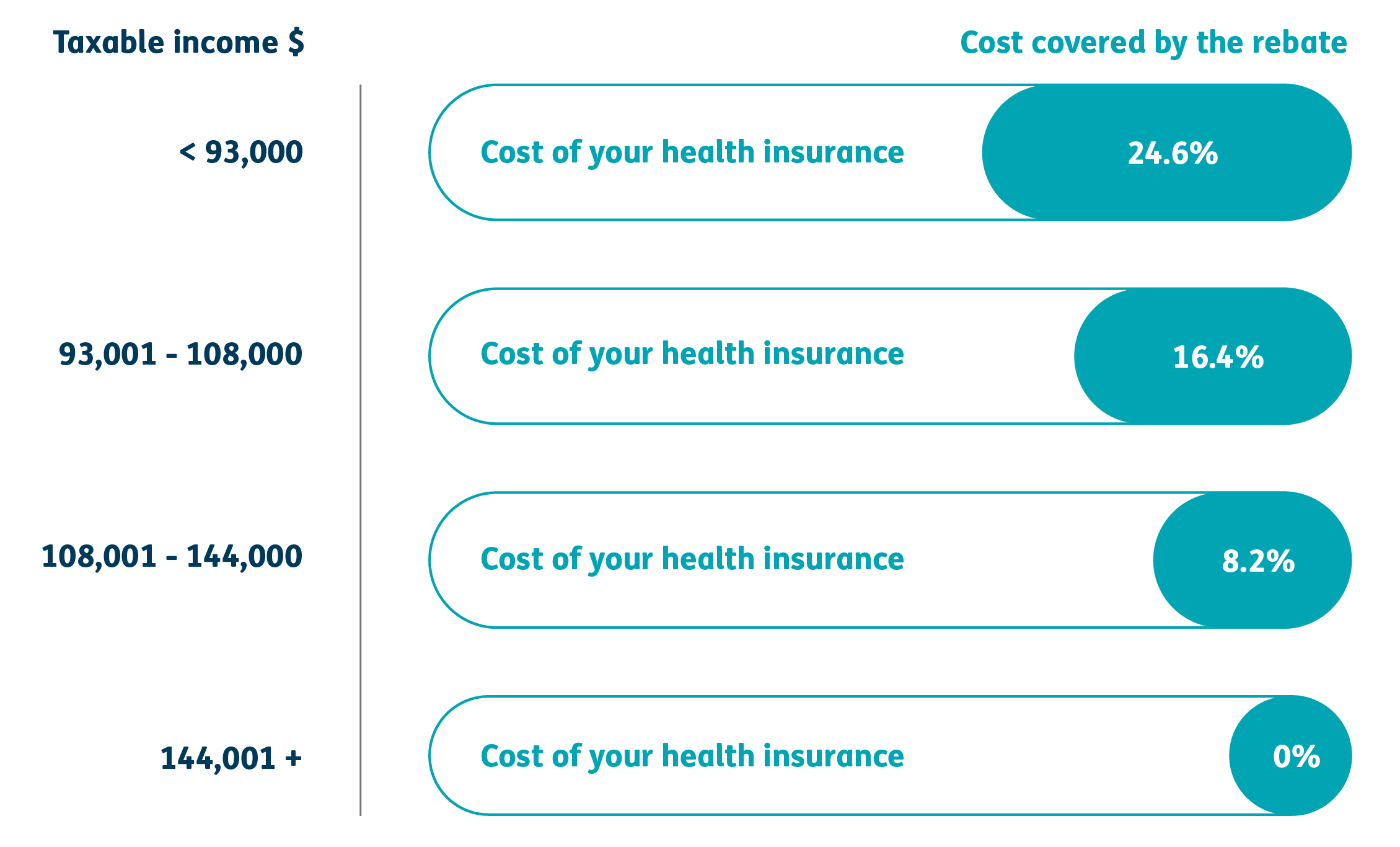

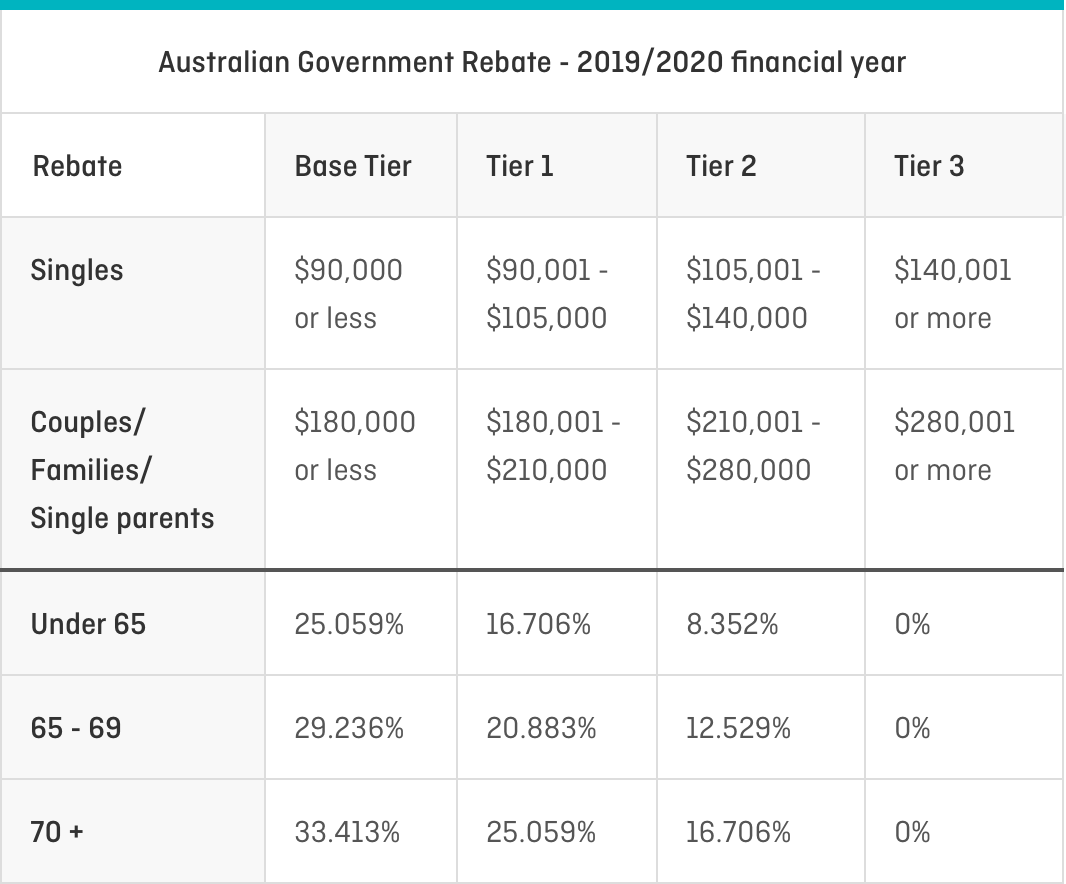

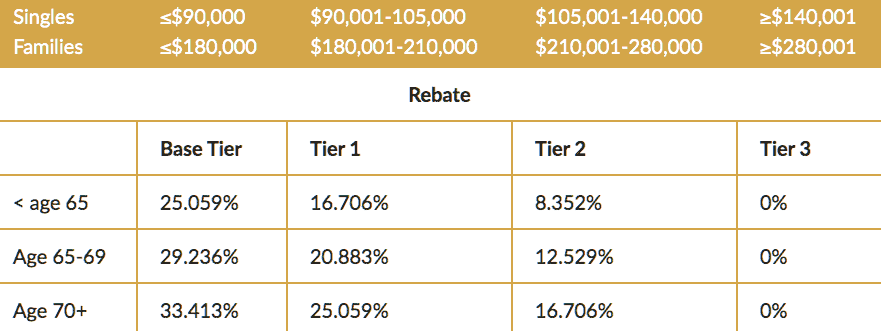

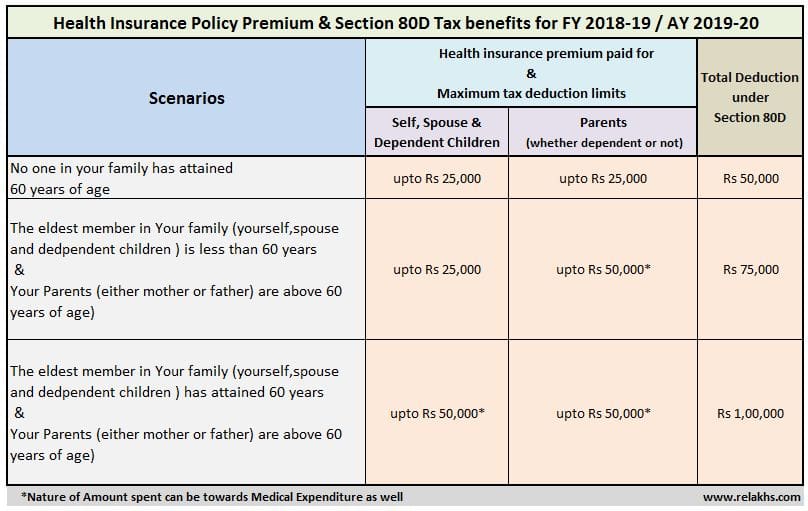

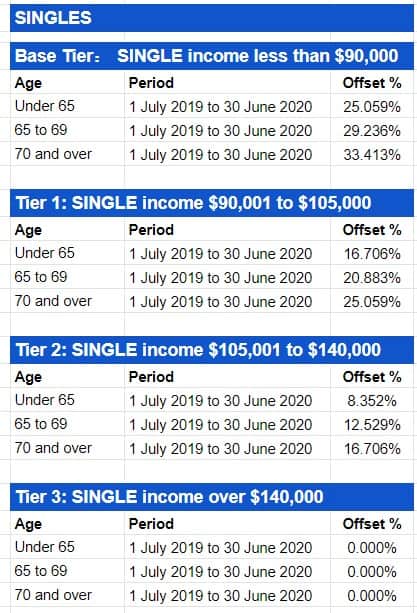

Web Income thresholds and rates for the private health insurance rebate Find out the private health insurance rebate income thresholds and rebate percentage rates Lifetime Web Your rebate rate is the percent that you get back from your health insurance premiums in the form of a reduction of the premium or as a refundable tax offset Your rebate

Income Tax Rebate For Health Insurance

Income Tax Rebate For Health Insurance

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

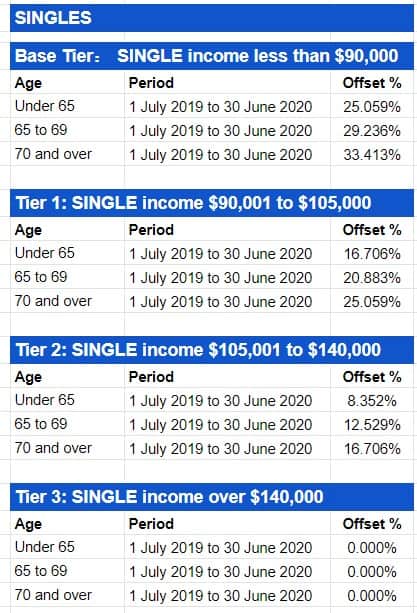

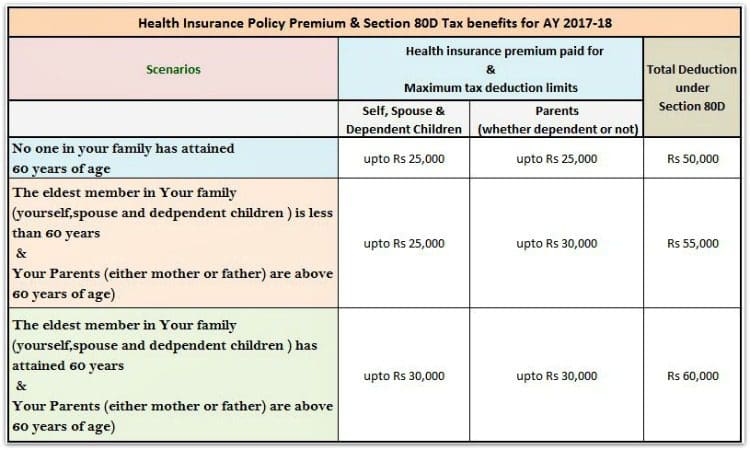

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

https://www.relakhs.com/wp-content/uploads/2018/02/Medical-Insurance-Premium-Tax-Benefits-Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2018-19-AY-2019-20-Medical-treatment-expenditure-bills.jpg

Medicare Levy Surcharge Private Health Insurance What s The Link

https://www.blgba.com.au/hs-fs/hubfs/Imported_Blog_Media/Table-10.png?width=609&height=639&name=Table-10.png

Web 11 mai 2023 nbsp 0183 32 Find Insurers No spam No hassle No hidden costs A premium tax credit can reduce your monthly health insurance cost It s only available for those who Web Income for surcharge purposes is used to test your eligibility for the private health insurance rebate It is not the same as your taxable income To be eligible for the

Web 30 juin 2023 nbsp 0183 32 receive 16 405 of premium reduction from his health insurer for premiums paid in the respective months claim the rebate as a refundable tax offset in his tax Web 12 ao 251 t 2022 nbsp 0183 32 The refunds generally work out to an average of about 141 per participant in plans through the public marketplace 155 for those in plans through a small

Download Income Tax Rebate For Health Insurance

More picture related to Income Tax Rebate For Health Insurance

Tax And Rebates HBF Health Insurance

https://www.hbf.com.au/-/media/images/hbf/health-insurance/extras/singles-under-65.png?la=en&hash=46D4FB6E7BDC69C8763810EDA3F938B622C37A8C

Private Health Insurance Quote Qantas Insurance

https://insurance.qantas.com/dist/static/table-agr-6a9b38.png

Health Insurance Rebate Is It Time To Ditch The Private Health

https://healthdeal.com.au/wp-content/uploads/2020/02/rebate-tier.png

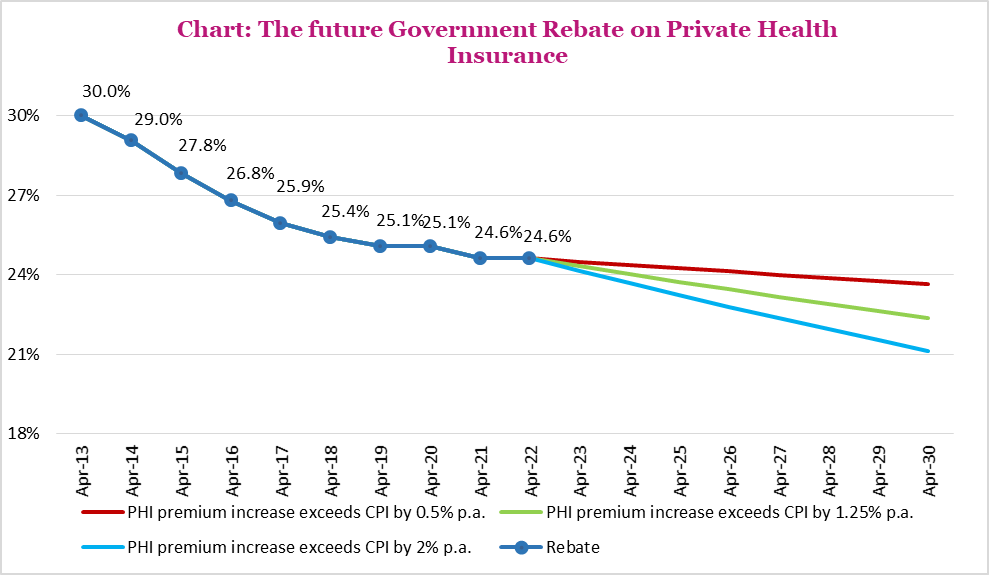

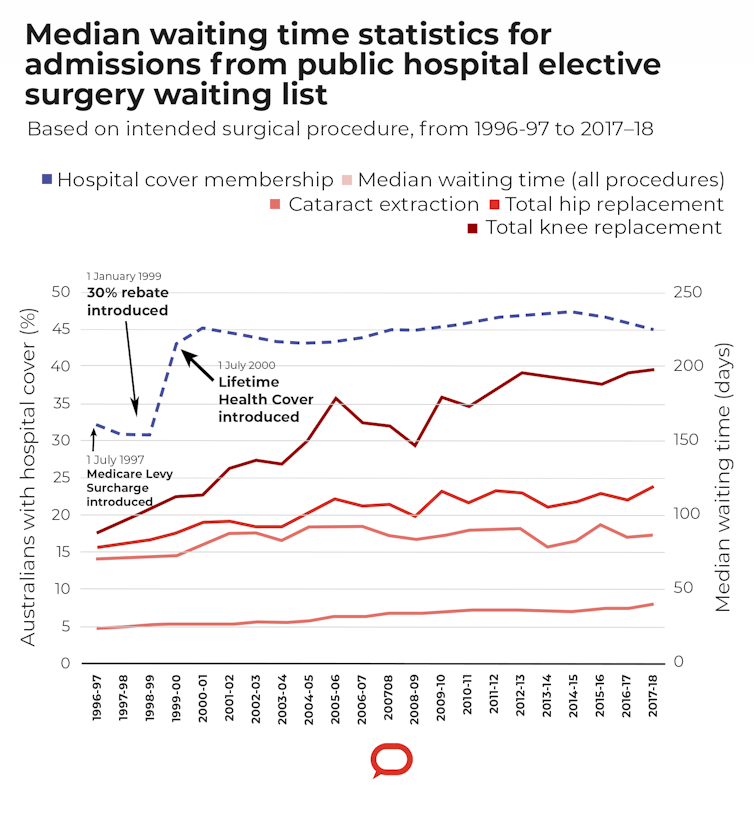

Web 19 avr 2022 nbsp 0183 32 The private health insurance rebate costs Australian taxpayers nearly A 7 billion per year and has cost over 100 billion since its introduction Yet the rebate s Web Section 80D of the Income Tax Act 1961 offers tax deductions of up to Rs 25 000 on health insurance premiums paid in a financial year The tax deduction limit increases to

Web The private health insurance rebate is income tested If you share the policy you will be income tested on your share Your rebate entitlement depends on your family status on Web 7 f 233 vr 2022 nbsp 0183 32 Feb 7 2022 at 1 30 p m Tax Breaks for Health Insurance Premiums You may be eligible for tax benefits to offset some of your health insurance premiums or

Private Health Insurance Tax Offset Atotaxrates info

http://atotaxrates.info/wp-content/uploads/2020/05/Private-Health-Insurance-Rebate-Percentages-SINGLES-2019-20.jpg

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2019/12/NAV20358-MLS-Rebate-Table-April-2020-Rates_DE1.4-1.jpg

https://www.healthcare.gov/taxes

Web New lower costs available 2022 health coverage amp your federal taxes If you had Marketplace coverage at any point during 2022 you must file your taxes and quot reconcile quot

https://www.ato.gov.au/.../Private-health-insurance-rebate

Web Income thresholds and rates for the private health insurance rebate Find out the private health insurance rebate income thresholds and rebate percentage rates Lifetime

DEDUCTION FOR MEDICAL INSURANCE PREMIUM PREVENTIVE HEALTH CHECK UP

Private Health Insurance Tax Offset Atotaxrates info

How Does Private Health Insurance Affect My Tax Return Compare Club

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

Not For Profits Call For Pledge To Restore 30 Per Cent Private Health

Why Is Medicare

Why Is Medicare

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

What Should Happen To The Private Health Insurance Rebate This Election

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Income Tax Rebate For Health Insurance - Web 11 mai 2023 nbsp 0183 32 Find Insurers No spam No hassle No hidden costs A premium tax credit can reduce your monthly health insurance cost It s only available for those who