Revenue Tax Relief Health Insurance To qualify for tax relief the scheme you take part in must be Revenue approved Relief due You will receive tax relief based on the premiums that you paid in the year that you are claiming for The relief is allowed by either your employer who will deduct the payments from your gross pay before calculating Pay As You Earn PAYE

You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 This section will explain the types of expenses that qualify If you have health insurance you can get tax relief on the premium you pay to an approved insurer You do not need to claim the relief it is given as a reduction in the amount of the insurance premium you pay This is known as tax relief at source

Revenue Tax Relief Health Insurance

Revenue Tax Relief Health Insurance

https://properly.com.my/wp-content/uploads/2022/07/LHDN-Tax-Relief-01-scaled-1600x900.jpg

Tax Relief Malaysia Want To Maximise Tax Relief With Your Medical

https://www.ibanding.my/wp-content/uploads/2017/09/Green-Tax-Jar-min.jpg

Work From Home Tax Relief Scheme How It Works For 2021 22

https://i.dailymail.co.uk/1s/2021/04/07/11/41443864-0-image-a-32_1617791775808.jpg

If you rack up 500 in medical expenses in a year you can get back 100 in tax relief on expenses like GP costs prescribed drugs and medicines hearing aids home nursing and maternity care Overview As an employer providing medical or dental treatment or insurance to your employees you have certain tax National Insurance and reporting obligations What s included What you need

Quick and easy guide to claiming your health expenses from Revenue Know your entitlements Claim tax relief on your medical expenses Learn more about your laya healthcare benefits However there are certain situations where tax relief at source TRS does not apply and that is when an employer pays the health insurance premiums on behalf of an employee and his or her dependents

Download Revenue Tax Relief Health Insurance

More picture related to Revenue Tax Relief Health Insurance

Learn How To Generate Tax Debt Relief Leads At Broker Calls

https://brokercalls.com/wp-content/uploads/2019/06/tax-debt-relief.jpg

Finance Malaysia Blogspot Tax Relief From Life Insurance YOU Must Know

http://3.bp.blogspot.com/-nmtmGtIE3Rw/VSP3ceMbLcI/AAAAAAAAC54/VHPKFOTfaKM/s1600/life%2Binsurance%2Btax%2Brelief.jpg

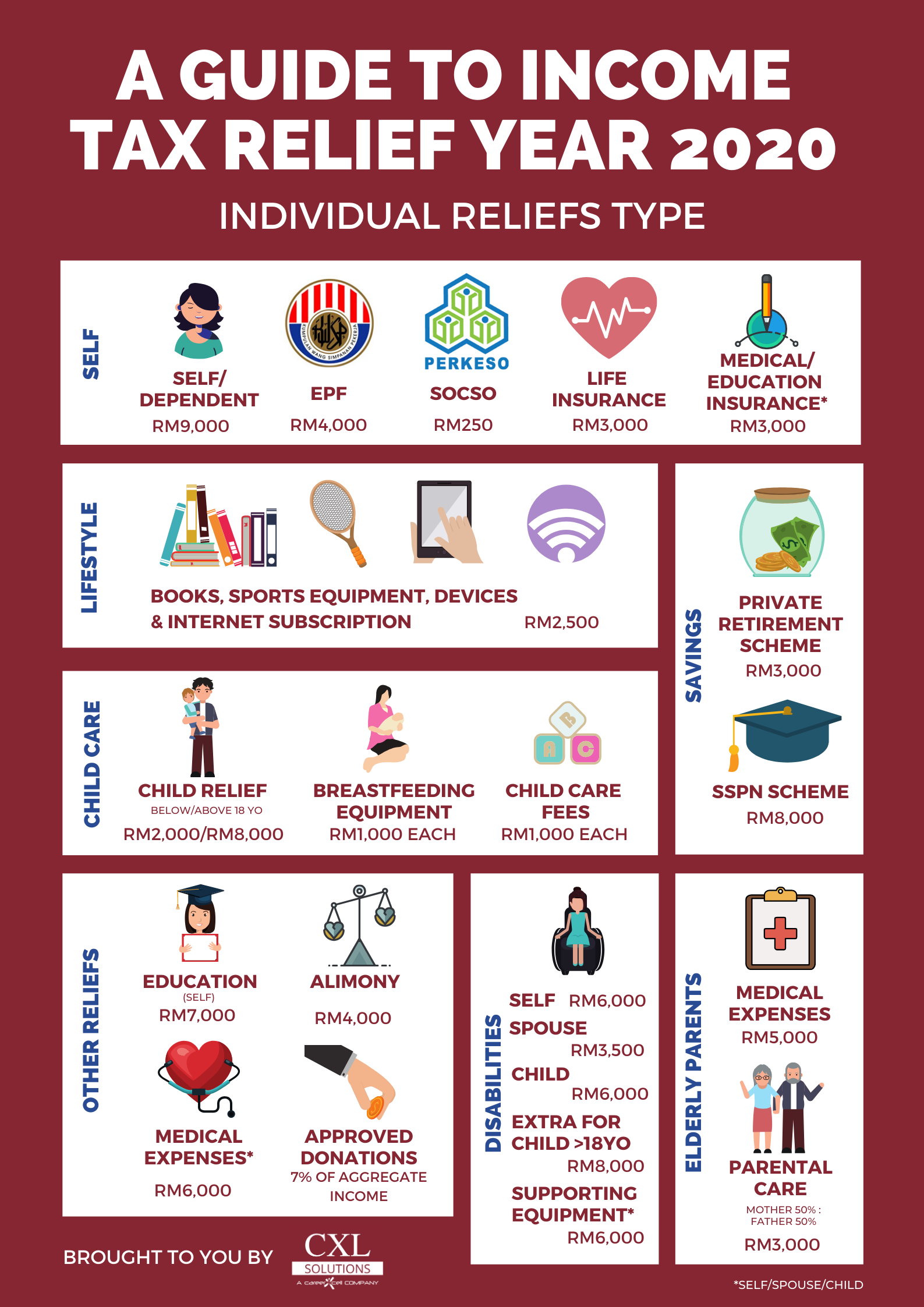

Breaking It Down Income Tax Relief For The Year 2020 YA 2019 CXL

https://cxlgroup.com/wp-content/uploads/2020/02/5ad298_fa36b68799e848d9abafe02d6ac0f197_mv2_d_1587_2245_s_2.png

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace also known as the Exchange The size of your Premium Tax Credit is based on a sliding scale The good news is that yes tax relief is available on private health insurance premiums and has been for many years This relief is not related to whether you have made any claims against the

The Affordable Care Act contains comprehensive health insurance reforms and includes tax provisions that affect individuals families businesses insurers tax exempt organizations and government entities The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace

The Cost Of Tax Relief APT Workplace Pensions

https://www.aptworkplacepensions.com/wp-content/uploads/2018/09/TaxRelief.jpg

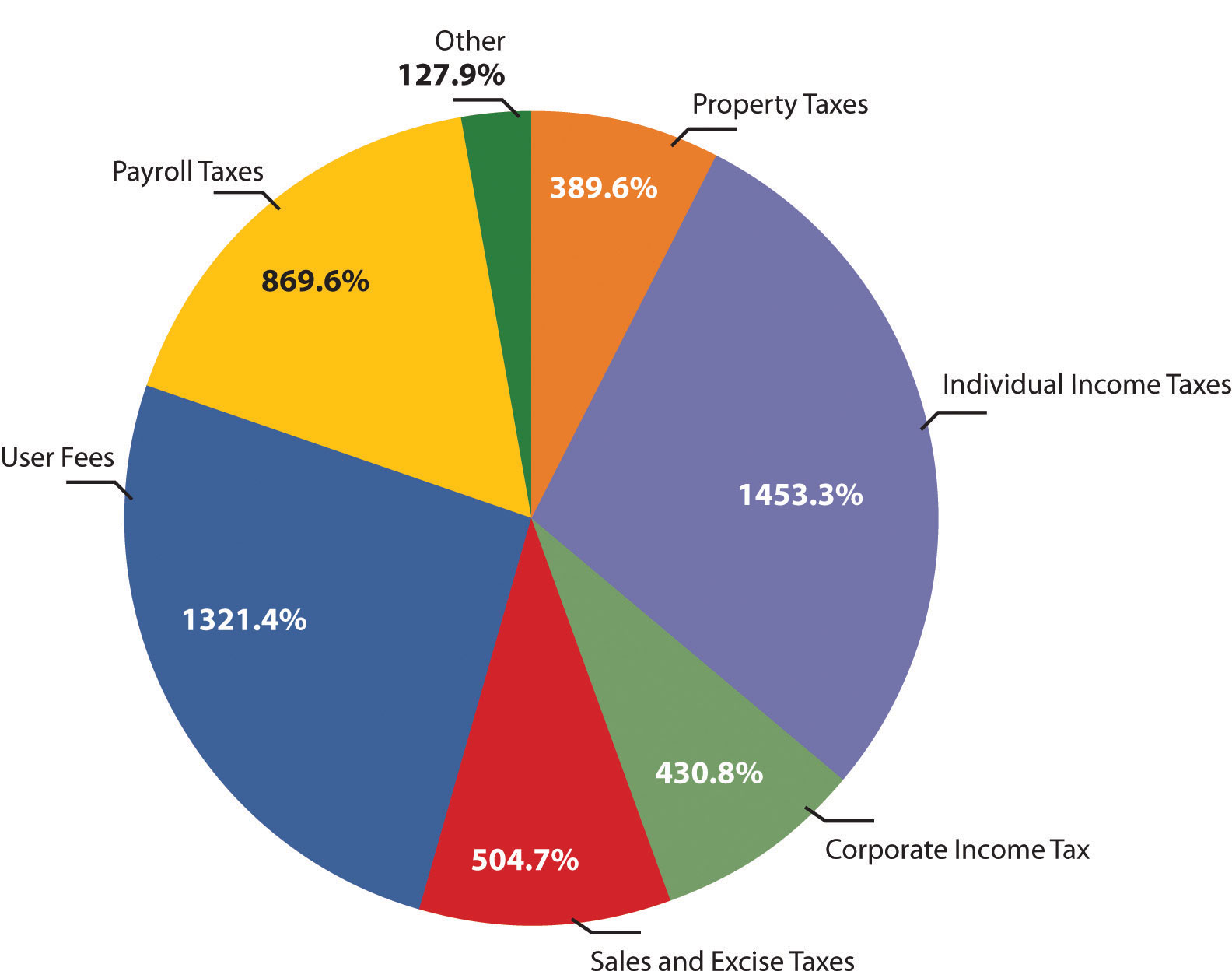

Financing Government

https://saylordotorg.github.io/text_principles-of-economics-v2.0/section_18/29c7299d7ba75aa8dc44935b17a6f28e.jpg

https://www.revenue.ie › en › personal-tax-credits...

To qualify for tax relief the scheme you take part in must be Revenue approved Relief due You will receive tax relief based on the premiums that you paid in the year that you are claiming for The relief is allowed by either your employer who will deduct the payments from your gross pay before calculating Pay As You Earn PAYE

https://www.revenue.ie › en › personal-tax-credits...

You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 This section will explain the types of expenses that qualify

Tax relief RateMuse

The Cost Of Tax Relief APT Workplace Pensions

Tax Debt Relief Your Options Keep Asking

New Revenue Numbers Make NH Tax Relief More Likely Despite Fed Threats

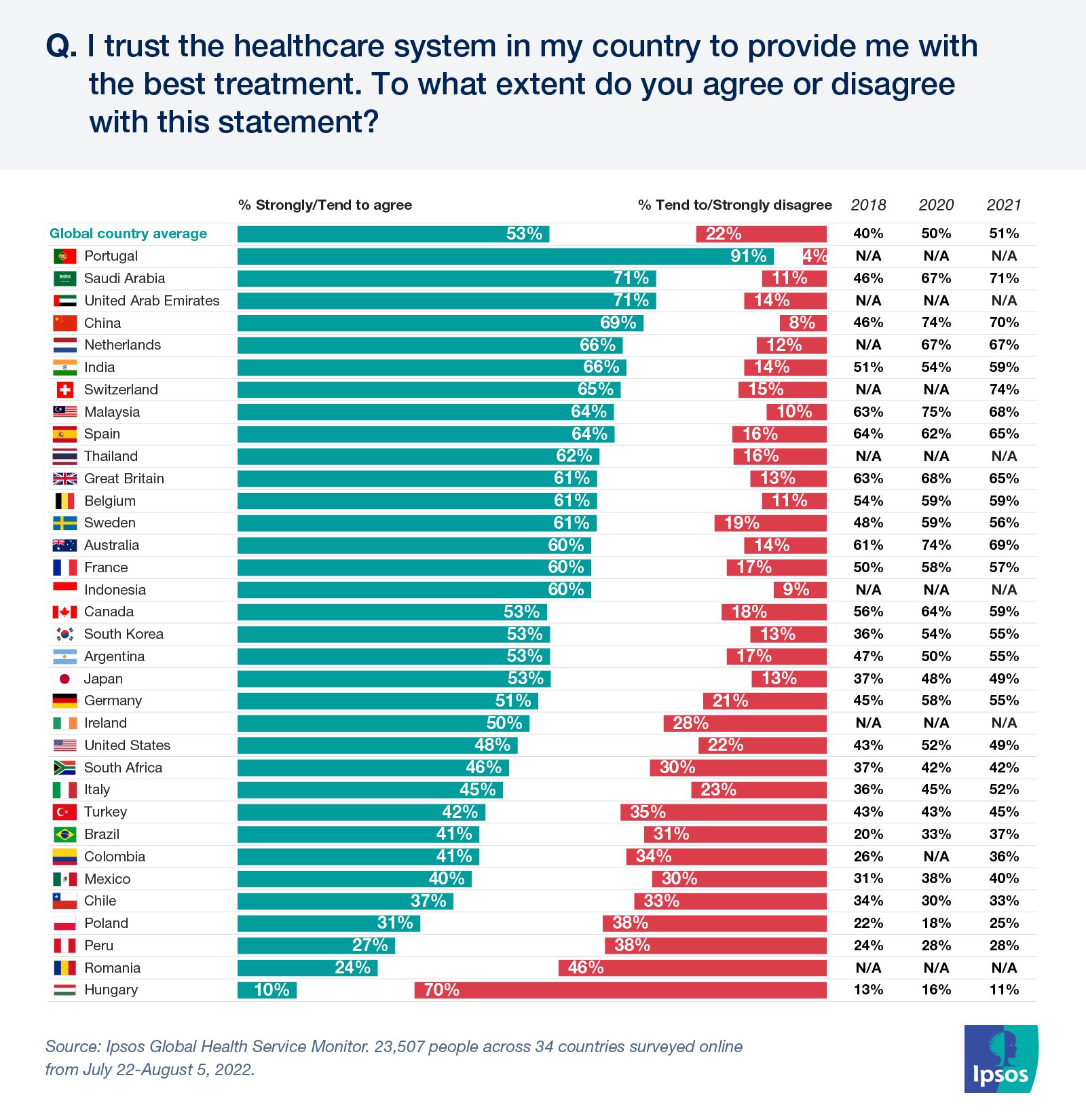

Ben Page On Twitter NEW 61 Say They Trust Healthcare System In

Going Self Employed What Can I Claim For TAX TWERK Going Self

Going Self Employed What Can I Claim For TAX TWERK Going Self

Save On 2020 Taxes Fi Life

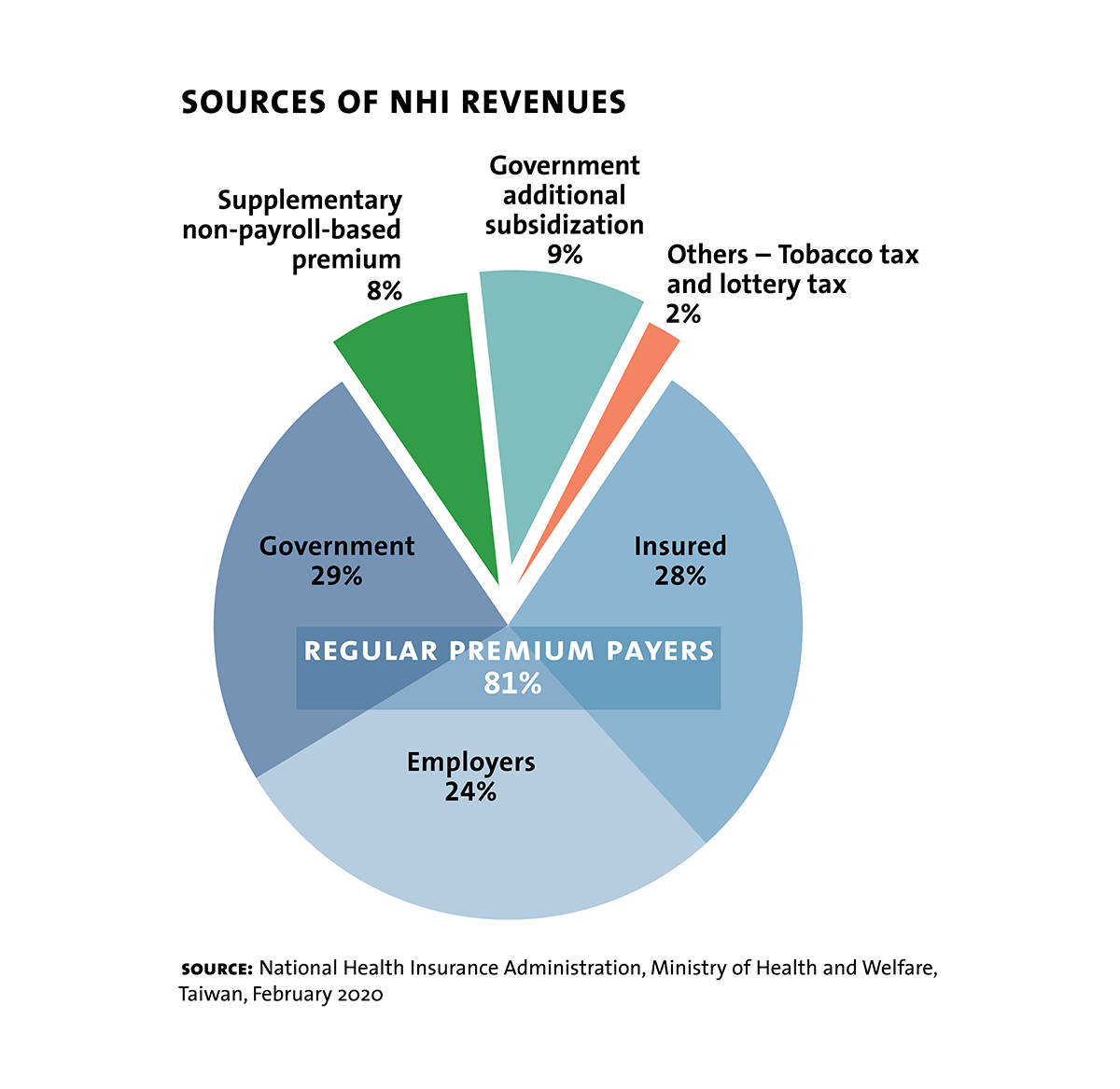

A Lesson For AMERICA Milken Institute Review

Income Tax Relief Items For 2020 MalaysianPF

Revenue Tax Relief Health Insurance - Relief for your health expenses is granted by way of a tax refund To benefit you must have paid tax in the relevant year If you have private health insurance you can claim tax relief on the portion of those qualifying expenses not covered by your insurer