Income Tax Rebate For Salaried Person Web 27 d 233 c 2022 nbsp 0183 32 For salaried employees Section 10 of the Income Tax details a wide range of allowances that can be used to reduce their tax outgo Let us examine some

Web Use this tool to find out what you need to do to get a tax refund rebate if you ve paid too much Income Tax Web 19 mars 2018 nbsp 0183 32 The income tax law allows an employee to claim a tax free reimbursement of expenses incurred An employee can claim reimbursement of the

Income Tax Rebate For Salaried Person

Income Tax Rebate For Salaried Person

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

List Of Benefits Available To Salaried Persons AY 2023 24 S N

https://i.pinimg.com/originals/48/c3/12/48c312da8305a5cda6203f455cb6b26b.jpg

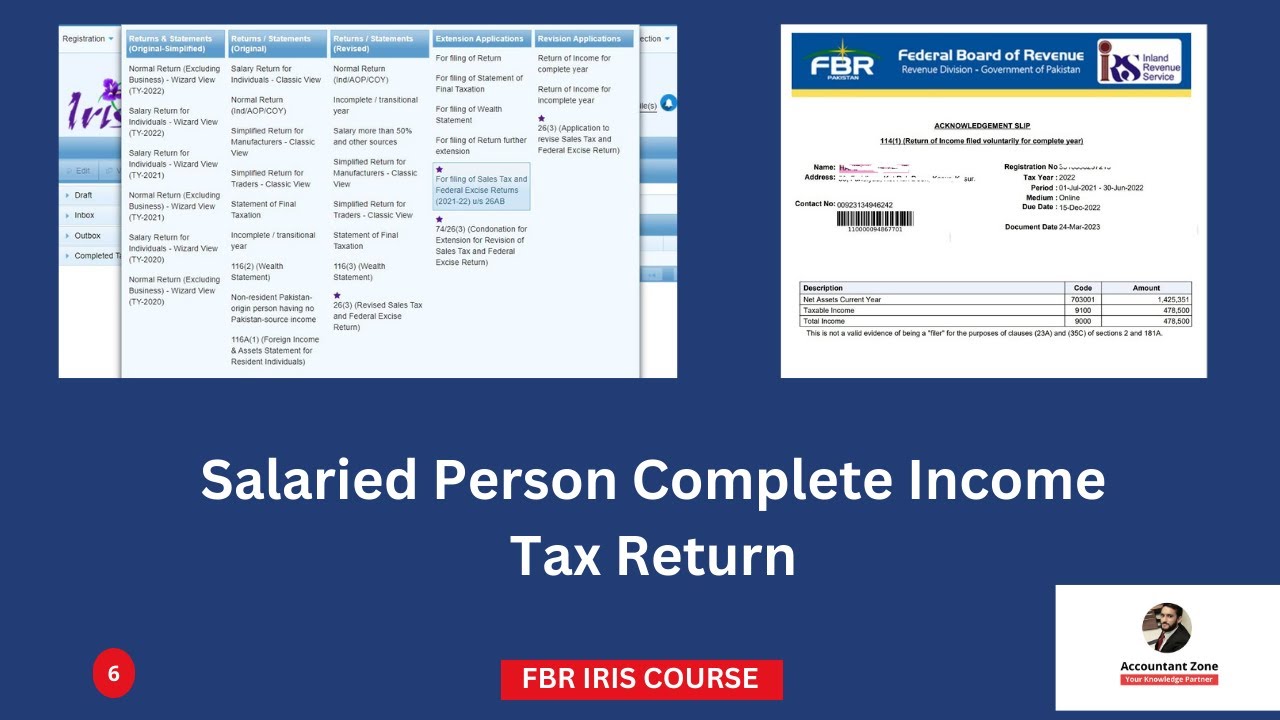

FBR Income Tax Return For Salaried Person File Online Salaried Person

https://i.ytimg.com/vi/5GtnCAoSl-4/maxresdefault.jpg

Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less Web 19 janv 2023 nbsp 0183 32 Rebate under Sec 87A Tax rebate is a form of tax incentive provided by the government to individuals earning an income below a specified limit In case your

Web 16 juil 2021 nbsp 0183 32 These payments investments and incomes will give you tax benefits in 2021 Top 10 List The Financial Express Top 10 List of Income Tax Deductions for AY Web It means that if your total tax payable is up to 25 000 the amount will be a total exemption For FY 2022 23 this limit was set at 5 lakhs Under the old tax regime the tax rebate

Download Income Tax Rebate For Salaried Person

More picture related to Income Tax Rebate For Salaried Person

Income Tax Calculator Ay 2023 24 Excel For Government Salaried

https://infoghar.com/wp-content/uploads/2022/06/Income-Tax-Slabs-for-year-2022-23.jpg?is-pending-load=1

Download Automated All In One TDS On Salary For West Bengal Govt

https://2.bp.blogspot.com/-MLBWDjPvYf8/WeK9d3Zq1gI/AAAAAAAAFm4/nn4jY1sdLfIGhTRoRIaLDxhJFsuLJLh4wCLcBGAs/s1600/Tax%2BSlab%2Bfor%2BF.Y.17-18.jpg

How To Reduce Tax In India Societynotice10

https://myinvestmentideas.com/wp-content/uploads/2017/02/income-tax-slabs-ways-to-save-income-tax-by-salaried-individuals-min.jpg

Web 15 f 233 vr 2023 nbsp 0183 32 Given below are the various tax saving options for salaried individuals under the old tax regime to save income tax for the current FY 2022 23 Common deductions Web Special Allowances under Section 10 for Salaried Employees The tax rebate that is given to salaried people falls under this section of the Income Tax Act 1961 Here is a list of

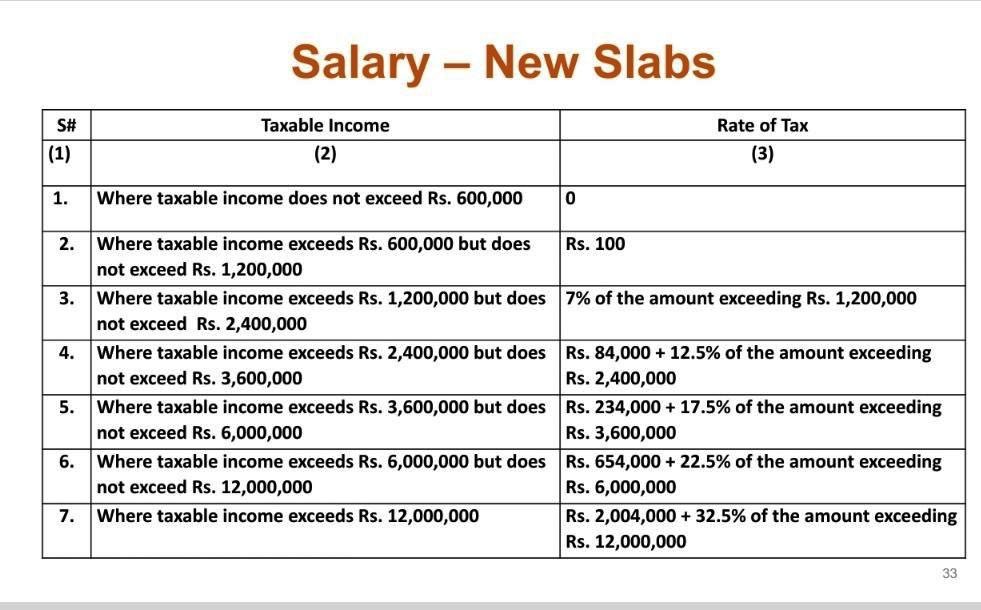

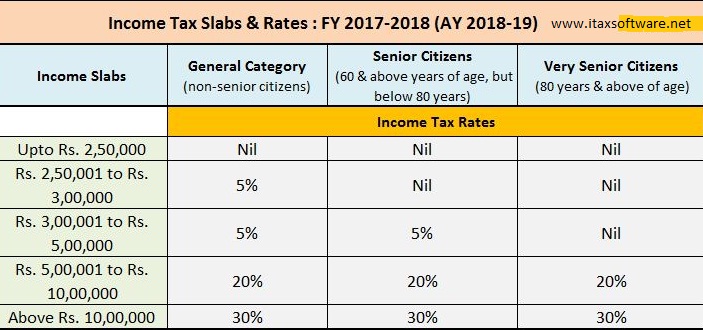

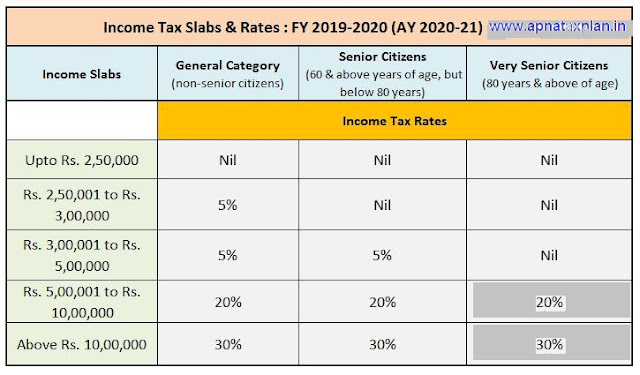

Web 1 Income Tax Slab Rate for Individual resident or non resident or HUF or AOP or BOI or any other artificial juridical person 1 1 Individual resident or non resident Other than Web 2 mai 2023 nbsp 0183 32 A resident individual with taxable income up to Rs 5 00 000 will be eligible for a tax rebate of Rs 12 500 or the amount of tax payable whichever is lower Under the

Standard Deduction For Salaried Employees Transport Medical Reimbursem

https://d1avenlh0i1xmr.cloudfront.net/d3136ff6-6bb2-49a5-b589-60367a770ccd/salary-person-eg-3.jpg

Income Tax Calculator India In Excel FY 2021 22 AY 2022 23

https://www.apnaplan.com/wp-content/uploads/2017/02/Income-Tax-Slab-for-FY-2017–18-AY-2018-19.png

https://www.etmoney.com/learn/income-tax/tax-exemptions-how-salaried...

Web 27 d 233 c 2022 nbsp 0183 32 For salaried employees Section 10 of the Income Tax details a wide range of allowances that can be used to reduce their tax outgo Let us examine some

https://www.gov.uk/claim-tax-refund

Web Use this tool to find out what you need to do to get a tax refund rebate if you ve paid too much Income Tax

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Standard Deduction For Salaried Employees Transport Medical Reimbursem

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

Cukai Pendapatan How To File Income Tax In Malaysia

E Filing Of Income Tax Return For Salaried Persons YouTube

Fbr Tax Return For Salaried Person 2022 Fbr Income Tax Return Filing

Fbr Tax Return For Salaried Person 2022 Fbr Income Tax Return Filing

Income Tax Return 2022 Which Documents Required To File Tax Return

Ultimate Income Tax Saving Guide Best Tax Saving Guide Complete Tax

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Income Tax Rebate For Salaried Person - Web 16 juil 2021 nbsp 0183 32 These payments investments and incomes will give you tax benefits in 2021 Top 10 List The Financial Express Top 10 List of Income Tax Deductions for AY