Income Tax Rebate Investments Web The tax credit rate for R amp D expenditure is 30 of outlays up to 100 million per year and 5 over this limit The tax credit rate for innovation expenditure is 20 of the eligible

Web 15 juil 2020 nbsp 0183 32 Taxes on investments depend on the investment type See current tax rates for capital gains dividends mutual funds 401 k s Web 22 janv 2022 nbsp 0183 32 Rebate A rebate is the portion of interest or dividends earned by the owner lender of securities that are paid to a short seller borrower of the securities The borrower is required to pay

Income Tax Rebate Investments

Income Tax Rebate Investments

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Income Tax Deductions List FY 2019 20

https://www.relakhs.com/wp-content/uploads/2019/02/Revised-Section-87A-Tax-Rebate-impact-on-Income-tax-liability-calculation-FY-2019-20-AY-2020-21.jpg

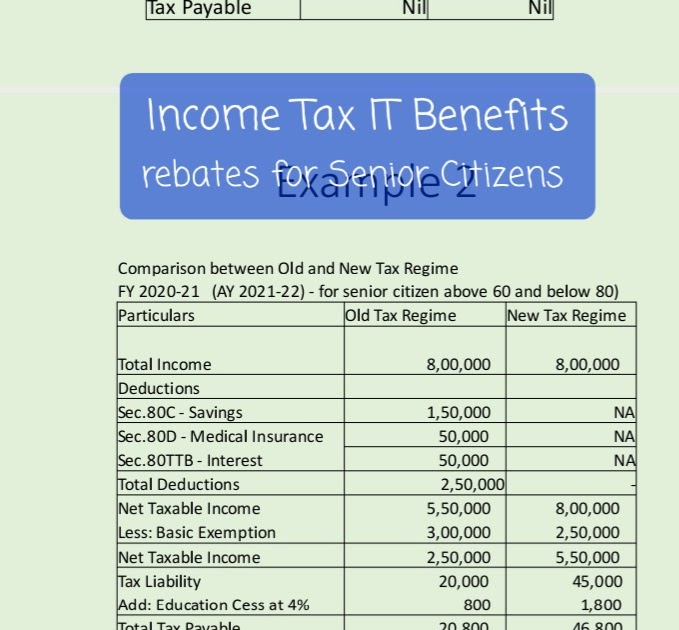

Web 17 juil 2021 nbsp 0183 32 Income Tax Deductions for AY 2021 22 By now most of the companies have issued Form 16 to their employees So they must be preparing for filing income tax return ITR for the financial year 2020 Web Must be a resident of India Your overall income after taking deductions into consideration is less than Rs 5 lakh The maximum amount of rebate that can be claimed is Rs 12 500

Web 14 juin 2022 nbsp 0183 32 Currently taxpayers with an annual earning of Tk15 lakh the minimum taxable income are enjoying 15 rebate on their allowable investment limit which is Web 27 mai 2023 nbsp 0183 32 27 May 2023 10 15 pm Last modified 28 May 2023 09 33 am How to maximise tax rebates through planned investments The government offers a generous

Download Income Tax Rebate Investments

More picture related to Income Tax Rebate Investments

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

https://www.firstpost.com/wp-content/uploads/large_file_plugin/2019/02/1549021404_Salarytable.jpg

Tax Rebate For Individual To Qualify For The 2001 And 2008 Rebates

https://blog.tax2win.in/wp-content/uploads/2019/03/80C-Deduction-in-respect-of-LIP-PF-PPF-NSC-etc-1024x819.jpg

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

Web 11 juin 2022 nbsp 0183 32 Taxpayers having up to Tk15 lakh in annual taxable income are enjoying 15 rebate on their investments up to 25 of their annual taxable income while the rebate is 10 for taxpayers whose taxable Web 2 juil 2023 nbsp 0183 32 July 2 2023by tamble If you are looking for Income Tax Rebate Investmentyou ve come to the right place We have 32 rebates about Income Tax

Web 10 oct 2021 nbsp 0183 32 If your annual income is less than Tk15 lakh you will get 15 tax exemption of total investment and donation Tax exemption at the rate of 10 will be available if it exceeds Tk 15 lakh And to avail such Web 10 juil 2023 nbsp 0183 32 Invest Now DSP Tax Saver Fund G 11 9 5Y CAGR Mirae Asset Tax Saver Fund G 13 4 5Y CAGR 1 Unit Linked Insurance Plan ULIP ULIP Life Insurance

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

https://teachersbuzz.in/wp-content/uploads/2020/05/TAX2BRebate.png

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

https://www.impots.gouv.fr/international-professionnel/tax-incentives

Web The tax credit rate for R amp D expenditure is 30 of outlays up to 100 million per year and 5 over this limit The tax credit rate for innovation expenditure is 20 of the eligible

https://www.nerdwallet.com/article/taxes/inv…

Web 15 juil 2020 nbsp 0183 32 Taxes on investments depend on the investment type See current tax rates for capital gains dividends mutual funds 401 k s

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Tax Rebate U s 87A Income Tax Exemption Guide Deduction Sections For

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Income Tax Rebate Investments - Web 14 ao 251 t 2017 nbsp 0183 32 Government has encouraged taxpayers to invest money and get tax rebate And therefore specified the areas where you could invest for tax rebate From this article