Income Tax Rebate Schemes To save tax on your salary you can utilize deductions and exemptions offered under the Income Tax Act These include allowances like HRA and LTA as well as the

Learn about the CIT rebate CIT rebate cash grant and tax exemption schemes for companies in Singapore Find out the eligibility criteria rebate percentages caps and how to compute the Find out which ITR form to use and which forms to submit for tax deduction and refund for salaried individuals in India Learn about the eligibility criteria sources of income and new tax

Income Tax Rebate Schemes

Income Tax Rebate Schemes

https://navi.com/blog/wp-content/uploads/2022/03/income-tax-rebate-1.jpg

Income Tax Rebate Astonishingceiyrs

https://www.aseanbriefing.com/news/wp-content/uploads/2018/08/asb-Partial-Tax-Exemption-Scheme-for-Companies-Available-for-All-Companies-YA-2018-002.jpg

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

Learn about the best tax saving schemes in India for 2024 such as ELSS funds PPF SSY NSC and more Compare the benefits risks and eligibility criteria of each scheme and invest wisely Income tax in India follows a progressive slab rate system under the Income tax Act 1961 with old and new regimes offering different tax rates and deductions For FY 2024 25 the tax slabs have been revised providing more

Find out if you can get a tax refund rebate for overpaying tax on various sources of income such as a job a pension or a redundancy payment Use this tool to check your eligibility and Find out about various tax reliefs and allowances available from HMRC if you run a business employ people or are self employed Learn how to claim deduct reclaim or pay

Download Income Tax Rebate Schemes

More picture related to Income Tax Rebate Schemes

Income Tax Rebate Under Section 87A

https://life.futuregenerali.in/media/mu2i0shn/income-tax-rebate-under-section-87a.jpg

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/585/571/585571881/large.png

How To Calulate Rebate FY 2019 20 AY 2020 21 Chapter 4 Income Tax

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/4f3e8d40-1fcf-4c08-b717-2df0bca83a73/rebate-1.png

Learn how to get tax relief on your private pension contributions up to 100 of your annual earnings Find out if you need to claim it yourself or get it automatically and how to do it online Compare the tax slabs and rates deductions and exemptions and eligibility criteria of new and old tax regimes for AY 2024 25 Learn how to opt for or opt out of the new tax regime and the

Section 87A of the Income Tax Act offers a rebate to individuals with a total taxable income of up to 5 lakh under the old regime and 7 lakh under the new tax regime Learn how to calculate and claim the tax rebate u s 87A for FY 20 21 under old and new tax regimes Find out the eligibility steps FAQs and examples of rebate u s 87A

Eight Moves To Make To Give Yourself A Larger Tax Refund Between 2 000

https://www.the-sun.com/wp-content/uploads/sites/6/2023/01/lm-tax-rebate-debit-card-COMP-1.jpg

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

https://cachandanagarwal.com/wp-content/uploads/2021/04/Income-Tax-Rebate.jpeg

https://cleartax.in › income-tax-savings

To save tax on your salary you can utilize deductions and exemptions offered under the Income Tax Act These include allowances like HRA and LTA as well as the

https://www.iras.gov.sg › taxes › corporate-income-tax › ...

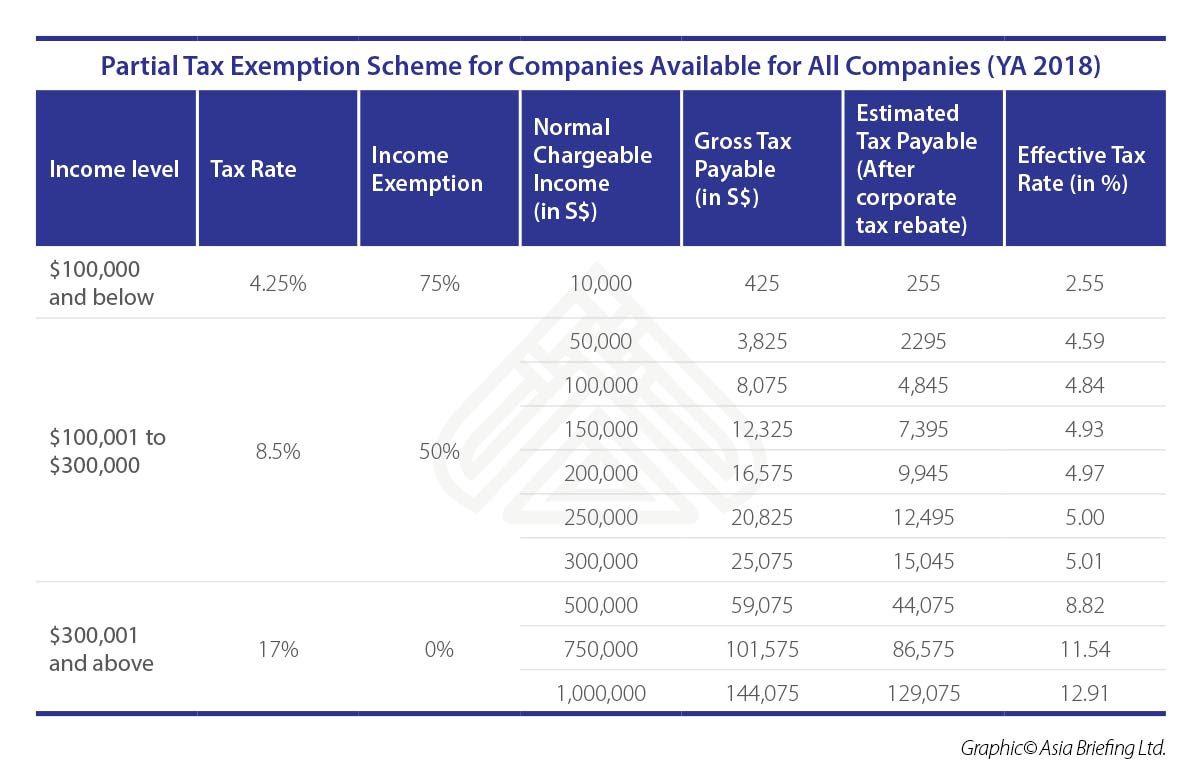

Learn about the CIT rebate CIT rebate cash grant and tax exemption schemes for companies in Singapore Find out the eligibility criteria rebate percentages caps and how to compute the

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Eight Moves To Make To Give Yourself A Larger Tax Refund Between 2 000

300 Bonus Tax Rebate For Thousands Of Families By Check Or Direct

Right To A Tax Rebate For Whom Is It Available And How To Use It

How To Compute Income Tax On Salary Kanakkupillai

Deadline For Tax And Rent Relief Extended

Deadline For Tax And Rent Relief Extended

Treatment Of Income From Different Sources AY 2023 24 FY 2022 23

Understanding New Income Tax Regime Vs Old Income Tax Regime Jordensky

Option To Accelerate Claims On Renovation And Refurbishment Costs

Income Tax Rebate Schemes - Learn about the best tax saving schemes in India for 2024 such as ELSS funds PPF SSY NSC and more Compare the benefits risks and eligibility criteria of each scheme and invest wisely