Income Tax Benefit Schemes To save tax on your salary you can utilize deductions and exemptions offered under the Income Tax Act These include allowances like HRA and LTA as well as the Standard Deduction

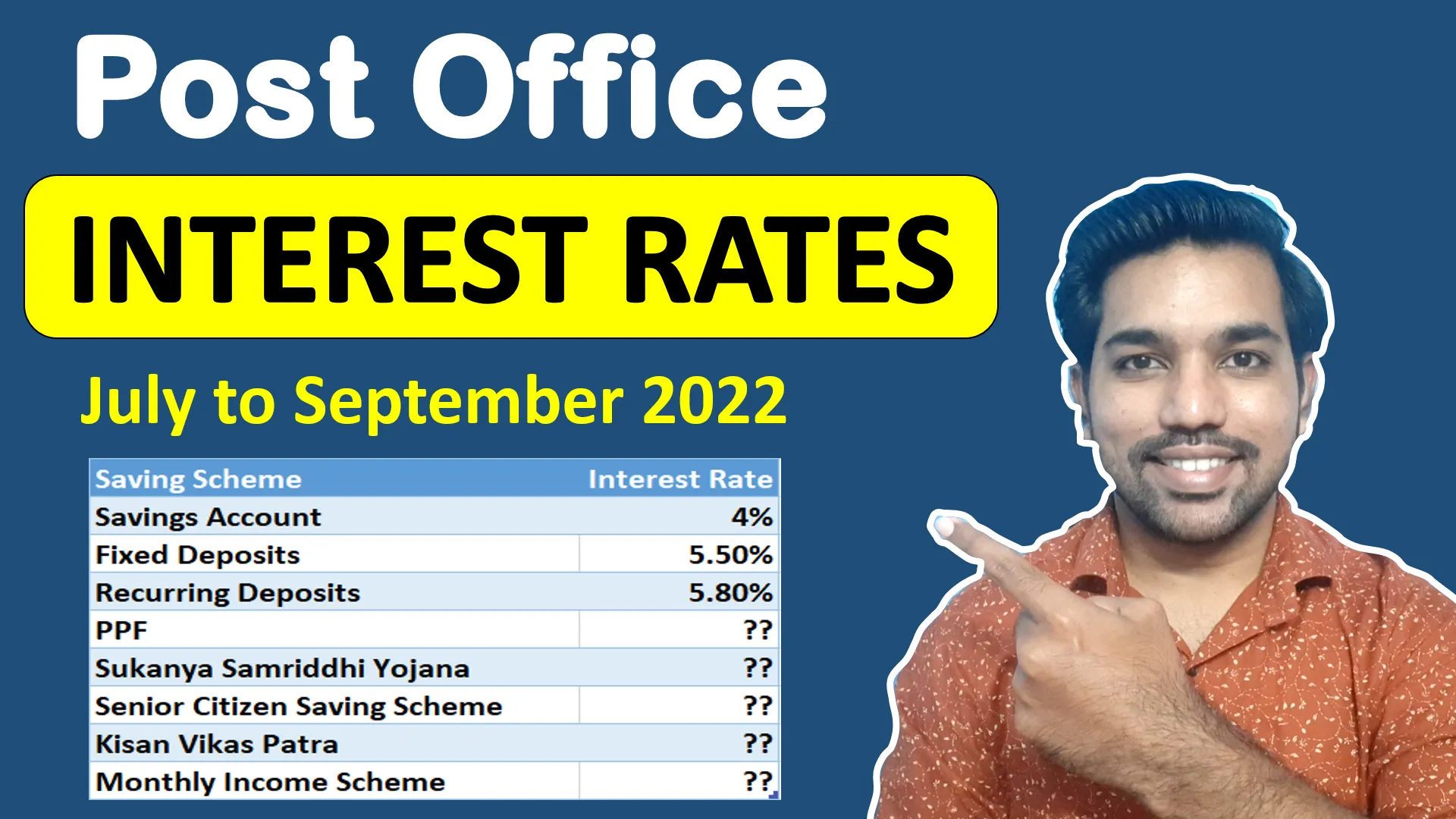

Every salaried taxpayer can further reduce their income taxes can save taxes other than 80c Check here the top 10 income tax saving schemes options other than 80c Investments in post office schemes help to create a corpus for emergency purposes and achieve goals They also offer tax benefits up to Rs 1 5 lakh under Section 80C of the Income Tax Act The various schemes offered by the post office are discussed below

Income Tax Benefit Schemes

Income Tax Benefit Schemes

https://pmmodiyojana.in/wp-content/uploads/2022/09/image-149.png

Income Tax Elimination Institute For Reforming Government

https://reforminggovernment.org/wp-content/uploads/2021/12/[email protected]

Income Tax Benefits On Housing Loan In India

https://blog.saginfotech.com/wp-content/uploads/2016/09/income-tax-benefit.jpg

Public provident fund PPF 5 year post office deposit scheme National Savings Certificate NSC Sukanya Samriddhi Yojana SSY and Senior Citizen Savings Scheme SCSS are among the 5 Income Tax Saving Schemes Income tax savings schemes are offered as per the relevant sections of the Income Tax Act 1961 The chief among these is the Section 80C which offers potential tax savings options of up to Rs 1 5 lakhs yearly

Here is the list of best income tax saving schemes and plans this year to be known by the tax payers The Senior Citizens Savings Scheme SCSS allows senior citizens in India to invest up to Rs 30 lakhs providing a safe and tax saving stream of income The scheme features a government backed retirement benefits program with a fixed 8 2 interest rate

Download Income Tax Benefit Schemes

More picture related to Income Tax Benefit Schemes

Income Tax Return And Tax Benefit Claim Koppel Services

https://www.koppelservices.com/wp-content/uploads/2017/03/tax-benefit.jpg

https://c.pxhere.com/photos/c2/d6/tax_return_control_tax_office_form_finance_money_income_tax_billing-1038566.jpg!d

Post Office Interest Rates Table July To September 2022 FinCalC

https://fincalc-blog.in/wp-content/uploads/2022/06/post-office-interest-rates-table-2022-july-to-september-2022-video.webp

Emily s estate for Inheritance Tax purposes will be valued at 1 500 000 and the Inheritance Tax liability will be 470 000 1 500 000 325 000 nil rate band 1 175 000 Inheritance Depending on the benefit you receive the payments you make may reduce your taxable income meaning your payments are essentially tax free This includes schemes for pensions childcare Cycle to Work ultra low emissions vehicles retraining courses and intangible benefits

Killing taxes on tips sounds good but experts say it doesn t solve the real problem Economy Sep 4 2024 5 13 PM EDT As the election kicks into high gear both former President Donald Trump The UK Budget 2024 saw changes which could impact the operation of employee shares schemes as well as the tax benefit of these for employees However the impact was not as significant as was feared in some quarters and use of share schemes remains a valuable tool for incentivising and rewarding employees There are a variety of share schemes

RoDTEP Scheme Remission Of Duties And Taxes On Exported Products

https://papertyari.com/wp-content/uploads/2021/01/Remission-of-Duties-and-Taxes-on-Exported-Products.jpg

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

https://journalistsresource.org/wp-content/uploads/2018/04/tax-forms.jpg

https://cleartax.in/s/income-tax-savings

To save tax on your salary you can utilize deductions and exemptions offered under the Income Tax Act These include allowances like HRA and LTA as well as the Standard Deduction

https://www.etmoney.com/learn/income-tax/options...

Every salaried taxpayer can further reduce their income taxes can save taxes other than 80c Check here the top 10 income tax saving schemes options other than 80c

How To Compute Income Tax On Salary Kanakkupillai

RoDTEP Scheme Remission Of Duties And Taxes On Exported Products

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Income Tax Statistics 2023 Tax Brackets USA UK And More

Treatment Of Income From Different Sources AY 2023 24 FY 2022 23

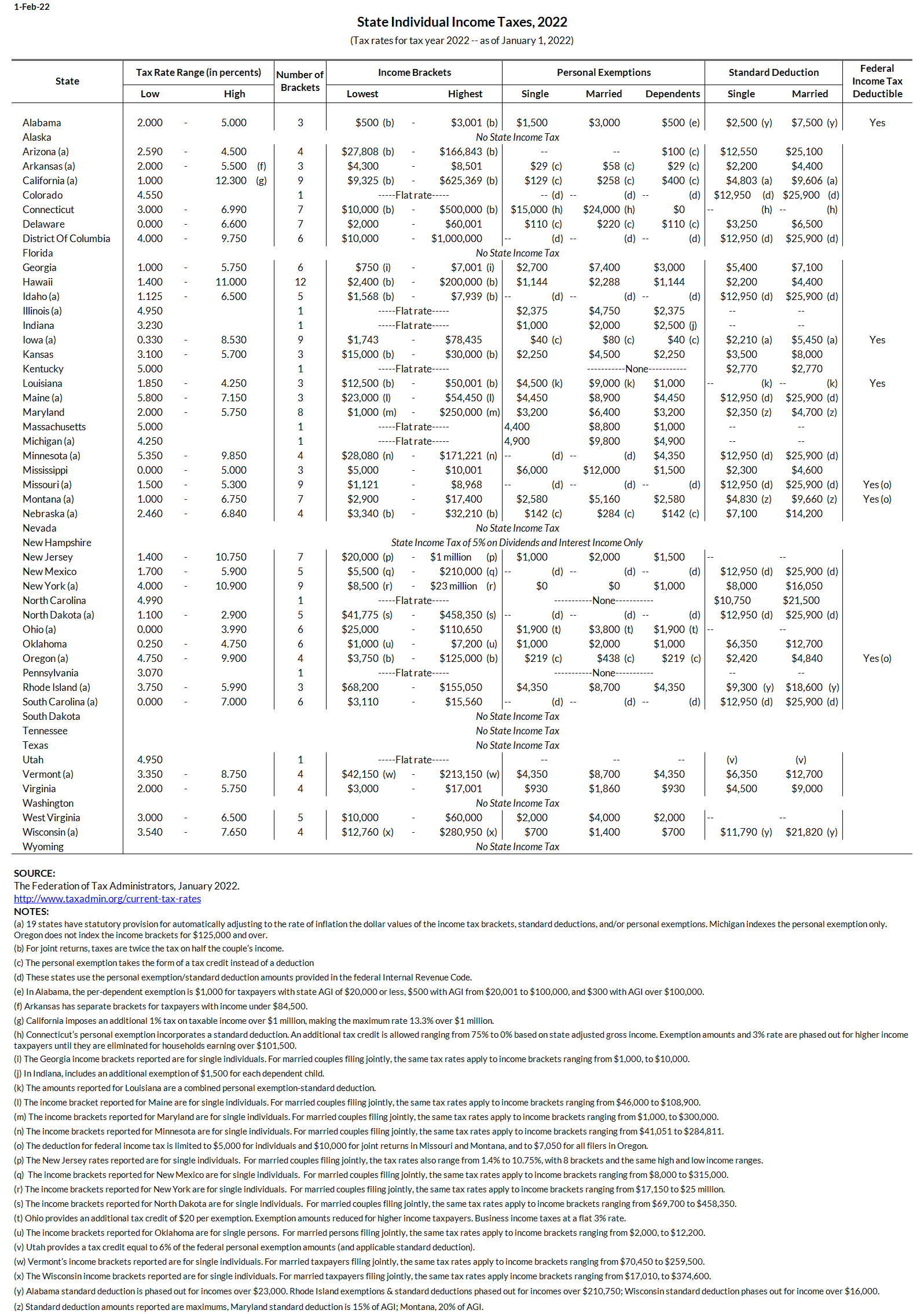

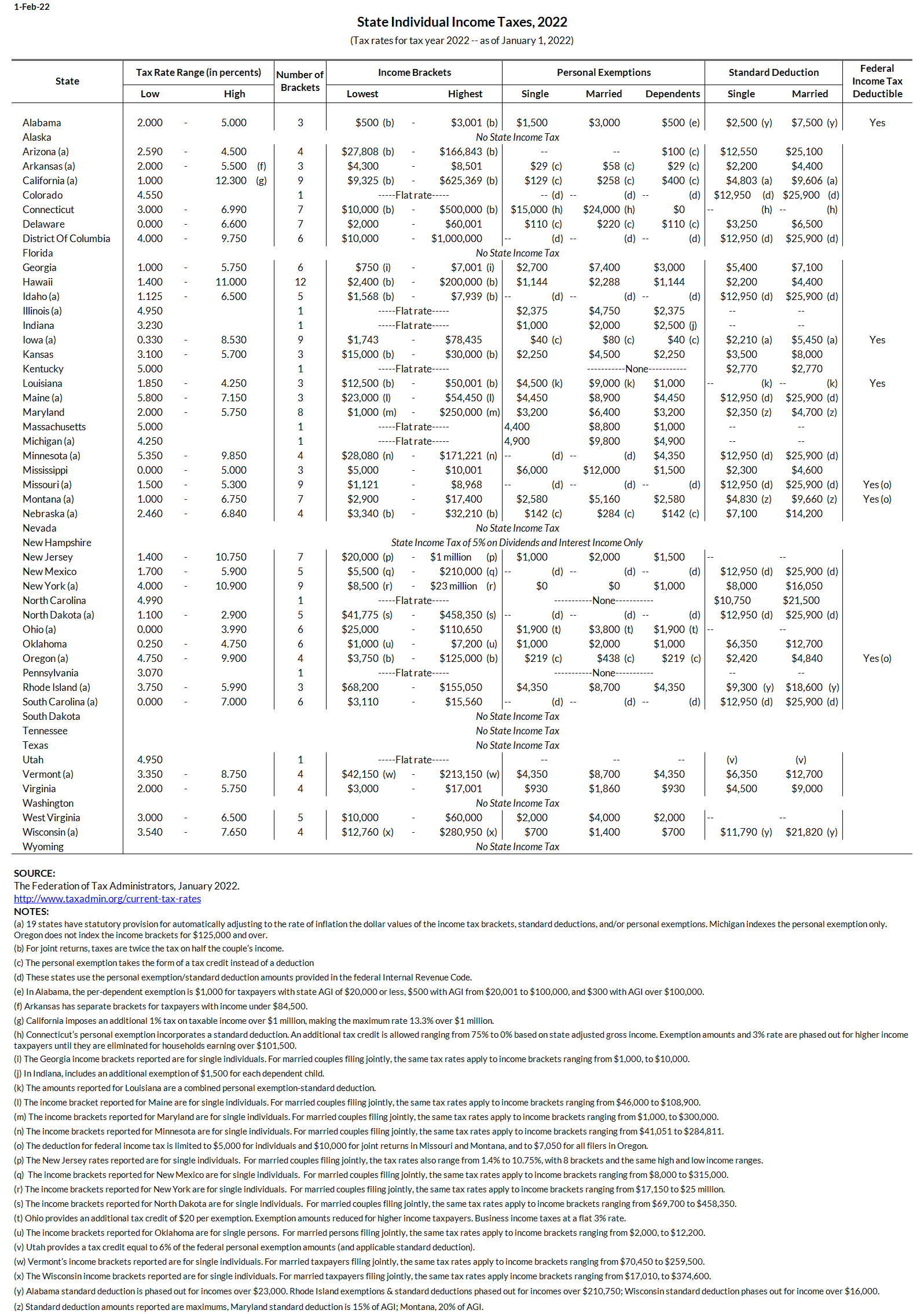

State Individual Income Tax Rates Tax Policy Center

State Individual Income Tax Rates Tax Policy Center

Income Tax Benefits On Home Loan Loanfasttrack

Best Tax Saving Investment Scheme ELSSs Wealth4india

CNN News18 News Anchor Journalist Columnist Blogger Page363

Income Tax Benefit Schemes - Here is the list of best income tax saving schemes and plans this year to be known by the tax payers