Income Tax Rebate On Child Education Loan Web 30 mars 2023 nbsp 0183 32 Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan A

Web If any tax free educational assistance for the qualified education expenses paid in 2022 or any refund of your qualified education expenses paid in 2022 is received after you Web To encourage borrowers to take an education loan there is a tax benefit on repayment of the education loan Once you avail of an education loan the interest paid which is a component of your EMI on the education loan is

Income Tax Rebate On Child Education Loan

Income Tax Rebate On Child Education Loan

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

2022 Child Tax Rebate Stratford Crier

https://stratfordcrier.com/wp-content/uploads/2022/06/hh-1030x1030.png

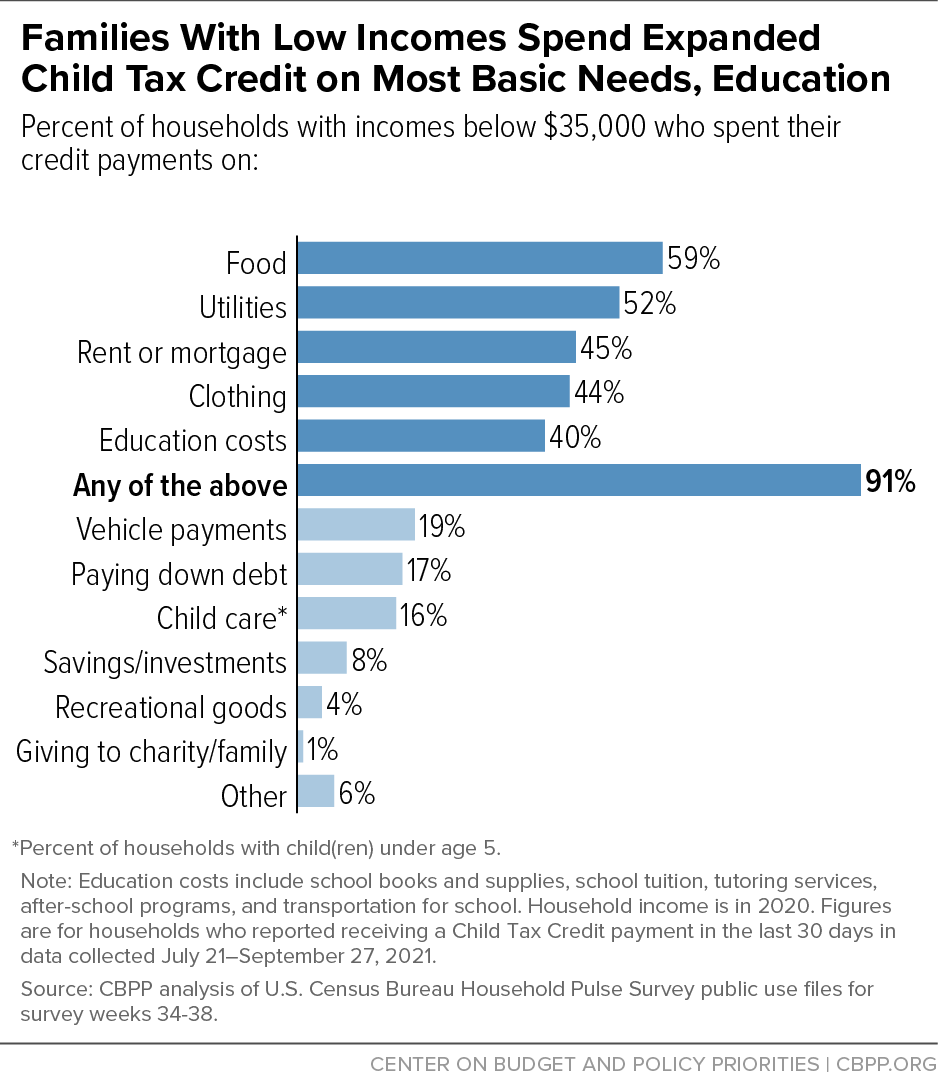

9 In 10 Families With Low Incomes Are Using Child Tax Credits To Pay

https://www.cbpp.org/sites/default/files/styles/report_580_high_dpi/public/2021-10/blog_ctc_spending_2021-10-21_f0.png?itok=CiCJ0n64

Web If you ve taken an Education Loan and are repaying the same you can always claim deduction under Section 80E of the Income Tax Act for the Repayment of Interest on Education Loan However this deduction is Web 31 mai 2023 nbsp 0183 32 Interest paid on education loans taken for higher studies of self spouse or children including for whom you are the legal guardian can be claimed as a deduction

Web 5 avr 2023 nbsp 0183 32 The tax benefits offered on children s education are as follows Childrens Education Allowance Hostel Expenditure Allowance Tax deduction on tuition fees Web 16 oct 2020 nbsp 0183 32 You can claim tax deductions on education loans as tuition fees paid to any college university or other educational institution under Section 80E of the Income Tax Act You can take education loan tax

Download Income Tax Rebate On Child Education Loan

More picture related to Income Tax Rebate On Child Education Loan

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i1.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-25-at-11.16.02-PM.png?resize=645%2C267&ssl=1

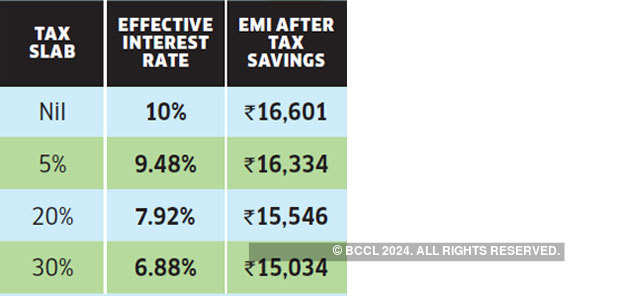

Education Loan Tax Benefits How Education Loan Can Help Your Child

https://img.etimg.com/photo/msid-65449820/education-loan-tax-benefit.jpg

Here s How You Calculate Your Adjusted Gross Income AGI

https://flyfin.tax/_next/image?url=https:%2F%2Fdem95u0op6keg.cloudfront.net%2Fflyfin-website%2Fself-employment-resources%2FThreeTaxBenefitsDesktop.png&w=2048&q=100

Web Section 80E of Income Tax Act is provides tax deduction or interest benefits on education loan in India Learn more about tax benefits of education loan eligibility under section Web 23 f 233 vr 2018 nbsp 0183 32 3 The income tax deduction on education loan is only available for up to eight years or until the payment of interest in full whichever is earlier For example if you

Web 25 ao 251 t 2022 nbsp 0183 32 The income tax rebate on education loan is available only for the repayment of the interest component of the loan No tax benefits are available for the principal Web 27 juin 2018 nbsp 0183 32 One relief is the tax benefit provided for spending on children s education The Income Tax Act provides a direct deduction on account of fees paid for the education of

Children Education Allowance CEA Approved Format CEA

https://4.bp.blogspot.com/-fN8IMTZFbX4/Wl61Ma6e4YI/AAAAAAAABME/DbR62hW8dV0fwBEWbXb5ooGXzbsAUCtHQCLcBGAs/s1600/002.jpg

Section 87A Tax Rebate Under Section 87A

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 Section 80E of the Income Tax Act 1961 deals with the terms and conditions of availing income tax deductions if you have an ongoing education loan A

https://www.irs.gov/publications/p970

Web If any tax free educational assistance for the qualified education expenses paid in 2022 or any refund of your qualified education expenses paid in 2022 is received after you

Education Rebate Income Tested

Children Education Allowance CEA Approved Format CEA

What Does Rebate Lost Mean On Student Loans

Child Care Rebate Income Tax Return 2022 Carrebate

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

DEDUCTION UNDER SECTION 80C TO 80U PDF

DEDUCTION UNDER SECTION 80C TO 80U PDF

Income Tax Rebate Under Section 87A

More Tax Credits More Rebates Education Magazine

Pin On Tigri

Income Tax Rebate On Child Education Loan - Web Education Loan Tax 80E Rebate Calculator Most accurate calculator for section 80E education loan income Tax exemption The easiest and the quickest way to calculate