Income Tax Rebate On Home Loan Interest And Principal Web 12 juin 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

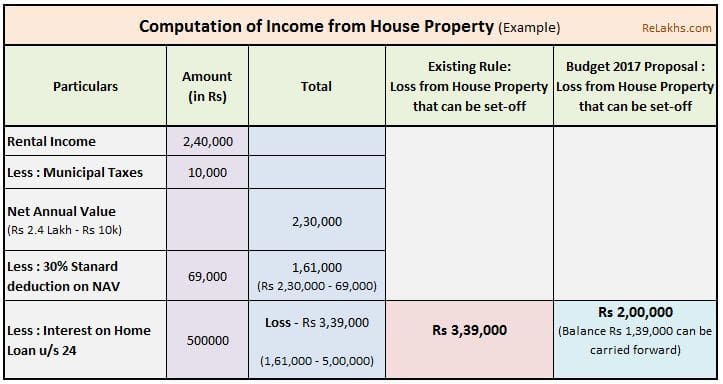

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan Web 25 mars 2016 nbsp 0183 32 For F Y 2017 18 a deduction for the interest is limited to Rs 2 00 0000 both in case of self occupied property and let out property

Income Tax Rebate On Home Loan Interest And Principal

Income Tax Rebate On Home Loan Interest And Principal

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Web 26 sept 2021 nbsp 0183 32 How To Fill Home Loan Interest and Principal in Income Tax Return Home Loan Tax Benefit in 2021 22 In this video I have tried to explain the knowledge Web Principal repayment of home loans can net annual tax deductions of up to Rs 1 5 lakh under Section 80C of the ITA On the interest payments for a home loan you can claim

Web Repayment of a home loan s principal is tax deductible under Section 80C Section 24 allows a tax deduction for mortgage interest Subsidised mortgage interest deduction Web If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to

Download Income Tax Rebate On Home Loan Interest And Principal

More picture related to Income Tax Rebate On Home Loan Interest And Principal

Mortgage Fundamentals An Illustrated Tutorial

http://thismatter.com/money/real-estate/images/mortgage-payments-interest-principal-portions.gif

Home Loan Repayments Principal And Interest Or Interest Only

https://www.realestate.com.au/blog/images/519x1024-fit%2Cprogressive/2017/08/30112149/Bankwest_Infographic_v5-519x1024.jpg

Home Loan Interest Rates November 2019 Archives Yadnya Investment Academy

https://blog.investyadnya.in/wp-content/uploads/2019/11/Interest-Rates-on-Home-Loan-of-Major-Banks-Dec-2019_Featured.png

Web 3 mars 2023 nbsp 0183 32 As per Section 24 a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI they paid throughout the year Income Web 28 janv 2014 nbsp 0183 32 Tax rebate on house loan for under construction property I have purchased a flat which is about to be completed by Dec 2014 As per the law I can get tax benefits

Web 24 ao 251 t 2023 nbsp 0183 32 Updated 24 08 2023 09 31 08 AM The Government of India offers home loan tax benefits of up to Rs 5 lakh to individuals deduction of up to Rs 1 5 lakh on Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of

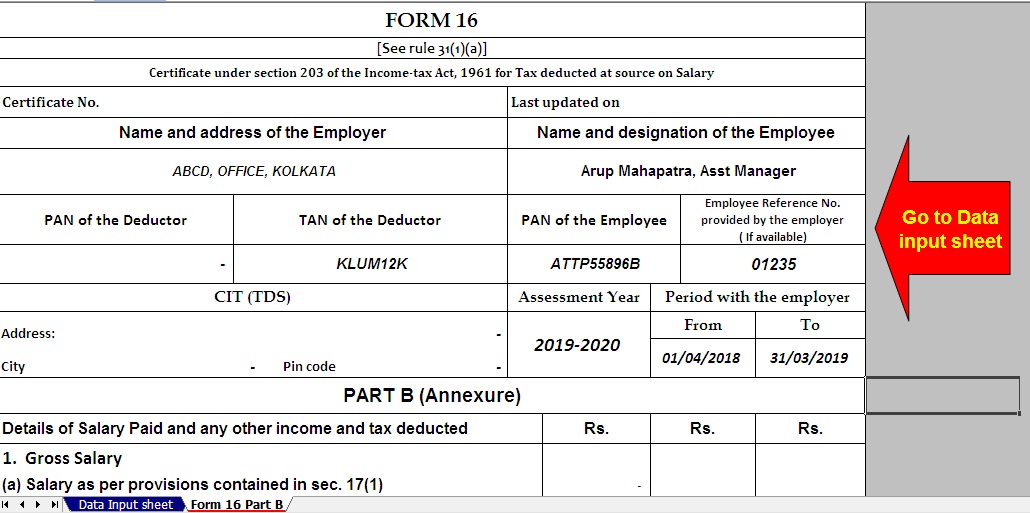

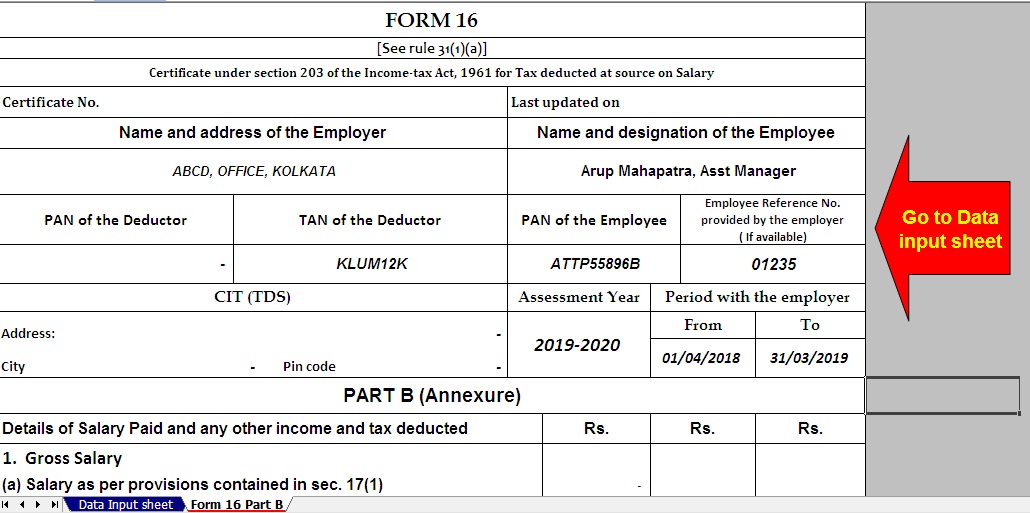

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

https://1.bp.blogspot.com/-iMxeS2BunP0/XqBA6tBeFDI/AAAAAAAAMqc/8rBcCs0zvickDhs3V41UMTzIPBp2MS3kQCEwYBhgL/s1600/Picture%2B4%2Bof%2BNew%2BForm%2B16%2BPart%2BB.jpg

Mortgage Why Is The Breakdown Of A Loan Repayment Into Principal And

https://i.stack.imgur.com/dLnok.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

https://cred.club/calculators/articles/how-to-calculate-home-loan-tax...

Web under Section 80C of the Income Tax Act you can claim a maximum home loan tax deduction of up to 1 5 lakh from your annual taxable income on the principal loan

Home Loan EMI Calculator 2023 Free Excel Sheet Stable Investor

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated Excel

How Home Loan Interest Is Calculated Kabar Flores

DEDUCTION UNDER SECTION 80C TO 80U PDF

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

How To Lower Loan Interest Rates

How To Lower Loan Interest Rates

New Form 12BB For LTA HRA And Home Loan Interest Proofs To Be

Income Tax Rebate Under Section 87A

INCOME TAX REBATE ON HOME LOAN

Income Tax Rebate On Home Loan Interest And Principal - Web 31 mars 2019 nbsp 0183 32 This includes a maximum of INR 2 lakhs per annum under section 24 of the Income Tax Act for the interest paid on home loans and INR 1 5 lakhs per annum on