Income Tax Rebate On Renovation Of House Most home improvements like putting on a new roof or performing routine maintenance don t qualify for any immediate tax breaks However some known as capital improvements may raise the

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation Under the Energy Efficient Home Improvement Credit a taxpayer can claim the credit only for qualifying expenditures incurred for an existing home or for an

Income Tax Rebate On Renovation Of House

Income Tax Rebate On Renovation Of House

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/Rebate-for-Joint-House-Loan-768x371.jpg

Home Addition Conversion And Renovation Rebates

https://www.newhousingrebate.ca/wp-content/uploads/home-addition-conversion-renovation-rebates.jpg

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/Rebate-on-Home-Loan-As-Per-Section-80EE-and-80-EEA-750x362.jpg

The government offers tax benefits under Section 24 for income from house property Taxable income includes rental income deemed let out properties self The Inflation Reduction Act includes rebates and tax credits to help homeowners install new heaters and other appliances

Thu Oct 10 2024 17 28 Investment funds buying apartment blocks will escape the new 6 per cent stamp duty on properties valued at over 1 5 million according to Here are some new and existing housing benefits and tax credits Multigenerational Home Renovation Tax Credit The MHRTC could provide a valuable

Download Income Tax Rebate On Renovation Of House

More picture related to Income Tax Rebate On Renovation Of House

Home Loan Tips Income Tax Rebate On Home Loan By Section 80c And

https://feeds.abplive.com/onecms/images/uploaded-images/2022/04/02/f76f68da854ba91279b6eb80f97615cb_original.jpg?impolicy=abp_cdn&imwidth=1200&imheight=628

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/Rebate-for-Interest-Paid-on-Loan-During-the-Initial-Phase.jpg

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

https://images.moneycontrol.com/static-mcnews/2021/02/affordable-housing.jpg

About the Property Tax Rent Rebate Program The Property Tax Rent Rebate Program supports homeowners and renters across Pennsylvania This program provides a Home renovations typically do not qualify for federal tax deductions but certain improvements may qualify for deductions and credits can help reduce taxes Financing home improvements through

Yes tax benefits on a home loan taken for the renovation of a property can be claimed under Section 24 of the Income Tax Act 1961 up to a maximum limit of Rs Harrisburg PA Governor Josh Shapiro today announced that his Administration has processed more than 500 000 tax rebates totaling over 304 million

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

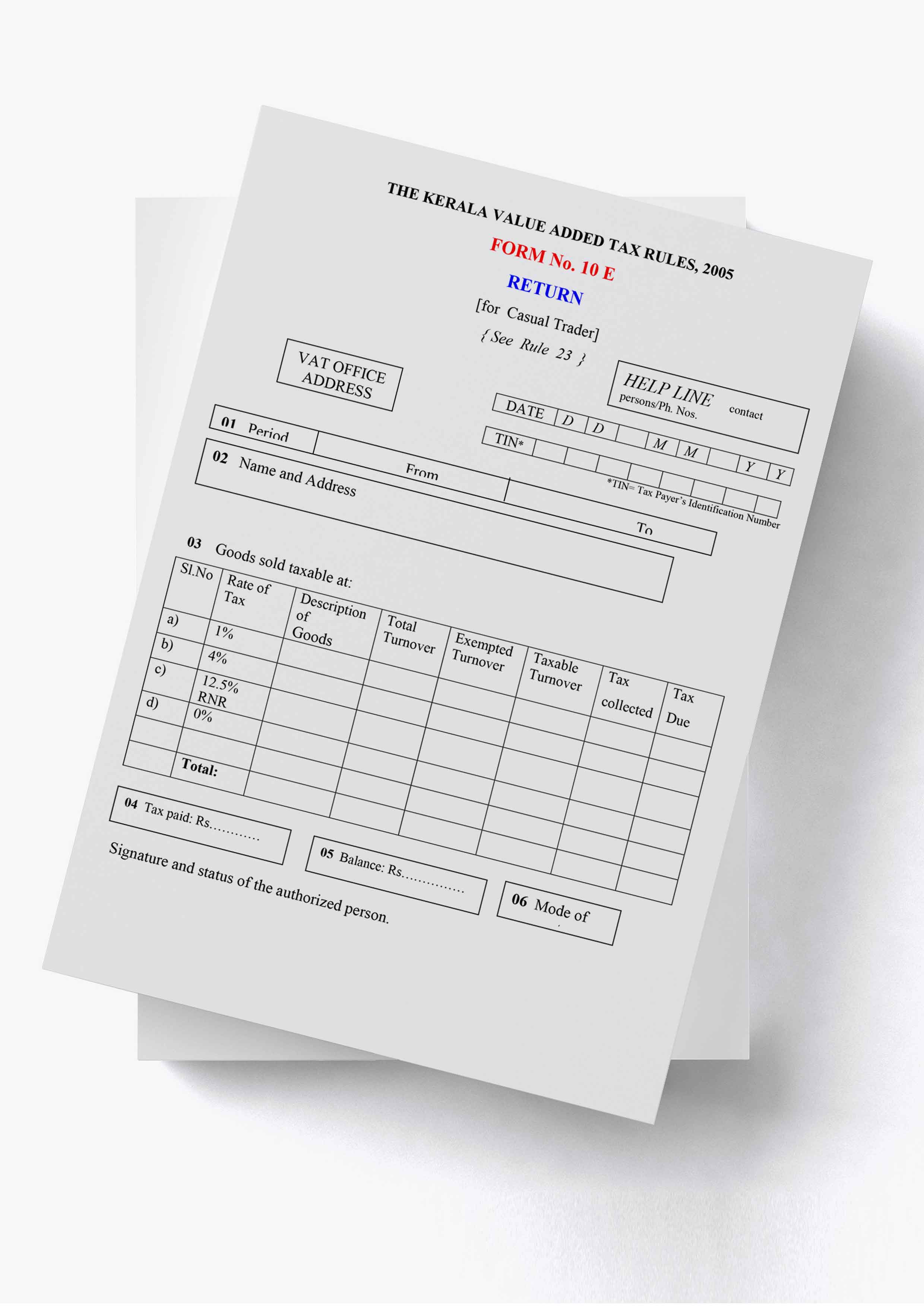

How To Fill Form 10 E For Income Tax Rebate On Arrears Paid

https://www.askbanking.com/wp-content/uploads/2016/03/form-10E.jpg

https://www.familyhandyman.com/article/…

Most home improvements like putting on a new roof or performing routine maintenance don t qualify for any immediate tax breaks However some known as capital improvements may raise the

https://www.irs.gov/newsroom/irs-home-improvements...

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation

Difference Between Income Tax Deductions Exemptions And Rebate Plan

How To Calculate Tax Rebate On Home Loan Grizzbye

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Latest Income Tax Rebate On Home Loan 2023

Home Loan Tax Benefits Get Income Tax Rebate On Home Loans

Difference Between Income Tax Rebate Tax Deduction And Exemption Tax

Difference Between Income Tax Rebate Tax Deduction And Exemption Tax

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

How To Get A Tax Rebate On Replacement Windows Sapling

Expense On Renovation Of Purchased Unit Is Eligible For Exemption U s

Income Tax Rebate On Renovation Of House - Thu Oct 10 2024 17 28 Investment funds buying apartment blocks will escape the new 6 per cent stamp duty on properties valued at over 1 5 million according to