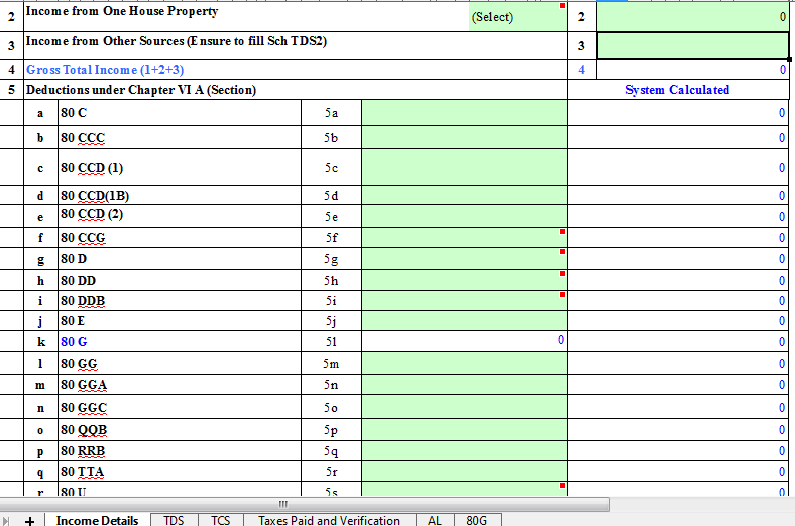

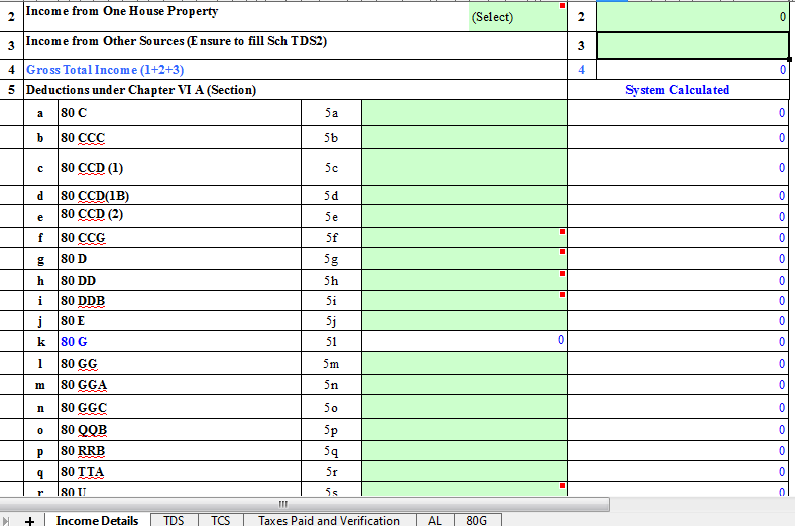

Income Tax Rebate On Savings Interest Web 11 mai 2023 nbsp 0183 32 Income Tax Guidance Claim a refund of Income Tax deducted from savings and investments English Cymraeg Apply for a repayment of tax on your savings

Web 17 juil 2019 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 deals with the tax deductions granted on interest on saving banks This deduction is Web 8 mai 2023 nbsp 0183 32 So for example let s say that you earn 10 000 in interest income and your marginal tax rate is 22 based on your 2023 federal income tax bracket Using that information the tax on your

Income Tax Rebate On Savings Interest

Income Tax Rebate On Savings Interest

https://taxadda.com/wp-content/uploads/ITR-1-1.png

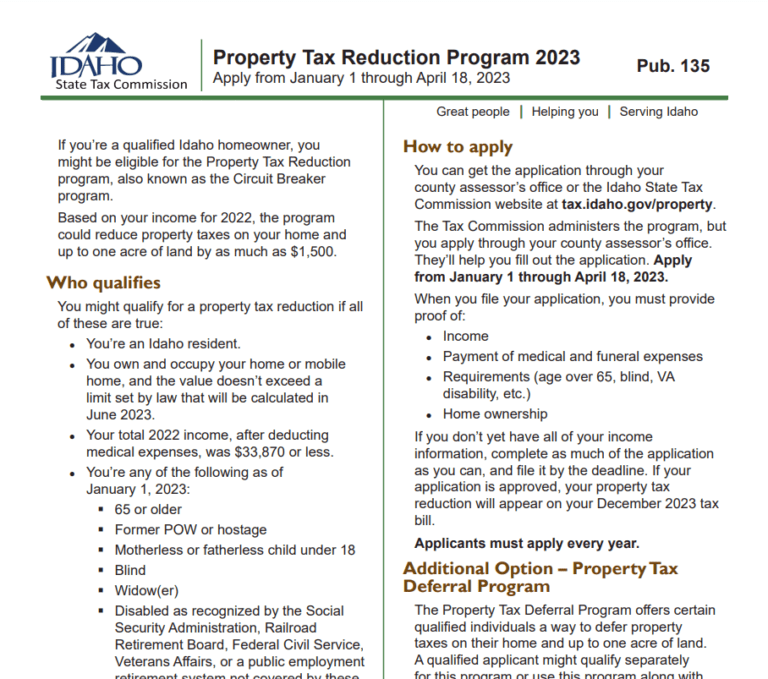

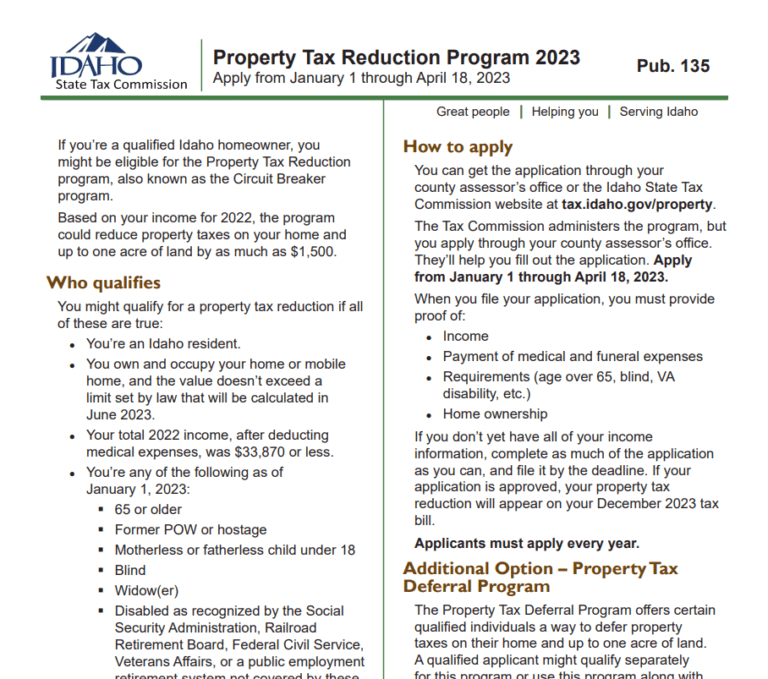

Idaho Tax Rebate 2023 Your Comprehensive Guide To Saving Money

https://printablerebateform.net/wp-content/uploads/2023/03/Idaho-Tax-Rebate-2023-768x679.png

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Web 6 avr 2023 nbsp 0183 32 You may need to claim a repayment of tax if any of your savings income should only have been subject to the starting rate of tax for savings 0 in 2023 24 or should not have been taxed at all for Web 6 avr 2023 nbsp 0183 32 You earn 163 20 000 a year and get 163 1 500 in account interest you won t pay tax on your interest up to 163 1 000 But you ll need to pay basic rate tax 20 on the 163 500 above this Higher rate taxpayers You earn

Web 26 avr 2023 nbsp 0183 32 Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 but you should report any interest earned even if Web 6 mars 2023 nbsp 0183 32 Interest per month Rs 5 lakh 06 30 365 Rs 246 Click here to know the best savings account interest rates for 2023 Income Tax Applicability on Savings Account Interest Earned The

Download Income Tax Rebate On Savings Interest

More picture related to Income Tax Rebate On Savings Interest

How Is Interest Income From Your Investments Taxed Personal Finance Plan

http://www.personalfinanceplan.in/wp-content/uploads/2017/04/20170420-Taxation-of-interest-income-tax.jpg

Income Tax Deductions List FY 2019 20

https://www.relakhs.com/wp-content/uploads/2019/02/Revised-Section-87A-Tax-Rebate-impact-on-Income-tax-liability-calculation-FY-2019-20-AY-2020-21.jpg

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

https://www.firstpost.com/wp-content/uploads/large_file_plugin/2019/02/1549021404_Salarytable.jpg

Web 10 mars 2022 nbsp 0183 32 Tax Rates on Interest From Savings Savings account interest will be taxed at the same marginal income tax rate as the rest of your earned income Here s a Web 10 juil 2023 nbsp 0183 32 Paying tax on savings account interest Just like any other source of income you need declare any interest you ve earned on an Australian savings account and you ll be taxed at your income tax rate By Alison Banney Updated Jul 10 2023 Fact checked Credit Unions Online Banking SMSF Accounts Investments Cash Mgmt

Web in excess of the maximum For example a cap labor income and on their income from of 500 on the amount of interest or dividends capital and as a result have somewhat Web 6 avr 2023 nbsp 0183 32 In 2023 24 you can earn 163 1 000 of interest on savings tax free if you re a basic rate taxpayer If you re a higher rate taxpayer your tax free allowance is 163 500 If you re a higher rate taxpayer your tax free

First Time Home Buyer Tax Questions

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

https://www.gov.uk/guidance/claim-a-refund-of-income-tax-deducted-from...

Web 11 mai 2023 nbsp 0183 32 Income Tax Guidance Claim a refund of Income Tax deducted from savings and investments English Cymraeg Apply for a repayment of tax on your savings

https://tax2win.in/guide/section-80tta

Web 17 juil 2019 nbsp 0183 32 Section 80TTA of the Income Tax Act 1961 deals with the tax deductions granted on interest on saving banks This deduction is

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

First Time Home Buyer Tax Questions

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

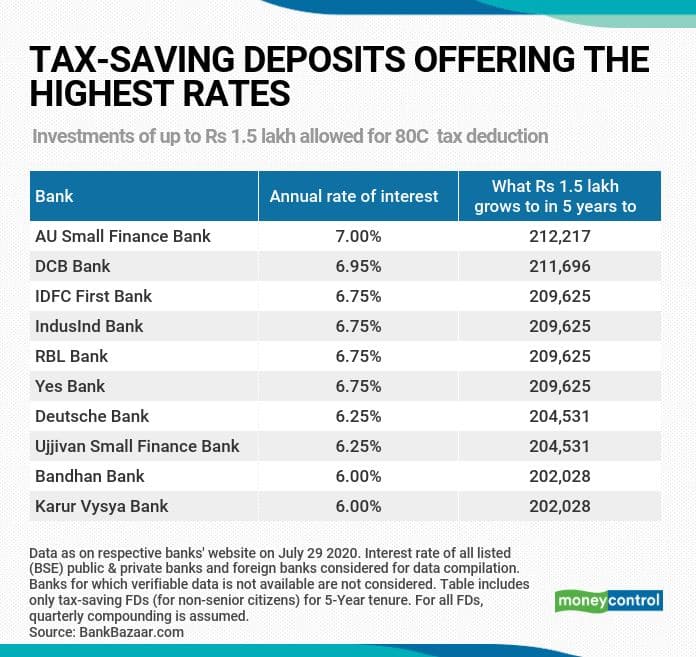

10 Tax saving Fixed Deposits That Offer The Best Interest Rates 10 Tax

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Income Tax Rebate Up To 2 Lakhs On Home Loan The Viral News Live

Section 87A Tax Rebate FY 2019 20 How To Check Rebate Eligibility

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Income Tax Rebate Under Section 87A

Income Tax Rebate On Savings Interest - Web 6 avr 2023 nbsp 0183 32 You earn 163 20 000 a year and get 163 1 500 in account interest you won t pay tax on your interest up to 163 1 000 But you ll need to pay basic rate tax 20 on the 163 500 above this Higher rate taxpayers You earn