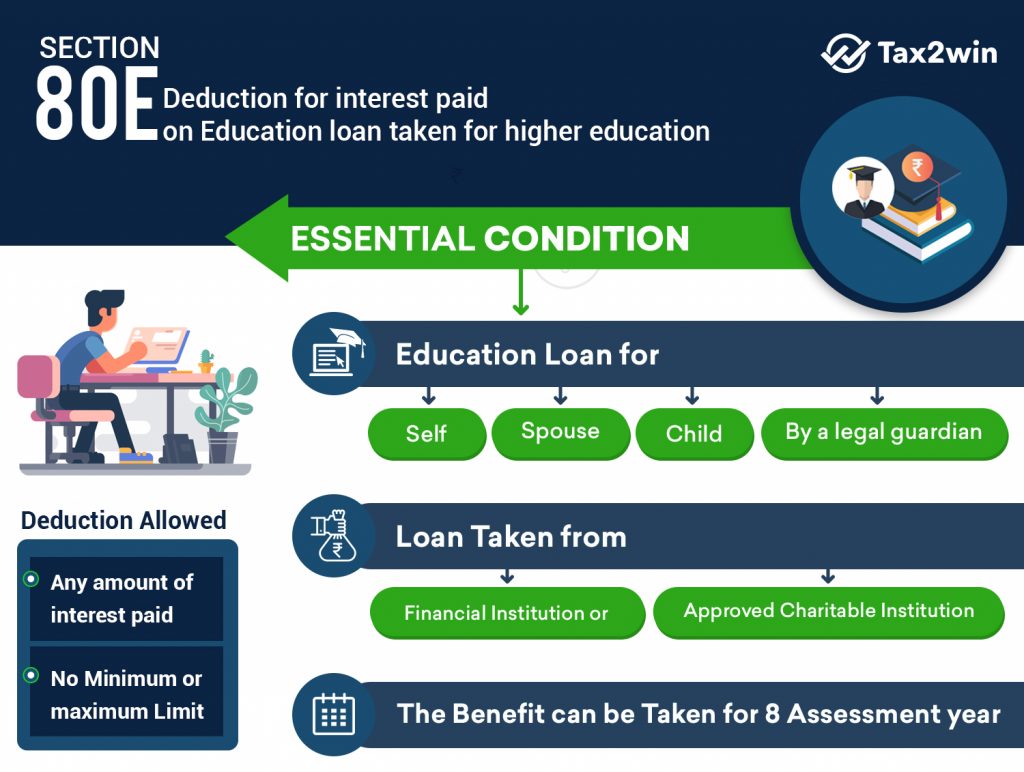

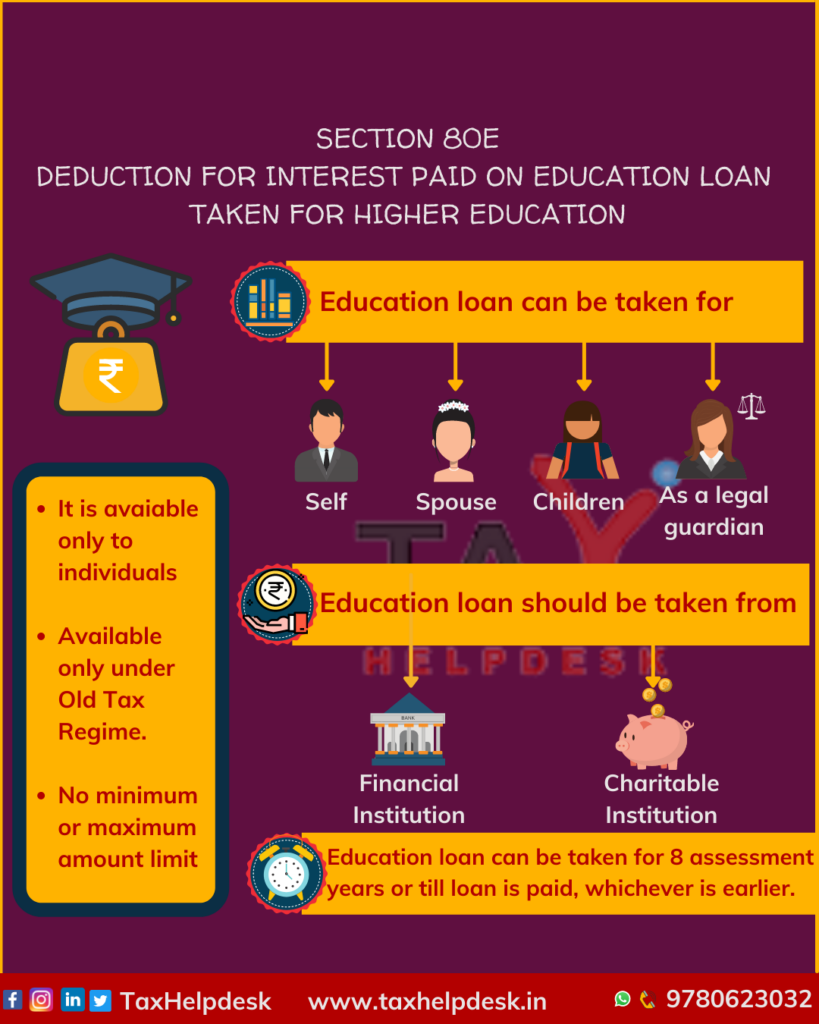

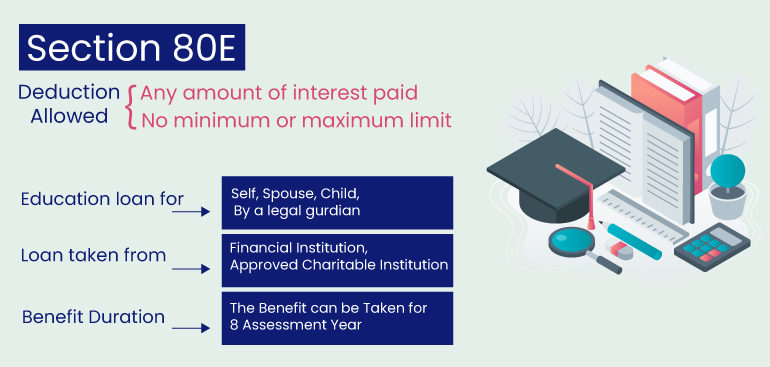

Income Tax Rebate Under Section 80e Web 30 mars 2023 nbsp 0183 32 According to Section 80E of income tax you must request an education loan from reputable financial institutions such as a bank an NBFC or a charitable

Web 12 janv 2022 nbsp 0183 32 You can claim tax deductions under Section 80E of the Income Tax Act while you file your ITR You do not need to attach any documentary proof for availing of Web Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a tax deduction for the

Income Tax Rebate Under Section 80e

Income Tax Rebate Under Section 80e

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

http://cppunjab.org/wp-content/uploads/2023/05/AAEAC9089NF20231_signed-1_page-0001-724x1024.jpg

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

https://cppunjab.org/wp-content/uploads/2023/05/AAEAC9089NF20231_signed-1_page-0002-1085x1536.jpg

Web 26 juin 2018 nbsp 0183 32 Section 80E Deduction available if Interest is been paid during the previous year and was paid out of income chargeable to tax which means if repayment is made Web Section 80E Income Tax Deduction for Education Loan Since 2009 Section 80E Income Tax Deduction for Education Loan As per the Income Tax Act a taxpayer is allowed to claim deduction under Chapter VI A for

Web 23 sept 2019 nbsp 0183 32 Section 80C of the Income Tax Act provides deduction in respect of the tuition fees paid for the education However section 80E of the Income Tax Act Web According to Section 80E of the Income Tax Act 1961 you can claim a tax deduction on the interest paid on your education loans taken to pursue higher education This tax

Download Income Tax Rebate Under Section 80e

More picture related to Income Tax Rebate Under Section 80e

Section 80E Deduction For Interest On Education Loan Tax2win

https://blog.tax2win.in/wp-content/uploads/2019/03/80E-Deduction-for-interest-paid-on-loan-taken-for-higher-education-1024x772.jpg

Deduction Under Section 80E Interest Paid On Higher Education

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/SECTION-80E-DEDUCTION-FOR-INTEREST-PAID-ON-EDUCATION-LOAN-TAKEN-FOR-HIGHER-EDUCATION-1-819x1024.png

![]()

Section 80C Deduction Under Section 80C In India Paisabazaar

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_800/https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

Web In Section 80E of Income Tax Act 1961 it is mentioned that this education loan should be taken from a charitable or financial institution The tax deduction under Section 80E Web Education Loan Tax 80E Rebate Calculator Most accurate calculator for section 80E education loan income Tax exemption The easiest and the quickest way to calculate your education loan income tax benefits as

Web 31 mai 2023 nbsp 0183 32 Section 80E is the income tax deduction from taxable income which covers the deduction on the interest component paid on higher education loans Web According to Section 80E the deduction is allowed on the total interest amount of the EMI paid during the financial year The loan has to be taken from a bank or financial

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

https://www.fincash.com/b/wp-content/uploads/2017/01/80c-deductions.png

Section 80E

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/SECTION80Earticle.jpg

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 According to Section 80E of income tax you must request an education loan from reputable financial institutions such as a bank an NBFC or a charitable

https://navi.com/blog/section-80e-income-tax-act

Web 12 janv 2022 nbsp 0183 32 You can claim tax deductions under Section 80E of the Income Tax Act while you file your ITR You do not need to attach any documentary proof for availing of

Deduction Under Section 80E Of Income Tax Act YouTube

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

Section 80D Income Tax Deduction For Medical Insurance Preventive

Tax Benefit Related To Interest Paid On Education Loan Blog

9 Section 80E SAVE MONEY Claim deduction 100 FULL AMOUNT REBATE

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Income Tax Deductions 1 Section 80D 80DD 80DDB 80E 80G 80GG 80U 80CCD1B

Anything To Everything Income Tax Guide For Individuals Including

Deductions Under VI A Section 80D 80G 80E And The Rest

Income Tax Rebate Under Section 80e - Web Section 80E Income Tax Deduction for Education Loan Since 2009 Section 80E Income Tax Deduction for Education Loan As per the Income Tax Act a taxpayer is allowed to claim deduction under Chapter VI A for