Income Tax Rebate Under Section 89a Learn how to calculate tax relief under Sections 89 and 89A for arrears gratuity and foreign retirement benefits Understand the steps and eligibility criteria

To claim relief under Section 89A taxpayers must file Form No 10 EE and adhere to the prescribed procedures These amendments aim to streamline the taxation process for Section 89A of the Income Tax Act allows resident individuals to defer tax payments on income earned from foreign retirement benefits accounts from the year it accrues

Income Tax Rebate Under Section 89a

Income Tax Rebate Under Section 89a

https://live.staticflickr.com/65535/52505443069_b5e1cbe9b9_b.jpg

Income Tax Rebate Under Section 87A Total Taxable Income Enterslice

https://i.ytimg.com/vi/sn5ZqlTgaHo/maxresdefault.jpg

Income Tax Rebate Under Section 87A Eligibility Tax Deductions

https://i.ytimg.com/vi/NRfAawxyy-A/maxresdefault.jpg

The Department has recognised this issue and has introduced section 89A by the Finance Act 2021 w e f 1 4 2022 According to section 89A if a specified person has income accrued in a Know complete information on Income Tax Rebate under section 89A Also understand new rule 21AAA Form No 10AA before filing the ITR Read now

To save you from any additional tax burden due to delay in receiving income the tax laws allow a relief under section 89 1 In simple words you do not pay more taxes if there was a delay in payment to you and you were in a lower Finance Act 2021 inserted new section 89A in the ITA with effect from 1 April 2022 to address the mismatch in taxation of income earned by Indian residents from a

Download Income Tax Rebate Under Section 89a

More picture related to Income Tax Rebate Under Section 89a

Income Tax Rebate Under Section 87A PulseHRM

https://pulsehrm.com/wp-content/uploads/2023/04/8.-Section-87A-scaled.jpg

Understanding Section 89A Of Income Tax Act Relief For Pending Claims

https://margcompusoft.com/m/wp-content/uploads/2023/02/22-1024x576.jpg

Rebate Allowable Under Section 87A Of Income Tax Act

https://taxguru.in/wp-content/uploads/2020/08/Tax-Rebate.jpg

Section 89A of the tax code is specifically designed to provide relief to NRIs from double taxation on their foreign retirement benefits It allows NRIs to claim tax relief based on Section 89A was introduced in Budget 2021 to provide a relief from taxation on Income earned from foreign retirement benefit account maintained in notified country The

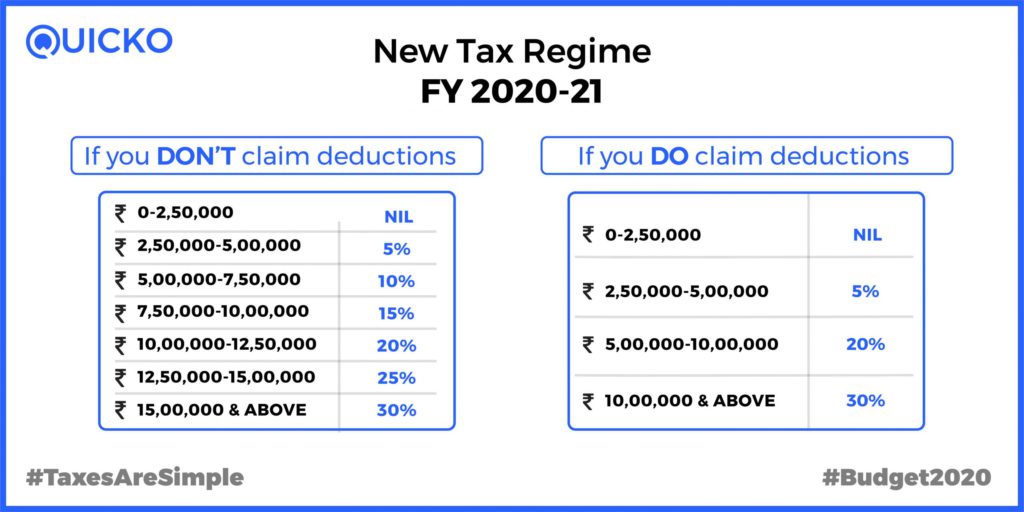

Finance Act 2021 introduced Section 89A providing relief from taxation in income from retirement benefit accounts maintained in a notified country by non resident The relief under Section 89A is available to taxpayers who have opted for the new tax regime and have a pending claim or return under any of the following provisions of the

Understanding Income Tax Rebate Under Section 87A Fi Money

https://assets-global.website-files.com/61559d56514fd6c31beea3ac/6480152837609ce5fdf66df8_6459bae6590e5fb47b6cc4a7_sIm0H1683536622_889436.webp

CBDT Notifies 4 Countries Under Section 89A Of Income tax Act 1961

https://taxguru.in/wp-content/uploads/2022/04/CBDT-notifies-4-Countries-under-section-89A-of-Income-tax-Act-1961.jpg

https://taxguru.in/income-tax/calculation-of-relief-sections-89-89a.html

Learn how to calculate tax relief under Sections 89 and 89A for arrears gratuity and foreign retirement benefits Understand the steps and eligibility criteria

https://www.thetaxheaven.com/blog/section-89a-of...

To claim relief under Section 89A taxpayers must file Form No 10 EE and adhere to the prescribed procedures These amendments aim to streamline the taxation process for

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Understanding Income Tax Rebate Under Section 87A Fi Money

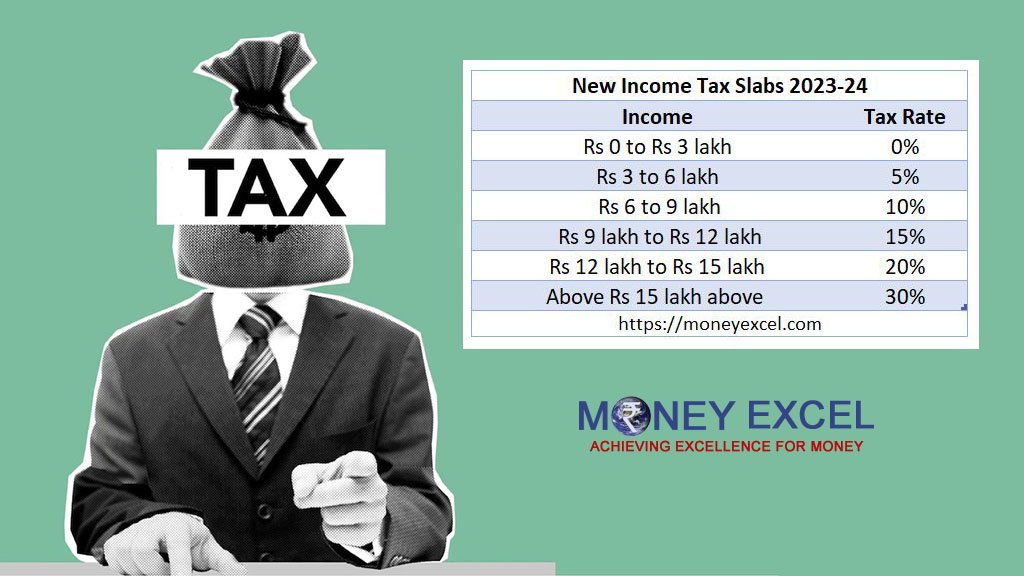

New Income Tax Slab 2023 24

Income Tax Rebate Under Section 87A How It Avail Eligibility

Section 87A Tax Rebate Under Section 87A Rebates Financial

Section 89A Of Income Tax Act 1961

Section 89A Of Income Tax Act 1961

Income Tax Clarification Opting For The New Income Tax Regime U s

Income Tax Rebate Under Section 87A Legalraasta

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 89a - Section 89A of the Income Tax Act provides relief to taxpayers who receive salary or arrears of salary in a financial year The purpose is to ensure that the taxpayer is not