Income Tax Return For Financial Year 2022 23 Verkko 30 marrask 2023 nbsp 0183 32 Income Tax Return ITR Filing Last Date 2023 Find out the Important Due Dates of ITR filing for the year FY 2022 23 AY 2023 24 for Individuals and Businesses See the Tax calendar for 2023 File Now

Verkko 1 p 228 iv 228 sitten nbsp 0183 32 Livemint Income Tax Return Filing Last Date The Income Tax Department allows the submission of updated ITRs after the December 31 deadline but additional taxes may apply for Verkko 7 hein 228 k 2023 nbsp 0183 32 Begin the process of filing your Income Tax Return today with the help of our article Easy ITR Filing Process 10 Steps to File Your ITR Online for FY 2022 23 AY 2023 24 Also keep your documents ready before you start filing your Income Tax Return for FY 2022 23 AY 2023 24 by checking out our comprehensive list of the

Income Tax Return For Financial Year 2022 23

Income Tax Return For Financial Year 2022 23

https://i.ytimg.com/vi/HyPP-urSbm4/maxresdefault.jpg

Income Tax Department Notifies New ITR Forms For FY 2021 22 Pedfire

https://static.india.com/wp-content/uploads/2022/03/Income-Tax-Return-Refund.jpg

Income Tax Return 2022 23 These Are The Exemptions And Deductions

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1cK7Oo.img

Verkko 15 huhtik 2023 nbsp 0183 32 Income Tax Articles Due dates for ITR Filing Online for FY 2022 23 Ishita Ramani Income Tax Articles Download PDF 15 Apr 2023 323 358 Views 9 comments The Income Tax Department has introduced seven different forms namely Form ITR 1 to ITR 7 for filing Income Tax Return based on the type of income and Verkko 20 kes 228 k 2023 nbsp 0183 32 File your Income Tax Return ITR for the financial year 2022 23 by July 31 2023 to avoid penalties and interest charges Learn about due dates late filing fees and Stay compliant with income tax regulations and secure your financial future

Verkko 16 huhtik 2022 nbsp 0183 32 The process of Income Tax Return ITR filing for the Assessment Year AY 2022 23 has been initiated with timely notification of ITR Forms from ITR 1 to ITR 6 Written by Amitava Chakrabarty Verkko 29 jouluk 2023 nbsp 0183 32 For those who missed the July 31 deadline to file their income tax return ITR for the financial year 2022 23 the Income Tax Department has issued a warning

Download Income Tax Return For Financial Year 2022 23

More picture related to Income Tax Return For Financial Year 2022 23

Income Tax Return ITR Filing For FY 2022 23 Important Tips Form 16

https://static.toiimg.com/thumb/msid-100690943,width-1070,height-580,imgsize-23082,resizemode-75,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

Photo Gallery Free EFiling Income Tax Return Online For FY 2021 22

https://czytax.in/wp-content/uploads/2023/01/preview.jpg

J K Lasser s Your Income Tax 2023 For Preparing Your 2022 Tax Return

https://images.thenile.io/r1000/9781394157686.jpg

Verkko 1 p 228 iv 228 sitten nbsp 0183 32 The clock is ticking for taxpayers as the deadline to file Income Tax Returns ITR for the financial year 2022 23 is set for today December 31 The Income Tax Department took to X urging Verkko 28 jouluk 2023 nbsp 0183 32 Income Tax Return Filing Last Date As the deadline for filing ITR for financial year 2022 23 draws closer taxpayers are urged to act promptly and file their income tax returns before December 31 2023 This is crucial for those who have not yet filed their income tax returns

Verkko 13 kes 228 k 2022 nbsp 0183 32 Rate of Income tax Assessment Year 2023 24 Assessment Year 2022 23 Up to Rs 2 50 000 Rs 2 50 000 to Rs 5 00 000 5 5 Rs 5 00 000 to Rs 10 00 000 20 20 Above Rs 10 00 000 30 30 Senior Citizen who is 60 years or more at any time during the previous year Net Income Range Rate of Verkko 6 tammik 2023 nbsp 0183 32 December 31 2022 was the last date for filing certain income tax returns These include belated ITR and reivsed ITR However if you have missed this deadline then you have an option to file updated income tax return or also known as ITR U Here s what you need to know about

How To File Income Tax Return For AY 2022 23 FY 2021 22 How Fill

https://i.ytimg.com/vi/oZZjaQmSmA4/maxresdefault.jpg

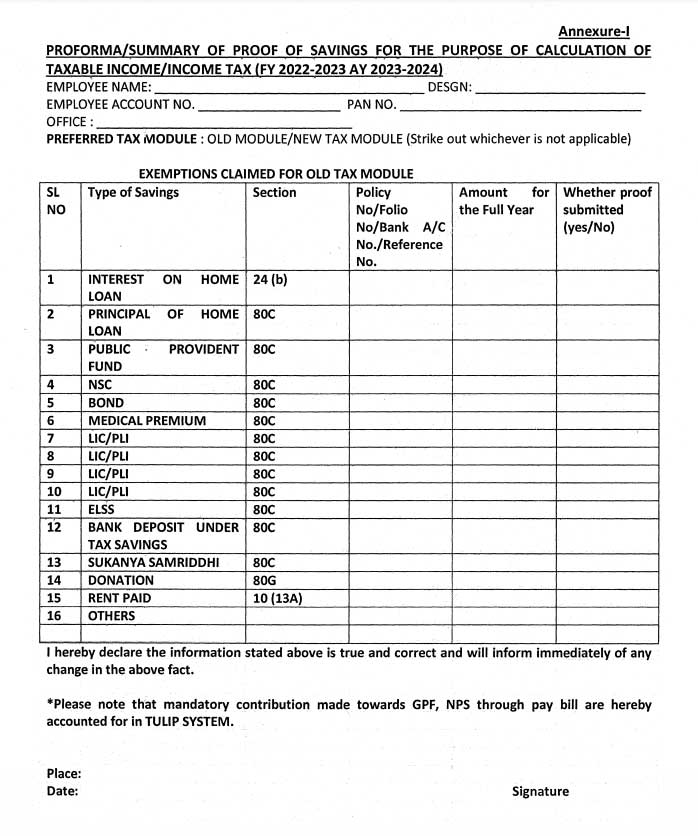

Income Tax Return For Defence Personnel Income Tax Exemption For

https://www.centralgovernmentnews.com/wp-content/uploads/2022/10/PROFORMA-SUMMARY-OF-PROOF-OF-SAVINGS-FOR-THE-PURPOSE-OF-CALCULATION-OF-TAXABLE-INCOME-INCOME-TAX-FY-2022-2023-AY-2023-2024.jpg

https://cleartax.in/s/due-date-tax-filing

Verkko 30 marrask 2023 nbsp 0183 32 Income Tax Return ITR Filing Last Date 2023 Find out the Important Due Dates of ITR filing for the year FY 2022 23 AY 2023 24 for Individuals and Businesses See the Tax calendar for 2023 File Now

https://www.livemint.com/money/personal-finance/last-day-for-filing...

Verkko 1 p 228 iv 228 sitten nbsp 0183 32 Livemint Income Tax Return Filing Last Date The Income Tax Department allows the submission of updated ITRs after the December 31 deadline but additional taxes may apply for

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

How To File Income Tax Return For AY 2022 23 FY 2021 22 How Fill

Supreme Annual Income Tax Statement Prepare Trading Profit And Loss Account

Income Tax Declaration Form For Financial Year 2021 2022 PDF

Irs Tax Return 2023 Form Printable Forms Free Online

Income Tax Return Salary At Best Price In Delhi

Income Tax Return Salary At Best Price In Delhi

:max_bytes(150000):strip_icc()/Form1040-SR2022-b0b21772ee8a4be689090dccb27bfec0.jpg)

Income Tax Form 2022

Income Tax Slab 2021 To 2022 Pdf PELAJARAN

All About Due Dates Of Filing Income Tax Return Assessment Year 2022

Income Tax Return For Financial Year 2022 23 - Verkko 16 huhtik 2022 nbsp 0183 32 The process of Income Tax Return ITR filing for the Assessment Year AY 2022 23 has been initiated with timely notification of ITR Forms from ITR 1 to ITR 6 Written by Amitava Chakrabarty