Income Tax Rules 80dd Deduction under section 80DD of the Income Tax Act covers the amount paid towards the medical expenditure of a dependant with a specific disability It also covers the amount of insurance premium paid towards specific insurance plans

Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents and dependent siblings The diseases eligible for this deduction are outlined in Rule 11DD of the income tax regulations Section 80DD of the Income Tax Act allows residents whether individuals or HUFs to claim a deduction for a dependent who is differently abled and completely reliant on them for support and maintenance

Income Tax Rules 80dd

Income Tax Rules 80dd

https://n3.sdlcdn.com/imgs/d/n/3/Income-Tax-Rules-5th-e-SDL076879114-1-da7d7.jpg

Taxmann s Income Tax Rules 2 Vols Buy Taxmann s Income Tax Rules 2

https://n4.sdlcdn.com/imgs/h/s/4/Taxmann-s-Income-Tax-Rules-SDL023588796-1-02ac7.jpg

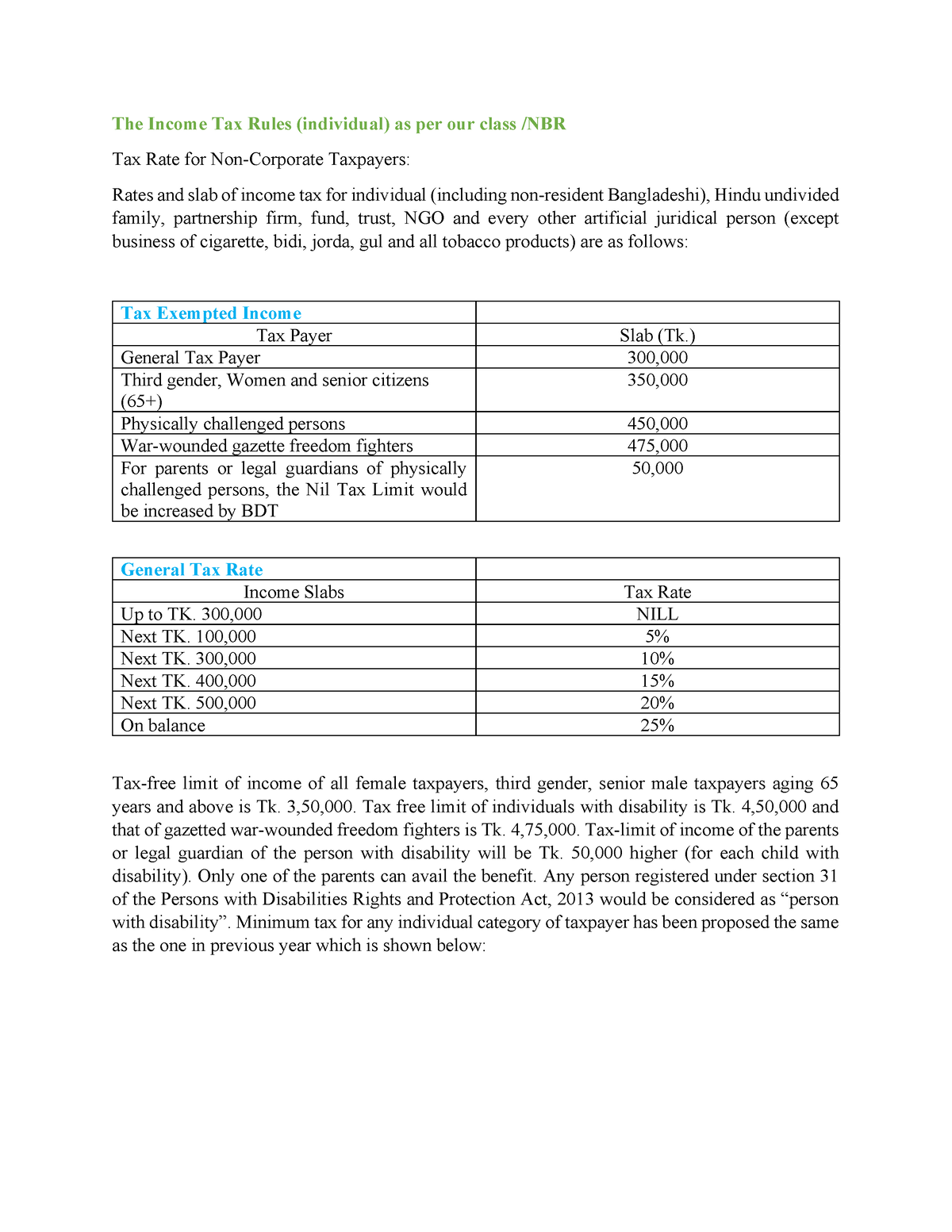

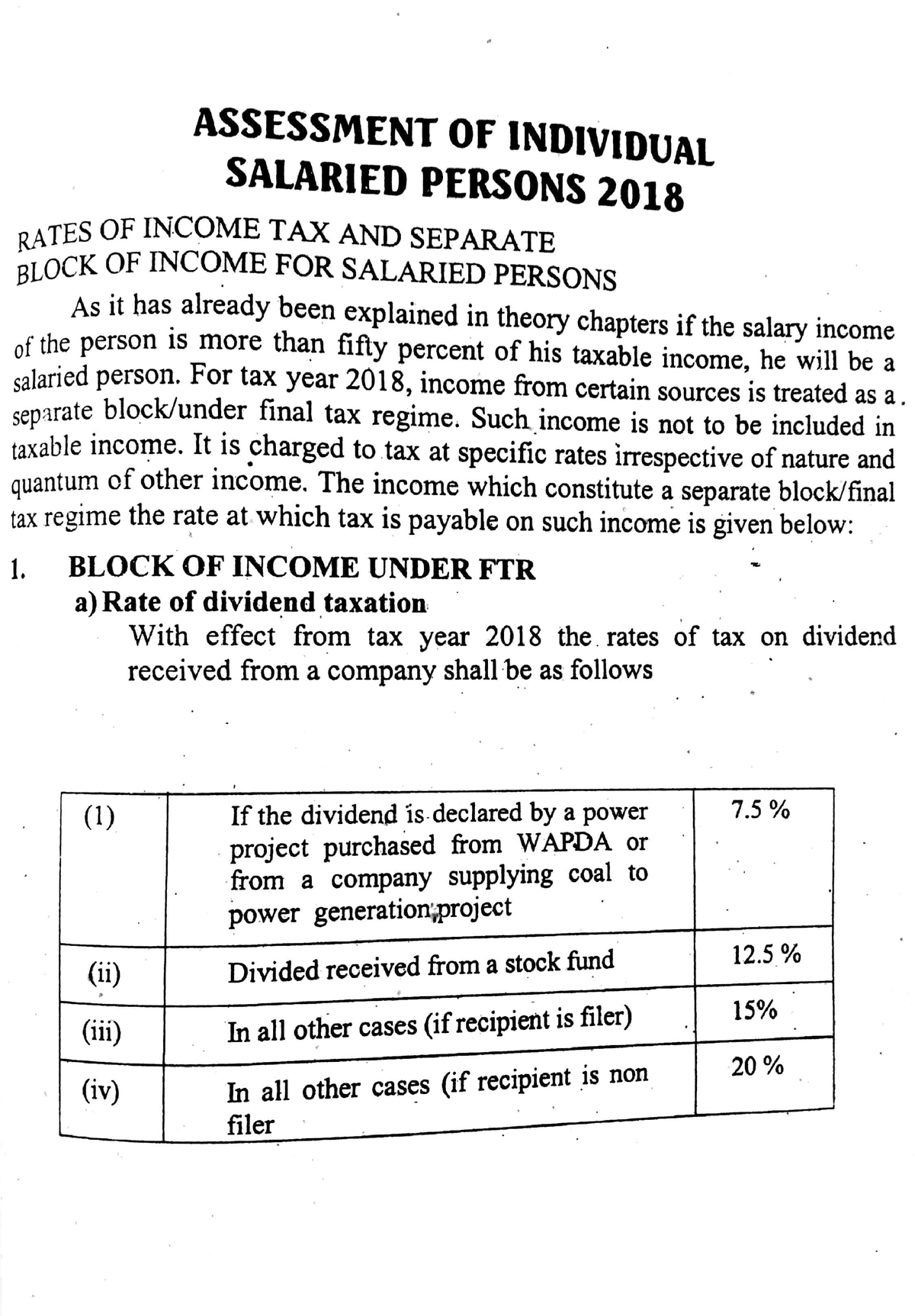

Compensation Assignment The Income Tax Rules individual As Per Our

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a1d2f5f26b4d061b8d49161c73452e57/thumb_1200_1553.png

A resident individual or HUF Hindu Undivided Family can claim a deduction in taxes under Section 80DD of Income Tax Act 1961 on medical treatment and expense on support and maintenance of a wholly dependent individual who Section 80DDB of the Income tax Act 1961 provides a deduction for specified diseases covered under Rule 11DD List of diseases as covered under Rule 11DD of Income Tax Rules 1962 are as under 1

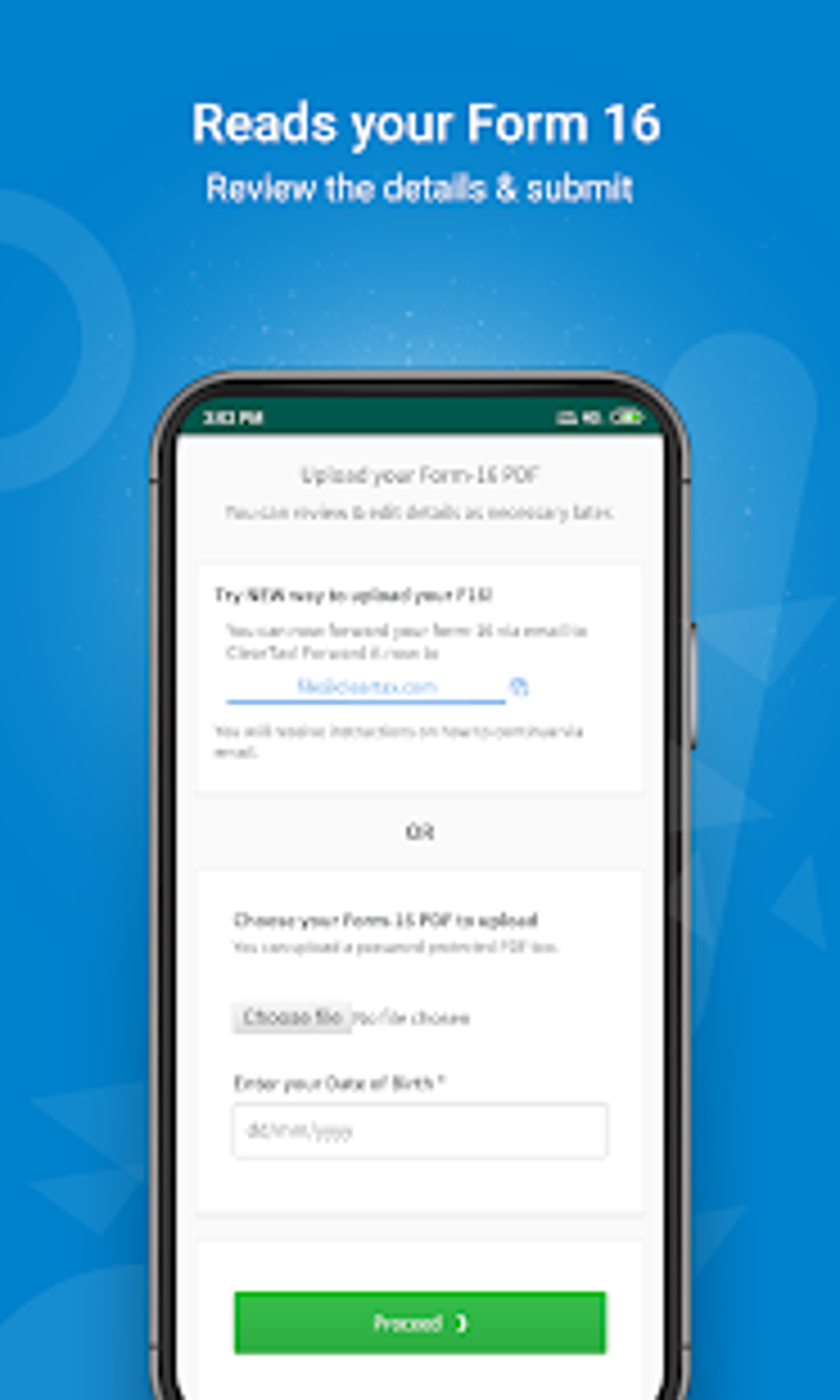

To claim a deduction under section 80DD you should submit Form 10 IA and the income tax return filed for the respective assessment year No deduction can be claimed under section 80DD if the certificate of disability provided by To claim a deduction under section 80DD of the Income Tax Act eligible taxpayers must submit a medical certificate issued by the prescribed medical practitioner certifying the type and severity of the disability Read on

Download Income Tax Rules 80dd

More picture related to Income Tax Rules 80dd

Income Tax Rules For Whom It Is Not Necessary To File ITR What Are

https://www.businessleague.in/wp-content/uploads/2022/07/ITR-1.jpg

Income Tax Rules Business Taxation I Studocu

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/54c676a7f241b5c77651308d61507441/thumb_1200_1725.png

IRS Taxes Archives TheAdviserMagazine

https://tax.thomsonreuters.com/blog/wp-content/uploads/sites/17/2024/03/AdobeStock_248268554.jpg

Today we learn the provisions of section 80DD of Income tax Act 1961 as amended by the Finance Act 2022 The amended provision of section 80DD is effective for financial year 2022 23 relevant to the assessment year 2023 24 Section 80DD provides a deduction based on percentage of disability and not based on percentage of the expenses incurred This means even if the actual expenses incurred for a dependent with disability is lower than Rs 75 000 taxpayers are eligible to claim the deduction up to Rs 75 000

Section 80DD of the Income Tax Act allows flat deductions irrespective of the amount of expenditure incurred during the year but it should not be nil However the amount of deduction depends upon the severity of the disability Under Section 80DD of the Income Tax Act taxpayers are entitled to a deduction for the expenses incurred on the medical treatment rehabilitation training or deposit in specified schemes for the maintenance of a dependent with a disability

New Income Tax Rules Everything You Need To Know About Income Tax Rule

https://images.indianexpress.com/2021/04/income-tax-rules-1200.jpg

New Tax Rules For Divorce And Alimony Payments

https://heavencpa.com/wp-content/uploads/2019/06/heavenandalvarezllc.jpg

https://taxguru.in/income-tax/deduction-section-80dd-income-tax-act.html

Deduction under section 80DD of the Income Tax Act covers the amount paid towards the medical expenditure of a dependant with a specific disability It also covers the amount of insurance premium paid towards specific insurance plans

https://cleartax.in/s/get-certificate-claiming-deduction-section-80ddb

Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents and dependent siblings The diseases eligible for this deduction are outlined in Rule 11DD of the income tax regulations

DOWNLOAD INCOME TAX CALCULAOR FOR THE A Y 2024 25 WITH INCOME TAX READY

New Income Tax Rules Everything You Need To Know About Income Tax Rule

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

Android File FREE Income Tax Return ClearTax ITR E filing

How To Set Up Tax Rules And Jurisdictions

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Treatment Of Income From Different Sources AY 2023 24 FY 2022 23

Common Income Tax Mistakes American Profile

Switching To New Age 72 RMD Rules Under SECURE Act Tax Rules Tax

Income Tax Rules 80dd - Section 80DD is a beneficial provision in the Indian Income Tax Act that offers financial relief to those caring for disabled dependents Knowing the eligibility requirements the maximum deduction limits and the necessary paperwork can enable you to take full advantage of these tax benefits