Income Tax Rules For Fixed Deposit Verkko 2 marrask 2023 nbsp 0183 32 FD interest or fixed deposit interest income gets taxed as per your income slab rates In case you are in the lowest slab you pay less tax However if you are in the highest slab you need to pay tax in addition to

Verkko In addition to the deductions mentioned above Section 80TTA of the Income Tax Act 1961 permits a deduction of up to Rs 10 000 for interest paid on Fixed Deposits FDs Therefore depending on the type of FD and the tax slab of the investor the tax free amount of FD can vary Verkko 22 maalisk 2023 nbsp 0183 32 If the interest you earn on your FD exceeds 40 000 50 000 in the case of senior citizens you are liable to pay a 10 tax on the FD interest earned If you still need to submit your PAN card to the bank the FD interest earned will be taxed at 20 Banks as well as post offices follow the same interest bracket for deductions

Income Tax Rules For Fixed Deposit

Income Tax Rules For Fixed Deposit

https://i.ytimg.com/vi/JFKGlJELKcE/maxresdefault.jpg

Tax Saver Fixed Deposit Top 10 Tax Saving FDs In India

https://www.taxscan.in/wp-content/uploads/2022/12/Tax-Saver-Fixed-Deposit-Tax-Saver-Fixed-Deposit-Tax-Tax-Saving-Saving-Top-10-Tax-Saving-FDs-in-India-Taxscan.jpg

Income Tax Rules

https://i.ytimg.com/vi/I8VT3fOKHPI/maxresdefault.jpg

Verkko 10 huhtik 2014 nbsp 0183 32 Form 26AS includes a record of all the TDS payments deducted on your fixed deposits Remember FDs will also be taxed at the same rate as the rest of your gross income This means if you are in the 20 percent tax bracket you will have to pay 20 percent tax on your interest income from FDs Verkko 21 kes 228 k 2023 nbsp 0183 32 TDS Tax Deducted at Source on Fixed Deposits FD is a mechanism by which the bank deducts a certain amount of tax from the interest income earned on fixed deposits before crediting it to the depositor s account This is generally deducted by the bank and deposited to the Income tax Department on due date

Verkko If any tax on Fixed Deposit interest is due after TDS the holder is expected to declare it in Income Tax returns and pay it by himself If the total income for a year does not fall within the overall taxable limits customers can submit a Form 15 G below 60 years of age or Form 15 H above 60 years of age to the bank when starting the FD and at Verkko 20 lokak 2022 nbsp 0183 32 The interest that you earn from a fixed deposit account is liable to taxes It is clubbed with your taxable income and is taxed at your income tax slab rates For example let s assume you earn an interest of Rs 10 000 on your fixed deposit account and fall into the 30 tax slab

Download Income Tax Rules For Fixed Deposit

More picture related to Income Tax Rules For Fixed Deposit

Tax Rules For Income From Moonlighting Know The Trick To Reduce Tax

https://i.ytimg.com/vi/cwaWnhyEgy0/maxresdefault.jpg

Income Tax Rules How To Download Annual Information Statement Online

https://tamil.cdn.zeenews.com/tamil/sites/default/files/2023/04/28/286661-itr.png

Understanding The Latest Income Tax Rules

https://www.globaltaxrevolution.com/img/4766dea5f21a6904bb87cd84c81c2d2d.jpg?01

Verkko How should I tax my fixed or recurring deposit interest Income tax Act 1961 has provided two methods viz accrual method and cash method for accounting of interest received on FDRs Taxpayers can go for any of these methods but once any method is chosen it should be used consistently Verkko The FD interest rate is lower at post offices but you can save on taxes You can deposit money in FDs under your spouse parents and kids name The income tax on interest on fixed deposit income is calculated for each person on the slab they fall into It may be possible to save or minimise taxes if you open fixed deposits at various

Verkko 30 huhtik 2022 nbsp 0183 32 My mother has pass away and had Fixed Deposits We are one bother and sister as her legal heirs All FDs were in my mother name and I am the nominee My mother has not made any Will Verkko 24 lokak 2023 nbsp 0183 32 All the joint holders must agree and provide a withdrawal mandate to the bank This mandate is as per the Joint FD rules set by the RBI In the case of a tax saving 5 year FD the tax deduction will be claimed by the primary account holder The interest income will be taxable in the hands of the primary FD account holder Joint FD

Taxpayers Follow Step by Steps Tax Rules For ITR Refund Tax Software

https://assets.pippa.io/shows/5d5d3d40807cec591cd77e01/1660716972157-e865f7e0fba3f7485a511bed3a27d5b0.jpeg

Income Tax Rules 1962 Form No 29B PDF Income Statement Debits

https://imgv2-2-f.scribdassets.com/img/document/605314684/original/fa74ba999f/1701964850?v=1

https://cleartax.in/s/income-tax-on-fixed-deposit-interest

Verkko 2 marrask 2023 nbsp 0183 32 FD interest or fixed deposit interest income gets taxed as per your income slab rates In case you are in the lowest slab you pay less tax However if you are in the highest slab you need to pay tax in addition to

https://www.wishfin.com/fixed-deposits/income-tax-on-fixed-deposits...

Verkko In addition to the deductions mentioned above Section 80TTA of the Income Tax Act 1961 permits a deduction of up to Rs 10 000 for interest paid on Fixed Deposits FDs Therefore depending on the type of FD and the tax slab of the investor the tax free amount of FD can vary

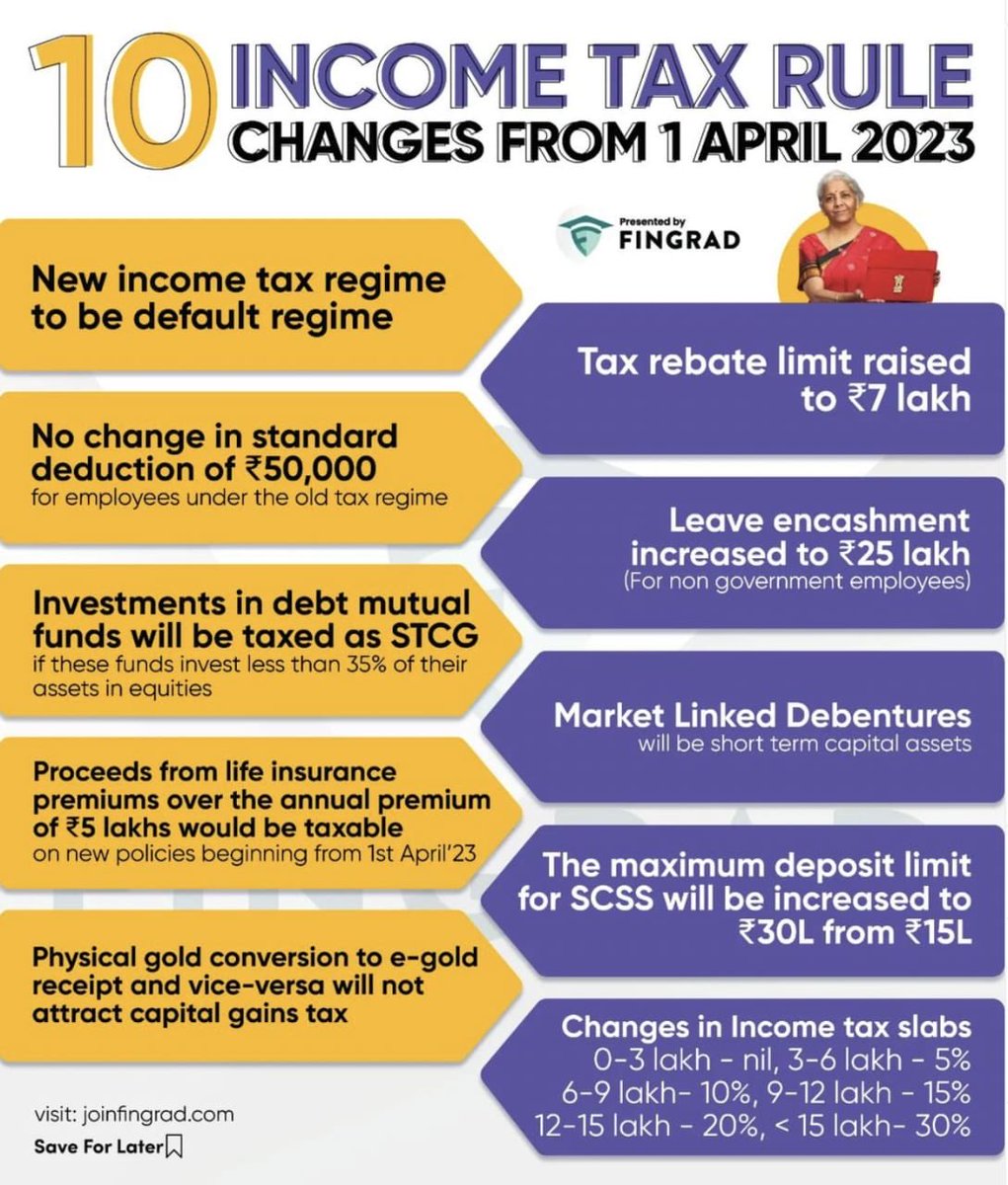

What Are The New Income Tax Rules

Taxpayers Follow Step by Steps Tax Rules For ITR Refund Tax Software

New Income Tax Rules To Come Into Effect From Today 01 04 2023 New

New Income Tax Rules

Tax 1

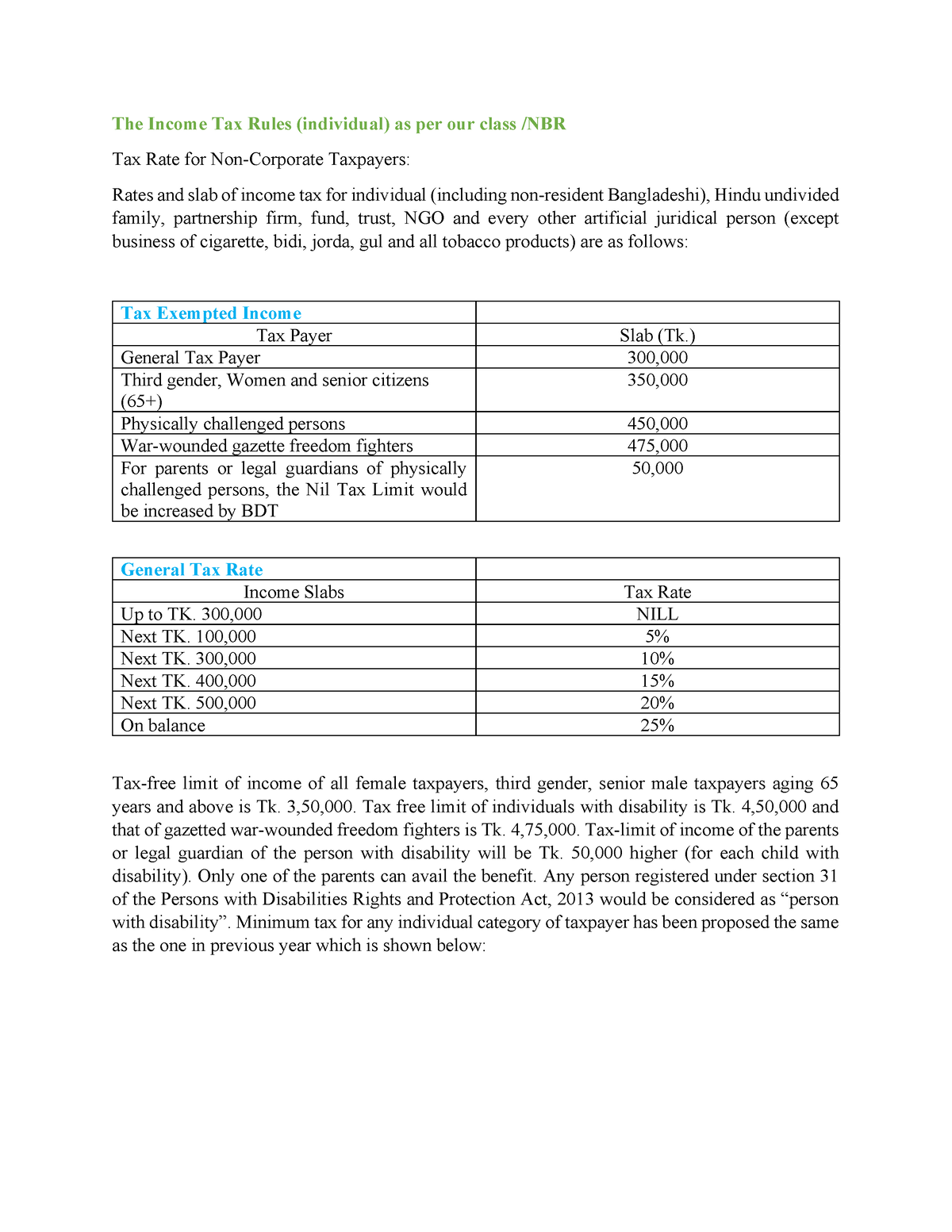

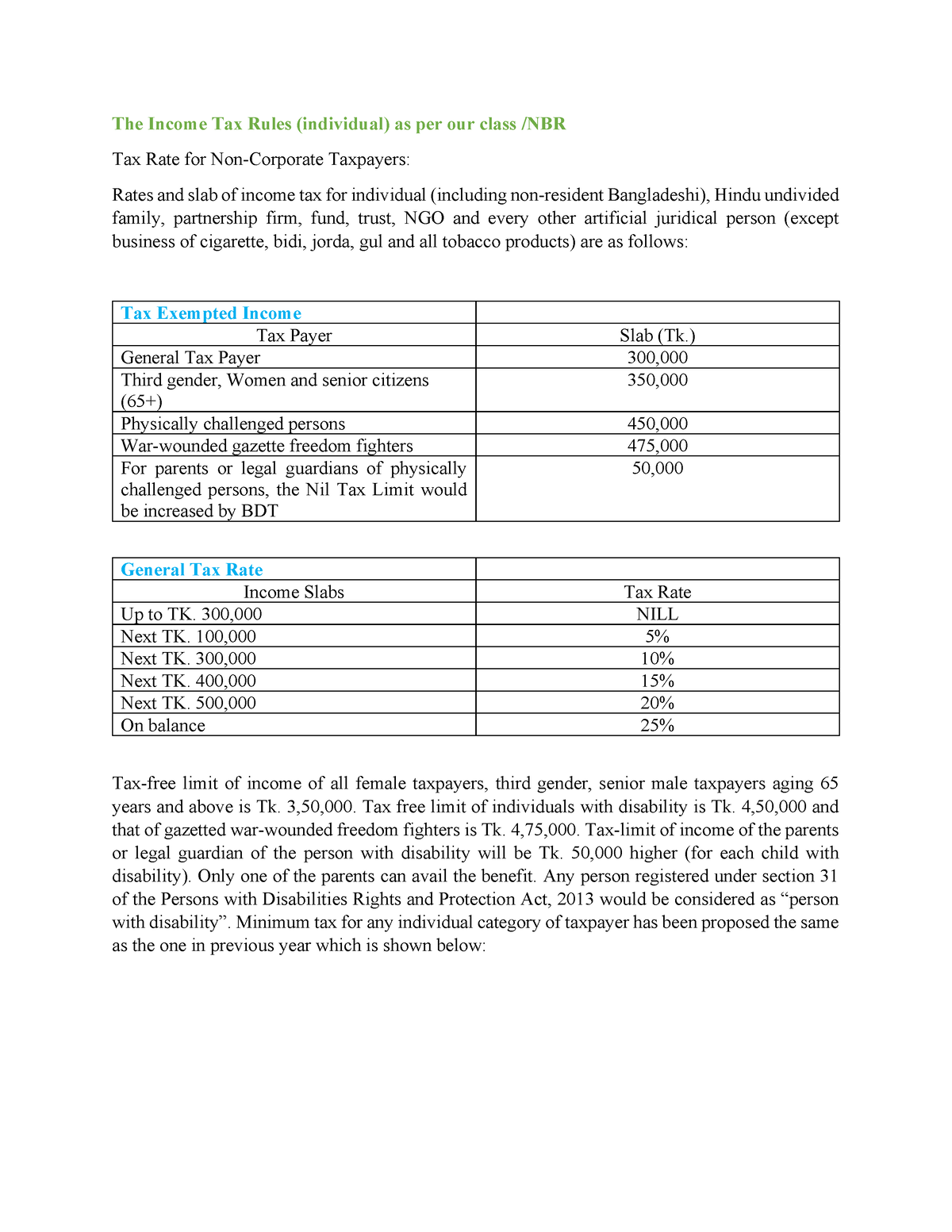

Compensation Assignment The Income Tax Rules individual As Per Our

Compensation Assignment The Income Tax Rules individual As Per Our

PDF Indian Income Tax Rules And Guidelines DOKUMEN TIPS

Income Tax Return Filing By Salaried Employees 5 Common Problems And

Gold Keeping Limits At Home Income Tax Rules TaxWinner

Income Tax Rules For Fixed Deposit - Verkko 21 kes 228 k 2023 nbsp 0183 32 TDS Tax Deducted at Source on Fixed Deposits FD is a mechanism by which the bank deducts a certain amount of tax from the interest income earned on fixed deposits before crediting it to the depositor s account This is generally deducted by the bank and deposited to the Income tax Department on due date