Is Income Tax Applicable On Fixed Deposit Tax Exemption on Fixed Deposits Tax exemptions on FDs are only available in case of interest received on FCNR B and NRE FD accounts Tax exemptions refers to

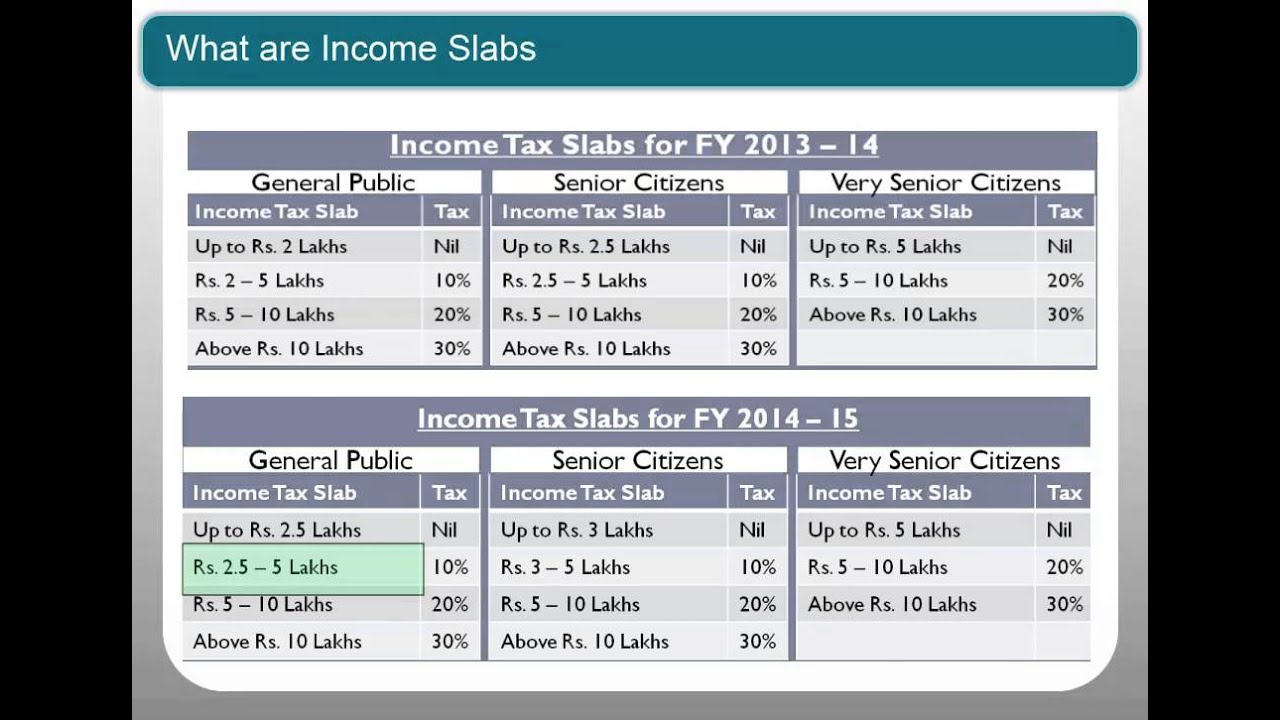

The interest earned on a Fixed Deposit FD is subject to tax based on the income tax slab you fall into There is TDS Tax Deducted at Source on FD interest along with any applicable surcharge or cess For example if your total The interest from fixed deposits under Income Tax Act is fully taxable It comes under Income from Other Sources while filing an income tax return FD Interest is taxable at

Is Income Tax Applicable On Fixed Deposit

Is Income Tax Applicable On Fixed Deposit

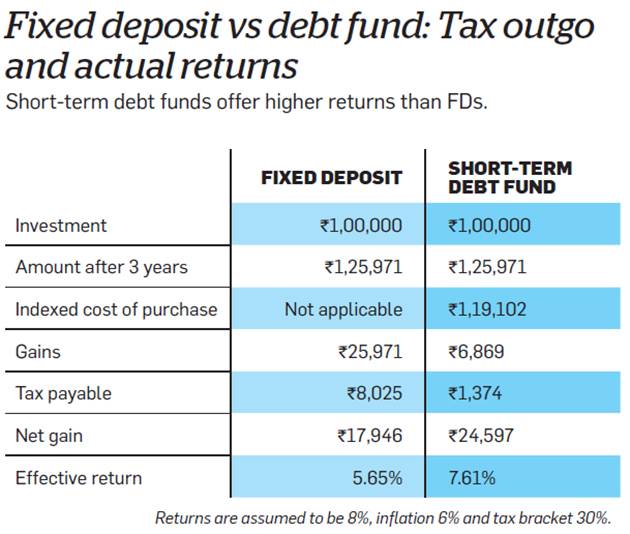

http://www.jagoinvestor.com/wp-content/uploads/files/debt-fund-fixed-deposits-taxation.jpg

FIXED DEPOSIT Is Income Tax Applicable On

https://i.ytimg.com/vi/j53M7tsD5oI/maxresdefault.jpg

Income Tax On Fixed Deposit Interests

https://assets-news.housing.com/news/wp-content/uploads/2022/06/29195205/Fixed-deposit-calculators-What-are-FD-calculators-and-how-do-they-work-FB-1200x700-compressed.jpg

You can take advantage of the income tax deduction provision under Section 80C of the Income Tax Act by investing up to Rs 1 5 lakh in a tax saver fixed deposit account The scheme ensures returns along with capital A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor can claim a

3Q2024 profit before tax of 2 668 million with a four quarter rolling average return on equity of 13 8 Resilient net interest income supported by volume growth in lending and The lower rate of Capital Gains Tax will rise from 10 to 18 and the Higher Rate from 20 to 24 while maintaining the rates of capital gains tax on residential property at 18 and 24

Download Is Income Tax Applicable On Fixed Deposit

More picture related to Is Income Tax Applicable On Fixed Deposit

PPT Fixed Deposit PowerPoint Presentation Free Download ID 7135773

https://image4.slideserve.com/7135773/what-is-fixed-deposit-l.jpg

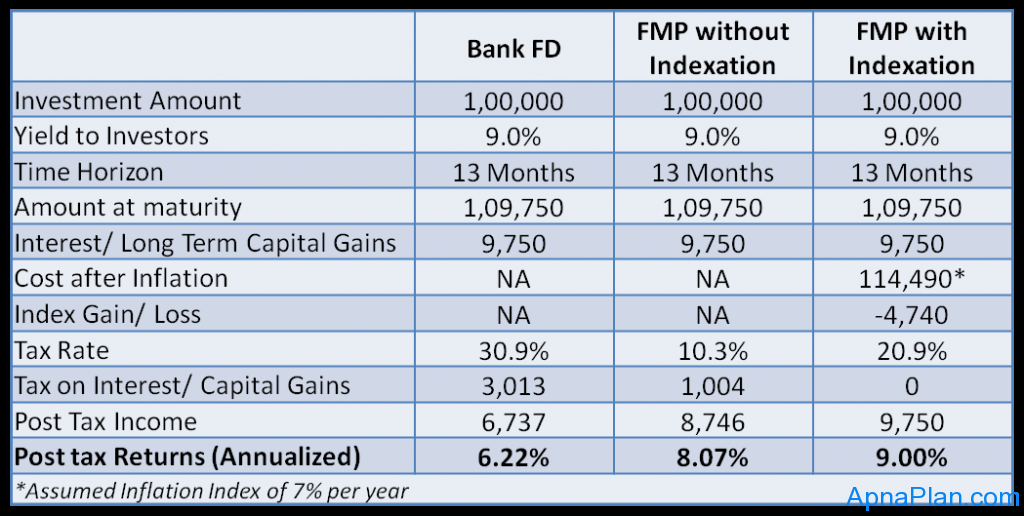

FMP VS Fixed Deposit Where To Invest

https://www.apnaplan.com/wp-content/uploads/2012/05/FMP-vs-Fixed-Deposit-tax-treatment-1024x516.png

Fixed Deposit TDS On FD And How To Show Interest Income From FD In ITR

https://i.ytimg.com/vi/iGLCsL4pEMw/maxresdefault.jpg

The interest income earned on a fixed deposit is taxable and you have to pay taxes as per the applicable tax rates under the IT Act for the said financial year Interest earned from fixed deposits up to 40 000 for non senior citizens or 50 000 for senior citizens in a financial year is tax free How is tax calculated on fixed

Interest earned on fixed deposits is considered income and is taxed according to your income tax slab rate If your total interest exceeds INR 10 000 in a financial year the This article provides an overview of how to pay income tax on FD interest income earned from fixed deposits It outlines the process of calculating the taxable amount filing the

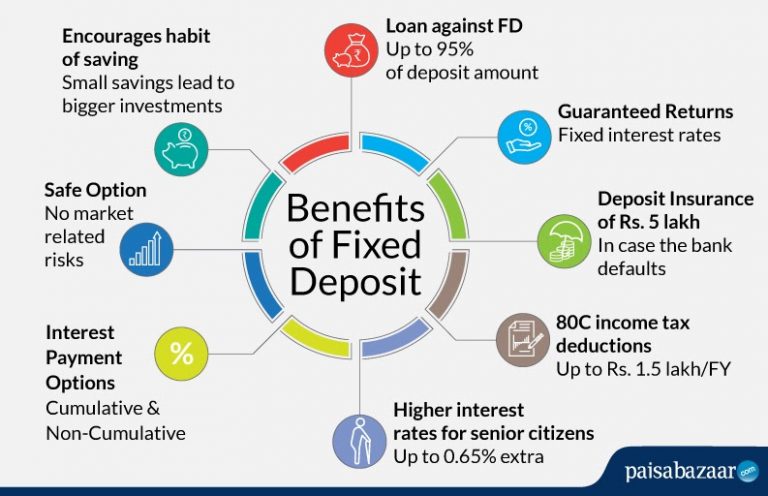

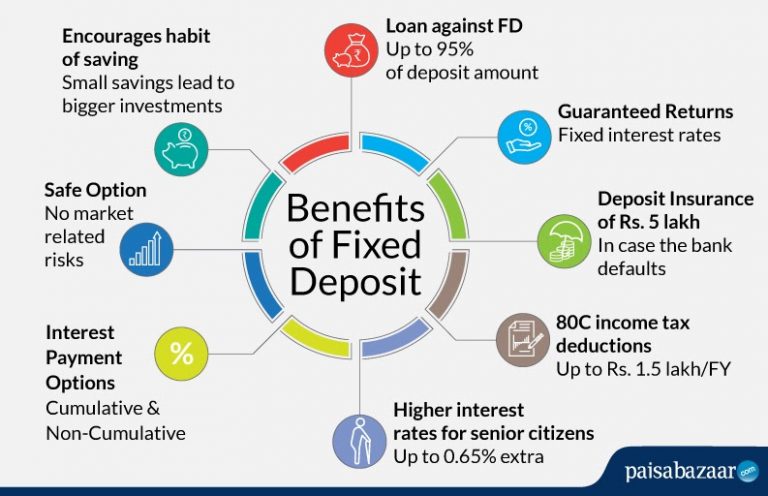

Benefits Of Fixed Deposits FDs In India

https://www.paisabazaar.com/wp-content/uploads/2020/02/fixed-deposit-benefits-768x496.jpg

Income Tax On Interest On Fixed Deposit By NRI

https://www.anbca.com/wp-content/uploads/2023/02/Income-Tax-on-Interest-on-Fixed-Deposit-by-NRI.jpg

https://www.paisabazaar.com › fixed-deposit › tax...

Tax Exemption on Fixed Deposits Tax exemptions on FDs are only available in case of interest received on FCNR B and NRE FD accounts Tax exemptions refers to

https://www.icicibank.com › blogs › fix…

The interest earned on a Fixed Deposit FD is subject to tax based on the income tax slab you fall into There is TDS Tax Deducted at Source on FD interest along with any applicable surcharge or cess For example if your total

What Is A Fixed Deposit And How Does It Work

Benefits Of Fixed Deposits FDs In India

How Can You Optimize Your Returns With A Fixed Deposit

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

Tax On Cash Deposit And Withdrawal What You Need To Know In 2023

All You Want To Know About Mounted Deposits And FD Calculators

All You Want To Know About Mounted Deposits And FD Calculators

Safe Mode Of Investment

SBI Tax Saving Fixed Deposit Scheme IndiaFilings

Fixed FD Recurring Deposit MIS Mutualfundeasy

Is Income Tax Applicable On Fixed Deposit - The lower rate of Capital Gains Tax will rise from 10 to 18 and the Higher Rate from 20 to 24 while maintaining the rates of capital gains tax on residential property at 18 and 24