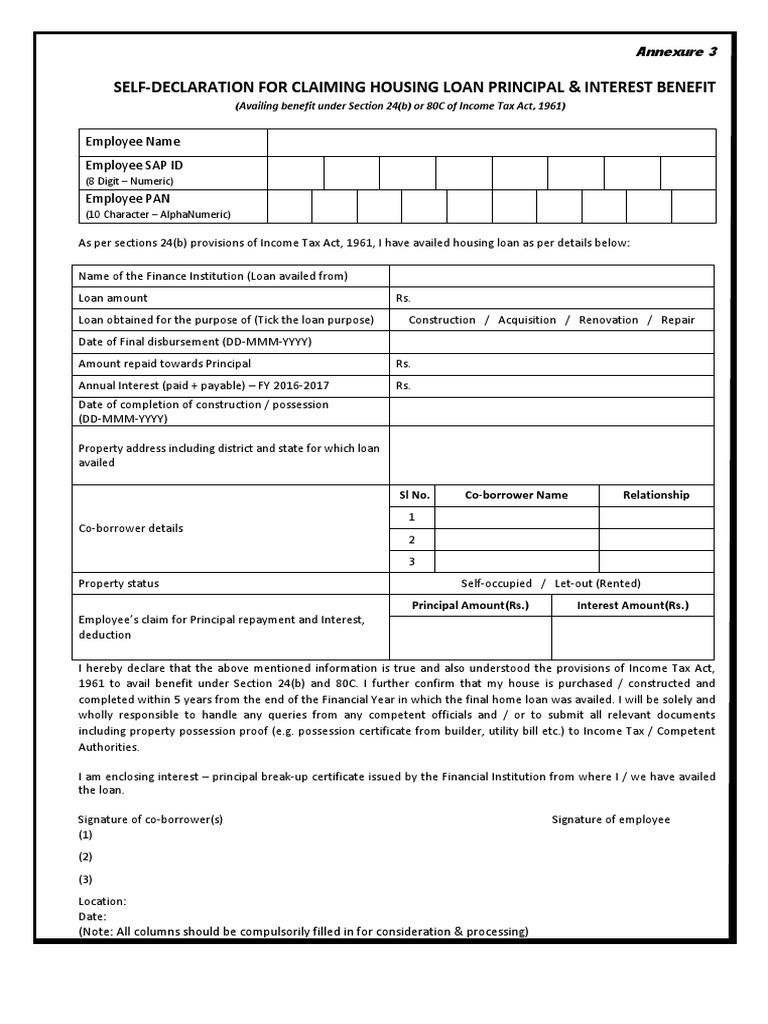

Income Tax Rules For Joint Home Loan Individuals can enjoy tax benefits in obtaining a home loan under the Income Tax Act Section 24 b Section 80 EE Section 80EEA and Section 80C

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs By applying jointly for a home loan tax deduction available on home loan can be enjoyed by the co applicants separately provided they are co owners of the property and each of them is contributing to the home

Income Tax Rules For Joint Home Loan

Income Tax Rules For Joint Home Loan

https://imgv2-2-f.scribdassets.com/img/document/558860084/original/8382a4f494/1672898190?v=1

Bank Account Income Tax

https://www.sarkaridna.com/wp-content/uploads/2022/01/Income-Tax-Notice-1-1.png

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

Section 80C of the Income Tax Act provides a deduction of up to Rs 1 5 lakh from an individual s taxable income In the case of a joint home loan each co Section 24 b of Income Tax Act 1961 amended Conditions for claiming Interest on Home Loan 1 Income Tax benefits on a joint home loan can be claimed

The joint home loan lets you avail of a loan together with any of your family members with a decent salary Hence the two combined incomes satisfy the bank s If I buy a house jointly with my spouse and take a joint home loan Can we both claim income tax deduction Yes if your spouse has a separate source of income both of you can claim tax deductions individually

Download Income Tax Rules For Joint Home Loan

More picture related to Income Tax Rules For Joint Home Loan

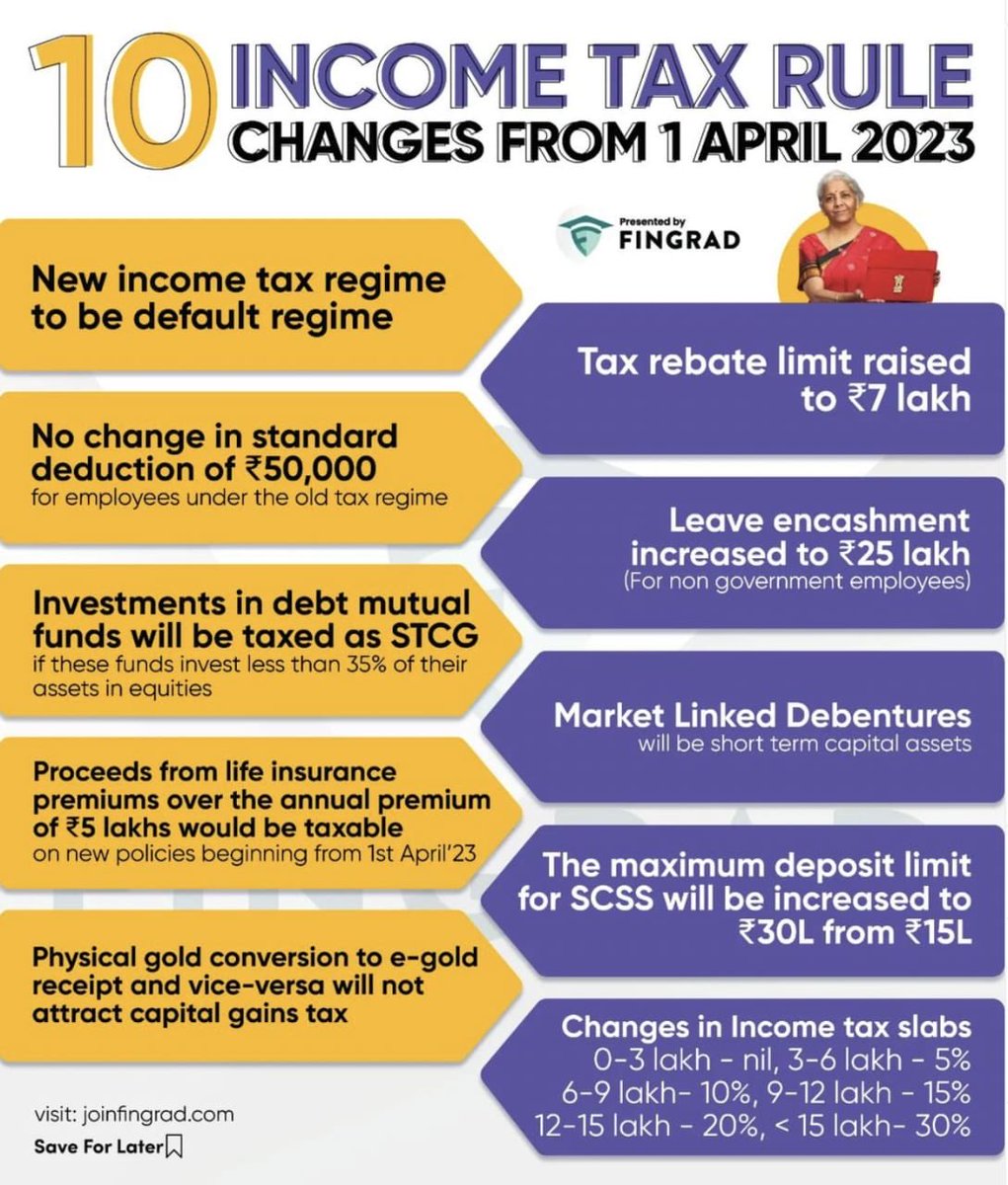

New Income Tax Rules To Come Into Effect From Today 01 04 2023 New

https://pbs.twimg.com/media/FsookcyaAAEqDqC.jpg

Notification No 23 2022 Income Tax 5th Amendment Rules 2022

https://compliancecalendar.s3.ap-south-1.amazonaws.com/assets/commentdir/be08da31a558e54913238cac907b9d98.jpg

Your Money New Tax Rules For 2021 Make Year end Charitable Giving Better

https://s.yimg.com/ny/api/res/1.2/qptZmEqBb7pt8WuqqaO7Rw--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD0xNjgw/https://media.zenfs.com/en/the-ledger/bd88b8b4629464978f58b2c7ddbd8737

By applying for a housing loan jointly both the financial co applicants can avail of tax benefits provided they are co owners of the property and contribute towards Find all about how joint properties are taxed for income tax calculations check out the tax benefits on Home Loan for joint property owners Read to know more

If you obtain a home loan you also become subject to tax benefits under the Income Tax Act Section 24 and Section 80C 1961 Here taking a joint home loan also brings The home loan customers are eligible for tax rebates under Section 80C and Section 24 of the Income Tax Act To get tax benefits the co applicant must also be the

What Are The New Tax Rules For Small Businesses Snagajob

https://images.ctfassets.net/h4bemxjtjotj/2VAuNtucsjnF3zi4hcl1HD/1dbff62f159d3e08bf601fa4b301f05e/Contentful_Taxes_2000x1000__1___1_.jpg

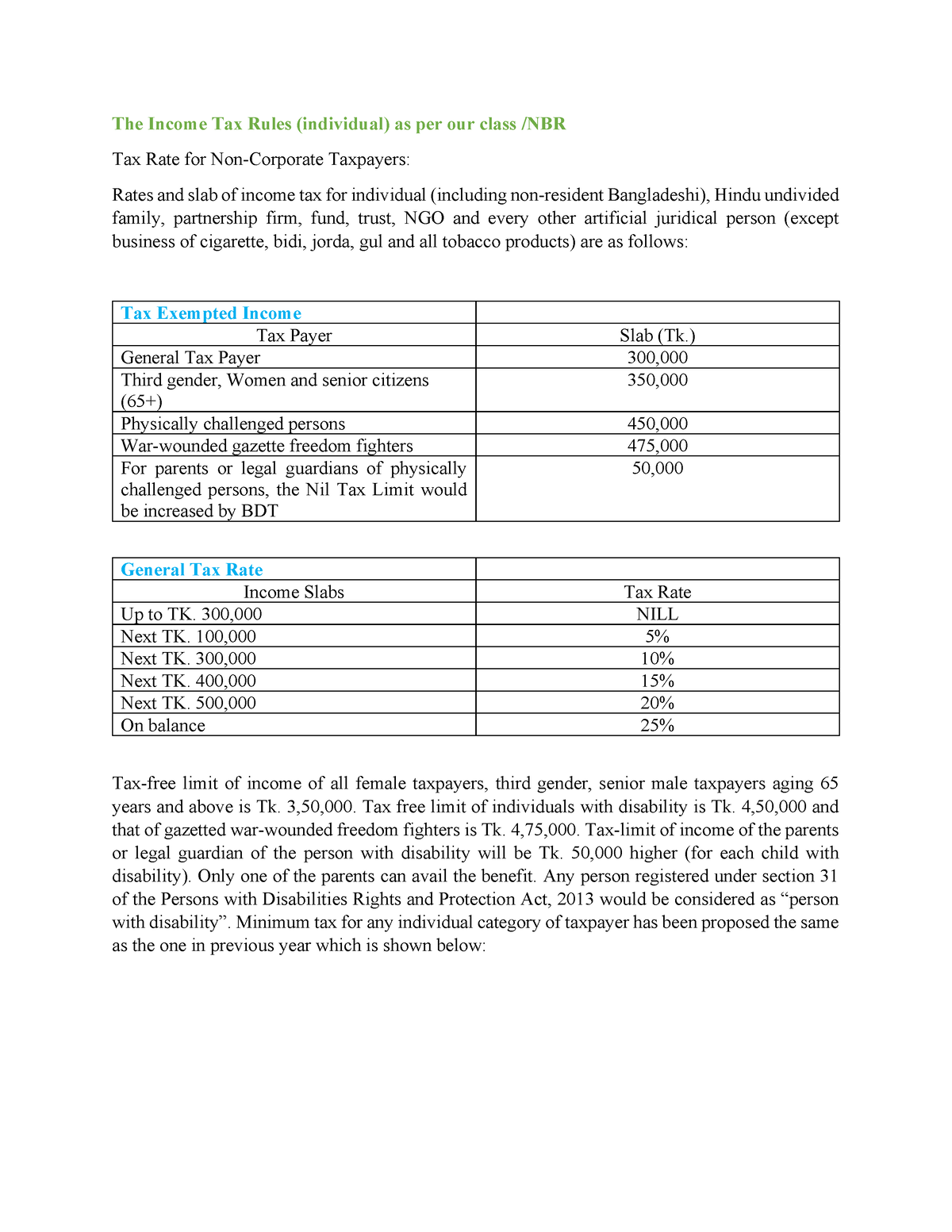

Compensation Assignment The Income Tax Rules individual As Per Our

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a1d2f5f26b4d061b8d49161c73452e57/thumb_1200_1553.png

https://tax2win.in/guide/joint-home-loan-tax

Individuals can enjoy tax benefits in obtaining a home loan under the Income Tax Act Section 24 b Section 80 EE Section 80EEA and Section 80C

https://cleartax.in/s/home-loan-tax-benefit

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

PDF Indian Income Tax Rules And Guidelines DOKUMEN TIPS

What Are The New Tax Rules For Small Businesses Snagajob

How To Save Taxes By Giving Money To Your Kids To Invest LRK Tax LLP

Income Tax Rules For Whom It Is Not Necessary To File ITR What Are

Income Tax Return Filing By Salaried Employees 5 Common Problems And

Income Tax ITR Filing 2024 7 Types Of Non taxable Incomes FULL LIST

Income Tax ITR Filing 2024 7 Types Of Non taxable Incomes FULL LIST

Resources

Received A Dividend Know What Income Tax Rules Say On Dividend Income

PM Issues New Income Tax Rates Phnom Penh Post

Income Tax Rules For Joint Home Loan - Tax benefit on a joint home loan can be availed individually by all co owners of the property on both Principal payment under section 80C and Interest payment under