Income Tax Standard Deduction For Pensioners Verkko Contribution rates for earnings related pensions in 2024 Insured persons pension act Contribution accrual of cross wages Employees Self employed persons

Verkko 14 huhtik 2017 nbsp 0183 32 Is pension eligible for standard deduction given for salary income Yes From FY 2023 24 you can claim a standard deduction on family pension Verkko Tax benefits with respect to medical insurance and expenditure According to Section 80D of the Income Tax Act Senior Citizens may avail a higher deduction of up to

Income Tax Standard Deduction For Pensioners

Income Tax Standard Deduction For Pensioners

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

Standard Deduction For Salaried And Pensioners

https://www.apnaplan.com/wp-content/uploads/2018/04/Standard-Deduction-for-Salaried-and-Pensioners.png

Pay Deduction Calculator 2021 Tax Withholding Estimator 2021

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/standard-deduction-for-salary-ay-2021-22-standard.jpg

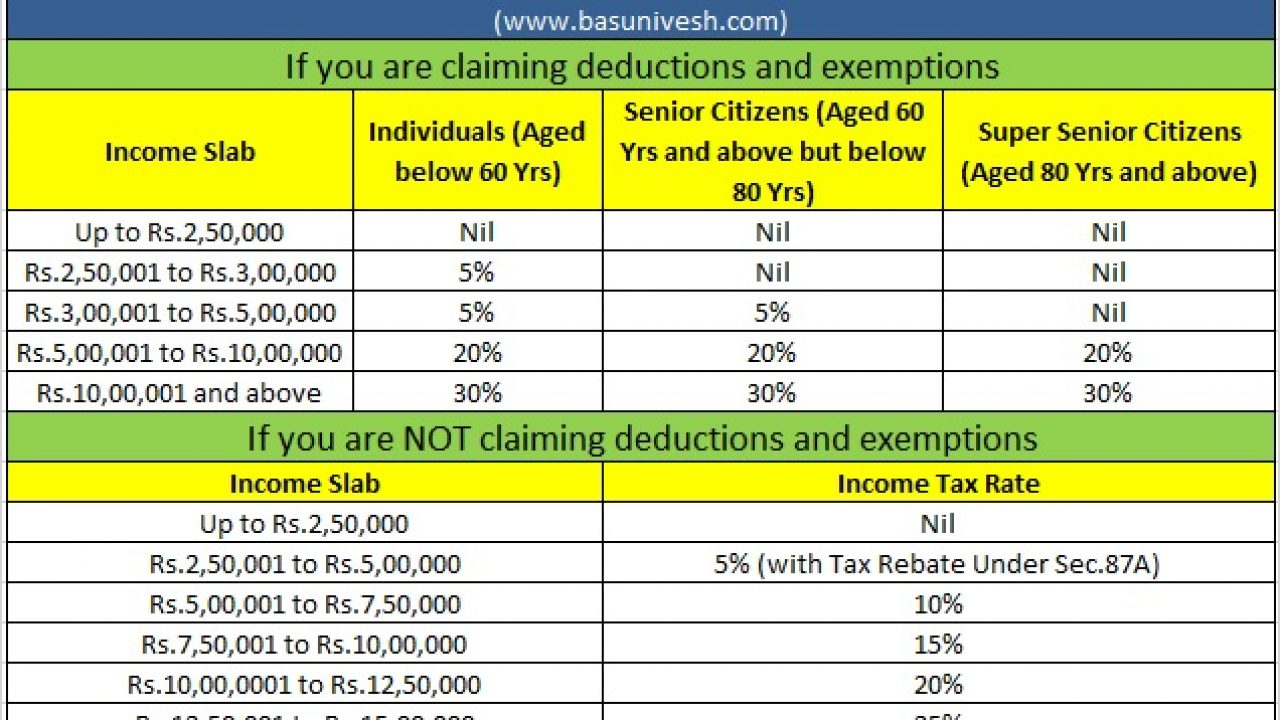

Verkko 31 hein 228 k 2023 nbsp 0183 32 Salaried taxpayers are now eligible for the standard deduction of Rs 50 000 under new tax regime from FY 2023 24 Standard Deduction Union Budget 2018 The Finance Minister Verkko 4 toukok 2022 nbsp 0183 32 You fill out a pretend tax return and calculate that you will owe 5 000 in taxes That is a 10 rate You can have 10 in federal taxes withheld directly from your pension and IRA distribution so that

Verkko If you took your pension on or after 6 April 2023 you ll pay Income Tax on some or all of the lump sum if it is more than 25 of the standard lifetime allowance If you hold Verkko 23 marrask 2023 nbsp 0183 32 Budget 2023 Update Standard Deduction on family pension under the new tax regime Rs 15 000 or 1 3rd of the pension amount whichever is lower Contents Are Pensions taxable

Download Income Tax Standard Deduction For Pensioners

More picture related to Income Tax Standard Deduction For Pensioners

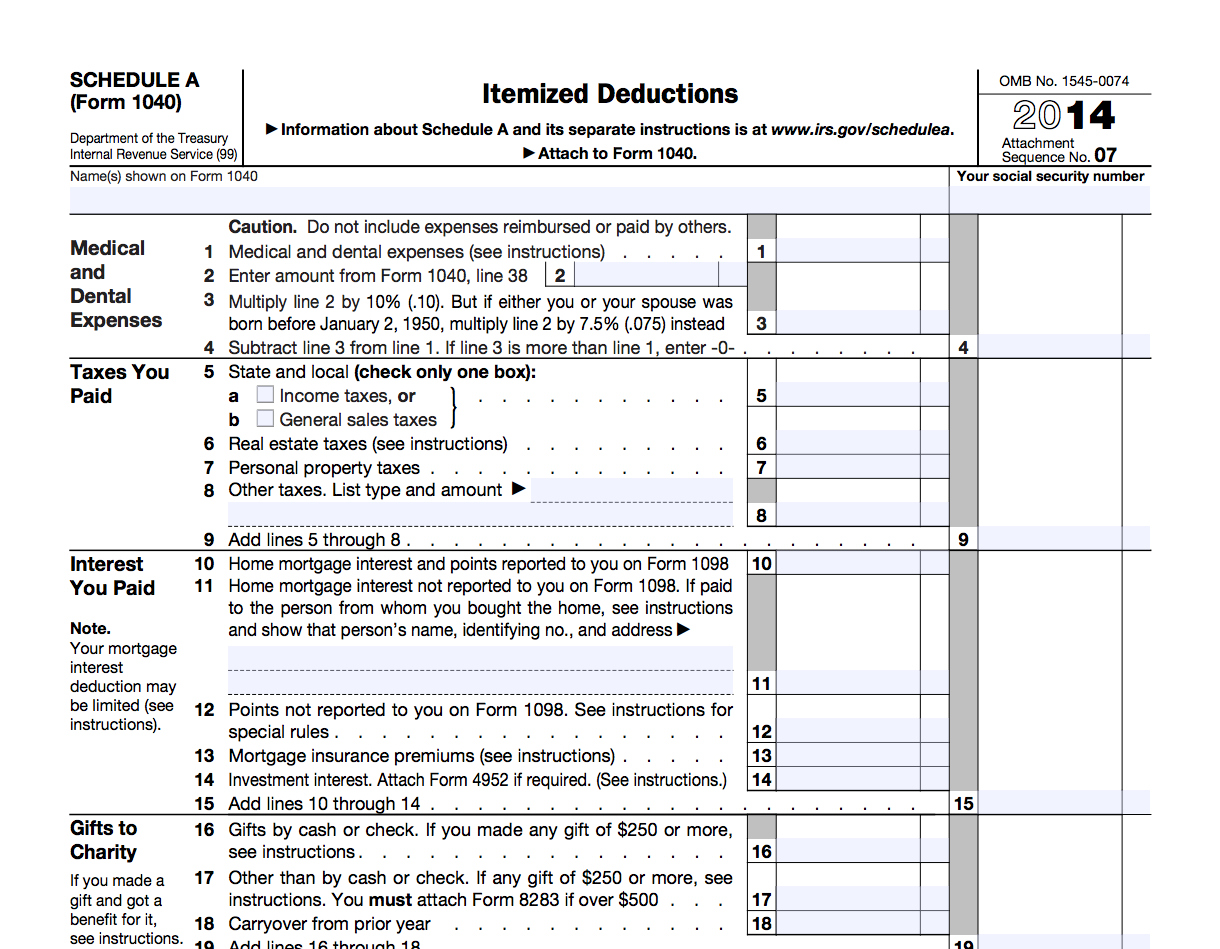

Sales Tax Deduction 2021

https://1044form.com/wp-content/uploads/2020/08/5-popular-itemized-deductions-8.jpg

How To Calculate Standard Deduction In Income Tax Act Scripbox

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/05/standard-deduction-income-tax.jpg

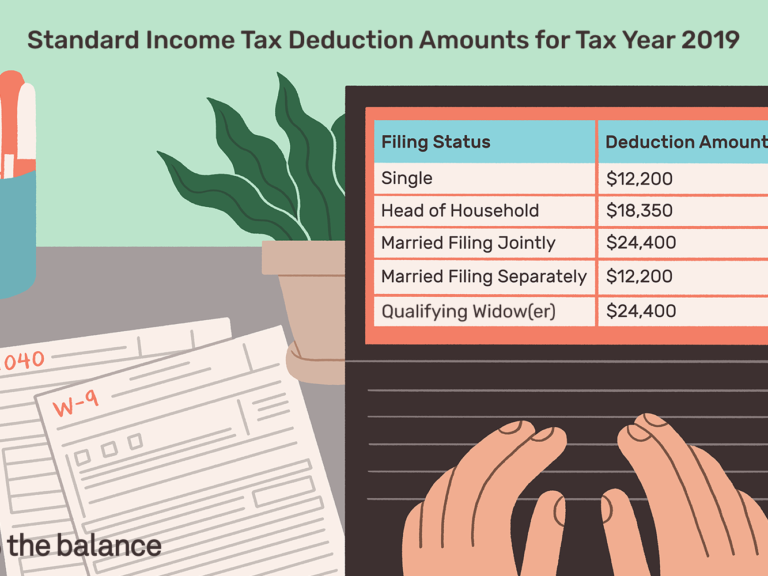

Standard Tax Deduction For 2020 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/the-standard-tax-deduction-how-it-works-and-how-to-use-it-1-768x576.png

Verkko Standard deduction If they are earning salary or pension income they can claim a deduction of Rs 50 000 from such income Tax rebate under Section 87A In case of Verkko 1 p 228 iv 228 sitten nbsp 0183 32 Standard Deduction The 50 000 standard deduction is now applicable under the new regime effectively raising your tax free income to Rs 7 5

Verkko 3 helmik 2023 nbsp 0183 32 Standard deduction of 50 000 will be available to salaried class and the pensioners and standard deduction of 15 000 or 1 3rd of the family pension Verkko 3 maalisk 2019 nbsp 0183 32 We know that standard deduction for salaried employees u s 16 ia has been increased from Rs 40 000 FY 2018 19 to Rs 50 000 for FY 2019 20

Claiming Standard Deduction For F1 Visa Students India US Tax Treaty

https://pub-d2baf8897eb24e779699c781ad41ab9d.r2.dev/VisaVerge/Taxes/TaxesPhotosbyVisaVerge-022.jpg

Potentially Bigger Tax Breaks In 2023

https://static.fmgsuite.com/media/InlineContent/originalSize/984f6148-60aa-49b7-971c-fb3554606b40.jpg

https://www.etk.fi/en/finnish-pension-system/financing-and-investments/...

Verkko Contribution rates for earnings related pensions in 2024 Insured persons pension act Contribution accrual of cross wages Employees Self employed persons

https://cleartax.in/s/are-pensions-taxable

Verkko 14 huhtik 2017 nbsp 0183 32 Is pension eligible for standard deduction given for salary income Yes From FY 2023 24 you can claim a standard deduction on family pension

Income Tax Standard Deduction How Your Tax Liability Take Home

Claiming Standard Deduction For F1 Visa Students India US Tax Treaty

Tax Rates Absolute Accounting Services

Pdf Non deduction Of Income Tax At Source From Pension

In New Tax Regime Standard Deduction Benefit Extended To Family Pensioners

Section 80GGA Deduction For Donation For Research Development

Section 80GGA Deduction For Donation For Research Development

Solved Please Note That This Is Based On Philippine Tax System Please

2022 Tax Rates Standard Deduction Amounts To Be Prepared In 2023

PurkBlog IRS Releases 2015 Tax Rates Credits And Deductions

Income Tax Standard Deduction For Pensioners - Verkko 23 marrask 2023 nbsp 0183 32 As per Budget 2023 Salaried taxpayers are now eligible for a standard deduction of Rs 50 000 under the new tax regime also from Financial