Income Tax Transfer Pricing Rules 2012 P U A 132 15 INCOME TAX ACT 1967 INCOME TAX TRANSFER PRICING RULES 2012 IN exercise of the powers conferred by paragraph 154 1 ed of the Income Tax

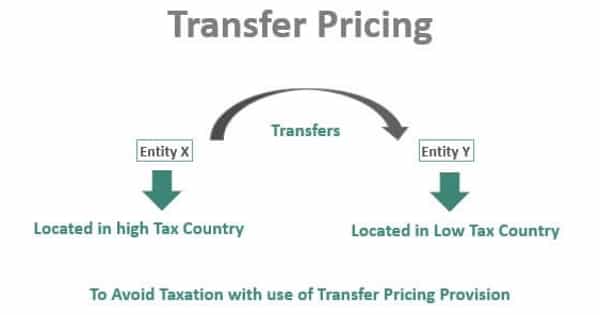

The Malaysian Transfer Pricing Guidelines explain the provision of Section 140A in the Income Tax Act 1967 and the Transfer Pricing Rules 2012 It governs the INCOME TAX TRANSFER PRICING RULES 2012 PU A 132 7 May 2012 IN exercise of the powers conferred by paragraph 154 1 b of the Income Tax Act 1967 Act 53 the

Income Tax Transfer Pricing Rules 2012

Income Tax Transfer Pricing Rules 2012

https://static.wixstatic.com/media/513af6_49eefdabe8614ee39c1bc3561e8a9895~mv2.jpg/v1/fill/w_1000,h_666,al_c,q_90,usm_0.66_1.00_0.01/513af6_49eefdabe8614ee39c1bc3561e8a9895~mv2.jpg

Transfer Pricing Rules LN 284 Of 2022 CSA Group

https://csagroup.mt/wp-content/uploads/2022/11/Transfer-Pricing-Rules.png

Summary Article Income Tax Transfer Pricing Rules 2023 Ong anya

https://onganyaombo.com/wp-content/uploads/2023/09/Transfer-Pricing-Law-Firm-980x569.jpg

The Inland Revenue Board of Malaysia IRB has released new Transfer Pricing Rules cited as the Income Tax Transfer Pricing Rules 2023 P U A 165 new TP Rules dated 29 May 2023 The changes set out Transfer pricing legislation in 2009 under section 140A of the Act and the Income Tax Transfer Pricing Rules 2012 hereinafter referred to as the Rules

Rule 5 sets out the hierarchy to apply the five 5 transfer pricing methods in the determination of the arm s length price ditional transactional Comparable Uncontrolled Recent developments include the introduction of the Income Tax Transfer Pricing Rules 2012 TP Rules 2012 and Income Tax Advance Pricing Arrangement Rules 2012

Download Income Tax Transfer Pricing Rules 2012

More picture related to Income Tax Transfer Pricing Rules 2012

COVID 19 Adjusting Low Risk Based Transfer Pricing Models To Increase

https://www.pearlcohen.com/wp-content/uploads/2019/09/1_0012_Tax-and-Transfer-Pricing-.jpg

Global Tax Management LinkedIn

https://media-exp1.licdn.com/dms/image/C4D1BAQEajUF-Lja5YA/company-background_10000/0/1519799753940?e=2159024400&v=beta&t=6fOHkQg9unfDFQfnMeYgbeb10TcJEUcTmrlom661cU4

Transfer Pricing In Terms Of Taxation And Accounting Assignment Point

https://assignmentpoint.com/wp-content/uploads/2021/09/transfer-pricing-1.jpg

ADVANCE PRICING ARRANGEMENT GUIDELINES 2012 The Guidelines prepared by the Inland Revenue Board of Malaysia Multinational Tax Department are to help explain The Malaysian Transfer Pricing Guidelines 2012 have been updated by the Inland Revenue Board IRB of Malaysia to reinforce the existing standards based on current international taxation requirements

Moreover Rule 2 2 of the Income Tax Transfer Pricing Rules 2012 provides that For the purposes of sub rule 1 a person shall determine and apply the Income Tax Transfer Pricing Rules 2012 TP Rules 2012 were released to the public on 11 May 2012 The scope of Transfer Pricing TP Rules 2012 applies to the

:max_bytes(150000):strip_icc()/transferprice.asp_final-6b9648f512974b73bc464682d58a1dbe.png)

Transfer Price What It Is How It s Used And Examples Transfer

https://alphabets.app/735079cd/https/2625bb/www.investopedia.com/thmb/BLOiCorl8MtmT9_QCf1GEERcgLo=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/transferprice.asp_final-6b9648f512974b73bc464682d58a1dbe.png

Tax Alert Grant Thornton Malaysia

https://www.grantthornton.com.my/globalassets/1.-member-firms/malaysia/open-graph-image/2023/income-tax-transfer-pricing-rules2023.jpg

https://www.hasil.gov.my/pdf/pdfam/Income_Tax...

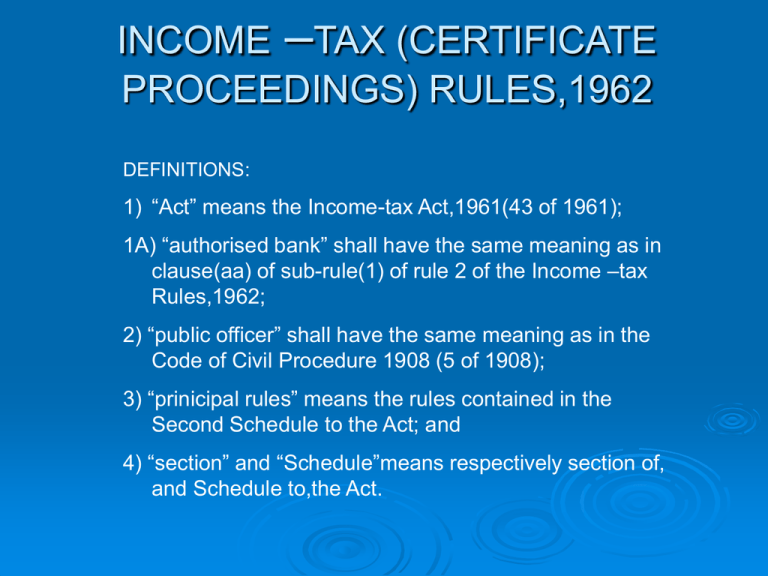

P U A 132 15 INCOME TAX ACT 1967 INCOME TAX TRANSFER PRICING RULES 2012 IN exercise of the powers conferred by paragraph 154 1 ed of the Income Tax

https://www.hasil.gov.my/en/international/transfer-pricing

The Malaysian Transfer Pricing Guidelines explain the provision of Section 140A in the Income Tax Act 1967 and the Transfer Pricing Rules 2012 It governs the

Learn About Transfer Pricing Example Benefits Importance Of

:max_bytes(150000):strip_icc()/transferprice.asp_final-6b9648f512974b73bc464682d58a1dbe.png)

Transfer Price What It Is How It s Used And Examples Transfer

Transfer Pricing Regulations In India An Overview

What Is Transfer Pricing TPC GROUP

INCOME TAX CERTIFICATE PROCEEDINGS RULES

National Payment System Act CTL Strategies

National Payment System Act CTL Strategies

Income Taxation And Transfer And Business Taxation By Tabag 2021

:max_bytes(150000):strip_icc()/Term-Definitions_transfer-pricing-49c8de8ae5a649849a48fbd9139dc8c2.png)

What Does Book Transfer Debit Mean Leia Aqui How Does A Book Transfer

Transfer Pricing In UAE Regulations Their Implications

Income Tax Transfer Pricing Rules 2012 - Recent developments include the introduction of the Income Tax Transfer Pricing Rules 2012 TP Rules 2012 and Income Tax Advance Pricing Arrangement Rules 2012