India Tax Return Filing Date The last date to file Income Tax Return ITR for FY 2023 24 AY 2024 25 without a late fee is 31st July 2024 Taxpayers filing their return after the due date will have to pay interest under Section 234A and a penalty under Section 234F

The last date to file Income Tax Return for FY 2023 24 AY 2024 25 is 31st July 2024 File Now It is important to complete ITR filing on time to comply with tax laws avoid penalties claim timely refunds maintain accurate financial records and facilitate financial transactions Taxpayers failing to file ITR on the due date will have to pay The assessment year which starts immediately after the financial year ends is the year when ITR is filed for the concerned financial year For instance income earned in FY 2023 24 between April 1 2023 and March 31 2024 will be assessed in AY 2024 25 April 1 2024 and March 31 2025

India Tax Return Filing Date

India Tax Return Filing Date

https://www.thinkwriteba.com/wp-content/uploads/2021/11/income-tax-return-filing-2021-last-date-extended-defd84d9.jpg

How To Get Online Tax Return

https://i.ytimg.com/vi/v8PWzbBuZi0/maxresdefault.jpg

ITR Filing Due Date For AY 2022 23

https://www.taxmann.com/post/wp-content/uploads/2021/12/01_Blog-Post-2.jpg

Home Central Board of Direct Taxes Government of India The last date to file your income tax return ITR for the assessment year 2024 25 in India is July 31 2024

E Filing Home Page Income Tax Department Government of India LOADING Returns and Forms Applicable for Salaried Individuals for AY 2024 25 Disclaimer The content on this page is only to give an overview and general guidance and is not exhaustive For complete details and guidelines please refer Income Tax Act Rules and Notifications 1 ITR 1 SAHAJ Applicable for Individual

Download India Tax Return Filing Date

More picture related to India Tax Return Filing Date

Why Delivering Government IT Projects Can Be So Taxing CIO

https://www.cio.com/wp-content/uploads/2021/12/indian-income-tax-return-100894119-orig-2.jpeg?quality=50&strip=all&w=1024

File Tax Returns Free In 2022 With These Recommendations Faveplus

https://faveplus.com/wp-content/uploads/2022/02/tax-returns.jpg

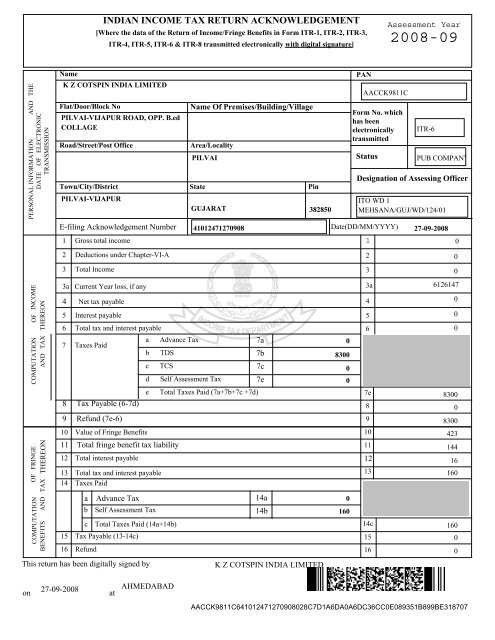

Indian Income Tax Return Acknowledgement Ca Ahmedabad Ca Firm

https://img.yumpu.com/26394070/1/500x640/indian-income-tax-return-acknowledgement-ca-ahmedabad-ca-firm-.jpg

Last date to file Income Tax Return ITR for Financial Year 2023 24 Assessment Year 2024 25 without late fees is 31st July 2024 However if you fail to file within the due date you can still file a belated return before December 31 2024 Income Tax Returns ITRs must be filed by July 31 for the FY 2022 23 April 1 will mark the start of the new assessment year 2023 24 Usually the ITR filing due date is July 31

[desc-10] [desc-11]

Income To File Tax Return INCOMEBAU

https://i2.wp.com/certicom.in/wp-content/uploads/2018/07/income-tax-return-online.jpg

Income Tax Return Due Date Last Date 2021 ITR Filing Online Payment

https://static.india.com/wp-content/uploads/2021/12/Income-Tax-Return-ITR-Filing-News.jpg

https://cleartax.in/s/due-date-tax-filing

The last date to file Income Tax Return ITR for FY 2023 24 AY 2024 25 without a late fee is 31st July 2024 Taxpayers filing their return after the due date will have to pay interest under Section 234A and a penalty under Section 234F

https://tax2win.in/guide/itr-filing-due-date

The last date to file Income Tax Return for FY 2023 24 AY 2024 25 is 31st July 2024 File Now It is important to complete ITR filing on time to comply with tax laws avoid penalties claim timely refunds maintain accurate financial records and facilitate financial transactions Taxpayers failing to file ITR on the due date will have to pay

Income Tax Return Filing Date Extend YouTube

Income To File Tax Return INCOMEBAU

ITR Filing 2022 What Are The Disadvantages Of Filing Income Tax Return

Get To Know All Important Dates Of Income Tax Return Filing For

Income Tax Return Filing Date For AY 2019 20 Extended Again Check New

GST AND INCOME TAX RETURN FILING DATE MUST BE EXTENDED ALL FILING

GST AND INCOME TAX RETURN FILING DATE MUST BE EXTENDED ALL FILING

Fbr Extended Last Date For Filing Income Tax Return Up To December 24

Income Tax Return Filing Last Date Revised ITR Deadline For Taxpayers

Income Tax Return Filing Deadline For FY 2020 21 Is Extended Till 31st

India Tax Return Filing Date - [desc-13]