Indiana Tax Credits Find Indiana tax forms Know when I will receive my tax refund File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident

Indiana Deductions from Income Indiana deductions are used to reduce the amount of taxable income First check the list below to see if you re eligible to claim any of the EARNED INCOME TAX CREDIT EITC Rate Fully Refundable 10 of the federal credit 1 Eligibility Requirements All Indiana taxpayers must have filed for the federal credit

Indiana Tax Credits

Indiana Tax Credits

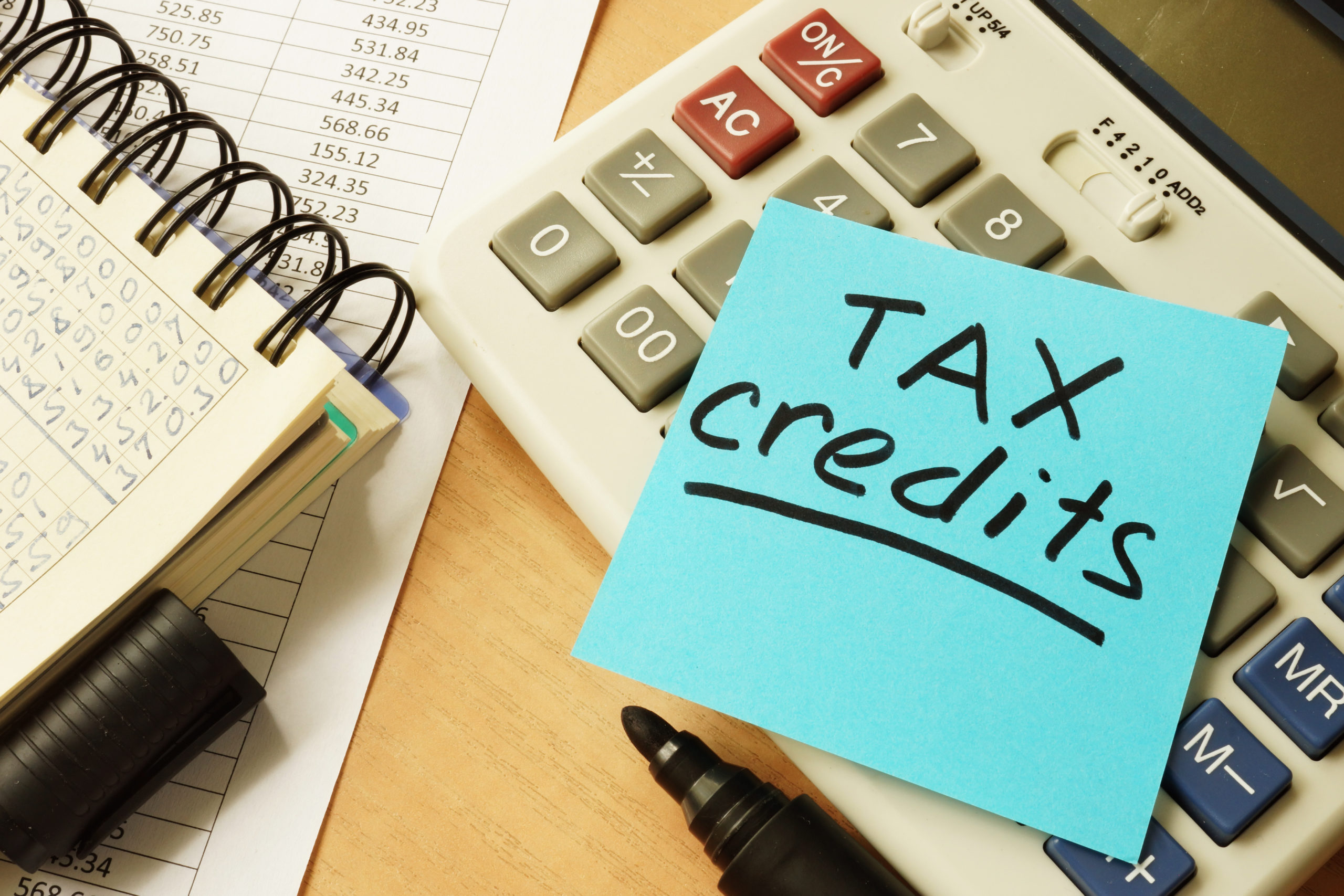

https://info.gutweinlaw.com/hs-fs/hubfs/170724_tax-incentive-graphic.png?width=1645&height=6658&name=170724_tax-incentive-graphic.png

/GettyImages-936298906-5c40d40fc9e77c0001947a6f.jpg)

Earned Income Credit Indiana

https://www.thebalance.com/thmb/3RdlaO92GxC27TT7knl8ECCEE2g=/2121x1414/filters:fill(auto,1)/GettyImages-936298906-5c40d40fc9e77c0001947a6f.jpg

Tax Credits Renewal S Smith Accounting

https://www.ssmith-accountants.co.uk/wp-content/uploads/2021/10/Tax-Credits-scaled-1.jpg

Tax credits reduce the amount of the tax you must pay For example if you made a charitable contribution to an Indiana college or university tuition is not a charitable Which Indiana Tax Form Should You File Indiana has three different individual income tax returns Read the following to find the right one for you to file Credits A new credit

The extra 1 1 billion will go to bolster retirement funding and become a refundable tax credit for Hoosier taxpayers The move is required by law when INDIANAPOLIS WANE The state of Indiana will provide a refundable tax credit to all tax filing Hoosiers State Auditor Tera Klutz CPA Certified Public

Download Indiana Tax Credits

More picture related to Indiana Tax Credits

What Is A Tax Credit Tax Credits Explained

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

Indiana R D Tax Credits Tax Point Advisors

http://taxpointadvisors.com/images/uploads/blog/256498-indianapolis-1280x720.jpg

Neighborhood Assistance Program NAP Indiana Tax Credits Fort Wayne

http://fortwayne.safe-families.org/wp-content/uploads/sites/12/2019/09/SF-NAP-FlyerFullPage2019-6.png

Below is a list of credits that are available to you on your Indiana return Unified Tax Credit for the Elderly You may qualify for this credit if you and you spouse meet ALL of the Indiana Modernizes Their Economic Development Tax Credit Toolbox In March 2022 SB 361 became Public Law 135 which modernizes Indiana s incentives

A new credit is available for qualified investments at a mine reclamation site Indiana s Earned Income Tax Credit EITC Indiana EITC is now 10 of federal EITC 19 95 3 MNC The Indiana State Treasurer s office announced a new tax credit worth up to 500 beginning taxable year 2024 for contributions into INvestABLE

Tax Accounting Services Lee s Tax Service

https://leestaxservicellc.com/files/IMG_1348.png

Tax Credits For Republic Services To 20m Customer Resource Center In

https://imgs.waste-management-world.com/m/333_1_1200-0-1.85_.JPG

https://www.in.gov/dor

Find Indiana tax forms Know when I will receive my tax refund File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident

/GettyImages-936298906-5c40d40fc9e77c0001947a6f.jpg?w=186)

https://www.in.gov/dor/individual-income-taxes/...

Indiana Deductions from Income Indiana deductions are used to reduce the amount of taxable income First check the list below to see if you re eligible to claim any of the

HMRC Reveals Details Of R D Credits Anti fraud Campaign Tax Tips G T

Tax Accounting Services Lee s Tax Service

Tax Credits Life At HMRC

Curious About Tax Breaks For Homeowners No One Knows Them Better Than

Indiana R D Tax Credit Summary PMBA

Georgia Tax Credits For Workers And Families

Georgia Tax Credits For Workers And Families

Indiana Tax Refund State To Return Money To Taxpayers After Surplus

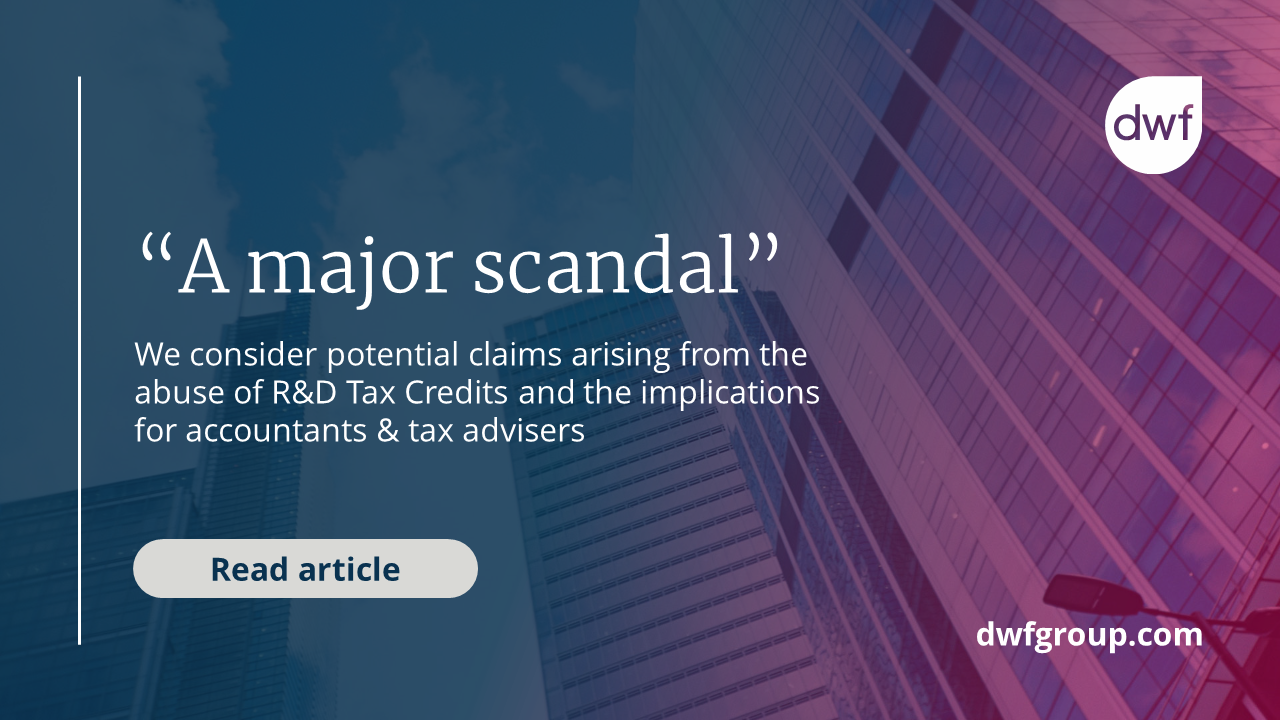

Potential Claims Arising From The Use and Abuse Of Research And

Do I Have To Pay Tax To Both States If I Live In Indiana Work In

Indiana Tax Credits - INDIANAPOLIS WANE The state of Indiana will provide a refundable tax credit to all tax filing Hoosiers State Auditor Tera Klutz CPA Certified Public