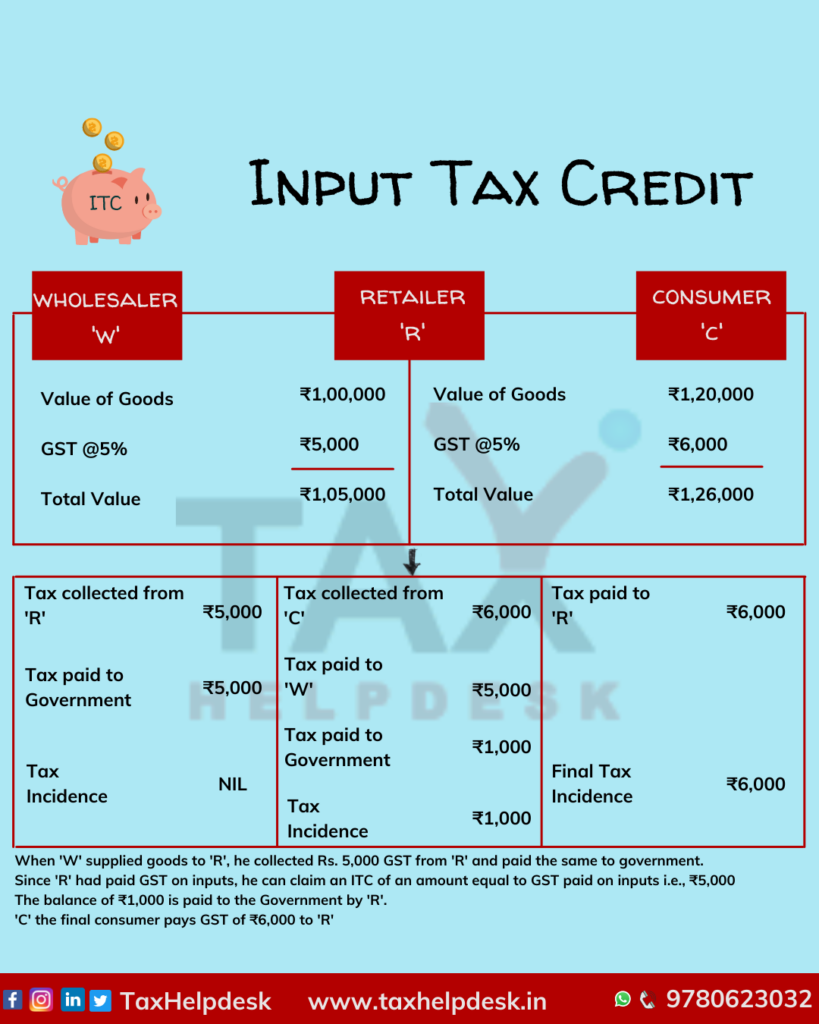

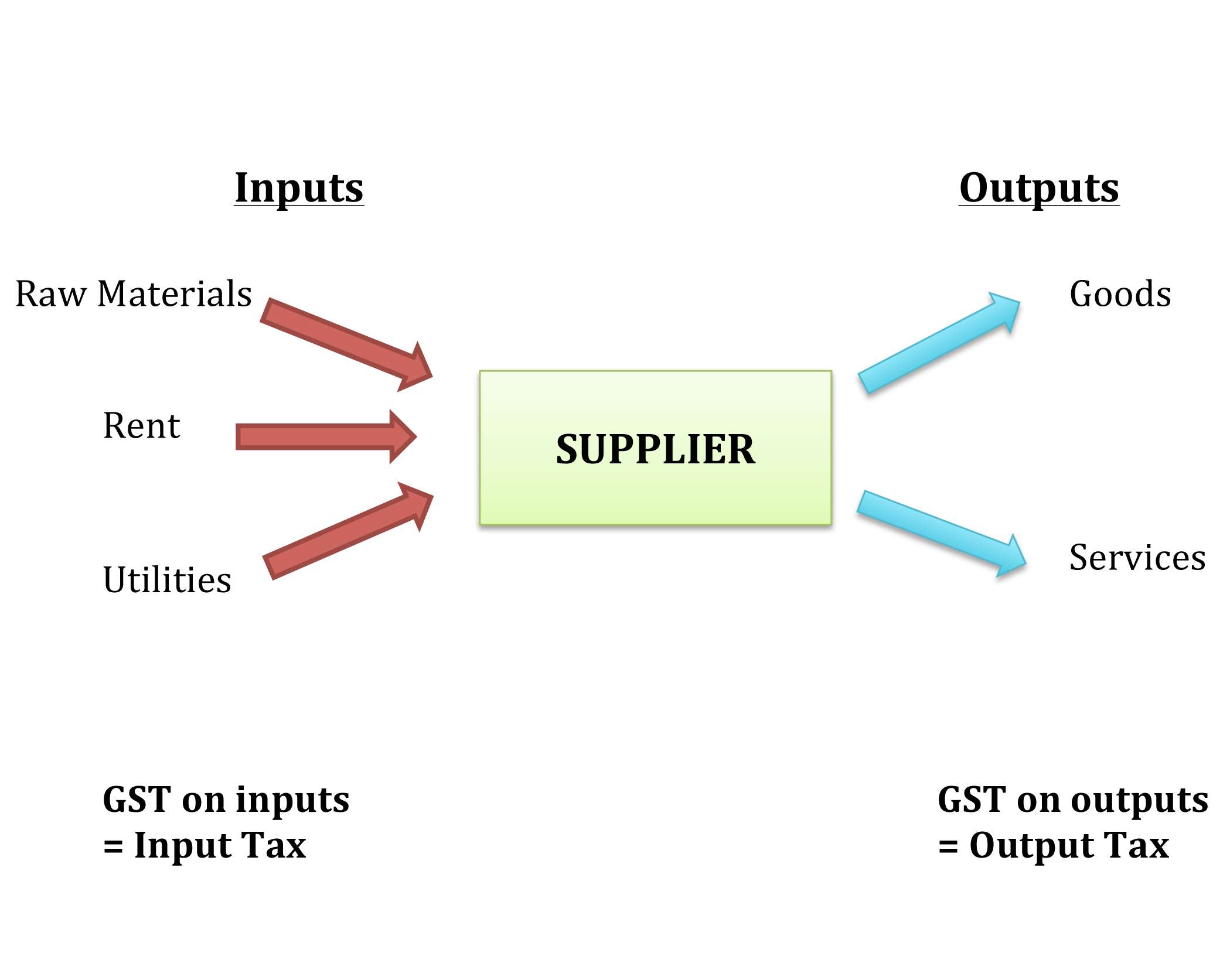

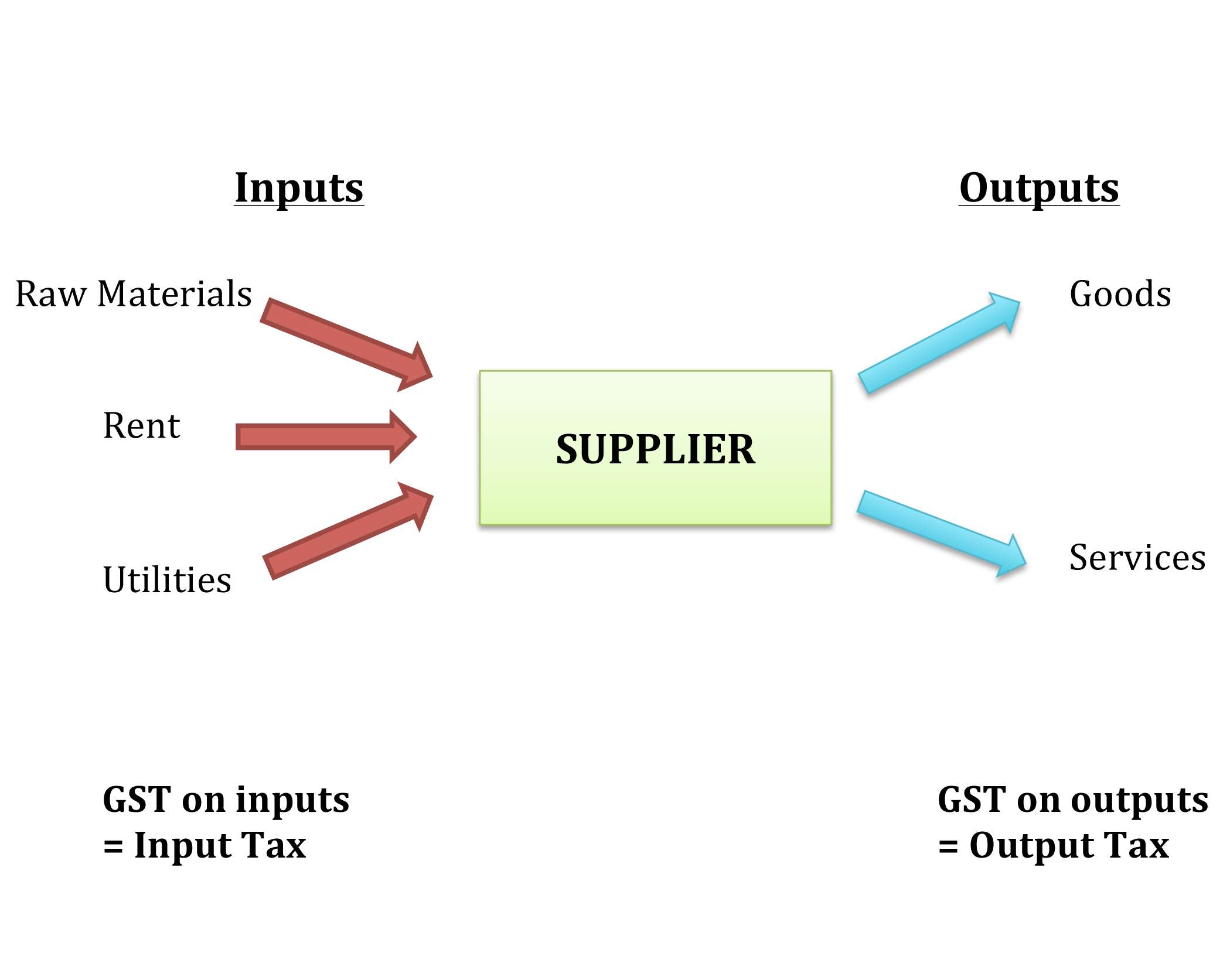

Input Tax Credit Allowed To Web 24 Jan 2023 nbsp 0183 32 Input credit means that when you pay tax on output you can deduct the tax you ve already paid on inputs and pay the difference When you buy a product service from a registered dealer you pay taxes on the purchase On selling you collect the tax

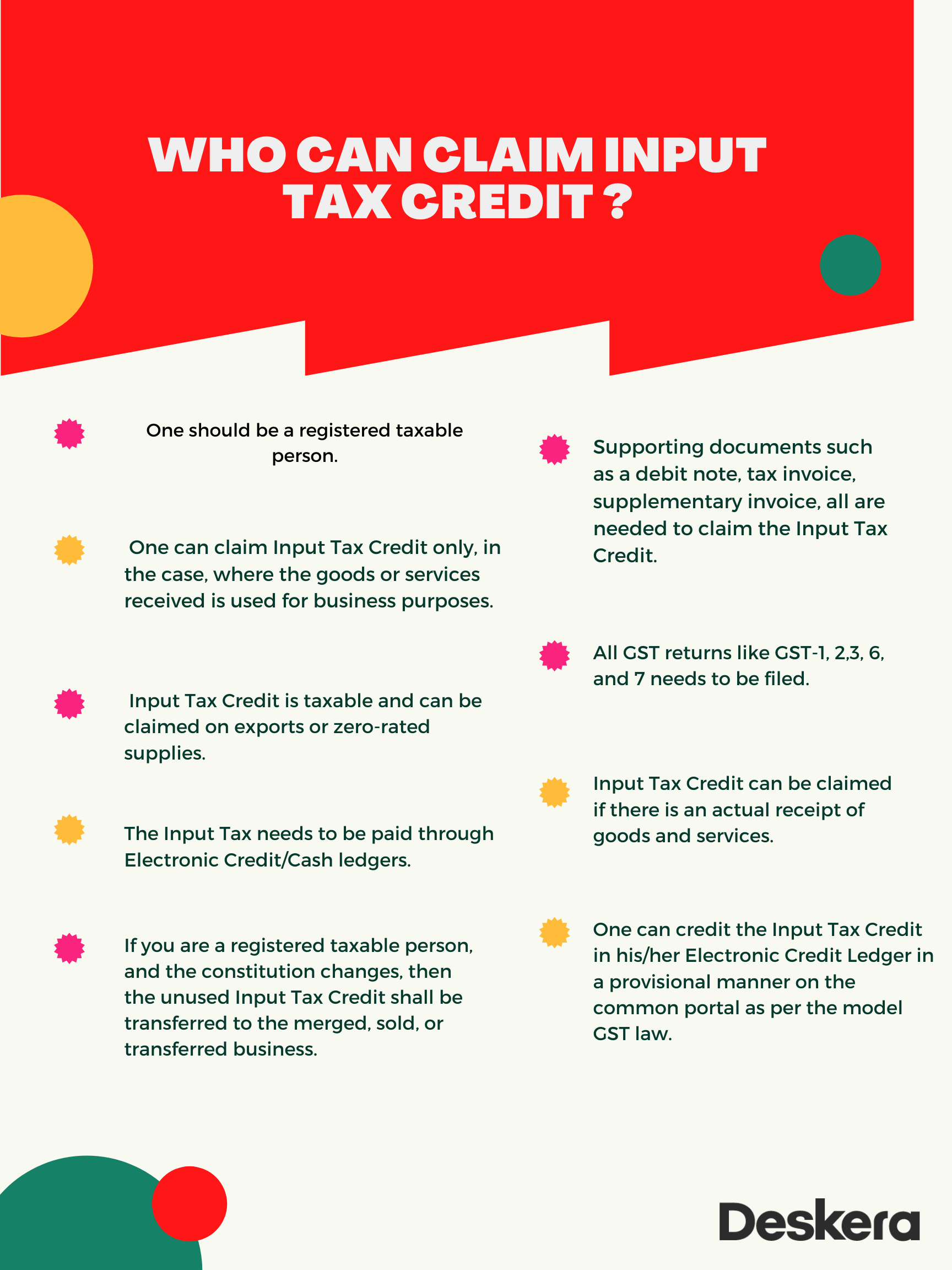

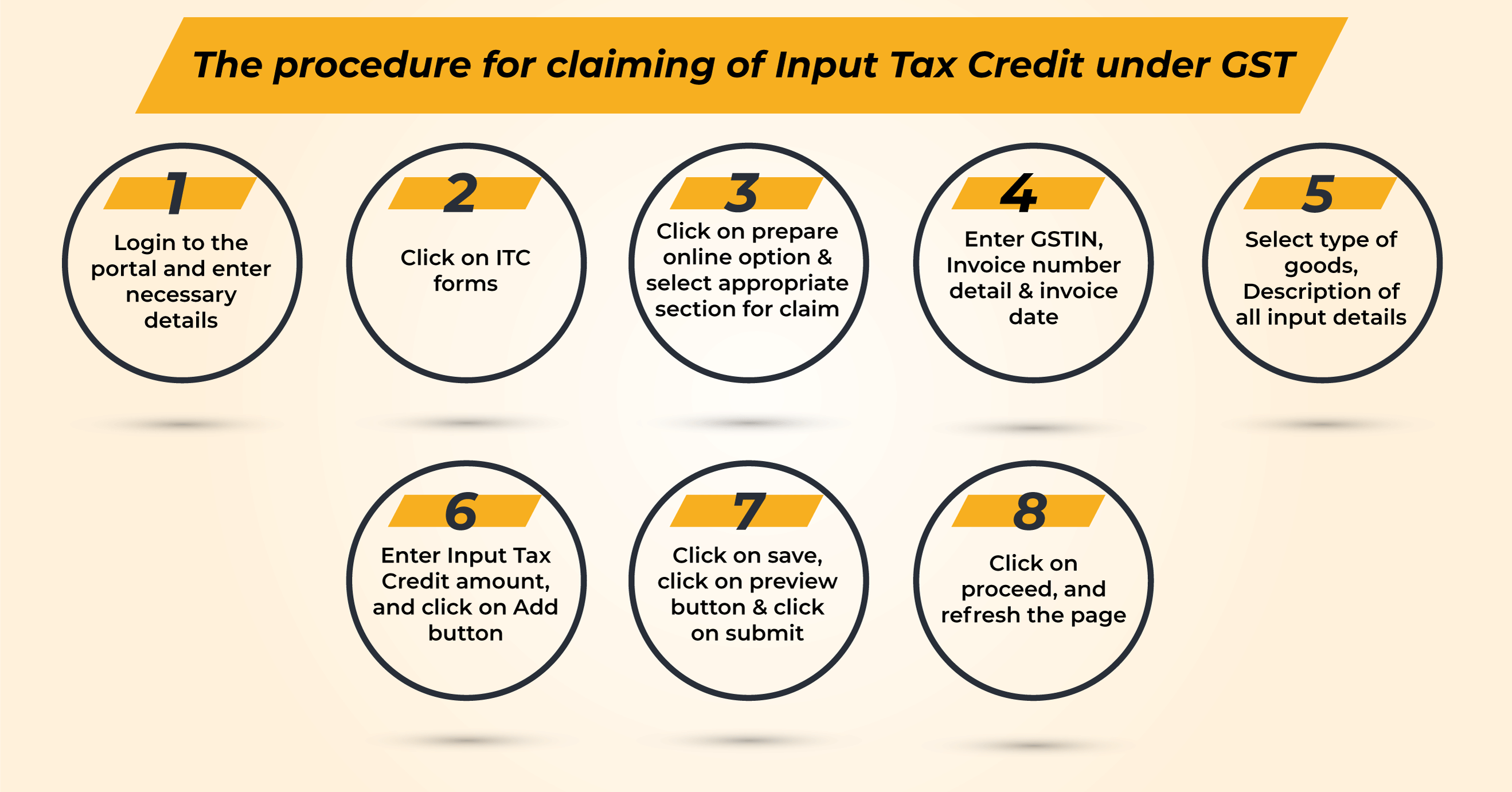

Web 7 Juni 2020 nbsp 0183 32 Input tax Credit ITC is a major element of understanding which has various implications under GST In changing scenario the government keeps on making various amendments to the GST Law There are different rules defined under GST Law in relation to ITC for all categories of taxpayers Web Input tax credit is allowed only on purchases made for selling taxable or zero rated goods or services ITC is not allowed for purchases made for exempted supplies The input tax credit of goods and or service attributable to only taxable supplies can be taken by registered taxable person The amount of eligible credit would be calculated in

Input Tax Credit Allowed To

Input Tax Credit Allowed To

https://www.taxmann.com/post/wp-content/uploads/2021/07/Screenshot-2022-05-23-132914-e1653293146602.png

Complete Guide To Input Tax Credit Under GST Busy

https://lh4.googleusercontent.com/5hwolQtDt61P7Mcah2HElnIoQsT2WceGufSC7Wq5tLISGADKSMir2eVSxHexbQxONOsMabhgjc6QkGyh1fCFZrn7ljeub6zzR1EvWan8mOtdtF7WzpXhyFssXjVJtXZ_YOiBnYgdEkDBh5fwpm2nkJ2Dzb5s8qin-_Ir7SSqkYC1Oxw1pB6fAhSEsbhL7Q

Input Tax Credit Invest In India Virtual CFO Virtual General Counsel

https://letscomply.com/wp-content/uploads/2020/04/input-tax-credit.jpg

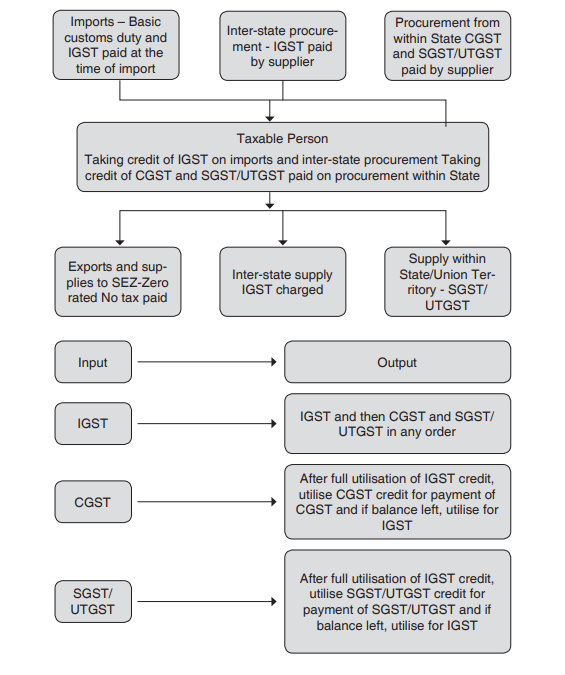

Web The input tax credit of these components of GST would be allowed in the following manner Credit of CGST Allowed 1 st for payment of CGST and the balance can be utilised for the payment of IGST Credit of CGST is not allowed for payment of SGST Web This follows the simple principle that credit is allowed on inputs only if tax is charged on the output However there are cases when final supply may be exempt but credit is still allowed exports for example Such supplies are often called zero rated supplies

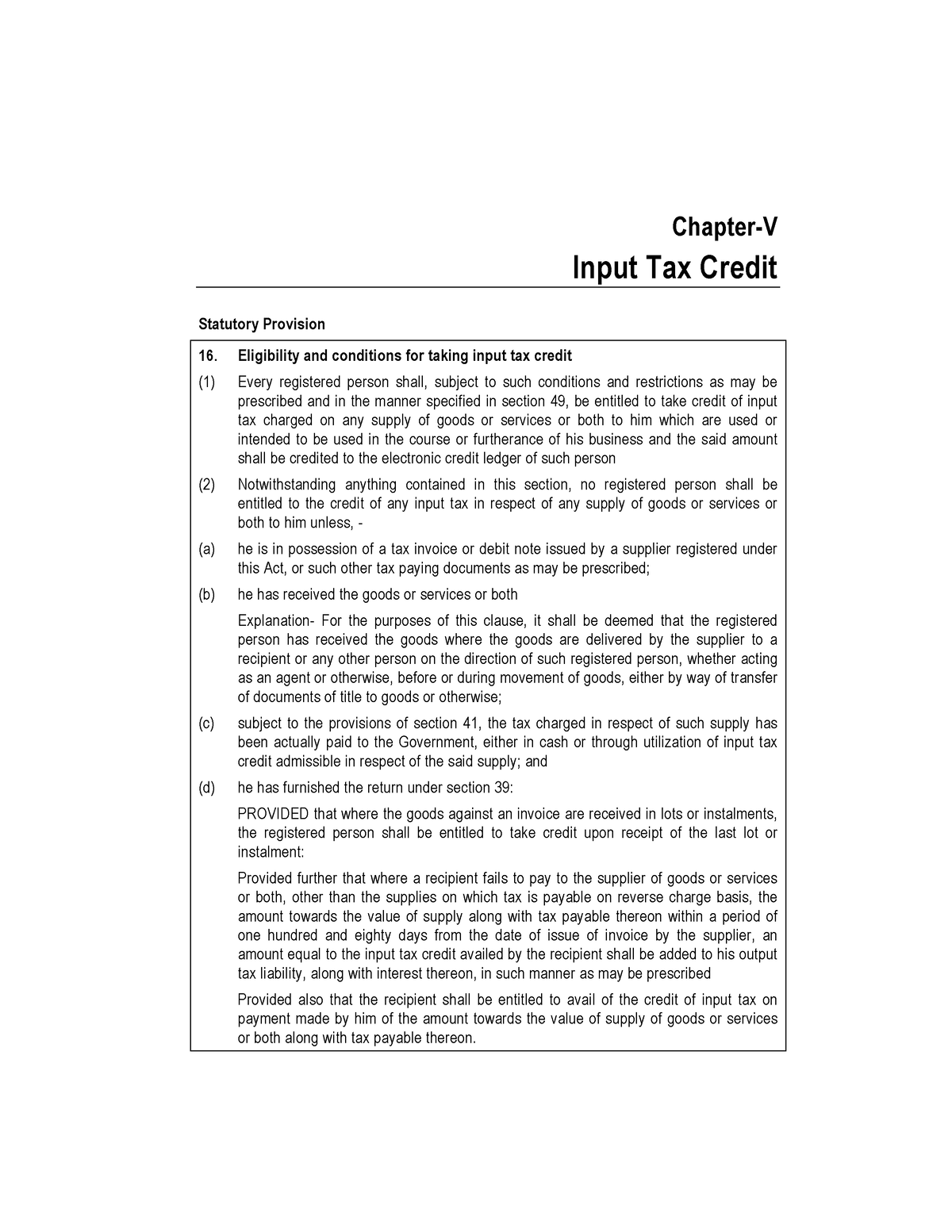

Web 5 Aug 2022 nbsp 0183 32 Input Tax Credit can be taken only with respect to input tax on goods and or services which are used or intended to be used in course or furtherance of business Conditions for taking Input Tax Credit a Person taking Input Tax Credit should be in possession of Tax Invoice Debit Note Other tax paying document b Web The input tax credit shall not be allowed on the said tax component in respect of which depreciation has been claimed Is credit of tax paid on every input used for supply of taxable goods or services or both is allowed under GST Yes except a small list of items provided in the law the credit is admissible on all items The list covers mainly items of

Download Input Tax Credit Allowed To

More picture related to Input Tax Credit Allowed To

INPUT TAX CREDIT thetaxtalk BACKBONE OF GST

https://thetaxtalk.com/wp-content/uploads/2018/02/82-1024x800.png

Chapter 9 CHAPTER 9 INPUT VAT INPUT TAX Refers To The VAT Due Or

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/074eb9126ea2066fa625faf6b09fcdc0/thumb_1200_1835.png

What Is Input Credit ITC Under GST

https://www.deskera.com/blog/content/images/2021/08/ITC-CLAIM.png

Web Assuming all requirements are met the capture and sequestration of carbon dioxide may be eligible for an IRC Section 45Q tax credit however IRC Section 45V d 2 prohibits an IRC Section 45V credit with respect to any qualified clean hydrogen produced at a facility that includes carbon capture equipment for which a credit is allowed to any taxpayer under Web 5 Jan 2024 nbsp 0183 32 Now companies with revenues of at least 750 million active in any of the 27 EU states will face a minimum corporate tax rate of 15 The bloc s economy commissioner Paolo Gentiloni described

Web Input tax credit is allowed on capital goods Input tax is not allowed for goods and services for personal use No input tax credit shall be allowed after GST return has been filed for September following the end of the financial year to which such invoice pertains or filing of relevant annual return whichever is earlier Web 6 Okt 2021 nbsp 0183 32 The registered person is entitled to the credit of any input tax credit on a supply only if all the following conditions are fulfilled a Possession of a Tax Invoice or Debit Note b Furnishing and communication of details c The ITC is not restricted d Receipt of goods and or services e Payment of tax to the Government

Input Tax Credit PDF Invoice Value Added Tax

https://imgv2-2-f.scribdassets.com/img/document/435590913/original/07c9df0e8a/1709325949?v=1

Input Tax Credit Edited PDF Value Added Tax Tax Credit

https://imgv2-1-f.scribdassets.com/img/document/408344750/original/e91197b2a4/1666929986?v=1

https://www.embibe.com/exams/input-tax-credit

Web 24 Jan 2023 nbsp 0183 32 Input credit means that when you pay tax on output you can deduct the tax you ve already paid on inputs and pay the difference When you buy a product service from a registered dealer you pay taxes on the purchase On selling you collect the tax

https://taxguru.in/goods-and-service-tax/input-tax-credit-itc-gst-regime.html

Web 7 Juni 2020 nbsp 0183 32 Input tax Credit ITC is a major element of understanding which has various implications under GST In changing scenario the government keeps on making various amendments to the GST Law There are different rules defined under GST Law in relation to ITC for all categories of taxpayers

Chapter V Input TAX Credit Chapter V Input Tax Credit Statutory

Input Tax Credit PDF Invoice Value Added Tax

ITC Rules Under GST 2021 Guide On Types Conditions Eligibility

All About Input Tax Credit Under GST

Input Tax Credit Know How Does It Work

Significant Things To Know About Input Tax Credits ITC

Significant Things To Know About Input Tax Credits ITC

Practicesheet Input Tax Credit PDF Value Added Tax Taxes

A Complete Guide On Input Tax Credit ITC Under GST

Input Tax Credit ITC On Corporate Social Responsibilities CSR CA

Input Tax Credit Allowed To - Web 28 Aug 2021 nbsp 0183 32 How input tax credit is allowed for payment of CGST SGST UTGST and IGST Supplier of goods or services or both can take credit of input tax charged on any supply of goods or services or both to him which are used in the course of his busniess These provisions are given by sections 16 to 21 and rules 36 to 45