Input Tax Credit Under Construction Property SC clarifies Input Tax Credit under Section 17 5 of CGST Act for immovable property construction defining plant machinery eligibility for ITC

The latest Supreme Court judgment on GST Input Tax Credit ITC has provided significant clarity on ITC claims particularly for businesses in the construction and leasing Whether Input Tax Credit ITC on procurement of goods and or services for installation of the Installations as listed in the application are regarded as blocked credits

Input Tax Credit Under Construction Property

Input Tax Credit Under Construction Property

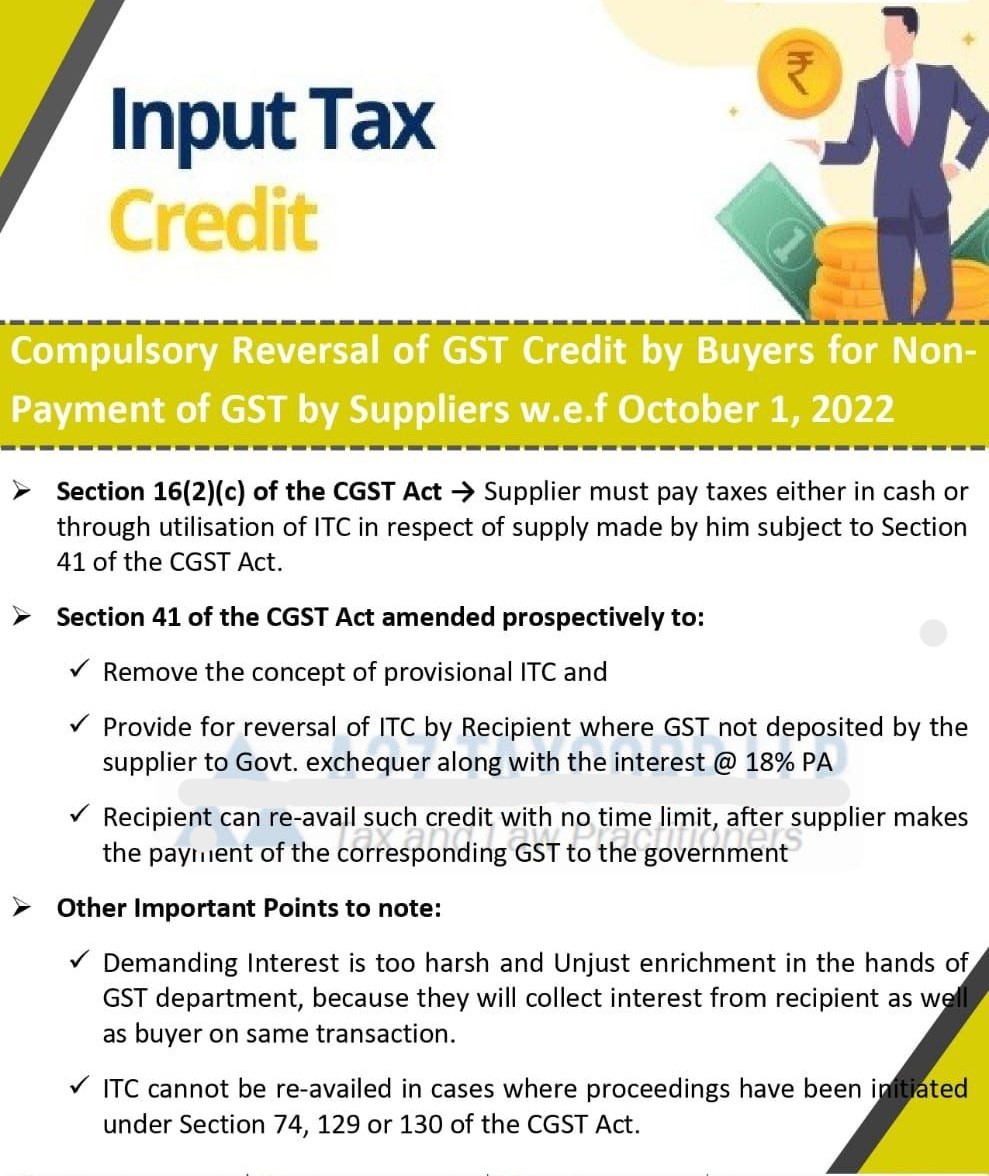

https://carajput.com/blog/wp-content/uploads/2021/09/Compulsory-Reversal-of-GST-Credit-by-Buyers-for-Non-Payment-.jpg

Input Tax Credit ITC Under GST TaxAdda

https://www.taxadda.com/wp-content/uploads/elementor/thumbs/gst-input-tax-credit-nbzx2zf9a1kswcv4r2gursi33pky2plqaaw17dpt3c.png

GST Input Tax Credit Definitions And Conditions For Claiming GST ITC

https://www.taxmann.com/post/wp-content/uploads/2021/10/BlogBanner_Pushpinder1.jpg

What are the new GST rates on the construction of residential apartments Below are the new tax rates without ITC for housing projects applicable w e f 1st April 2019 The Supreme Court recently delivered a crucial ruling on the question of whether input tax credit ITC can be claimed for transactions concerning the construct

The Supreme Court clarifies GST input tax credit can be claimed on construction for rental services The apex Court ruled that if a building s construction is essential for providing services like leasing or renting it could fall under the As of the September 2021 cut off date residential properties are subject to a 5 GST rate whereas commercial assets are subject to an 18 GST rate with Input Tax Credit Input Tax Credit ITC in Construction An

Download Input Tax Credit Under Construction Property

More picture related to Input Tax Credit Under Construction Property

Apportionment Of Input Tax Credit ITC Under GST Section 17 1 2

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GST-India/Images/Apportionment of Input Tax Credit in case of Goods and Services Used-Section 17-1.gif

Input Tax Credit UNDER GST Goods Service Tax YouTube

https://i.ytimg.com/vi/twNcA_MnKqs/maxresdefault.jpg

What Is Input Credit ITC Under GST

https://www.deskera.com/blog/content/images/2021/08/ITC-CLAIM.png

Input Tax Credit ITC in GST allows taxable persons to claim tax paid on goods services used for business Conditions are essential to claim ITC seen in updated rules and law amendments highlighted Dis Allowance of Input Tax Credit on Construction of Immoveable Property How Far Justiciable S ection 16 of CGST Act 2017 hereinafter called the Act speaks of taking of Input Tax Credit

In a landmark decision that significantly impacts India s real estate and taxation landscape the Supreme Court has established definitive criteria for claiming Input Tax Credits Input Tax Credit ITC Explained in detail including conditions for claiming ITC Apportionment of Input Tax credit Eligibility and time limit for Input Tax credit availment

A Complete Guide On Input Tax Credit ITC Under GST

https://okcredit-blog-images-prod.storage.googleapis.com/2021/02/taxcredits1-1.jpg

INPUT TAX CREDIT UNDER GST GOODS AND SERVICE TAX SIMPLE TAX INDIA

https://2.bp.blogspot.com/-BiunmBuXEe0/WPOo0ytkE_I/AAAAAAAAQlE/yMWRnc5x8XwJ3WXOqO4wFVtURgvQ2ue8wCLcB/w600-h315-p-k-no-nu/Input%2BTax%2BCredit%2BAvailment%2BUtilisation%2Bunder%2BGST%2BLaw.png

https://taxguru.in › goods-and-service-tax › supreme...

SC clarifies Input Tax Credit under Section 17 5 of CGST Act for immovable property construction defining plant machinery eligibility for ITC

https://restthecase.com › knowledge-bank › latest...

The latest Supreme Court judgment on GST Input Tax Credit ITC has provided significant clarity on ITC claims particularly for businesses in the construction and leasing

Input Tax Credit Under GST

A Complete Guide On Input Tax Credit ITC Under GST

Eligibility Conditions For Taking Input Tax Credit Under GST By

All About Input Tax Credit Under GST Ebizfiling India Pvt Ltd

Input Tax Credit Guide Under GST Calculation With Examples

An In Depth Look At Input Tax Credit Under Gst Razorpay Business Www

An In Depth Look At Input Tax Credit Under Gst Razorpay Business Www

Input Tax Credit On Capital Goods Under GST YouTube

Input Tax Credit Under GST Input Tax Credit Under SGST IGST CGST

An In depth Look At Input Tax Credit Under GST Razorpay Business

Input Tax Credit Under Construction Property - Check out the point wise guide for input tax credit under GST which includes sections 16 17 and 18 of CGST Act Check now for more details