Insulation Tax Credit 2022 Form The residential energy credits are The residential clean energy credit and The energy efficient home improvement credit Also use Form 5695 to take any residential clean

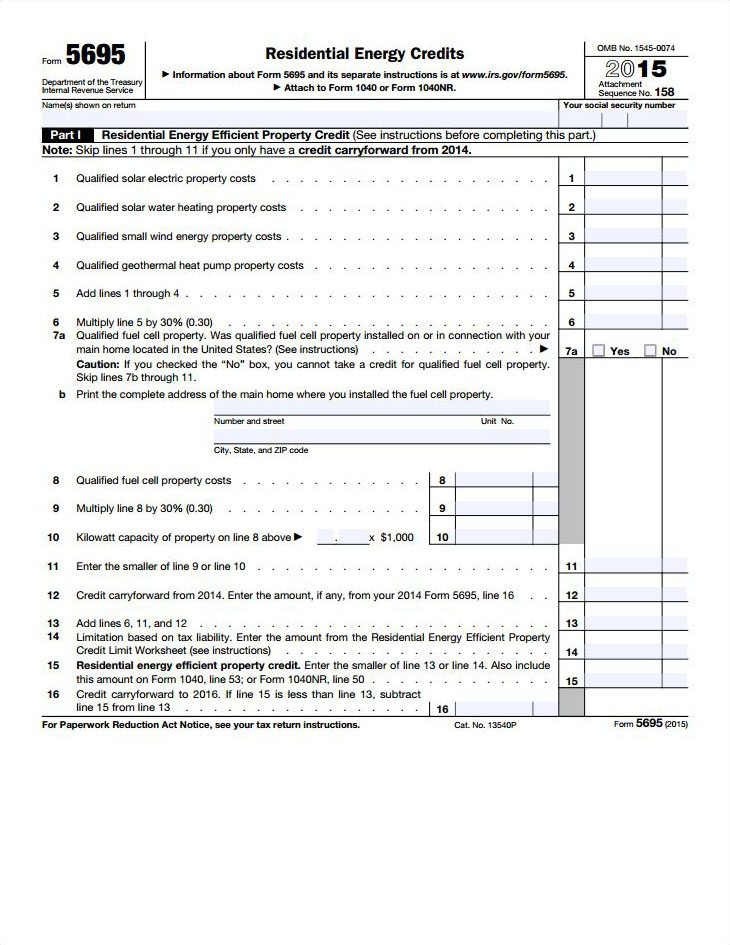

Department of the Treasury Internal Revenue Service Residential Energy Credits Go to www irs gov Form5695 for instructions and the latest information Attach to Form 1040 Tax Credit 10 of cost up to 500 or a specific amount from 50 300 Expires December 31 2022 Details Must be placed in service in an existing home

Insulation Tax Credit 2022 Form

Insulation Tax Credit 2022 Form

http://ww1.prweb.com/prfiles/2013/01/07/10300193/LOGOusaInsulationVertical.jpg

USA Insulation Announces 500 Government Tax Credit For New Insulation

http://ww1.prweb.com/prfiles/2013/01/07/10300193/bigstock-Government-Money-5217823.jpg

Crawl Space Insulation Tax Credits For 2022 2023

https://crawlspaceninja.com/wp-content/uploads/2021/10/Essential-Guide-to-Crawl-Space-Waterproofing_clickhere-1024x536.jpg

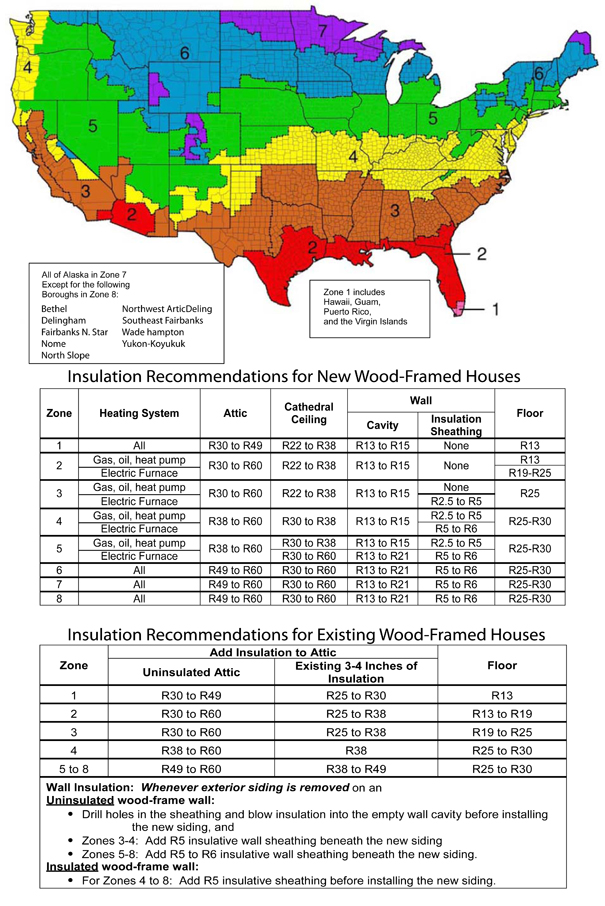

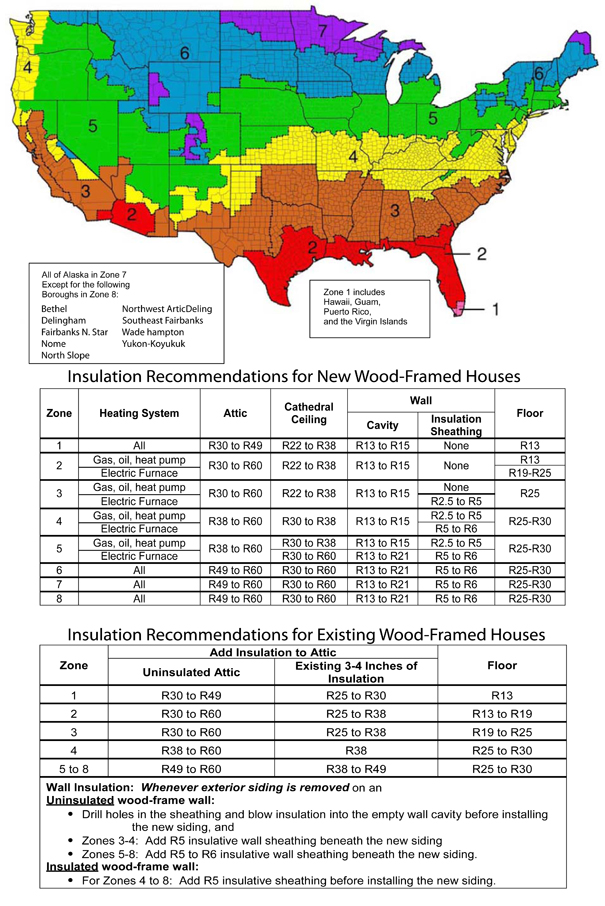

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your

Consumers will need to complete IRS Form 5695 and have a copy of any USA Insulation contracts for tax purposes Remember the insulation must have been How to Get Tax Credits for Insulation and Home Energy Upgrades The Inflation Reduction Act is about more than just solar panels and EVs It can help you pay

Download Insulation Tax Credit 2022 Form

More picture related to Insulation Tax Credit 2022 Form

SPRAY FOAM INSULATION TAX CREDITS FOR YOU AND YOUR CUSTOMERS Accufoam

https://accufoam.com/wp-content/uploads/2023/01/kelly-sikkema-8DEDp6S93Po-unsplash-scaled-1.jpg

Insulation Tax Credits Insulation Depot

https://insulationdepot.com/wp-content/uploads/2020/05/41611855_472915256538826_8157084038402670592_o.jpg

Insulation Tax Credits Eligible For Insulation Tax Credit

https://www.kangaroocontractors.com/wp-content/uploads/2023/03/insulation-credit-980x551.jpg

Enter the cost of insulation material or system include air sealing material or system specifically and primarily designed to reduce heat loss or gain of your home that meets Step by step instructions on how to fill out IRS Form 5695 to claim the Solar Investment Tax Credit on your federal taxes and get the savings you deserve

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide The RCE credit replaces the Residential Energy Efficient Property REEP credit beginning with the 2022 tax year The allowable credit is up to 30 percent of an unlimited amount

The New 25C Insulation Tax Credit Spray Foam Business News

https://profoam.com/photos/announcements/main/1fde98164d61bfc58355b08d41a1f26ed7fecc85.png

Home Insulation Are There Energy Efficient Tax Credits Attainable Home

https://www.attainablehome.com/wp-content/uploads/2021/09/EnergyStar.gov-website-screenshot-of-insulation-tax-credits-available..png

https://www.irs.gov/instructions/i5695

The residential energy credits are The residential clean energy credit and The energy efficient home improvement credit Also use Form 5695 to take any residential clean

https://www.irs.gov/pub/irs-prior/f5695--2022.pdf

Department of the Treasury Internal Revenue Service Residential Energy Credits Go to www irs gov Form5695 for instructions and the latest information Attach to Form 1040

Home Insulation Tax Credit Possible Thanks To Inflation Reduction Act

The New 25C Insulation Tax Credit Spray Foam Business News

Federal Tax Credit For Attic Insulation Bird Family Insulation

Residential Energy Credit Insulation Supply

Did You Know About Tax Credits For Adding Or Replacing Insulation

Federal Tax Credit Info Shore Insulation

Federal Tax Credit Info Shore Insulation

The Tax Credit For Home Insulation Windows And Doors In 2022

Owens Corning Insulation Tax Credit Rebate Owens Corning Insulation

Crawl Space Insulation Tax Credits For 2022 2023

Insulation Tax Credit 2022 Form - Consumers will need to complete IRS Form 5695 and have a copy of any USA Insulation contracts for tax purposes Remember the insulation must have been